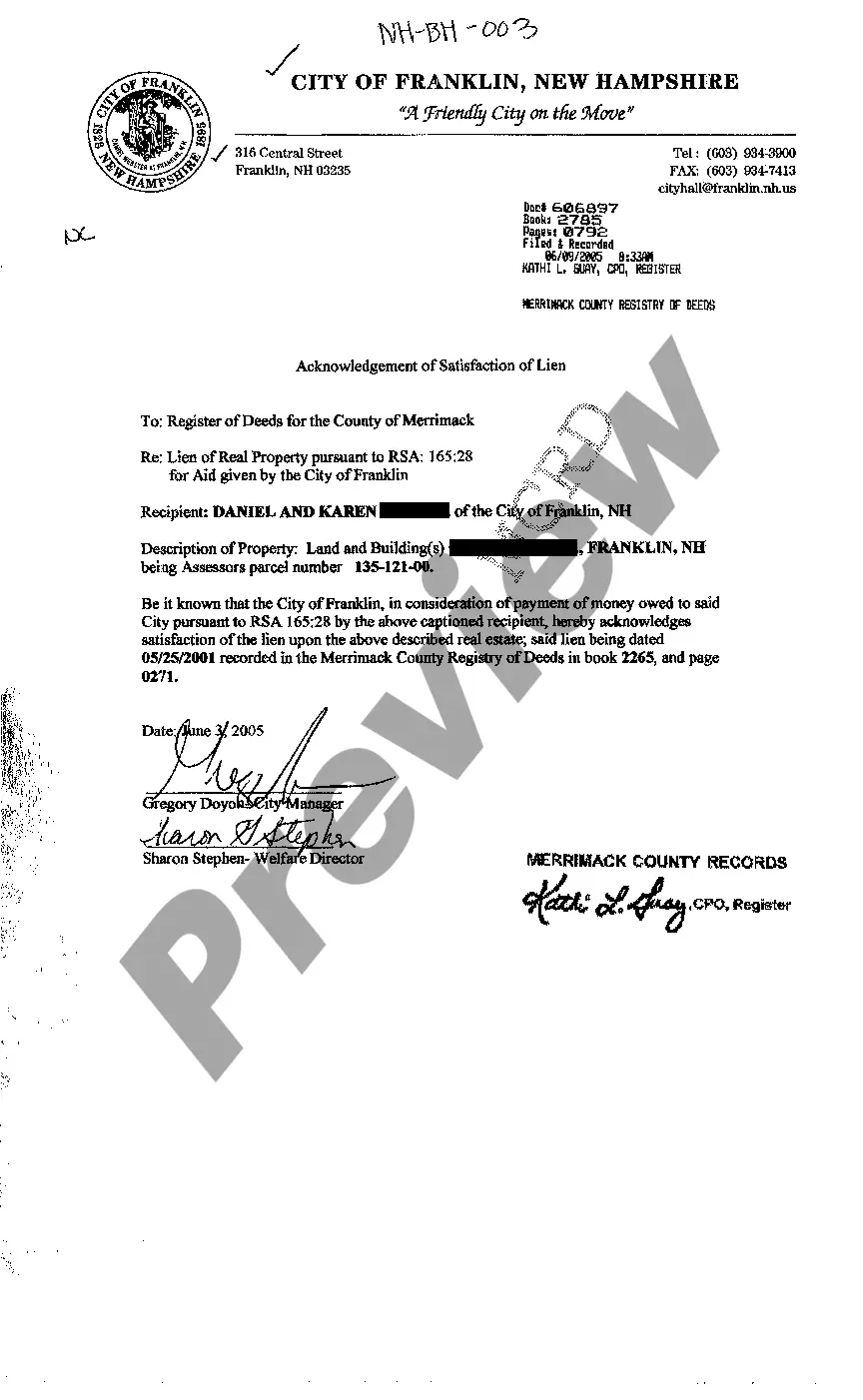

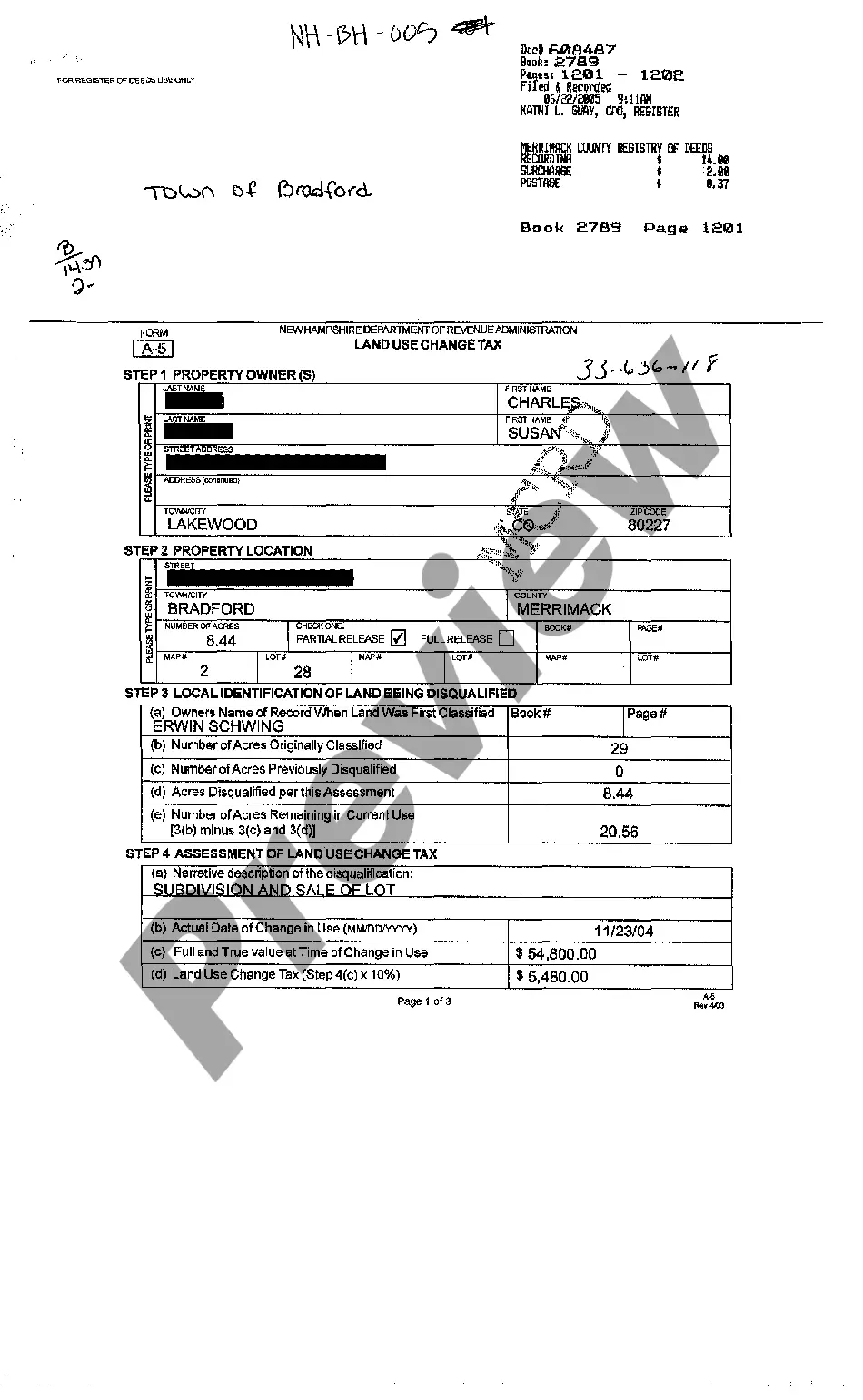

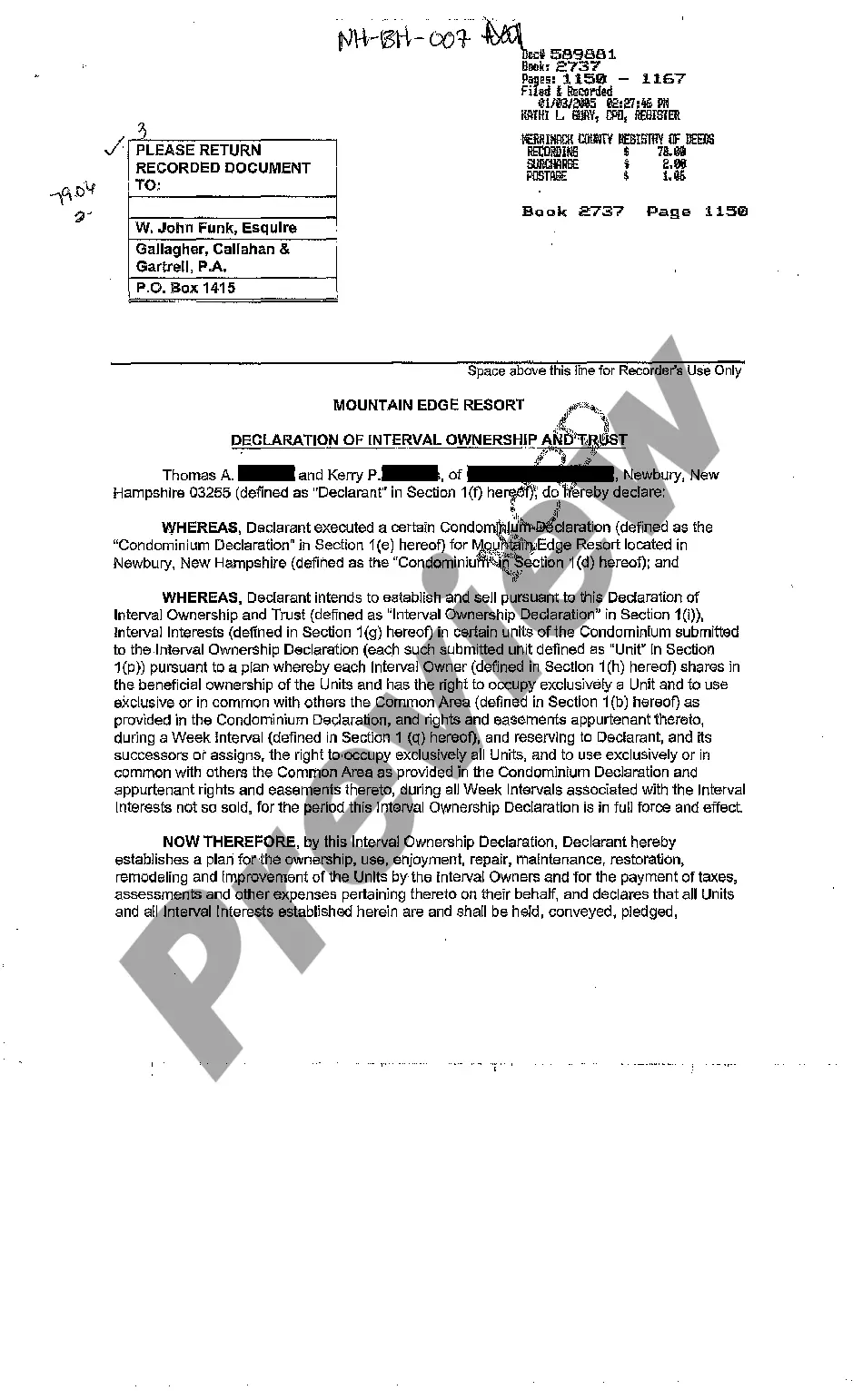

A Massachusetts Reaffirmation Agreement is a legal document that allows a debtor to reaffirm a debt that was previously discharged in a Chapter 7 bankruptcy. This document is signed by both the debtor and the creditor, and it serves to reinstate the debt and any associated obligations and liabilities. The agreement binds the debtor to the previously discharged debt and sets a payment plan for the repayment of that debt. There are two types of Massachusetts Reaffirmation Agreements: voluntary and involuntary. A voluntary reaffirmation agreement is one in which the debtor agrees to the terms of the agreement without any coercion from the creditor. An involuntary reaffirmation agreement is one that is entered into because of creditor pressure or coercion.

