Raffle Reporting Requirements

Description

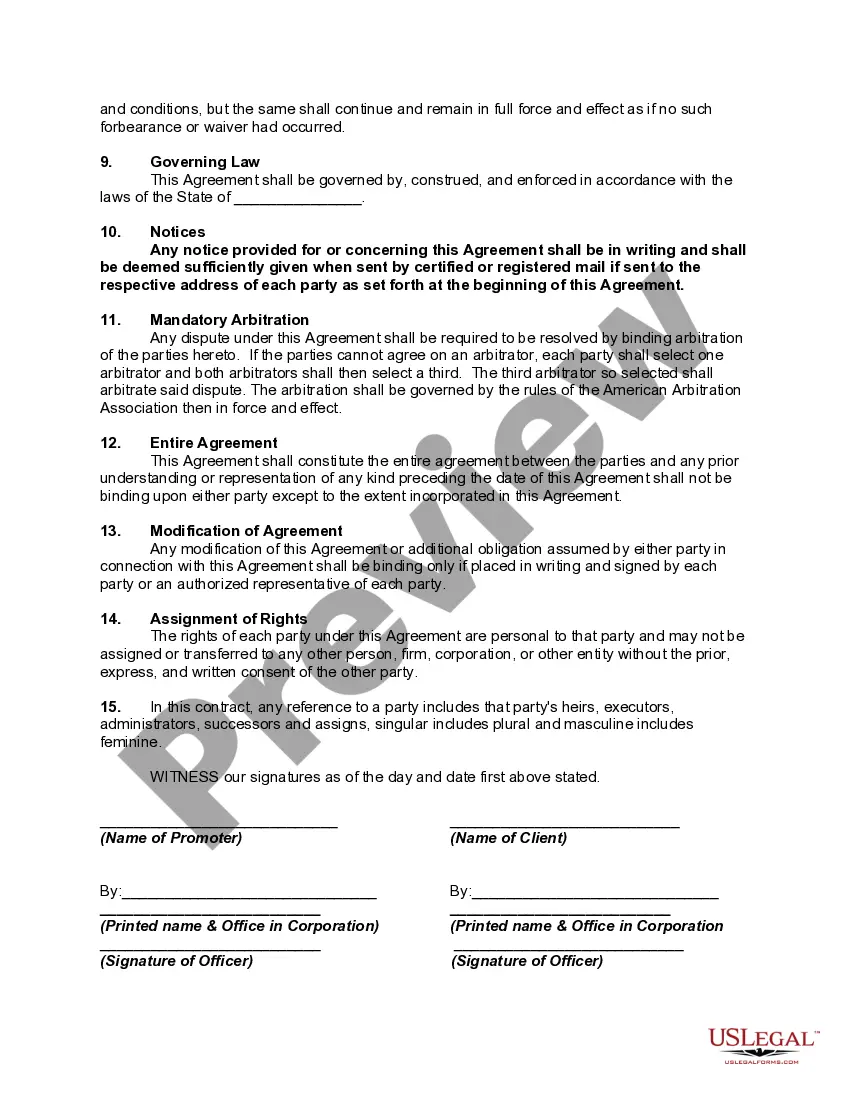

How to fill out Raffle Contract And Agreement?

The Raffle Reporting Documentation you see on this page is a versatile official template created by experienced attorneys in adherence to national and local statutes and guidelines.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with more than 85,000 verified, state-specific documents for any commercial and personal situation. It’s the quickest, simplest, and most reliable method to acquire the papers you require, as the service guarantees the utmost level of data protection and anti-malware safeguards.

Register for US Legal Forms to have confirmed legal templates for all of life's events readily available.

- Search for the document you require and evaluate it.

- Browse through the sample you searched for and preview it or assess the form description to confirm it meets your requirements. If it doesn’t, use the search feature to find the appropriate one. Click Buy Now once you have located the template you need.

- Register and sign in.

- Select the pricing package that fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, sign in and verify your subscription to proceed.

- Acquire the editable template.

- Choose the format you desire for your Raffle Reporting Documentation (PDF, Word, RTF) and download the example onto your device.

- Fill out and sign the document.

- Print the template to complete it manually. Alternatively, use an online multifunctional PDF editor to swiftly and accurately fill in and sign your form with a valid signature.

- Download your paperwork again.

- Reutilize the same document whenever necessary. Access the My documents section in your profile to redownload any forms you have previously downloaded.

Form popularity

FAQ

A personal loan can affect your credit score in a number of ways??both good and bad. Taking out a personal loan isn't bad for your credit score in and of itself. However, it may affect your overall score for the short term and make it more difficult for you to obtain additional credit before that new loan is paid back.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

Income is classified by the IRS as money you earn, whether through work or investments. A personal loan must be repaid and cannot be classified as income unless your debt is forgiven. If you do not intend to seek debt cancellation for your personal loan, you do not have to worry about reporting it on your income taxes.

Bottom line. The IRS generally does not consider personal loans taxable, as these loans do not count as income. However, if you had a loan canceled, that may count as taxable income. Also, if you used any part of the loan on business expenses, you may be able to deduct that potion of the interest.

Bottom line. The IRS generally does not consider personal loans taxable, as these loans do not count as income. However, if you had a loan canceled, that may count as taxable income. Also, if you used any part of the loan on business expenses, you may be able to deduct that potion of the interest.

Personal loans can be made by a bank, an employer, or through peer-to-peer lending networks, and because they must be repaid, they are not taxable income. If a personal loan is forgiven, however, it becomes taxable as cancellation of debt (COD) income, and a borrower will receive a 1099-C tax form for filing.

Income is classified by the IRS as money you earn, whether through work or investments. A personal loan must be repaid and cannot be classified as income unless your debt is forgiven. If you do not intend to seek debt cancellation for your personal loan, you do not have to worry about reporting it on your income taxes.

The loan is not considered income and there's generally no tax reporting required.