Stockholders Elect Statement Format

Description

How to fill out Voting Agreement Among Stockholders To Elect Directors?

Dealing with legal paperwork and operations can be a time-consuming addition to the day. Stockholders Elect Statement Format and forms like it often need you to search for them and understand the way to complete them appropriately. Consequently, if you are taking care of economic, legal, or individual matters, using a comprehensive and hassle-free online catalogue of forms when you need it will significantly help.

US Legal Forms is the top online platform of legal templates, featuring over 85,000 state-specific forms and numerous resources to assist you to complete your paperwork easily. Explore the catalogue of relevant documents accessible to you with just one click.

US Legal Forms provides you with state- and county-specific forms offered at any time for downloading. Protect your document administration operations by using a high quality services that allows you to put together any form in minutes with no extra or hidden fees. Simply log in to the profile, locate Stockholders Elect Statement Format and download it immediately from the My Forms tab. You may also gain access to previously downloaded forms.

Could it be your first time utilizing US Legal Forms? Sign up and set up up a free account in a few minutes and you will have access to the form catalogue and Stockholders Elect Statement Format. Then, adhere to the steps below to complete your form:

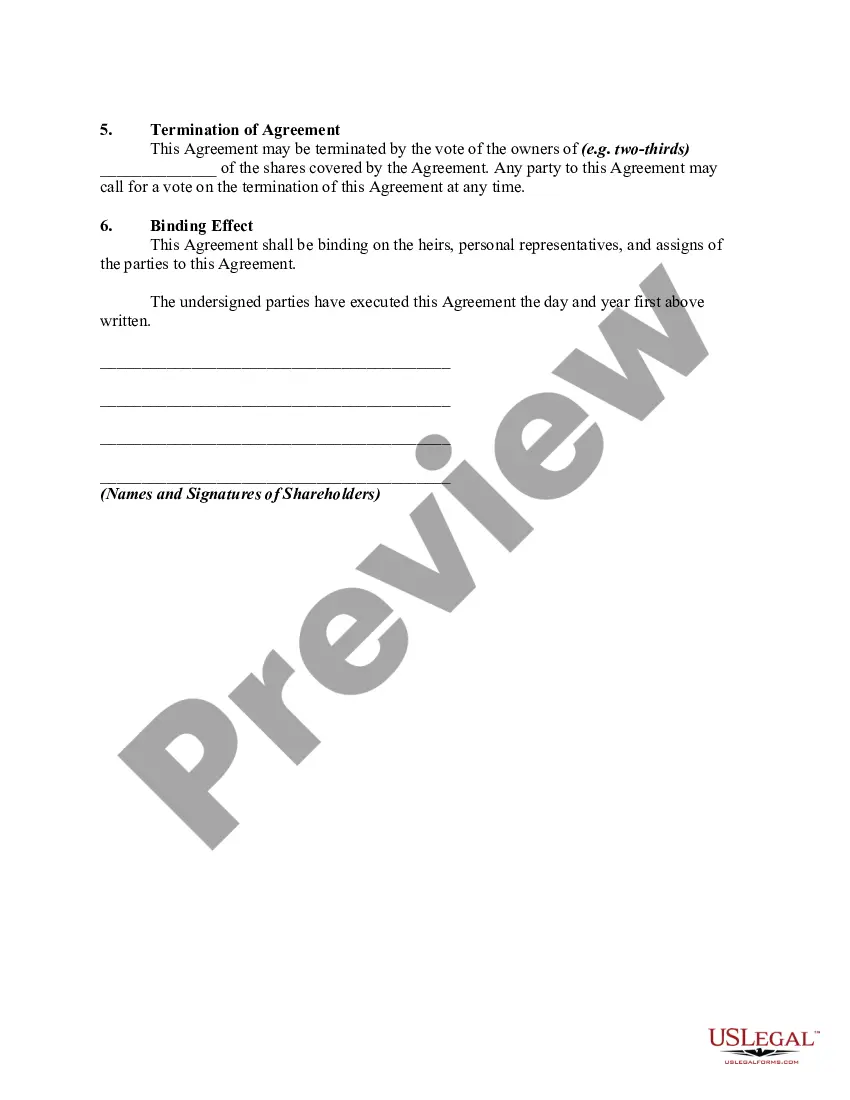

- Ensure you have the right form using the Review option and reading the form information.

- Pick Buy Now once all set, and choose the monthly subscription plan that suits you.

- Select Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience supporting users manage their legal paperwork. Find the form you require today and enhance any operation without breaking a sweat.

Form popularity

FAQ

Filling out IRS Form 8832: An Easy-to-Follow Guide - YouTube YouTube Start of suggested clip End of suggested clip If you correctly fill out and submit form 8832. You can elect for the LLC to be treated as ACMoreIf you correctly fill out and submit form 8832. You can elect for the LLC to be treated as AC corporation. For federal tax purposes. And the business will pay a corporate income tax.

The IRS recommends that an S Corporation shareholder complete Form 7203 every year and maintain the form in their tax records even in years where none of the above apply.

Failing to include Form 7203 on a tax return in future years may result in the IRS disallowing any losses reported on the Schedule K-1 (Form 1120-S) or subject the taxpayer to a request for the form.

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form.

Form 7203 is required when a shareholder of an S corporation sells shares, receives a payout, or receives a loan repayment from the company. Additionally, the IRS recommends you complete and save this form in years where none of the above apply, to better establish an S corporation stock basis.