Difference Between Limited And Non Limited Company

Description

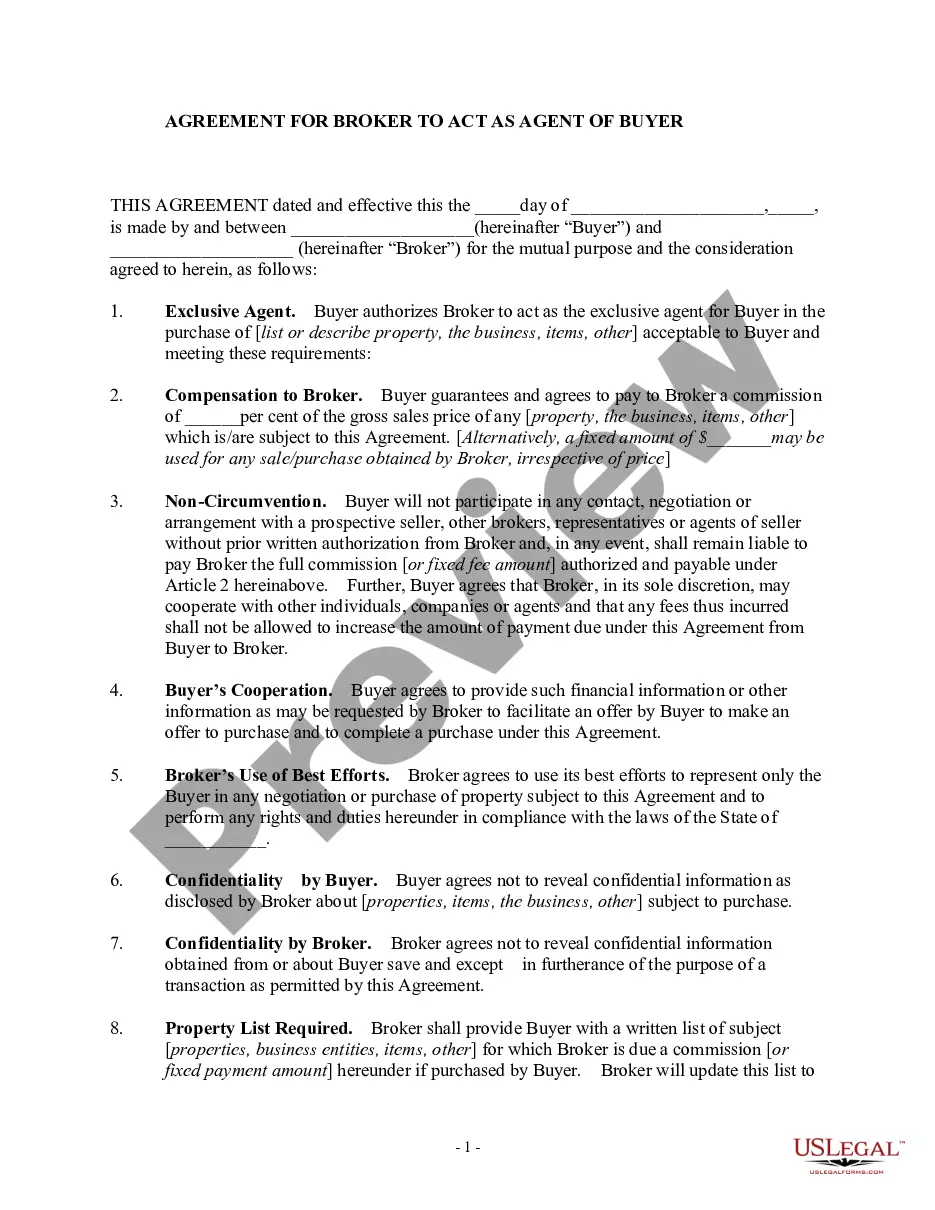

