Interest States Sample With Interest Rates

Description

How to fill out Assignment Of Interest In United States Patent?

Managing legal documents can be daunting, even for the most seasoned professionals.

When you're searching for an Interest States Sample With Interest Rates but lack the opportunity to invest time in finding the correct and current version, the process can become stressful.

US Legal Forms addresses all your needs, covering a range from personal to business documentation, all in one location.

Employ sophisticated tools to complete and manage your Interest States Sample With Interest Rates.

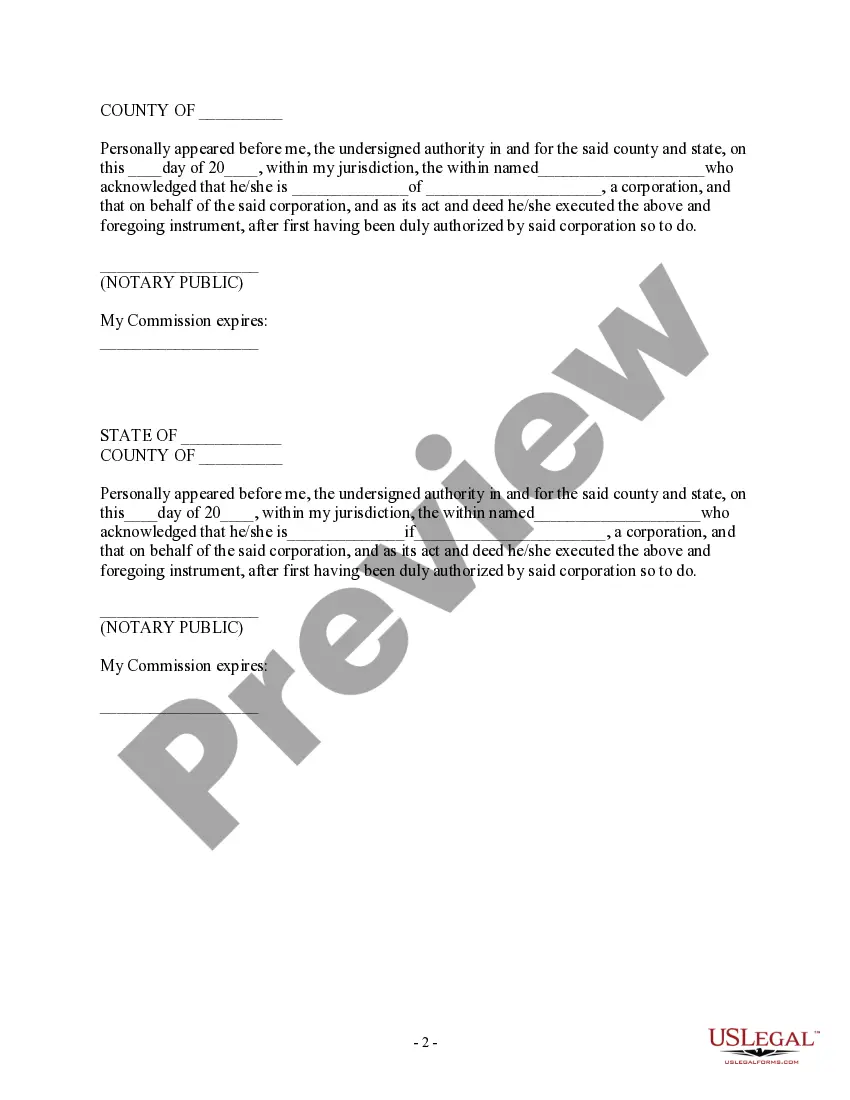

Here are the steps to follow after downloading the form you need: Verify that it is the correct form by previewing and reviewing its description. Confirm that the sample is approved in your state or county. Click Buy Now when you are ready. Select a subscription plan. Choose the desired file format, and Download, complete, eSign, print, and submit your document. Experience the US Legal Forms web library, bolstered by 25 years of knowledge and reliability. Change your routine document handling into a simple and user-friendly process today.

- Tap into a resource hub of articles, tutorials, handbooks, and materials pertinent to your circumstances and needs.

- Save time and effort in searching for necessary documents, using US Legal Forms’ advanced search and Preview tool to find Interest States Sample With Interest Rates and obtain it.

- If you hold a subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check the My documents tab to review documents you've previously saved and to organize your folders as required.

- If you're new to US Legal Forms, sign up and gain unlimited access to all the features of the library.

- Utilize a robust web form library that can significantly improve outcomes for anyone aiming to handle these scenarios effectively.

- US Legal Forms stands as a premier provider of online legal documents, boasting over 85,000 state-specific legal forms available at your convenience.

- Access either state- or county-specific legal and business forms.

Form popularity

FAQ

To find the force of interest from the interest rate, you can use the formula that relates the two concepts. The force of interest provides a continuous growth rate, while the interest rate is typically expressed on a discrete basis. When using interest states sample with interest rates, this conversion reveals how changes in interest rates can affect investment growth. By applying the formula, you gain vital insights into the compounding effect of your investments.

For example, if you borrow $100 with a 5% interest rate, you will pay $105 dollars back to the lender you borrowed from. The lender will make $5 in profit. There are several types of interest you may encounter throughout your life. Every loan has its own interest rate that will determine the true amount you owe.

The stated interest rate, which is also known as the nominal interest rate, will represent the rate of interest that has been charged prior to any adjustments for compounding market factors. The stated interest rate will be the rate displayed on the loan agreement.

Figure out your monthly interest due by dividing your interest rate by 12. For example, an 8% interest rate loan would be . 007 (. 08 divided by 12).

If you borrow $1,000 from a bank for one year and have to pay an agreed $60 in interest for that year, your stated interest rate is 6%. Here is the calculation: Stated interest rate = Interest ÷ Principal. = $60 ÷ $1,000 = 6%

Using the interest rate formula, we get the interest rate, which is the percentage of the principal amount, charged by the lender or bank to the borrower for the use of its assets or money for a specific time period. The interest rate formula is Interest Rate = (Simple Interest × 100)/(Principal × Time).