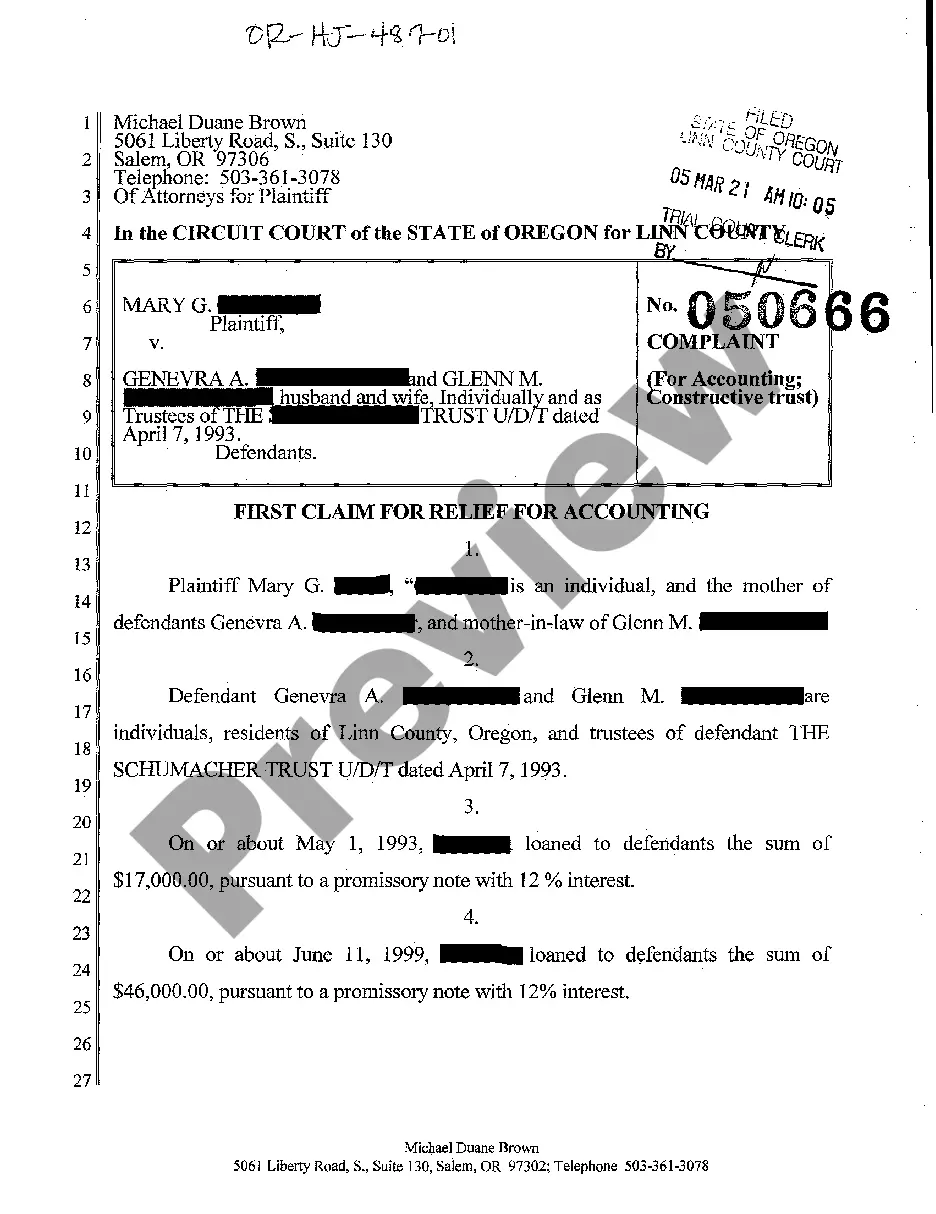

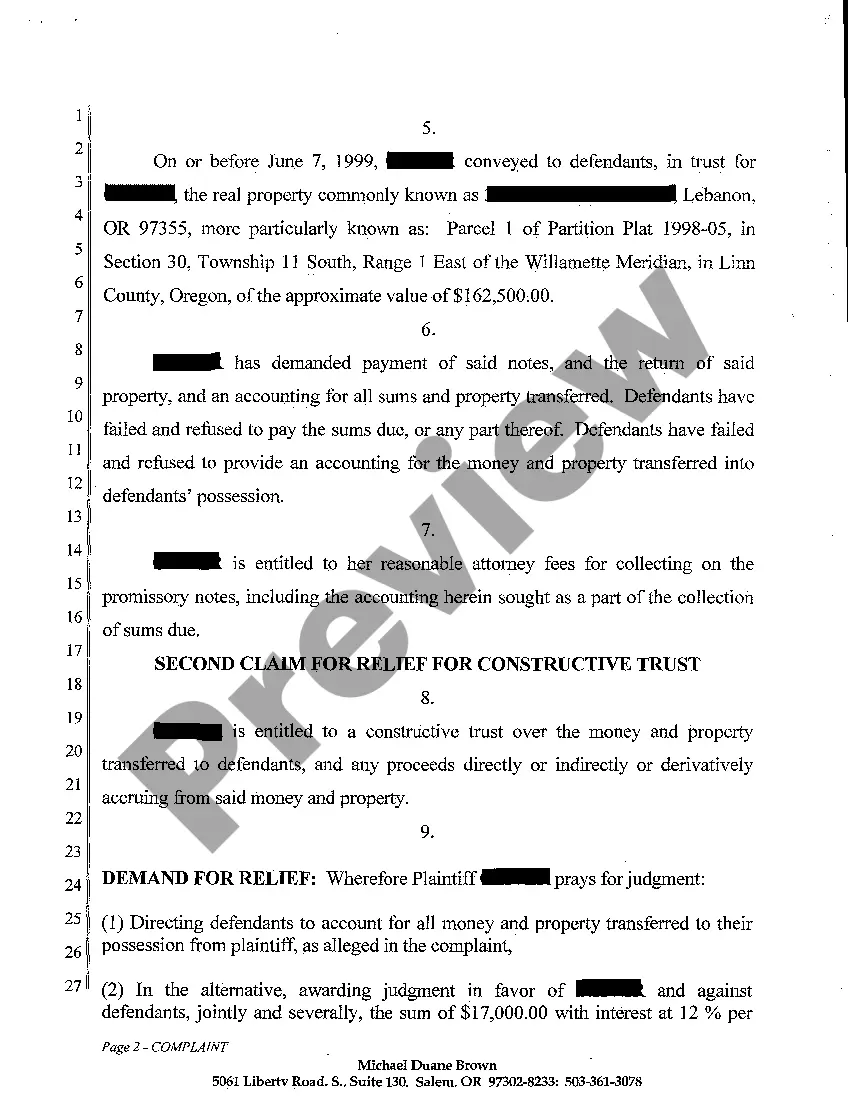

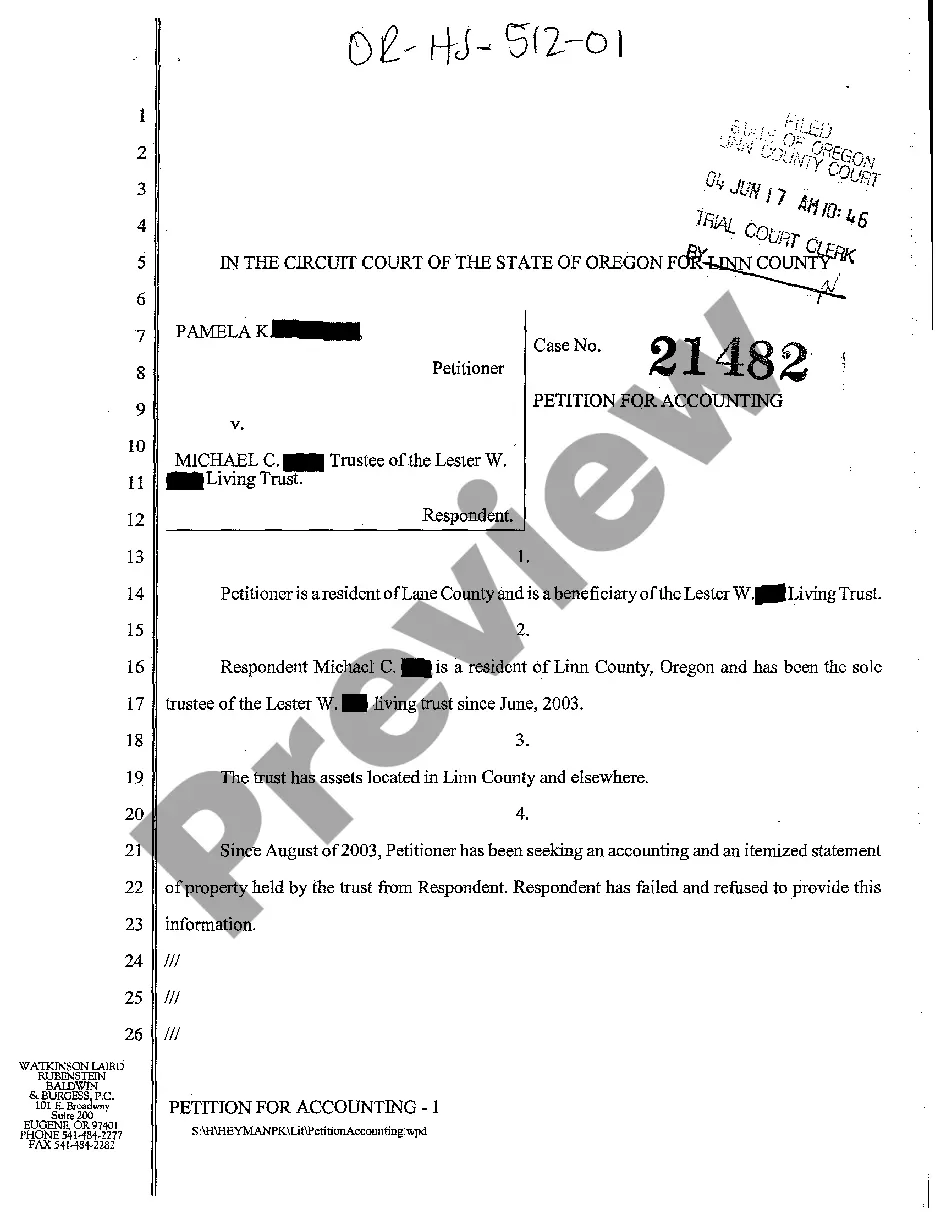

Oregon Complaint for Accounting and Constructive Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Accounting Constructive Trust: An equitable remedy used in situations where someone holds property under circumstances where they are obligated by the principles of justice and equity to account for it as a trustee for another. Complaint for Accounting: A legal document filed when a party seeks a detailed explanation of financial dealings. Particularly relevant in disputes like landlord-tenant issues or small business management disagreements.

Constructive Complaint Filing in Oregon: Refers to the legal process of initiating a complaint in Oregon where constructive mechanisms like trusts or equitable claims are involved.

Step-by-Step Guide for Filing a A01 Complaint for Accounting and Constructive Trust in Oregon

- Identify the Basis: Determine if your situation involves mismanagement of funds or property that should be held in trust.

- Gather Documentation: Collect all pertinent financial records, agreements, communications, and other evidence supporting your claim.

- Consult with a Professional: Seek advice from a professional specializing in real estate issues, financial information services, or professional ethics practice depending on the specifics of your complaint.

- Prepare the Complaint: Draft the complaint or use online legal forms that meet Oregon's legal standards.

- File the Complaint: Submit the complaint to the appropriate court along with any required filing fees. Ensure all procedural requirements are met for Oregon complaint filing.

Risk Analysis

Filing an A01 complaint involves certain risks such as potential legal costs, the possibility of retaliation, or counterclaims by the defendant. Missteps in filing can lead to dismissal of the case. Ensure compliance with local statutes and seek expert legal advice to mitigate these risks.

Key Takeaways

- Legal Precision: Ensure that your documentation and forms adhere to legal standards, particularly for Oregon complaint filing, to avoid dismissal.

- Expert Consultation: Utilize professionals in financial information services or related fields to strengthen your complaint.

- Documentation: Maintain thorough records of all transactions and communications related to the complaint.