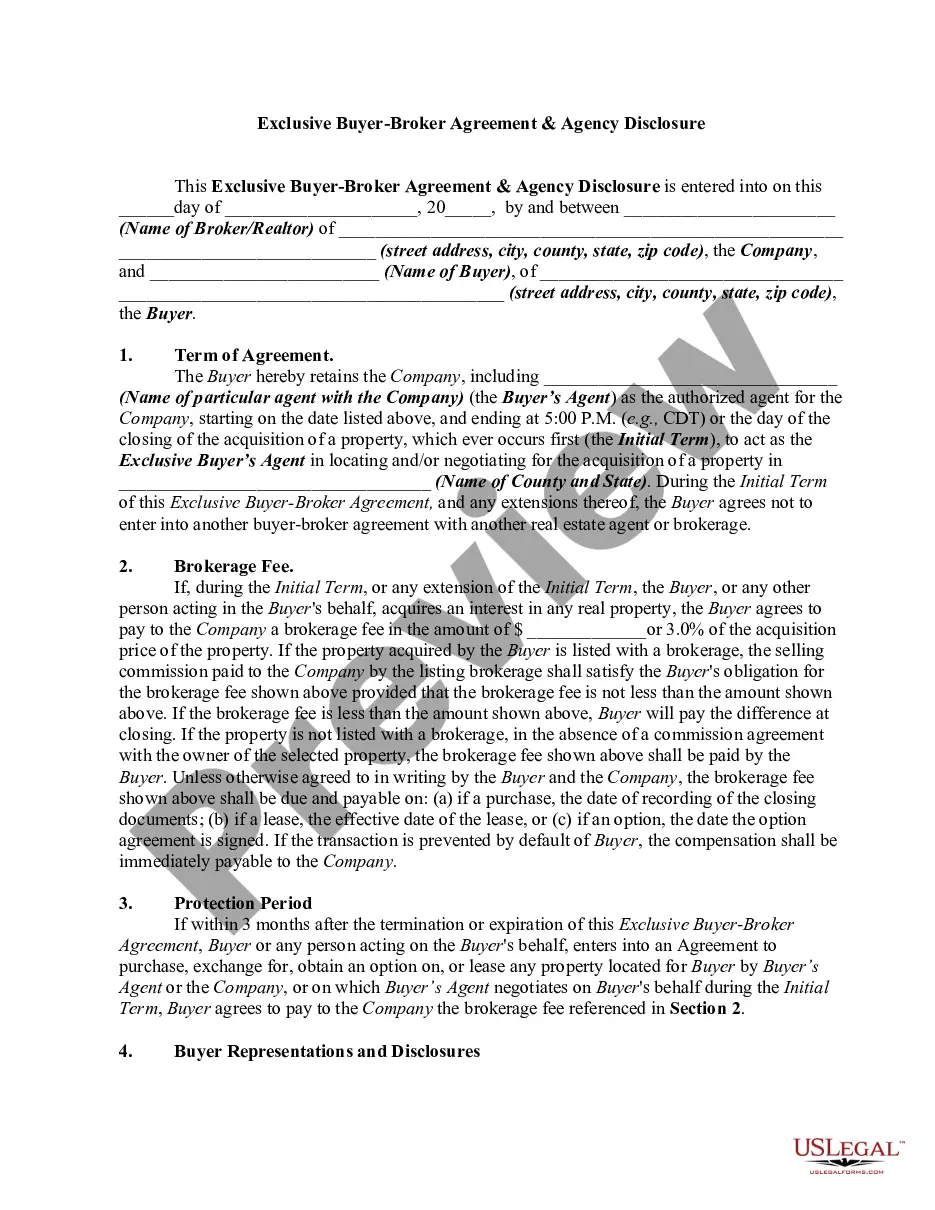

How to fill out Non-Exclusive Buyer-Broker Agreement And Agency Disclosure?