Massachusetts Reaffirmation Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Reaffirmation Agreement?

Managing official paperwork necessitates focus, precision, and utilizing well-prepared templates. US Legal Forms has been assisting individuals nationwide in this endeavor for 25 years, so when you select your Massachusetts Reaffirmation Agreement template from our collection, you can be confident it complies with federal and state standards.

Using our service is straightforward and rapid. To obtain the necessary document, all you’ll need is an account with an active subscription. Here’s a concise guide for you to locate your Massachusetts Reaffirmation Agreement within minutes.

All documents are designed for multiple uses, such as the Massachusetts Reaffirmation Agreement you see on this page. If you require them in the future, you can complete them without additional payment - simply access the My documents tab in your profile and finish your document whenever you need it. Explore US Legal Forms and efficiently manage your business and personal paperwork while ensuring full legal compliance!

- Ensure to meticulously review the form content and its alignment with general and legal criteria by previewing it or examining its description.

- Search for another formal template if the one you previously accessed does not align with your circumstance or state regulations (the tab for this is located in the upper page corner).

- Log in to your account and store the Massachusetts Reaffirmation Agreement in your desired format. If it’s your first time using our website, click Buy now to proceed.

- Create an account, select your subscription plan, and complete your payment with your credit card or PayPal account.

- Choose the format in which you wish to save your form and click Download. Print the template or add it to a professional PDF editor for a paperless submission.

