Qualified Trust Vs Non Qualified Trust

Description

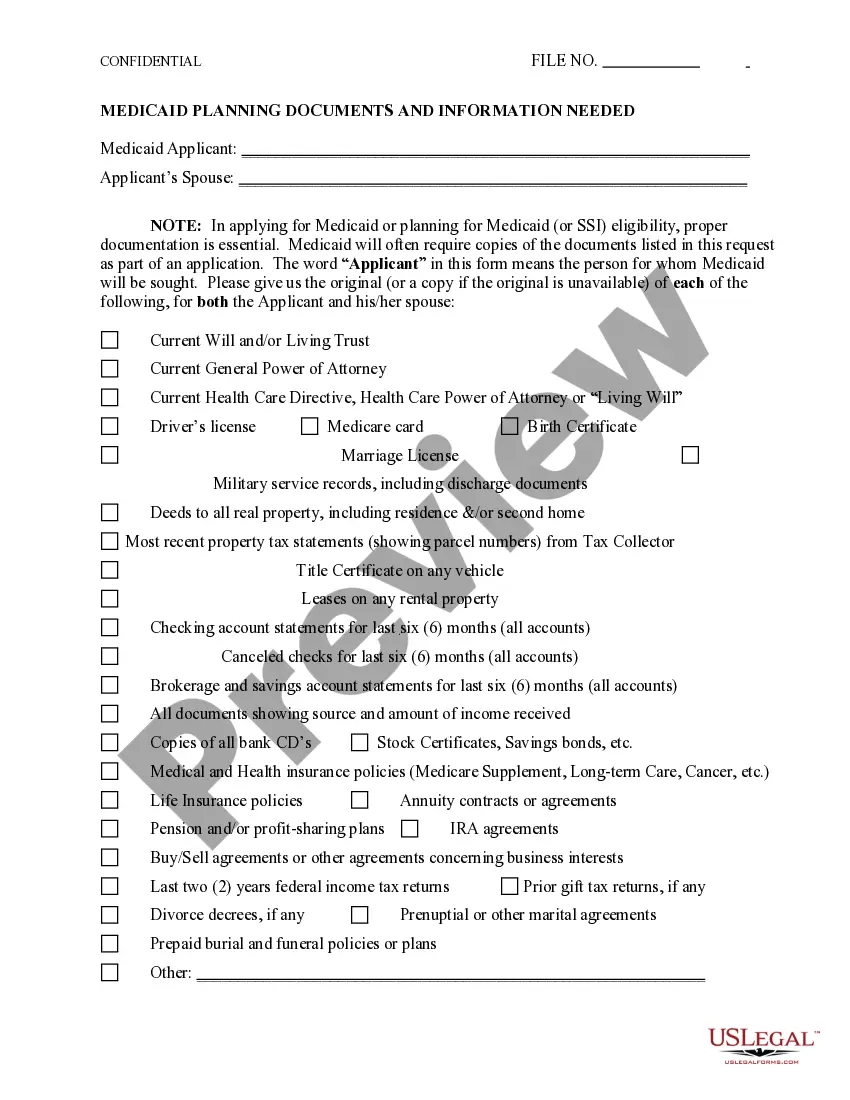

How to fill out Qualified Income Miller Trust?

- Log in to your US Legal Forms account if you're an existing user. Verify that your subscription is active, or renew it if necessary.

- For new users, start by exploring the extensive library. Ensure you review form previews and descriptions to select the appropriate document that complies with your local jurisdiction.

- Use the search function to find additional templates if needed. It's essential to pick exactly what suits your legal requirements.

- Select the 'Buy Now' option for your chosen document and decide on a subscription plan.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Download your chosen form for immediate use, with the option to access it later in the 'My Forms' section of your profile.

By following these steps, you can swiftly access legal documents for qualified trust vs non qualified trust, empowering your financial planning.

US Legal Forms is here to help you navigate this important aspect of asset management. Start using the platform today to streamline your legal document needs!

Form popularity

FAQ

A revocable trust is generally not classified as a qualified trust because the grantor retains control over the assets and can change the trust terms. This flexibility typically excludes it from the tax benefits associated with qualified trusts. When comparing qualified trust vs non qualified trust, it's crucial to see how the revocable option fits into your financial strategy. To explore your options in detail and find the right documentation, consider using US Legal Forms for clear and reliable resources.

A qualified trust account is a financial tool that meets specific criteria set by the IRS for tax benefits. These accounts allow the trust to receive favorable tax treatment, making it an attractive option for asset management. Understanding the differences in the qualified trust vs non qualified trust can help you make informed decisions. Using platforms like US Legal Forms can simplify the process of establishing a qualified trust by providing the necessary legal documents and guidance.

The primary difference between a qualified and a nonqualified trust lies in their tax treatment and eligibility criteria under IRS regulations. A qualified trust adheres to specific rules that allow for favorable tax benefits, while a nonqualified trust does not receive the same tax advantages. Understanding this contrast is essential for effective planning. For personalized solutions tailored to your situation, consider US Legal Forms for guidance.

A qualified trust for an IRA meets specific IRS requirements, allowing beneficiaries to stretch distributions over their lifetimes. This structure helps minimize tax burdens while maximizing the benefits of retirement savings. Understanding how a qualified trust functions compares to a nonqualified trust can impact your financial strategy significantly. Always consult a professional before deciding which option is best.

Yes, you can place an inherited IRA in a trust. Doing so can provide benefits like asset protection and control over distributions. However, it's crucial to ensure that the trust qualifies under IRS rules to optimize tax benefits. This step often leads to questions about the differences in outcomes between a qualified trust vs non qualified trust, so be sure to seek professional advice.

A smart choice for tax avoidance often involves using irrevocable trusts, as they can remove assets from your estate. This action can reduce estate tax liability while managing how income is distributed to beneficiaries. Knowing the distinctions between qualified trust vs non qualified trust enables you to choose the most beneficial approach for your specific tax situation.

While no trust can inherently avoid all taxes, some structures, like irrevocable trusts, can significantly reduce tax obligations. These trusts may help shield assets from estate taxes and can redirect income to beneficiaries, who will bear the tax responsibility. In the context of qualified trust vs non qualified trust, it's crucial to strategize effectively to minimize tax burdens.

Certain trusts are considered tax exempt under IRS regulations, such as charitable trusts and some types of irrevocable trusts. Generally, these trusts do not incur income taxes based on the income generated within the trust. When comparing qualified trust vs non qualified trust, it's vital to evaluate how these exemptions may apply and the potential financial impacts on your estate.

A qualified trust for tax purposes is a trust that meets specific IRS criteria, allowing it to obtain certain tax benefits. For instance, a qualified trust may pass income to beneficiaries without incurring immediate income taxes, making it advantageous for estate planning. Understanding the features of qualified trust vs non qualified trust can ultimately help you structure your assets for greater tax efficiency.

The best type of trust to minimize taxes often depends on individual circumstances. Many people find that a qualified trust is beneficial for tax purposes since it meets IRS requirements, offering potential tax benefits. Understanding the differences between qualified trust vs non qualified trust can help you make informed choices about tax efficiency.