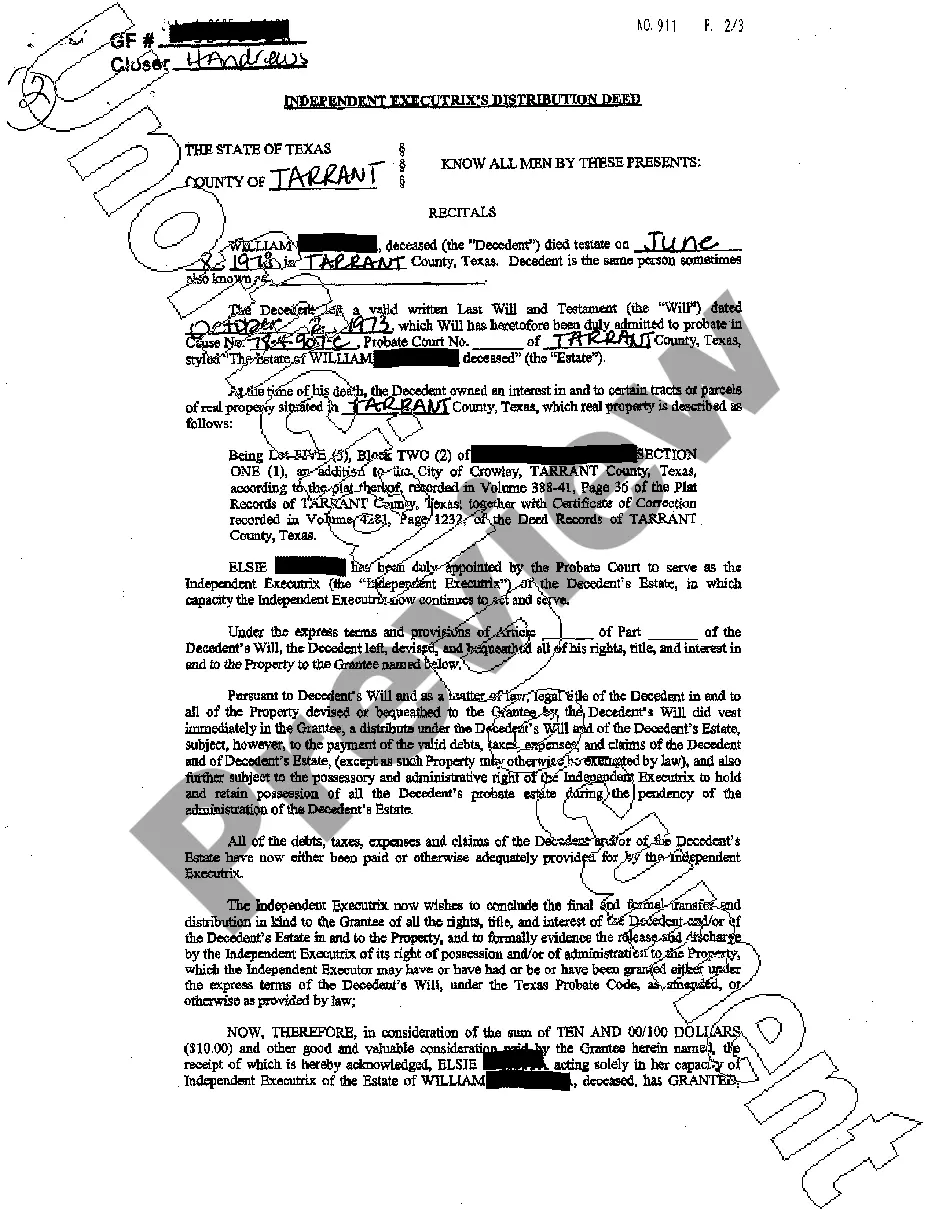

Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary

Understanding this form

This Distribution Deed - Joint Independent Executors to an Individual Beneficiary form allows Joint Independent Executors to transfer real property from a decedent's estate directly to a named beneficiary. This deed is essential for formally concluding the distribution process and is compliant with all relevant state statutory laws.

Form components explained

- Identification of Joint Independent Executors and Grantee.

- Description of the real property being transferred.

- Declaration of the fulfillment of debts and claims against the decedent's estate.

- Notarization section to validate the execution of the deed.

- Signatures of the Joint Independent Executors affirming the transfer.

Situations where this form applies

This form should be used when the estate of a decedent has been settled, all claims and debts are resolved, and the Joint Independent Executors are ready to distribute remaining property to the designated beneficiary. It formalizes the transfer of ownership and legally evidences the completion of the estate administration process.

Who needs this form

- Joint Independent Executors managing a decedent's estate.

- A beneficiary designated to receive property from the estate.

- Heirs of a decedent ensuring the proper transfer of real property.

Steps to complete this form

- Identify the parties involved: the Joint Independent Executors and the beneficiary (Grantee).

- Provide a detailed description of the real property being conveyed.

- State that all debts, taxes, and claims of the decedent have been addressed.

- Ensure both Joint Independent Executors sign the form where indicated.

- Have the signatures notarized to complete the process.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Common mistakes to avoid

- Failing to include a complete description of the property.

- Omitting signatures from all Joint Independent Executors.

- Neglecting to have the form notarized before submission.

Why complete this form online

- Convenient access to a legally reviewed template.

- Editability allows users to tailor the form to their specific situation.

- Quick download process saves time compared to traditional legal services.

Form popularity

FAQ

Beneficiaries are entitled to receive a financial accounting of the trust, including bank statements, regularly. When statements are not received as requested, a beneficiary must submit a written demand to the trustee.The court will review the trust account for any discrepancies or irregular activity.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

An executor can sell a property without the approval of all beneficiaries. The will doesn't have specific provisions that require beneficiaries to approve how the assets will be administered. However, they should consult with beneficiaries about how to share the estate.

Naming someone as the executor of your estate does not preclude him or her from inheriting from you. In fact, the executor can and often is a beneficiary of the estate.Distributing the remaining assets to your beneficiaries.

Beneficiaries often must sign off on the inheritance they receive to acknowledge receipt of the distribution. For example, if you inherit a portion of real estate from the decedent, you must sign a deed accepting that real estate.

The short answer is yes. It's actually common for a will's executor to also be one of its beneficiaries.Someone close enough to the decedent to be a beneficiary would have that familiarity and more. The probate court system actually favors beneficiaries serving as executors in some cases.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Each beneficiary is entitled to a trustee's accounting, at least annually, at termination of the trust, and on upon a change of trustee. (California Probate Code 16062). Unfortunately, not all beneficiaries are entitled to automatic accounting, nevertheless, the court may force the trustee to provide an accounting.

The executor can sell property without getting all of the beneficiaries to approve.If the executor can sell the property for more than 90 percent of its appraised value then they do not need to get the permission of the beneficiaries or of the court.