What Powers Make A Trust A Grantor Trust

Description

How to fill out Qualified Income Miller Trust?

- If you are an existing user, log into your account and select the necessary form template to download it securely onto your device. Ensure your subscription is active; renew as necessary to maintain access.

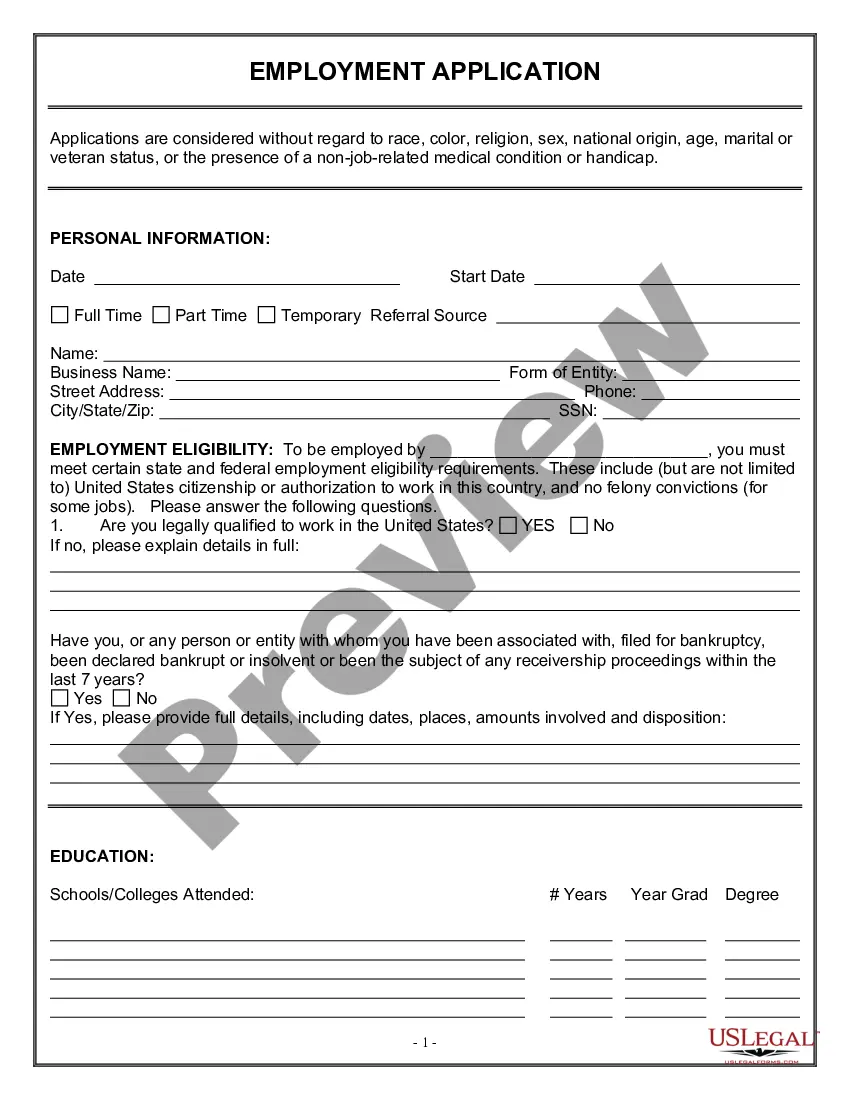

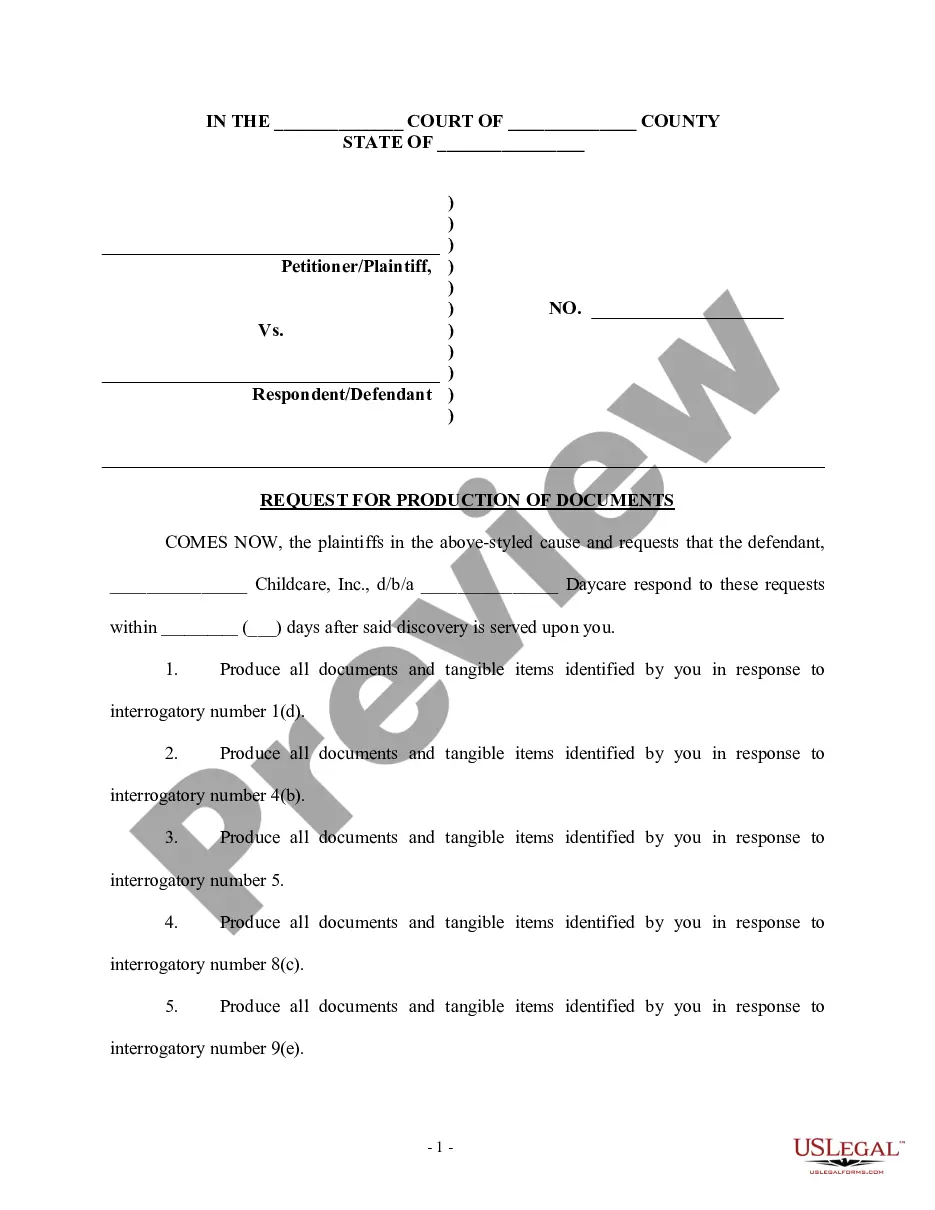

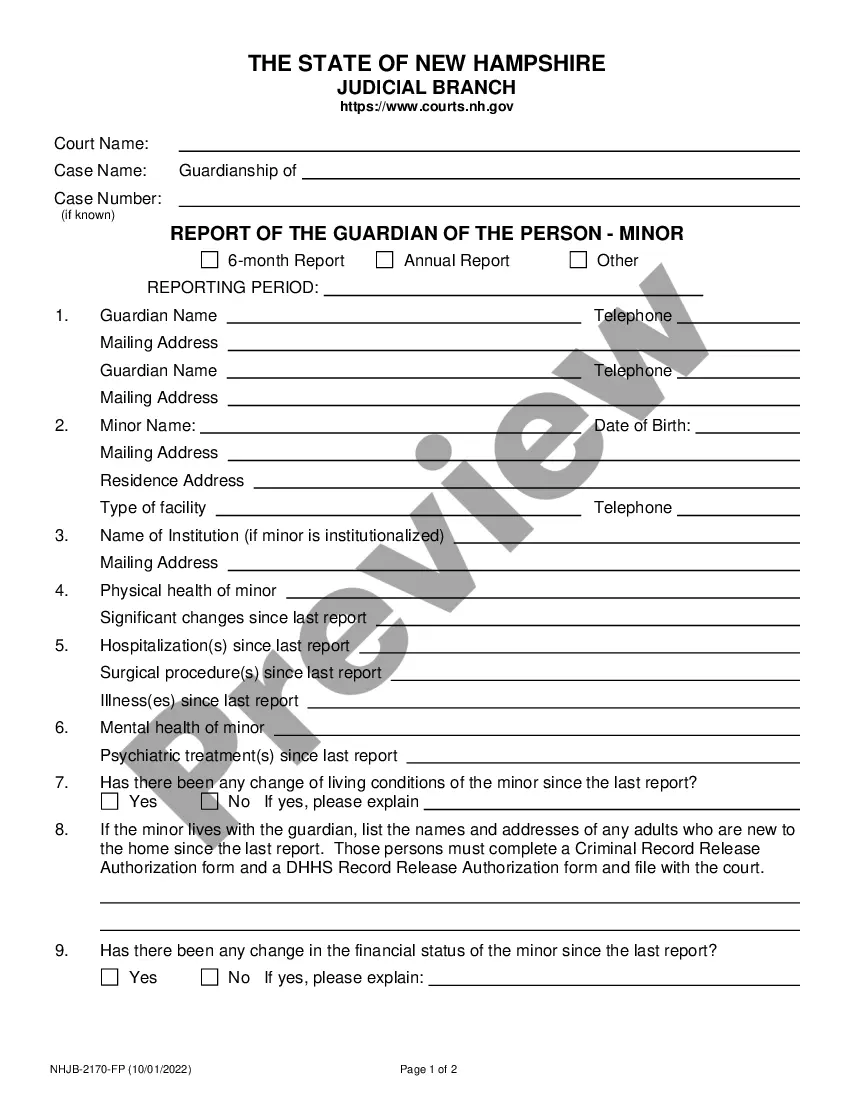

