Subcontract Work For Accountants

Description

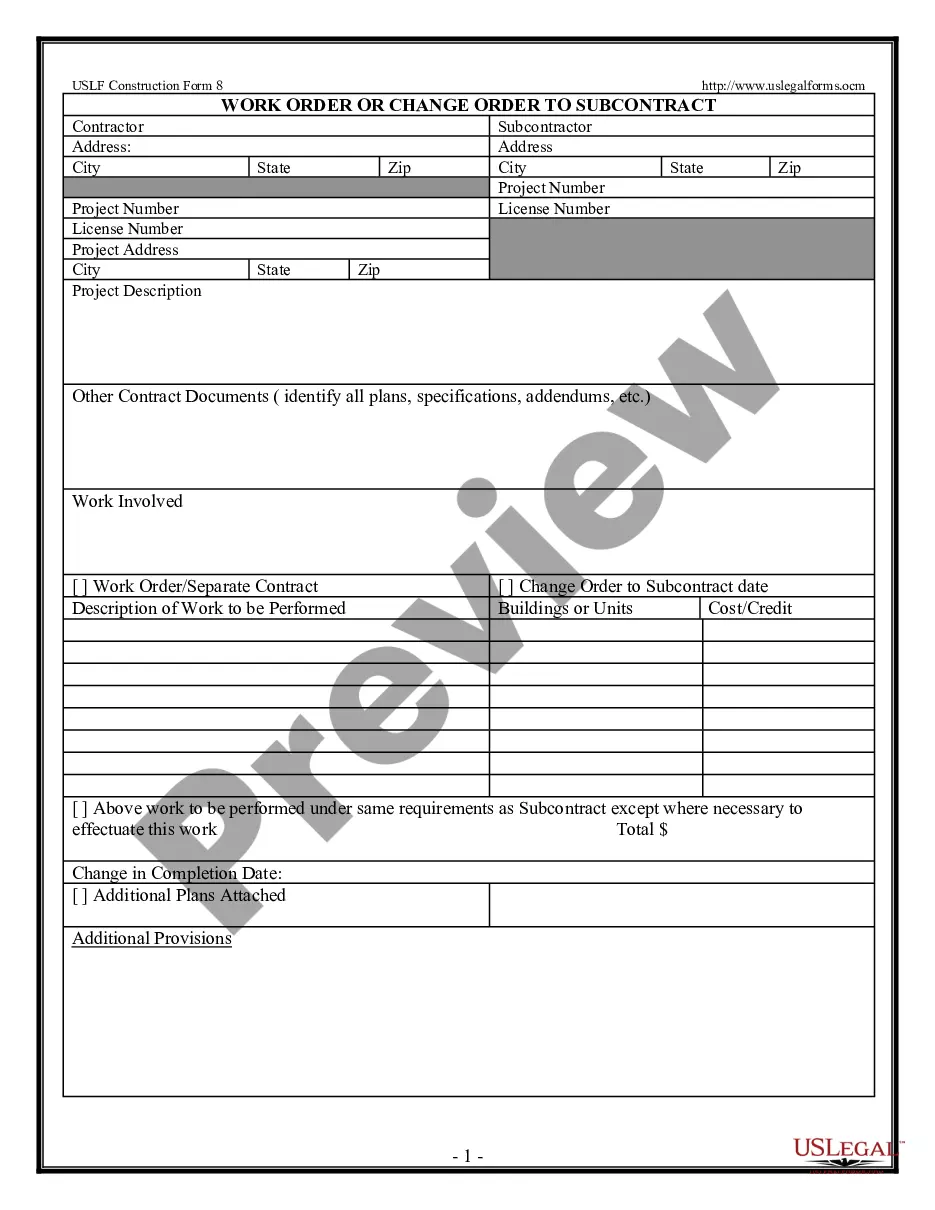

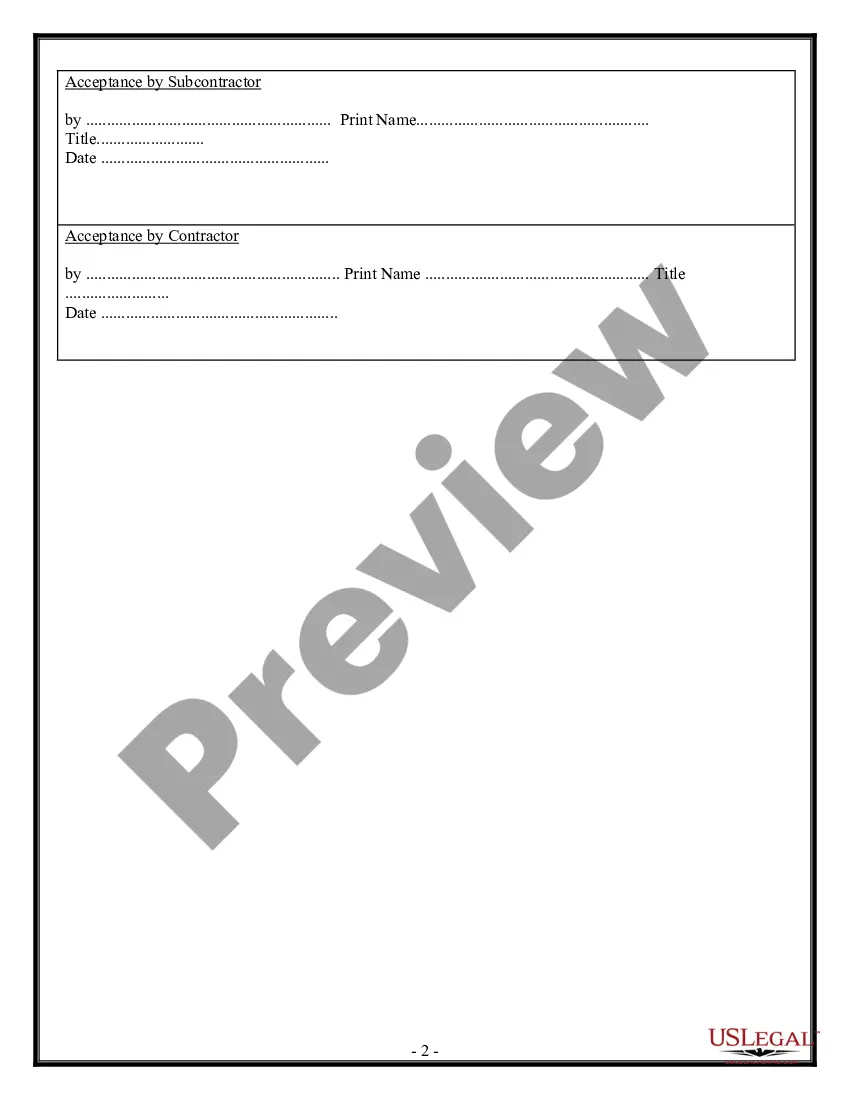

How to fill out Work Or Change Order To Subcontract By Contractor?

Individuals frequently link legal documentation with something intricate that solely an expert can handle.

In a sense, this is accurate, as creating Subcontract Work For Accountants requires significant knowledge in subject matter guidelines, including state and county laws.

Nonetheless, with the US Legal Forms, the process has become more straightforward: readily available legal templates for any personal and business situation specific to state legislation are compiled in a single online repository and are now accessible to everyone.

Print your document or upload it to an online editor for a quicker completion. All templates in our library are reusable: once purchased, they are kept stored in your profile. You can access them whenever necessary through the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current documents categorized by state and area of application, making it quick to search for Subcontract Work For Accountants or any other specific document.

- Previously registered individuals with an active subscription must Log In to their account and press Download to receive the form.

- New users of the platform will initially need to create an account and subscribe before they can download any documents.

- Here’s the step-by-step instructions on how to obtain the Subcontract Work For Accountants.

- Review the page content carefully to confirm it fulfills your requirements.

- Examine the form description or validate it using the Preview option.

- Find another sample via the Search field above if the previous one does not meet your expectations.

- Press Buy Now once you locate the appropriate Subcontract Work For Accountants.

- Select a pricing plan that suits your requirements and budget.

- Establish an account or Log In to continue to the payment page.

- Transact for your subscription using PayPal or your credit card.

- Choose the format for your file and click Download.

Form popularity

FAQ

To find contracting work, start by refining your resume and showcasing your skills and experience online. Utilize popular job boards, professional networking sites, and accounting forums to search for opportunities. Remember, engaging in subcontract work for accountants not only enhances your portfolio but also broadens your professional network.

General contractors often find subcontractors through recommendations, references, and online directories. Building a network within the industry is essential, as connections can lead to fruitful partnerships. As a general contractor, understanding the nuances of subcontract work for accountants can also help in finding skilled professionals who will meet the project’s goals.

