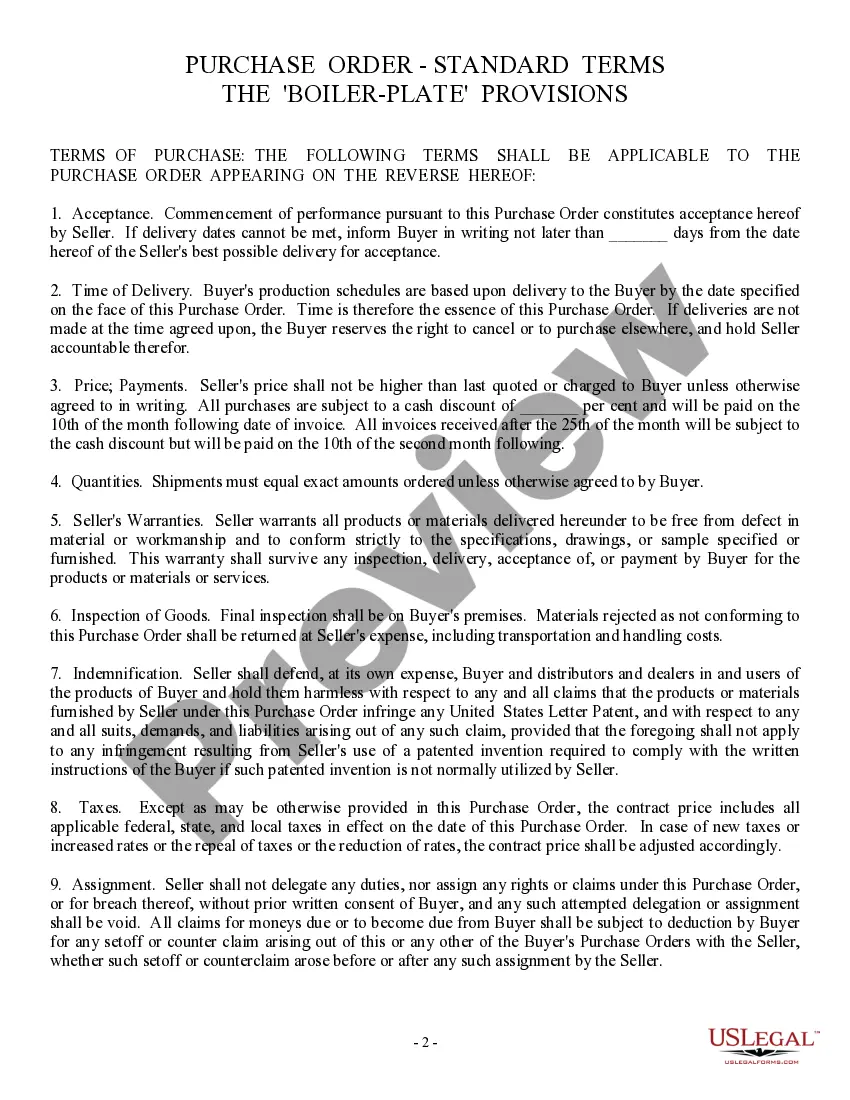

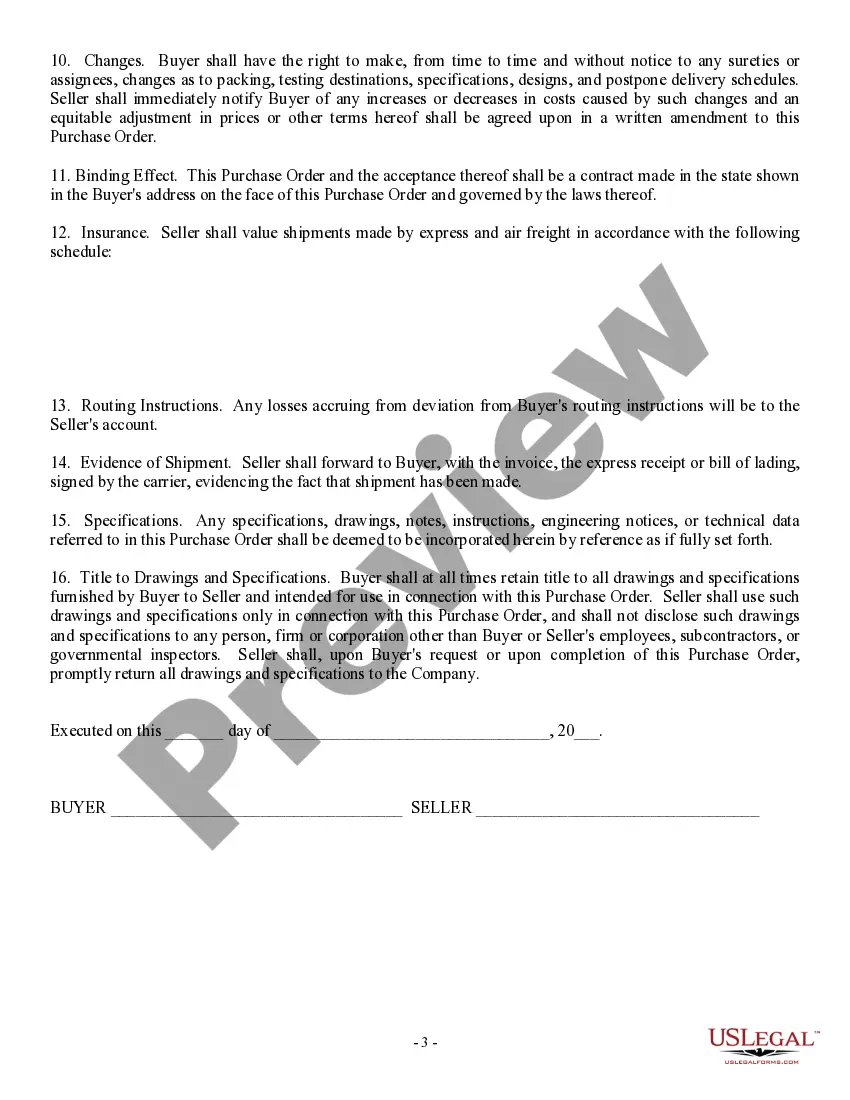

Purchase Order Format For Machinery

Description

How to fill out Purchase Order, Standard?

Managing legal documentation and tasks can be a lengthy addition to your daily routine.

Purchase Order Template for Machinery and similar forms generally necessitate you to search for them and comprehend how to finalize them accurately.

Thus, whether you are handling financial, legal, or personal issues, utilizing a comprehensive and user-friendly online repository of forms when required will greatly assist.

US Legal Forms is the leading online platform for legal templates, providing more than 85,000 state-specific documents alongside various tools to help you accomplish your paperwork swiftly.

Simply Log In to your account, find Purchase Order Template for Machinery and download it immediately under the My documents section. You can also retrieve previously saved documents.

- Explore the collection of relevant documents available with mere clicks.

- US Legal Forms offers state- and county-specific templates accessible for download at any time.

- Protect your document management processes using a premium service that enables you to assemble any form in moments without any extra or hidden fees.

Form popularity

FAQ

The lender keeps the original promissory note until you have fulfilled all obligations, i.e., paid off, your mortgage. A promissory note will generally contain the following information: The total amount of money borrowed; Your interest rate (either fixed or adjustable);

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

Names of All Involved Parties -the Promissory Note must include the legal names of all the parties who are a part of the transaction. Contact /Address Details of All Parties - The note must include the address and contact number of all the parties which are involved in the transaction.

Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

For example, you might agree to change the interest rate or the length of the loan. Always put promissory note changes in writing and have the borrower sign off on them, as oral changes can't be enforced in court. Changing a note without the borrower's written agreement makes a promissory note invalid.

To enforce a promissory note, you will likely need to: sue the debtor of the note. get a judgment from the court.

Once both the promissory note and the deed of trust are signed, the borrower and lender have evidence of this legally binding agreement. Your lender will typically provide you with a copy of the promissory note, along with several other documents, when you close on your home purchase.

In order for the note to be negotiable, the Code requires that it must be in writing, be signed by the maker, be an unconditional promise to pay, state a specific sum of money, be payable on demand or at a definite time and be payable to the payee or bearer.