Engagement Letter For Bookkeeping

Description

How to fill out Engagement Letter For Review Of Financial Statements By Accounting Firm?

What is the most reliable service to obtain the Engagement Letter For Bookkeeping and other up-to-date versions of legal documents? US Legal Forms provides the solution!

It hosts the largest collection of legal forms for any purpose. Each template is professionally written and verified for adherence to federal and local statutes and regulations.

Form compliance review. Prior to obtaining any template, ensure it aligns with your usage conditions and your state or county's regulations. Review the form details and use the Preview option if available.

- They are categorized by region and state of application, making it straightforward to locate the one you require.

- Experienced site users only need to Log In to their account, verify their subscription is active, and click the Download button next to the Engagement Letter For Bookkeeping to obtain it.

- Once saved, the document remains accessible for future usage in the My documents section of your profile.

- If you do not possess an account with us yet, follow these steps to create one.

Form popularity

FAQ

A financial engagement letter is a formal agreement between a client and an accountant or service provider. It outlines the scope of work, fees, and responsibilities, ensuring both parties understand their roles. This letter is essential for maintaining transparency and fostering trust within the working relationship. For businesses, using an engagement letter for bookkeeping can clarify services and expectations, promoting a smoother collaboration.

Typically, the accountant or bookkeeping service provider prepares the engagement letter. This document is crucial as it establishes the terms of service between the client and the service provider. By clearly defining expectations and responsibilities, the engagement letter for bookkeeping helps to prevent misunderstandings and enhances professional relationships. Collaborating with experienced professionals can simplify this process.

Yes, Certified Public Accountants (CPAs) can provide bookkeeping services, as they possess the necessary skills and knowledge. While bookkeeping is often associated with tracking daily financial transactions, CPAs bring additional expertise in financial management and reporting. This combination can be beneficial for businesses seeking accurate records and informed financial advice. When engaging a CPA for bookkeeping, ensure that an engagement letter for bookkeeping clearly outlines the services provided.

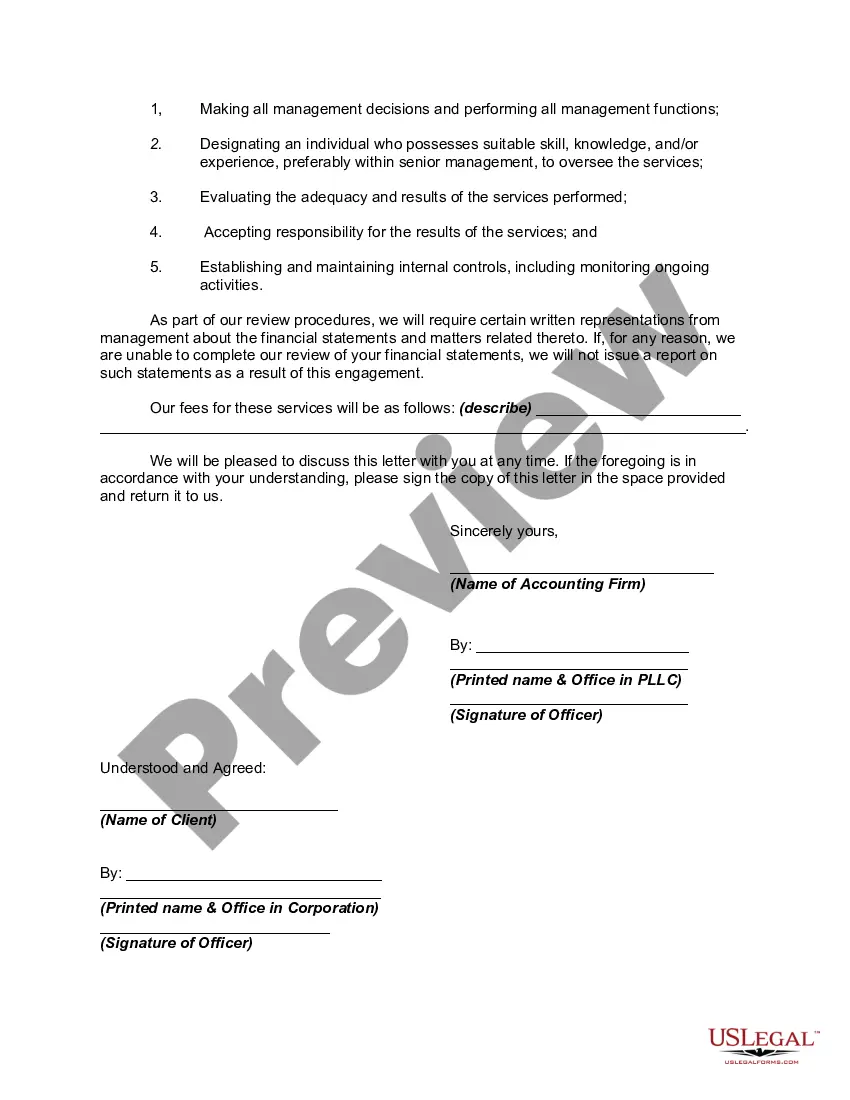

To write an engaging letter for bookkeeping, begin by clearly defining the scope of services you will provide. Ensure to include crucial details such as fees, payment methods, and the timeline for completion. Also, outline the responsibilities of both you and your client clearly. If you need additional guidance or a template, consider using platforms like uslegalforms, which offer tailored engagement letter samples.

An example of an engagement letter for bookkeeping might start with a brief introduction of the services to be provided. It would list the specific bookkeeping tasks, like recording transactions and preparing financial statements. Thereafter, it would clearly outline fees and timelines. This format helps ensure both parties understand their commitments and fosters a successful partnership.

Typically, the service provider, such as an accountant or bookkeeping firm, sends the letter of engagement. They initiate this process to clarify the terms of service and secure agreement from the client. Sending this letter demonstrates professionalism and fosters trust in the client-service provider relationship. Using a well-crafted engagement letter for bookkeeping can set the right tone for the engagement.

An engagement letter for bookkeeping usually includes the scope of services, fees, and payment terms. In addition, it often outlines the timeline and responsibilities of both the client and the service provider. This comprehensive approach ensures that everyone involved has clear guidelines and expectations. Having such details documented helps facilitate a smooth working relationship.

An engagement letter for bookkeeping is typically prepared by the bookkeeping service provider or accountant. This professional outlines the expectations, responsibilities, and scope of work in the letter. It's important for service providers to ensure clarity and agreement on terms. By crafting a detailed engagement letter, both parties can prevent misunderstandings.

The purpose of the engagement letter is to establish a mutual understanding of the services to be delivered, the fees, and the timeframe involved. This important document serves to protect both the client and the bookkeeper by clarifying roles and expectations from the outset. Additionally, a well-crafted engagement letter for bookkeeping enhances trust and sets a professional tone, ensuring a smooth collaboration.

An engagement letter in bookkeeping is a formal document outlining the agreement between a bookkeeper and a client. It details the duties and responsibilities of each party, the scope of work, and the fees involved. By providing this letter, both the bookkeeper and the client ensure they share the same expectations, fostering a professional relationship and reducing the risk of disputes.