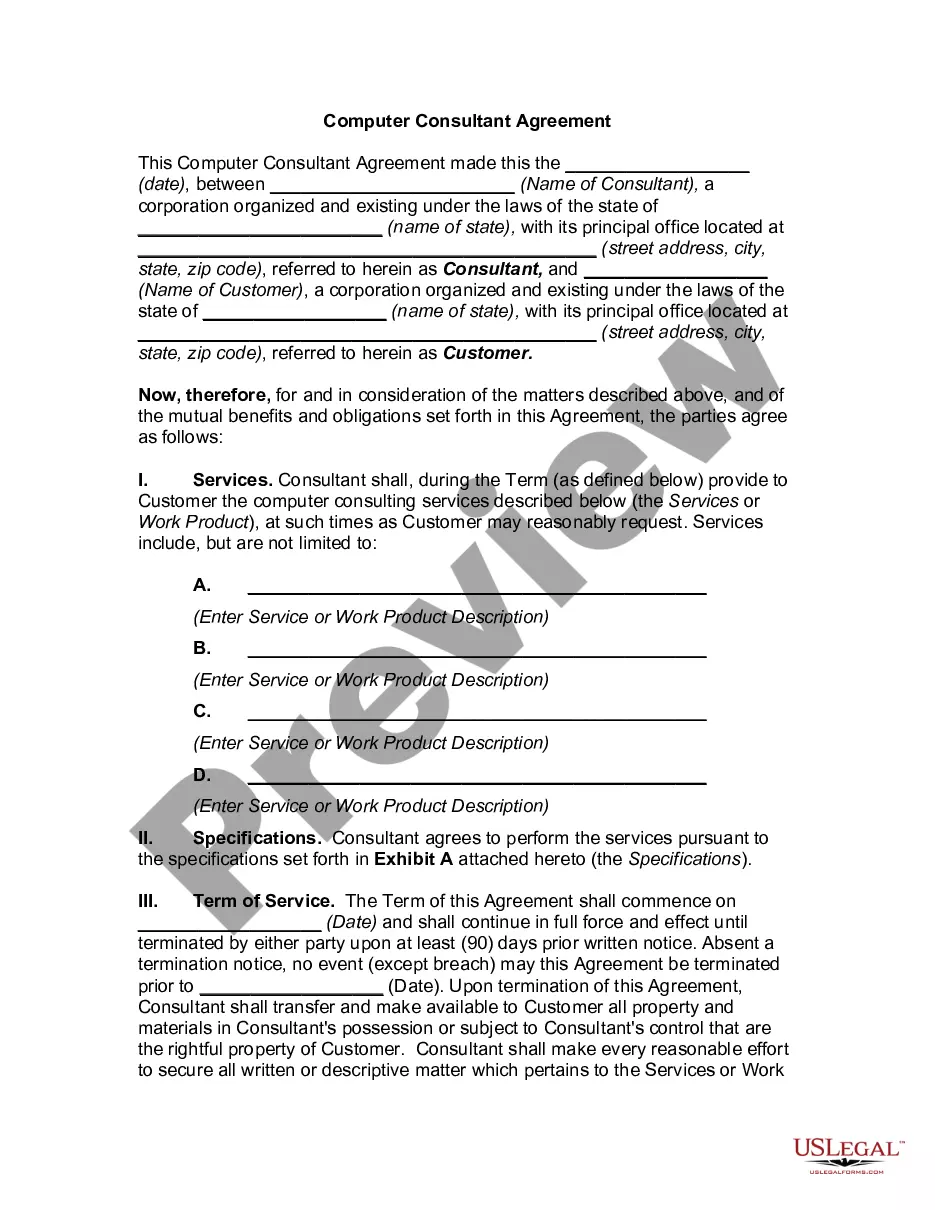

In accounting, subcontracting refers to hiring another professional or firm to manage specific accounting tasks. This can include tax preparation, bookkeeping, or financial analysis, allowing you to focus on your core strengths. Subcontract work for accountants offers an efficient way to handle larger projects while ensuring quality and timeliness.

Finding subcontract work typically requires networking and using job platforms tailored specifically for freelance professionals. You can also connect with other accountants or businesses that might require your expertise. Engaging effectively in local business events and online forums can lead to valuable opportunities in subcontract work for accountants.

Subcontracting your work involves identifying tasks or projects that you can delegate to other professionals. Start by assessing your workload and determining which aspects of your projects can be outsourced. Once you’ve identified potential subcontractors, communicate your expectations clearly to ensure successful collaboration in the subcontract work for accountants.

