New York Renunciation And Disclaimer of Property received by Intestate Succession

The Renunciation and Disclaimer of Property received by Intestate Succession is a legal form used in New York State when a beneficiary of an estate chooses to renounce their interest in property acquired through intestate succession. This form allows the beneficiary to disclaim all or part of their interest, transferring it to other heirs as if the beneficiary had predeceased the decedent. It is important to note that this form is distinct from other estate planning documents, such as wills or trusts, as it specifically caters to situations involving intestate succession.

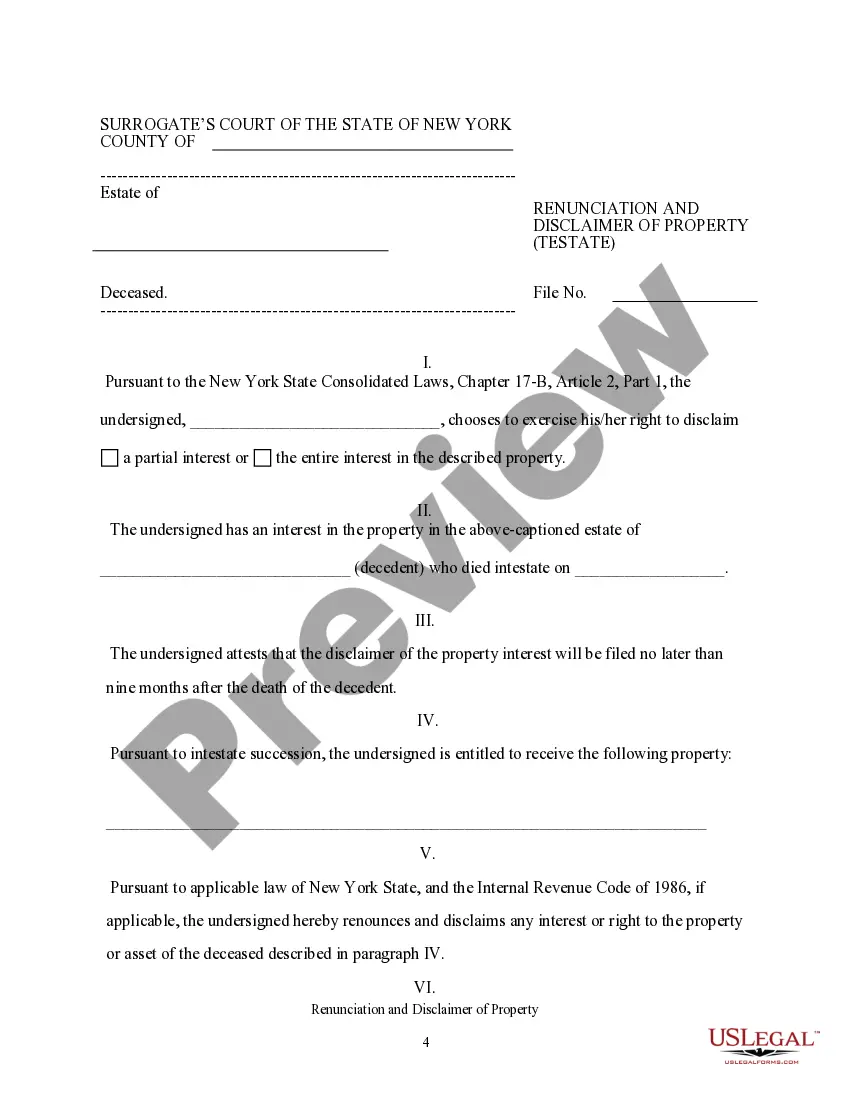

- Identification of the decedent and the beneficiary.

- Declaration of the intention to disclaim interest in the specified property.

- Affirmation that the disclaimer will be filed within nine months of the decedent's death.

- Details about the property interest being disclaimed.

- Signature of the affiant and notarization section for validation.

This form should be used when an individual inherits property from someone who died without a will (intestate) and wishes to refuse their inheritance. Common scenarios include situations where accepting the property may lead to unexpected financial burdens, such as taxes or debts associated with the estate. Utilizing this form helps clarify the beneficiary's decision to decline their interest formally.

Individuals eligible to use this form include:

- Beneficiaries of an intestate estate in New York State.

- Heirs who want to disclaim their share of the estate for personal or financial reasons.

- Individuals seeking to ensure proper distribution of the decedentâs assets in compliance with New York state law.

Steps to complete the Renunciation and Disclaimer of Property:

- Identify yourself as the beneficiary and provide your details.

- State the name of the decedent and confirm that they died intestate.

- Clearly indicate whether you are disclaiming a partial interest or the entire interest in the property.

- Enter specific details about the property you are renouncing.

- Sign the form in the presence of a notary public and ensure it is properly dated.

Yes, this form must be notarized to be legally valid. The signature of the affiant must be witnessed by a notary public, confirming the identity of the signer and the authenticity of the document. U.S. Legal Forms provides an integrated online notarization option, allowing for secure video calls at any time, ensuring your document meets legal requirements without the need for travel.

- Failing to file the disclaimer within the nine-month timeframe after the decedentâs death.

- Not providing complete and accurate details about the property being disclaimed.

- Neglecting to sign the form or obtain notarization where required.

Advantages of online completion

- Convenient access allows you to complete the form at your own pace.

- Edit fields easily to ensure all information is accurate and complete.

- Reliable templates drafted by licensed attorneys provide legal assurance.

This form is specifically tailored for use in the State of New York and complies with the stateâs laws regarding intestate succession and the disclaimer of property interests. Always ensure that you follow any additional state-specific regulations and timelines that may apply.

- The Renunciation and Disclaimer of Property is essential for legally refusing inheritance rights.

- It must be filed within nine months of the decedent's death to be valid.

- Notarization is required to ensure the form's legitimacy.

Form popularity

FAQ

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.

Disclaim Inheritance, Definition In a nutshell, it means you're refusing any assets that you stand to inherit under the terms of someone's will, a trust or, in the case of a person who dies intestate, the inheritance laws of your state.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

Disclaim Inheritance, DefinitionDisclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.

The beneficiary can disclaim only a portion of an inherited IRA or asset, allowing some to flow to the contingent beneficiary(s). Partial disclaiming is either a specific dollar or percentage amount as of the date of death.The balance will go to the next beneficiary(s).

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.