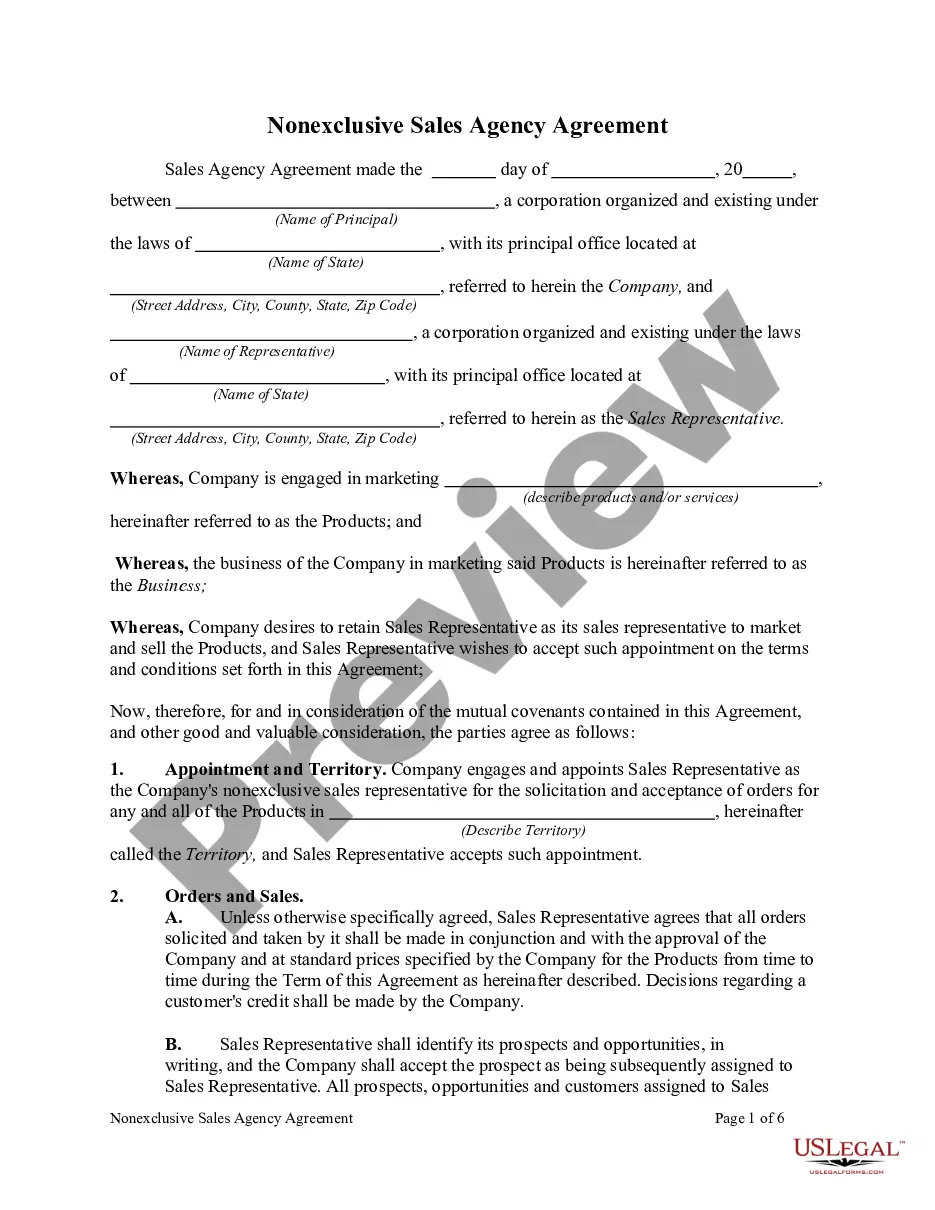

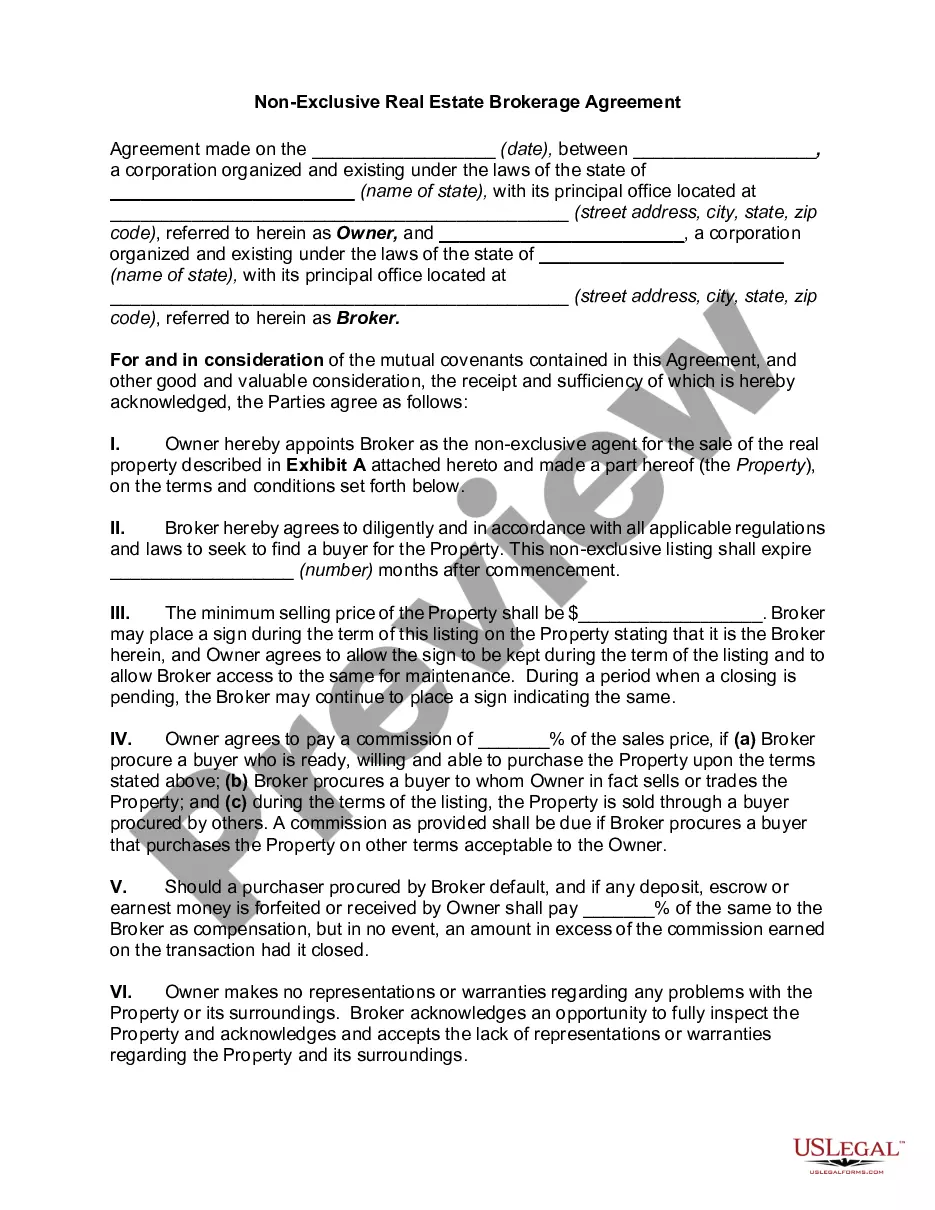

Whether for commercial purposes or personal matters, everyone must manage legal situations at some point in their lives.

Filling out legal documents requires meticulous attention, beginning with selecting the correct form template.

With a comprehensive US Legal Forms catalog available, you don’t have to waste time searching for the right template online. Utilize the library’s easy navigation to find the appropriate form for any situation.

- For example, if you choose an incorrect version of the Difference Between Limited And Non Limited Company, it will be rejected upon submission.

- Thus, it is vital to obtain a reliable source of legal documents like US Legal Forms.

- If you need to acquire a Difference Between Limited And Non Limited Company template, follow these uncomplicated steps.

- Utilize the search bar or catalog navigation to find the template you require.

- Review the form’s details to ensure it aligns with your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to locate the Difference Between Limited And Non Limited Company sample you seek.

- Obtain the template once it satisfies your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you have not set up an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing option.

- Fill out the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you prefer and download the Difference Between Limited And Non Limited Company.

- Once it is saved, you can complete the form using editing tools or print it to finish it by hand.

Form popularity

FAQ

Deciding whether a limited or unlimited company is better depends on your business goals and risk tolerance. Limited companies offer protection against personal liability, making them appealing for those who want to shield their assets. Unlimited companies may provide more flexibility in certain situations, but they come with increased personal financial risk. Evaluating your circumstances can help you determine the best fit for your needs.

A company qualifies as a limited company when it registers with the appropriate government authority and includes 'Limited' or 'Ltd' in its name. This designation indicates that the company's liability is limited to the amount invested by the shareholders. This structure provides financial security and can enhance credibility with clients and partners. By understanding the benefits, you can make informed decisions about your business structure.

When comparing a limited company to a non-limited one, the key difference lies in how liability is handled. Limited companies are separate legal entities, which limits the owners' liability to the amount they invested. Non-limited companies do not offer this legal protection, which can result in significant financial exposure for the owners. Choosing the right structure is essential for safeguarding your interests.

