Trust Template Withdrawal

Description

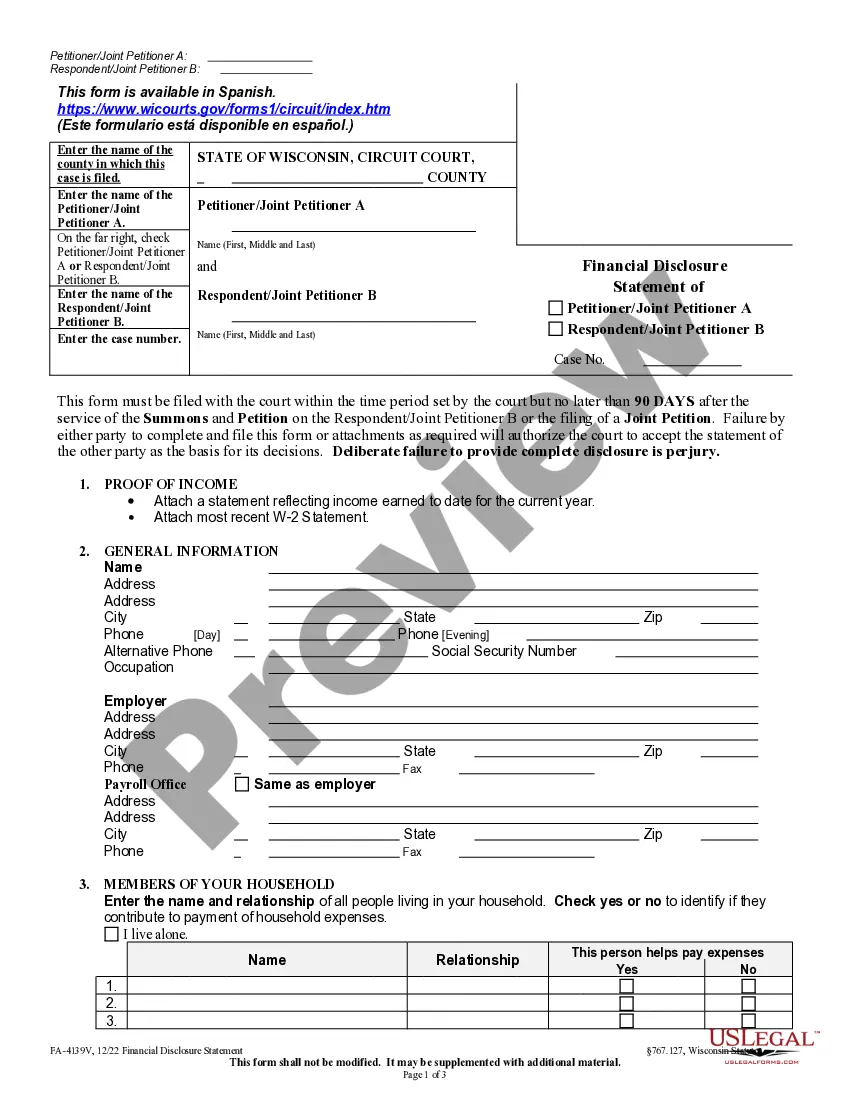

How to fill out Qualified Income Miller Trust?

Whether for commercial reasons or for personal matters, everyone must face legal issues at some stage in their life.

Filling out legal documents requires meticulous care, starting with selecting the correct form template.

Select your payment method: you can utilize a credit card or a PayPal account. Choose the document format you prefer and download the Trust Template Withdrawal. Once it is saved, you can complete the form with editing software or print it and finish it by hand. With an extensive US Legal Forms catalog available, you do not need to waste time looking for the correct sample across the internet. Make the most of the library’s straightforward navigation to find the appropriate template for any situation.

- For example, if you select an incorrect version of a Trust Template Withdrawal, it will be rejected when you submit it.

- Hence, it is crucial to have a reliable provider of legal documents like US Legal Forms.

- If you need to acquire a Trust Template Withdrawal template, follow these straightforward steps.

- Obtain the sample you require by utilizing the search bar or browsing the catalog.

- Review the form’s details to ensure it aligns with your situation, state, and locality.

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search feature to locate the Trust Template Withdrawal sample you seek.

- Obtain the template if it satisfies your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- Should you not have an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing option.

- Fill out the account registration form.

Form popularity

FAQ

To effectively revoke a trust, you should clearly state your intent to withdraw the trust in writing. The wording typically includes phrases like 'I, Your Name, revoke the Trust created on Date'. It is essential to also include your signature and the date of revocation to validate the trust template withdrawal. This clear wording ensures that there is no confusion about your decision and protects your interests.

Yes, beneficiaries can withdraw funds from a trust, but this depends on the specific terms set forth in the trust document. Some trusts allow for partial withdrawals while others may restrict access based on certain conditions. Using a trust template withdrawal can help define when and how beneficiaries can access the funds. It’s always wise to consult with legal advisors or use platforms like USLegalForms to ensure compliance with your trust's stipulations.

One of the biggest mistakes parents make when setting up a trust fund is not clearly defining the terms and conditions of the trust. A poorly crafted trust can lead to confusion and disputes among beneficiaries. To avoid this, consider using a reliable trust template withdrawal that outlines clear guidelines for distribution. Utilizing tools from platforms like USLegalForms can simplify this process, ensuring that your wishes are communicated effectively.

To dissolve your corporation in Oregon, you must provide the completed Articles of Dissolution ? Business/Professional form to the Oregon Secretary of State Corporation Division by mail, in person or by fax with a Fax Cover Sheet. Original signature is NOT required.

How much will it cost to revive an Oregon LLC? The reinstatement fee is $100. You'll also have to pay $100 for each year your Oregon LLC failed to file annual renewals.

You amend your articles of organization by submitting the completed Oregon Articles of Amendment/Dissolution ? Limited Liability Company form to the Oregon Secretary of State Corporation Division by mail, in person or courier service or by fax. When fax filing, you pay your filing fee with the Fax Cover Sheet.

How to Submit Reinstatement Forms Confirm your business is eligible for reinstatement. Go to Business Registry Web Renewal?? and enter the registry number of the business to be reinstated. Generate the appropriate forms.? ... Update your business information. ... Submit the forms ?to us.

How Do I Amend the Articles of Organization? Determine Whether an Update Is Necessary. ... Obtain Approval for the Update as Required by the LLC's Operating Agreement. ... Complete Appropriate Government Forms to Change the Articles of Organization. ... File Articles of Amendment with the Appropriate State Agency.

Articles of organization Oregon is a document that limited liability companies (LLCs) must file with the Oregon Secretary of State's corporation division to be authorized to operate in that state. This document is also called articles of incorporation.

To change the name of your business, submit the Articles of Amendment form and its fee to our office. (Each entity type has its own form.) The business name is normally Article 1, so you simply write the new name in Section 2 of the form as you want it to read. For example, ?Article 1 ? new name is ABC Metals, LLC?.