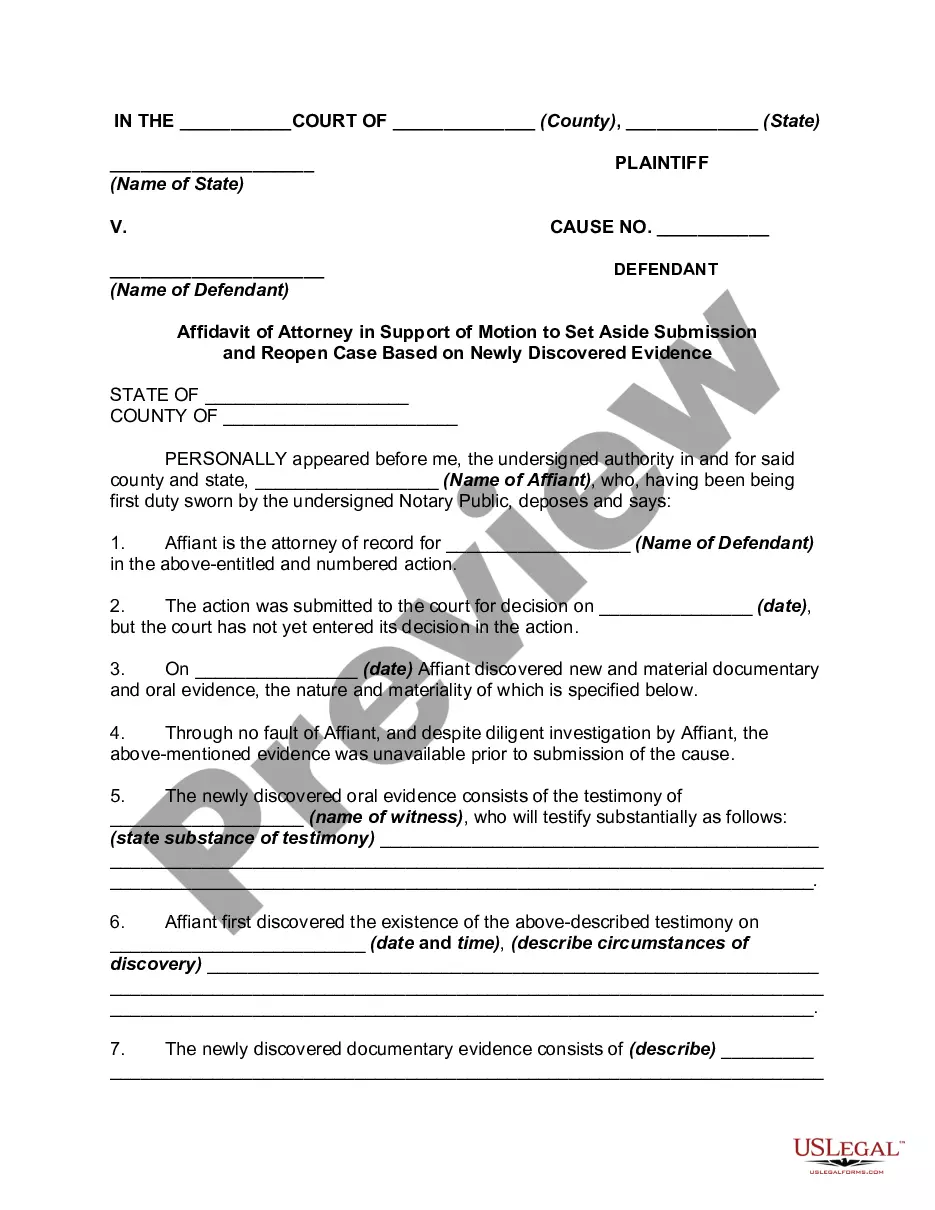

- For first-time users, begin by exploring the Preview mode and form description to verify that you have selected the appropriate document that aligns with your legal requirements.