The difference between limited and non-limited companies primarily lies in liability. Limited companies protect owners from personal liability, meaning their personal assets are safe if the business fails. On the other hand, non-limited companies do not offer this protection, exposing owners to potential financial risk. Understanding this distinction is crucial for any entrepreneur considering their options.

Choosing not to be a limited company may stem from various reasons, including simplicity and lower regulatory requirements. Some entrepreneurs prefer a non limited structure for ease of management, especially in small ventures. However, it is essential to weigh the risks of personal liability against the benefits of protection when considering the difference between limited and non limited company.

The difference between limited and non limited companies focuses on liability and ownership. Limited companies protect shareholders' personal assets from the company's liabilities, whereas non limited companies do not provide this safety net. This distinction influences how business owners manage risks and responsibilities.

Limited and LLC are not the same, though they share similarities. An LLC, or Limited Liability Company, provides personal liability protection and has flexible ownership options, while 'limited' often refers to limited companies that may not offer the same level of protection. Knowing the difference between limited and non limited company can aid in your business structure choice.

When evaluating the tax implications, both LTD and LLC structures offer unique advantages. An LLC typically allows for pass-through taxation, meaning profits are taxed at the owner's personal tax rate, which can be beneficial. Conversely, an LTD may face corporate tax rates. Understanding the difference between limited and non limited company can help you make an informed decision about taxes.

The difference between limited and non limited company lies primarily in liability and ownership structure. A limited company protects its owners' personal assets from business debts, while a non limited company does not provide such protection, exposing owners to greater risk. This distinction is crucial for businesses to consider when choosing their structure.

To determine the type of LLC you have, start by checking your formation documents, which should indicate whether it is a single-member or multi-member LLC. Additionally, look at your operating agreement for specific details regarding management and ownership. Understanding the type of LLC helps clarify the difference between limited and non limited company structures.