Escrow Account With Bank

Description

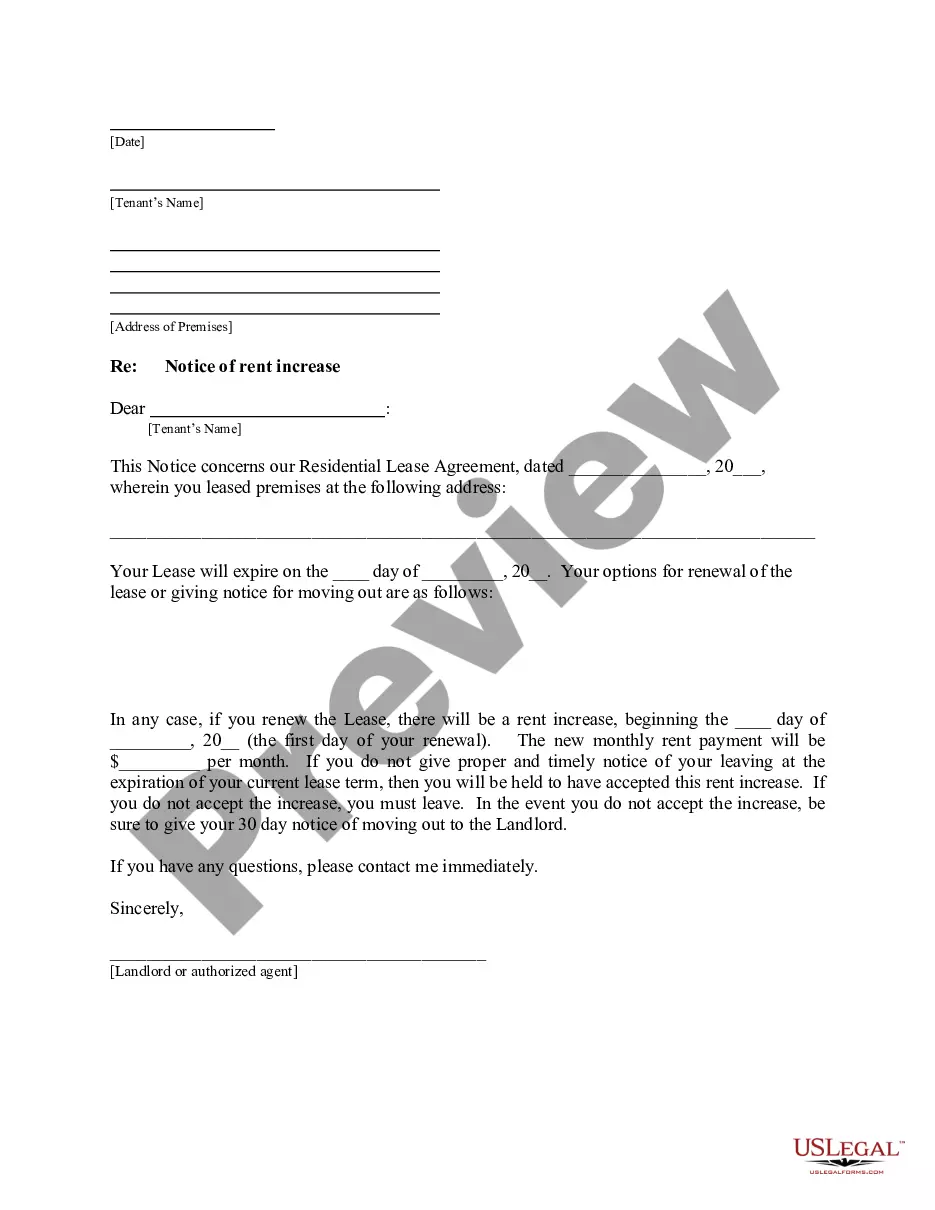

How to fill out Assignment Of Escrow Account?

It’s clear that you cannot become a legal expert instantly, nor can you easily learn how to promptly set up an Escrow Account With Bank without possessing a specific background.

Assembling legal documents is a lengthy undertaking that necessitates a particular education and skills.

So why not entrust the setup of the Escrow Account With Bank to the professionals.

You can regain access to your documents from the My documents tab at any moment. If you’re a returning customer, you can simply Log In, and locate and download the template from that same tab.

No matter the purpose of your documents—whether financial, legal, or personal—our platform has you covered. Try US Legal Forms today!

- Explore the form you need using the search bar at the top of the page.

- View it (if this option is available) and read the accompanying description to ascertain whether Escrow Account With Bank meets your requirements.

- Commence your search anew if you require a different form.

- Create a free account and choose a subscription plan to purchase the form.

- Select Buy now. Once the payment is finalized, you can download the Escrow Account With Bank, fill it out, print it, and send or mail it to the specified individuals or entities.

Form popularity

FAQ

To get an escrow account, start by contacting your bank to inquire about their specific requirements. Generally, you will need to provide personal information and documentation about the transaction you need the escrow account for. Some banks may require a deposit to open the account. Working with platforms like USLegalForms can simplify this process and ensure you meet all necessary guidelines for establishing your escrow account with a bank.

Several banks have escrow accounts available to their customers. Most major banks have this service, as it facilitates real estate and other financial transactions. Be sure to inquire about the terms they offer, as each bank might have different structures. USLegalForms can assist you in navigating these options to find a bank that meets your escrow account needs.

Many banks provide escrow accounts, including large national banks and local credit unions. Institutions such as Bank of America, Wells Fargo, and Chase are known for offering these services. It’s important to compare the features and fees between different banks. Consider using resources like USLegalForms to find the best option for setting up your escrow account.

While you can technically create an escrow-like arrangement, it’s advisable to use a bank's escrow account for security and legality. A bank's escrow account provides protection and structure that might be hard to replicate independently. Using a bank also ensures compliance with regulations. Services like USLegalForms can help you set up the right escrow account with a bank efficiently.

You can open an escrow account with any bank that provides this service. Typically, major banks and credit unions offer escrow accounts. It’s beneficial to research different banks to find one that suits your needs. Additionally, services like USLegalForms can guide you through the process of establishing your escrow account with ease.

Yes, you can set up an escrow account with a bank. Many banks provide this service as part of their offerings. It allows you to securely manage funds during various transactions, such as real estate deals or online purchases. This gives both parties the confidence they need during the process.

For a smooth escrow process, you will need to provide names and contact information of all parties involved, transaction details, and any documentation related to the agreement. It's also important to include instructions for the release of funds or documents from the escrow account. This clarity will help the bank manage the account effectively.

While it is technically possible to set up an escrow account independently, it is not advisable. Working with a bank ensures that all legal aspects are covered and that trust is established among parties. Additionally, using a platform like UsLegalForms can help you navigate the requirements and generate necessary documents efficiently.

Starting an escrow process is straightforward. First, you will need to select a reputable bank to manage your escrow account. After that, consult with the involved parties to draft an escrow agreement and present the necessary documents to initiate the process at the bank.

To create a valid escrow account with a bank, you must establish a clear agreement between all parties involved. This agreement should outline the terms and conditions of the transaction, including what funds or documents are held in escrow. The bank will also require the associated transaction documents to ensure compliance with legal requirements.