- If adjustments are needed, utilize the Search function at the top to locate the correct template. Once you find one that fits, proceed to purchase.

- Click on the Buy Now button and select your preferred subscription plan. You will need to create an account to access the full library.

- Complete your purchase by entering your credit card information or using PayPal for quick transaction processing.

- Once your order is finalized, download the form to your device. You can always access it later via the My Forms section in your profile.

Utilizing US Legal Forms empowers both individuals and legal professionals to swiftly create and manage essential legal documents.

With an extensive library of over 85,000 fillable forms and access to premium expert support, achieving legally sound documentation has never been easier. Start today and simplify your legal needs!

Form popularity

FAQ

You can identify a grantor trust by looking at specific provisions within the trust document. Signs include the grantor's control over distributions, the power to revoke or amend the trust, and the ability to receive income or principal from the trust. Clarifying what powers make a trust a grantor trust can ease the decision-making process for beneficiaries. For detailed documents and professional advice, consider using US Legal Forms.

Yes, every trust has a grantor, also known as a trustor or settlor. The grantor is the individual who establishes the trust and contributes assets to it. Even in the case of irrevocable trusts, where the grantor generally cannot control the trust after its creation, the initial grantor's role remains crucial. It's important to delve into what powers make a trust a grantor trust to fully comprehend the implications for estate planning.

To determine if a trust is a grantor trust, you should examine the rights and powers that the grantor retains. If the grantor holds control over income, principal distribution, or the ability to revoke the trust, it likely qualifies as a grantor trust. These factors directly contribute to understanding what powers make a trust a grantor trust. Consulting a legal expert can clarify any complexities involved.

Yes, a 2503 C trust is typically a grantor trust. This type of trust allows the grantor to retain certain powers that qualify it as a grantor trust under tax law. The grantor usually controls the assets during their lifetime, influencing the tax obligations. Understanding what powers make a trust a grantor trust is essential when managing estate plans.

To identify if a trust is a grantor or non-grantor trust, review the trust's terms for language about powers retained by the grantor. A grantor trust allows the grantor to exert control, whereas a non-grantor trust typically outlines a separate tax treatment. Additionally, check how income is taxed—if it is reported on the grantor's personal tax return, it is likely a grantor trust. For clarity, consider utilizing platforms like US Legal Forms to analyze your trust document.

Typically, the grantor of a trust is the individual who creates it, often a parent or grandparent wishing to manage their estate. The grantor establishes the trust to provide for beneficiaries, which can include family members or other entities. They are essential in defining how the trust operates and who benefits from it, which emphasizes the significance of their role in estate planning.

A grantor holds significant power over a trust, including the ability to dictate its terms and manage its assets. For instance, the grantor can decide who receives benefits, establish distributions, and even dissolve the trust if it's revocable. This control is vital as it allows the grantor to shape their estate according to their wishes, satisfying both personal and tax strategies.

The classification of a trust as a grantor trust primarily hinges on the controls retained by the grantor. If the grantor can change the beneficiaries, modify terms, or dissolve the trust, it will be classified as a grantor trust. Tax implications also play a role, as the trust's income is often reported on the grantor’s personal tax return. Knowing what powers make a trust a grantor trust helps in effective financial planning.

To determine if your trust is revocable or irrevocable, check the trust document for specific language regarding the grantor's rights. A revocable trust typically includes clauses that allow the grantor to modify or revoke the trust. In contrast, an irrevocable trust usually restricts these powers once established. Consulting with a legal professional can also clarify the nature of your trust.

A trust becomes a grantor trust when the grantor retains certain powers over it during their lifetime. These powers include the ability to revoke the trust, add or remove beneficiaries, and change the terms of the trust. Essentially, the control the grantor maintains allows the income from the trust to be taxed to the grantor. Understanding what powers make a trust a grantor trust is important for tax planning and estate management.