Form popularity

FAQ

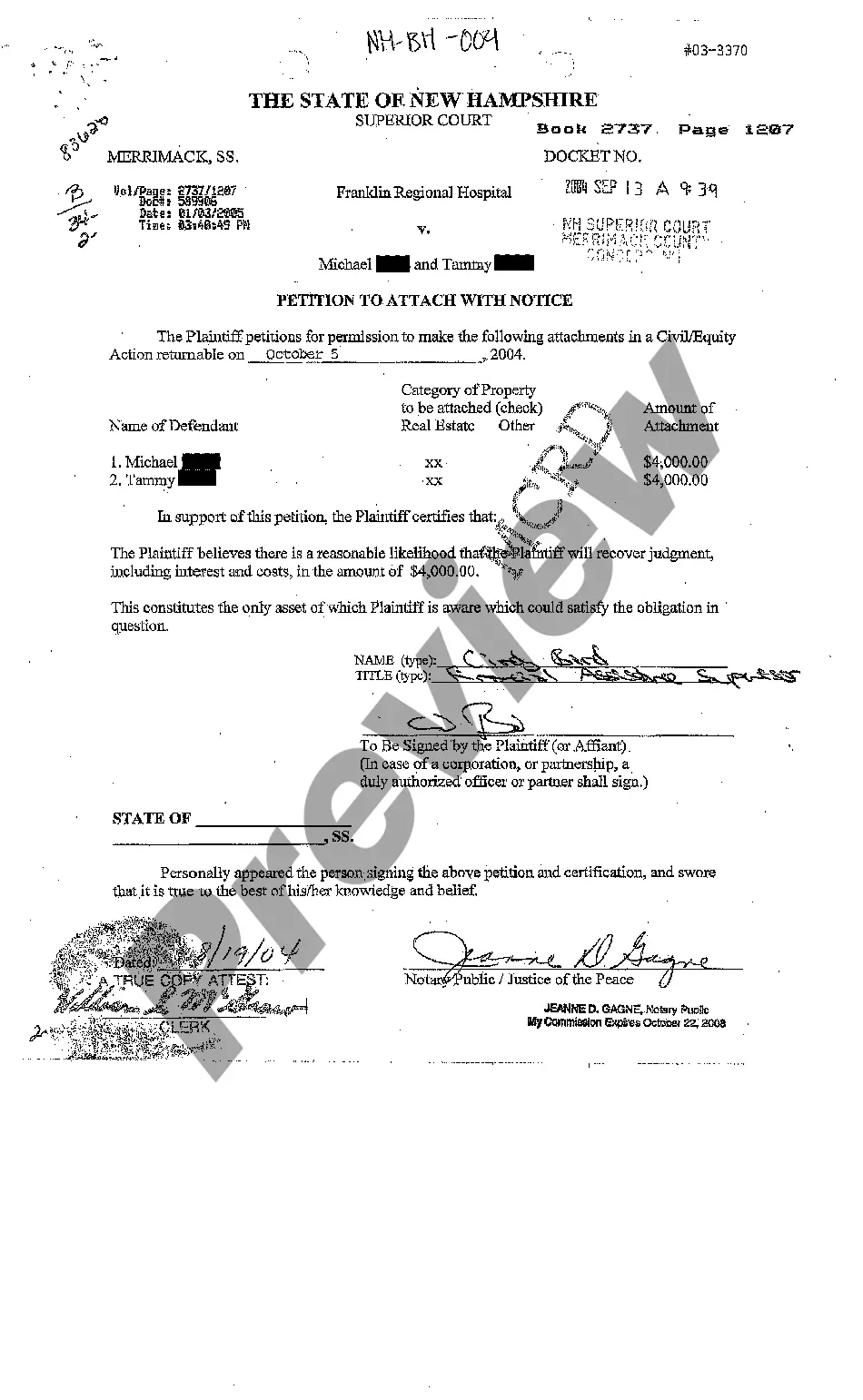

If you reaffirm a debt and then fail to pay it, you owe the debt the same as though there was no bankruptcy. The debt will not be discharged, and the creditor can take action to recover any property on which it has a lien or mortgage. The creditor can also take legal action to recover a judgment against you.

A reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion of the money owed, even though the debtor has filed bankruptcy. In return, the creditor promises that, as long as payments are made, the creditor will not repossess or take back its collateral.

Creditors frequently do not automatically generate reaffirmation agreements. Sometimes creditors may not even file a reaffirmation agreement even after you have signed and returned the agreement to them.

Reaffirmation agreements are voluntary, so you're not required to sign one. It's unnecessary to have one if you want to voluntarily repay a debt instead of including it in your bankruptcy.

A reaffirmation agreement is where you agree to pay a debt even though you could have eliminated the debt in your bankruptcy case. When you reaffirm a debt, you continue to be legally responsible for paying it back. This gives the creditor some legal rights.

Reaffirming a mortgage debt requires a comprehensive multi-page reaffirmation agreement that must be filed with the court. The reaffirmation agreement also requires the debtor's bankruptcy attorney to indicate that he or she has read the agreement and that it does not impose any undue hardship on the client.

You will likely have to default on the loan before the lender takes such an action, but if you don't reaffirm, you'll live in a legal gray area. Your lender can take your home even if you make all your payments, as you are no longer obligated under the terms of the promissory note.

If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.