Yes, accountants often engage in contract work. They provide specialized services to businesses on a temporary basis, which allows for flexibility in meeting clients' needs. Contract work enables accountants to leverage their skills and expertise across various projects, and it can be a smart way to enhance your experience in subcontract work for accountants.

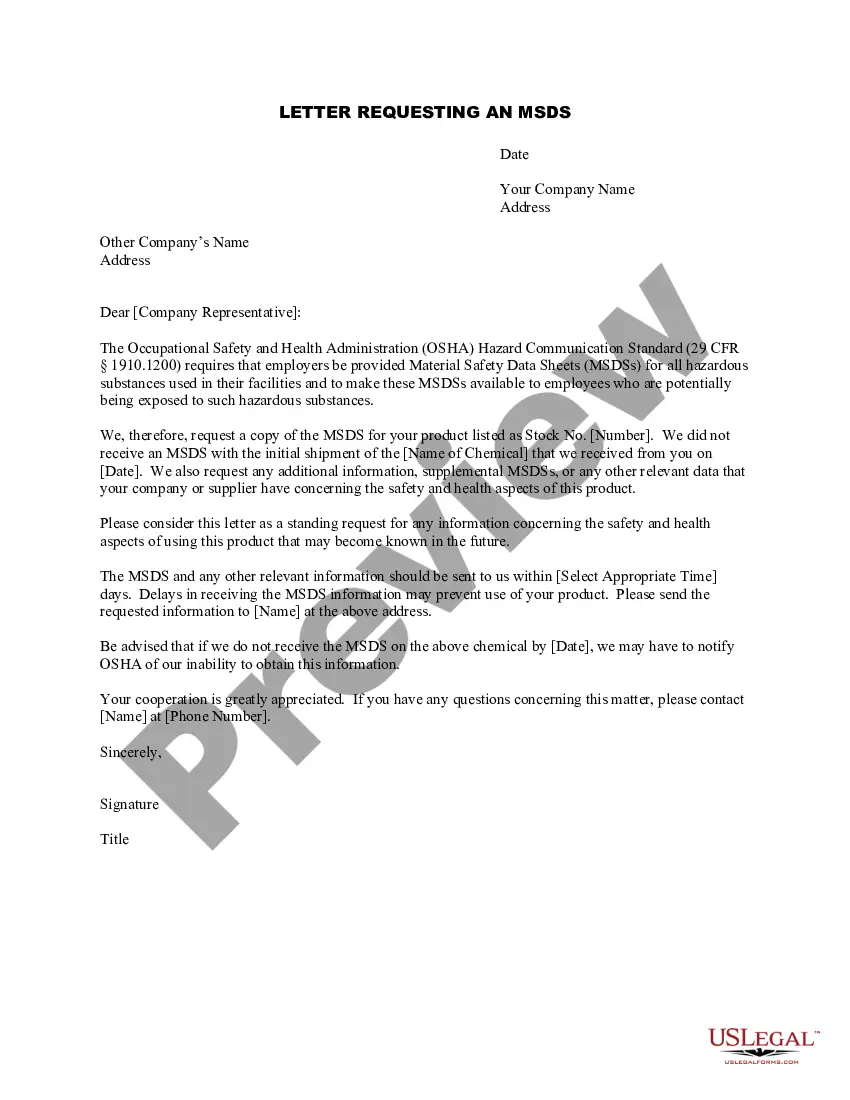

A subcontractor should fill out a W-9 form to provide their taxpayer identification number. This form helps businesses report payments to the IRS correctly. Additionally, using resources like US Legal Forms for subcontract work for accountants can guide you through all necessary documentation, ensuring you have everything covered.

Subcontractors, including accountants, need to fill out various forms, including subcontractor agreements and tax documents like the W-9. These forms help clarify the services provided and outline payment arrangements. Always ensure you have the appropriate paperwork to make subcontract work for accountants secure and compliant.

Accountants working as subcontractors typically receive a 1099 form at the end of the tax year instead of a W-2. This indicates they are self-employed and not traditional employees. If you engage in subcontract work for accountants, expect to manage your taxes differently, reflecting your independent contractor status.

Yes, an accountant can be considered a subcontractor if they are working on a project basis for another entity. This often occurs when businesses need financial services without employing a full-time accountant. Subcontract work for accountants hinges on creating mutually beneficial arrangements that allow flexibility and expertise.