Authorization Form To Pull Credit For Business

Description

How to fill out Credit Card Charge Authorization Form?

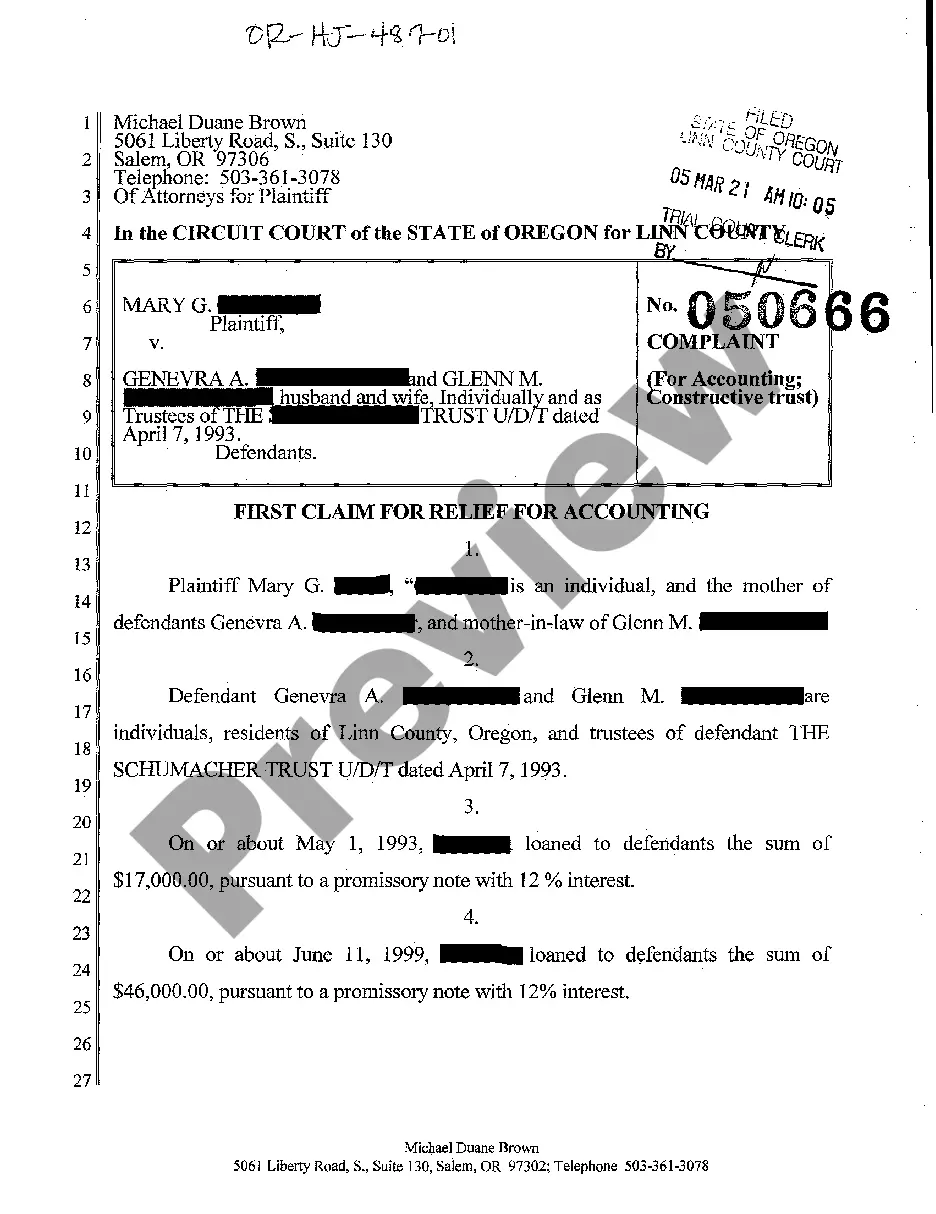

The Authorization Form To Access Credit For Business displayed on this page is a reusable formal document created by experienced attorneys in compliance with federal and local regulations.

For over 25 years, US Legal Forms has offered individuals, entities, and legal experts over 85,000 confirmed, state-specific documents for any business and personal needs. It is the quickest, easiest, and most dependable method to acquire the forms you require, as the service ensures the utmost level of data security and protection against malware.

Register for US Legal Forms to have validated legal templates for all of life's situations readily available.

- Browse for the document you require and evaluate it.

- Look through the sample you searched for and preview it or check the form description to confirm it meets your needs. If it doesn't, use the search bar to find the suitable one. Click Buy Now after you have found the template you need.

- Register and Log In.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card for a quick payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the fillable document.

- Choose the format you desire for your Authorization Form To Access Credit For Business (PDF, DOCX, RTF) and download the sample to your device.

- Complete and sign the document.

- Print the template to fill it out by hand. Alternatively, use an online multi-functional PDF editor to swiftly and accurately complete and sign your form with an electronic signature.

- Redownload your documents as needed.

- Access the same document again whenever required. Navigate to the My documents tab in your profile to redownload any forms you previously saved.

Form popularity

FAQ

I agree and give my consent to you to process my personal information for the purposes relating to obtaining my credit report through you and agree that you may share this information for this purpose with a registered credit providers as well as your service providers in order to enable them to process my personal ...

Typically it contains: The cardholder's credit card information: Card type, Name on card, Card number, Expiration date. The merchant's business information. Cardholder's billing address. Language authorizing the merchant to charge the customer's card on file. Name and signature of the cardholder. Date.

Before a financier, landlord, or any party would like to perform a credit check on an individual, it's required, under the Fair Credit Reporting Act, that the individual gives consent before their credit is searched.

There are hard inquiries and soft inquiries, and both the rules around them and the effect they have on your credit score are very different. Hard inquiries typically require your written permission.

Getting Consent to Run a Credit Report Step 1 ? Explain the Purpose to the Individual. ... Step 2 ? Completing the Form. ... Step 3 ? Obtaining a Real Signature. ... Step 4 ? Run the Credit Report. ... Step 5 ? Review and Give a Copy to the Consenter (if asked)