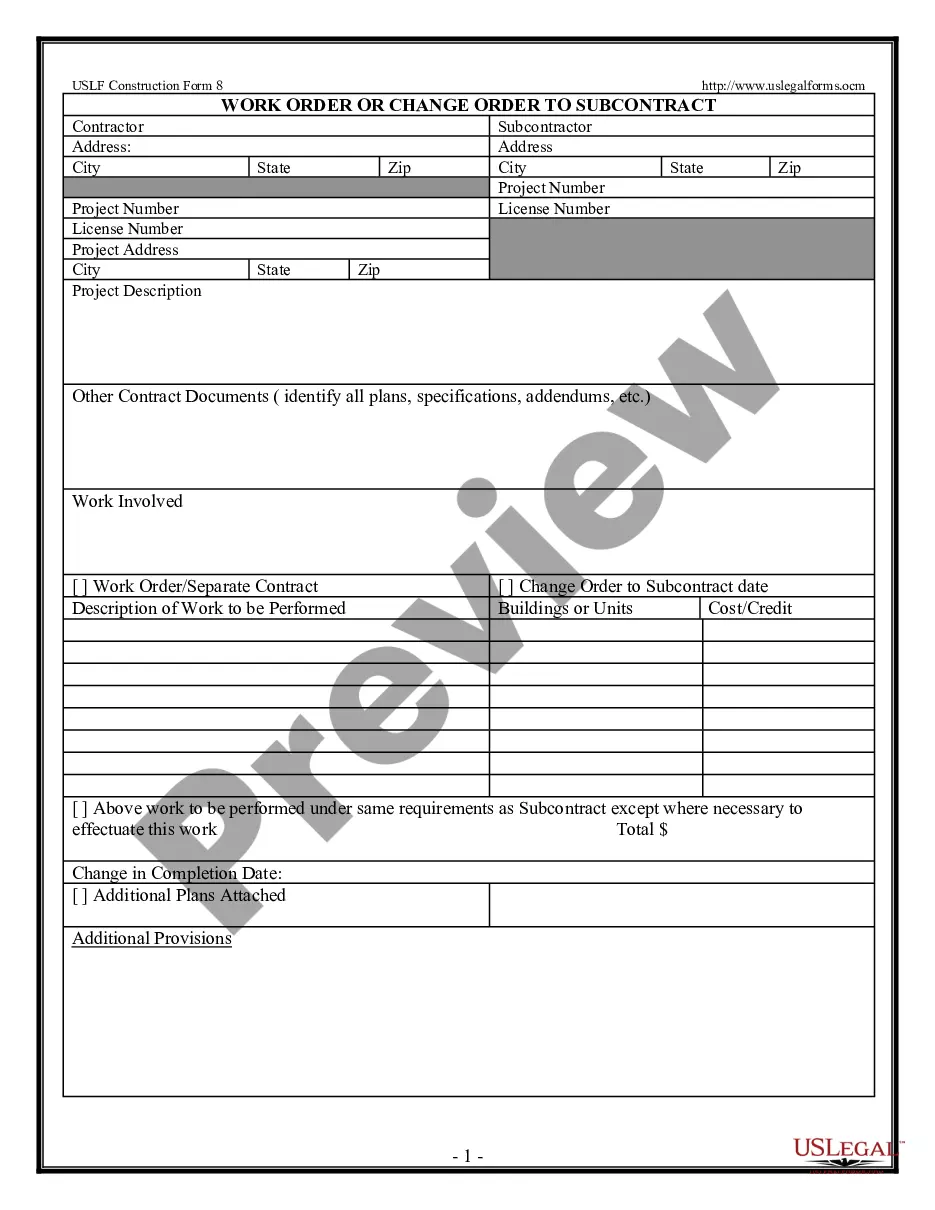

Change Order Form With Cra

Description

How to fill out Change Order For Construction Or Repairs By Contractor?

The Change Order Form With Cra that you observe on this page is a reusable legal template crafted by expert lawyers in accordance with federal and state laws.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal practitioners more than 85,000 confirmed, state-specific forms for any commercial and personal circumstances. It’s the quickest, simplest, and most dependable method to acquire the documents you require, as the service ensures the utmost level of data protection and anti-malware measures.

Register for US Legal Forms to have verified legal templates for all of life’s circumstances accessible to you.

- Browse for the document you require and review it.

- Select the file you searched and preview it or examine the form description to confirm it meets your needs. If it doesn’t, utilize the search function to find the correct one. Click Buy Now once you’ve found the template you need.

- Subscribe and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to move forward.

- Obtain the editable template.

- Select the format you desire for your Change Order Form With Cra (PDF, Word, RTF) and download the sample onto your device.

- Complete and endorse the documentation.

- Print out the template to fill it out manually. Alternatively, use an online versatile PDF editor to swiftly and precisely fill out and sign your form with a valid signature.

- Download your documents again.

- Access the same document whenever necessary. Visit the My documents tab in your profile to redownload any previously stored forms.

Form popularity

FAQ

We have four common personalized remittance vouchers that we may send with your statements or notices: Form RC158, Remittance Voucher ? Payment on Filing. Form RC159, Remittance Voucher ? Amount Owing. Form RC160, Remittance Voucher ? Interim Payments.

How to update your direct deposit, mailing address or telephone number complete the eServiceCanada form. visit a Service Canada Office, or. contact the call centre responsible for the benefits you have received.

Here are 4 ways you can notify the CRA you're changing your address: Online: Visit your My Account portal on the CRA website. ... By Phone: Call the CRA at 1-800-959-8281. By mail to your local tax centre: Complete and submit form RC325 (Address Change Request) By filing your annual tax return:

To make your GST/HST instalment payments, use Form RC160, Remittance Voucher ? Interim Payments. This form is only available in a personalized and printed format. You still have to make your payment by the due date even if you do not receive your remittance form on time.

ReFILE for individuals who use NETFILE If you did not file your return online, you can use Change my return which is a secure My Account service that allows you to make an online adjustment. Otherwise, you will have to mail a paper Form T1-ADJ, T1 Adjustment Request, to the Canada Revenue Agency (CRA).