Setting Aside Judgment Of Guilt

Description

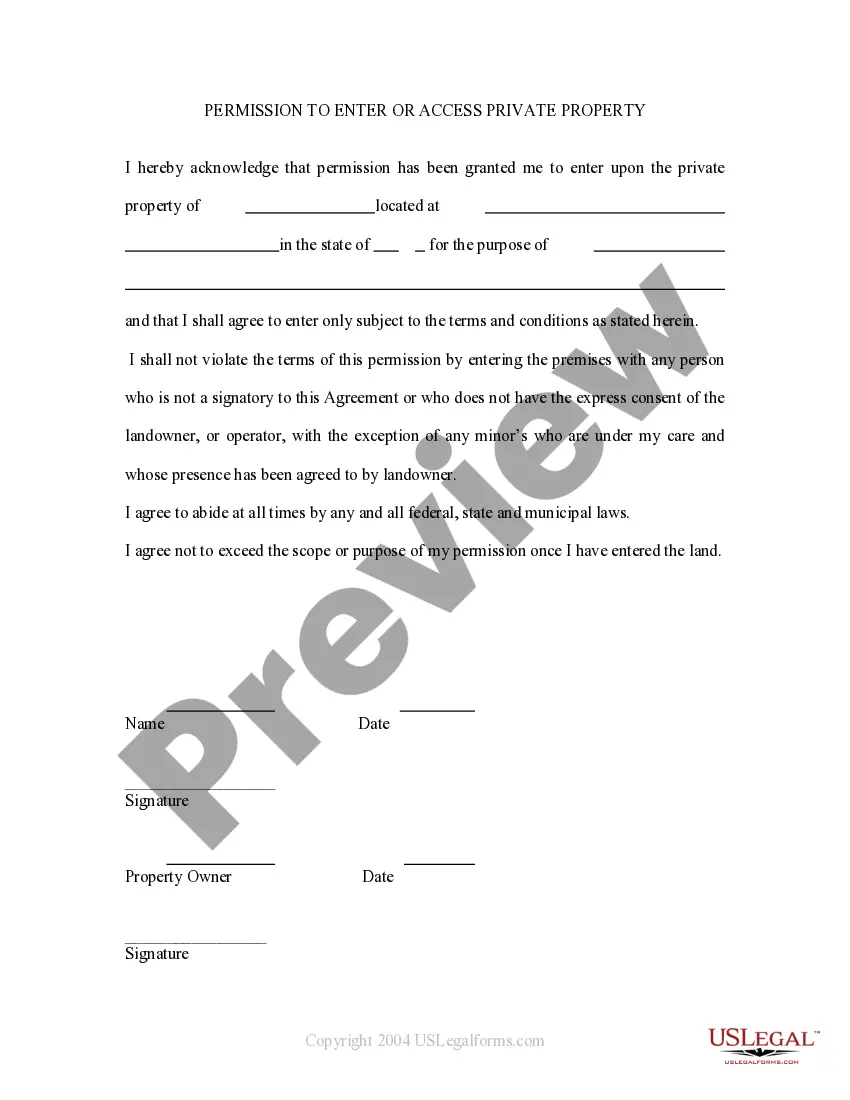

How to fill out Motion To Set Aside Entry Of Default And Default Judgment?

Utilizing legal forms that adhere to national and local regulations is crucial, and the web presents numerous choices to choose from.

However, why squander time hunting for the accurately composed Setting Aside Judgment Of Guilt template online when the US Legal Forms digital library already compiles such documents in one location.

US Legal Forms stands as the largest virtual legal inventory featuring over 85,000 customizable templates crafted by lawyers for any personal or business situation.

Take advantage of the most comprehensive and user-friendly legal documentation service!

- They are straightforward to navigate, with all documents categorized by state and intended use.

- Our experts keep pace with legal amendments, ensuring your form is current and compliant when acquiring a Setting Aside Judgment Of Guilt from our site.

- Securing a Setting Aside Judgment Of Guilt is quick and efficient for both existing and new clients.

- If you possess an account with an active subscription, sign in and save the form sample you need in your chosen format.

- If you are a newcomer to our platform, adhere to the following guidelines.

Form popularity

FAQ

'Judgment set aside' in Arizona refers to a legal process that removes the legal consequences of a guilty verdict or plea from your record. When a judgment is set aside, it indicates that you have been granted relief from the penalties associated with your conviction. Importantly, this does not erase the conviction, but it restores your civil rights and helps mitigate the impact on your life. Understanding this can be pivotal in your journey of setting aside judgment of guilt.

How to start an Illinois Sole Proprietorship Step 1 ? Business Planning Stage. ... Step 2 ? Name your Sole Proprietorship and Obtain a DBA. ... Step 3: Get an EIN from the IRS. ... Step 4 ? Research business license requirements. ... Step 5 ? Maintain your business.

Service and retail businesses must have annual gross sales of less than $6 million; Wholesale businesses and construction firms must have annual gross sales of less than $10 million; Manufacturing firms must have annual gross sales of less than $10 million and less than 250 employees.

The state of Illinois doesn't require or issue a statewide business operating license ? a license that simply permits you to do business in the state. Anyone can start and operate a business without a general license.

If you prefer to operate as a sole proprietorship, you can do that and still get the Illinois business licenses you need. And, yes, you're still required to complete tax registration and apply for proper licenses and permits, even if you operate as sole proprietor.

When it comes to being a sole proprietor in the state of Illinois, there is no formal setup process. There are also no fees involved with forming or maintaining this business type. If you want to operate an Illinois sole proprietorship, all you need to do is start working.

If you are the only owner and begin conducting business, you automatically become a sole proprietorship. There is no need to formally file paperwork or submit anything at the federal, state, or local level to be recognized as such.

While there's no mandatory action to create a sole proprietorship, you can follow four straightforward steps to kickstart your business: Choose A Business Name. File A Fictitious Business Name Statement With Your County. Apply For Licenses, Permits, And Zoning Clearance. Obtain An Employer Identification Number (EIN)