Common Mistakes & How to Avoid Them

- Insufficient Documentation: Always keep detailed records and gather comprehensive evidence before filing.

- Neglecting Expert Advice: Failing to consult with legal or financial experts can lead to weak claims and procedural errors.

- Ignoring Filing Guidelines: Each jurisdiction, including Oregon, has specific filing requirements that must be followed carefully to ensure the complaint is accepted.

FAQ

- What is a Constructive Trust? An equitable remedy imposing a duty to hold assets for the benefit of others.

- How do I file a complaint for accounting? Begin by gathering evidence, consulting with professionals, and following local legal protocols.

- Can I file a complaint for issues with a landlord in Oregon? Yes, if financial mismanagement or disputes over property handling are involved.

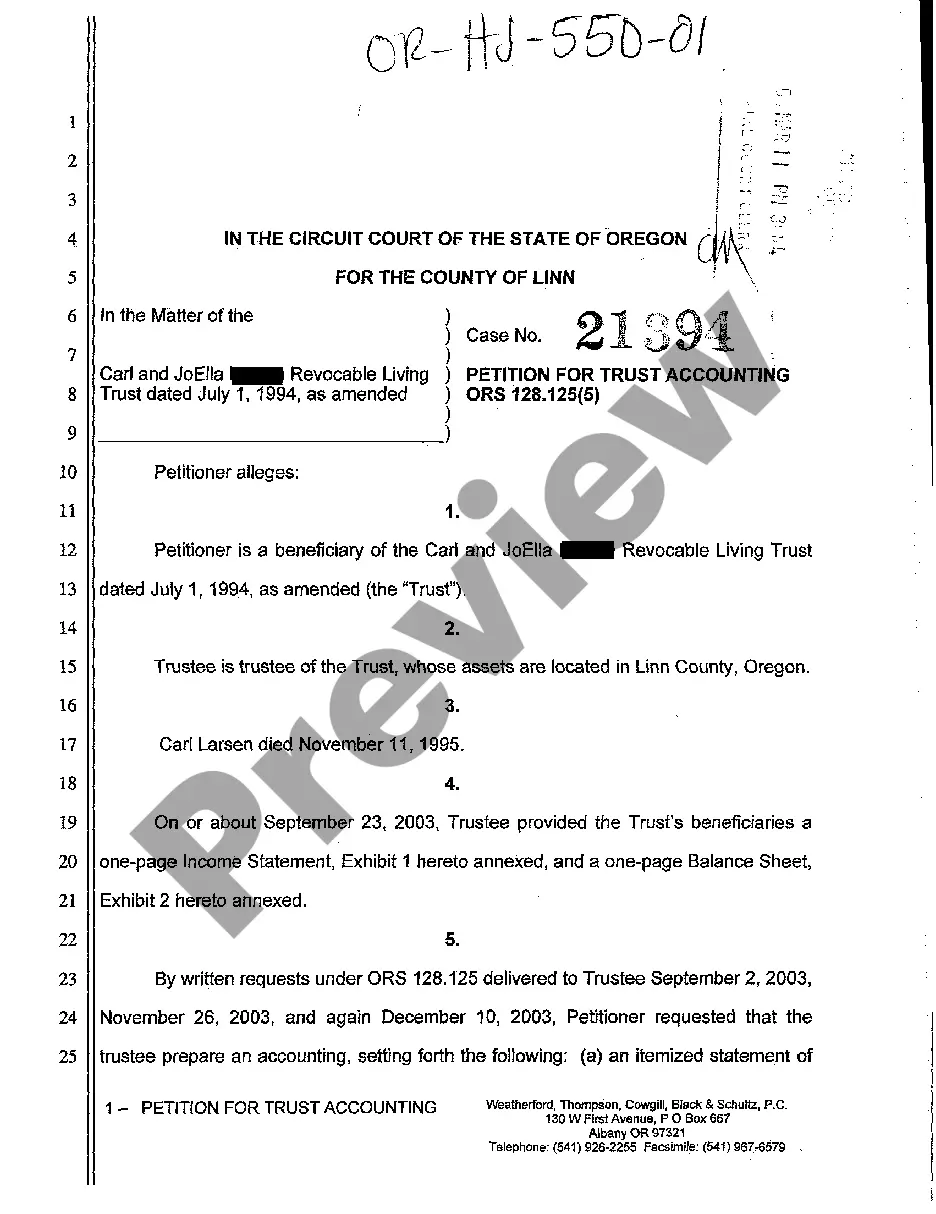

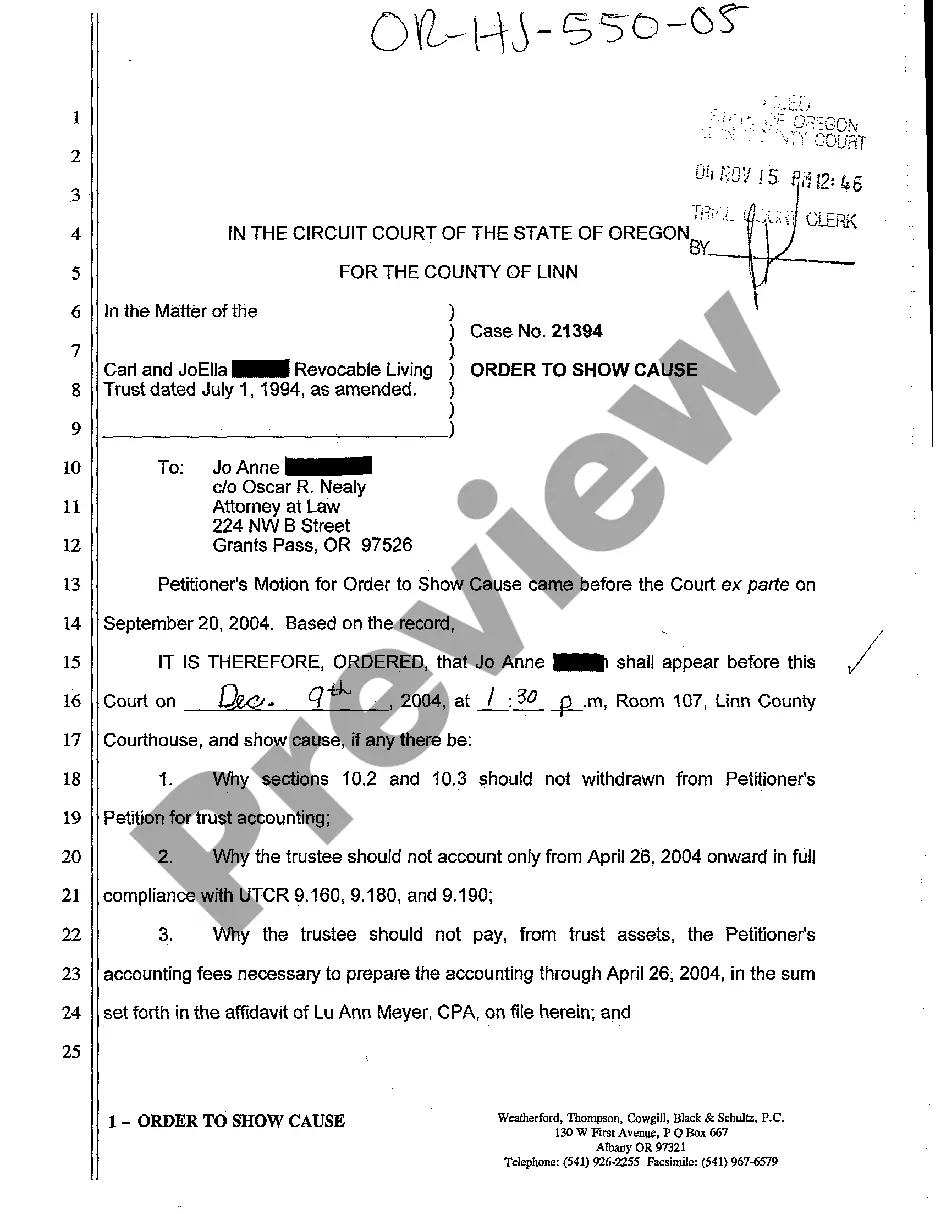

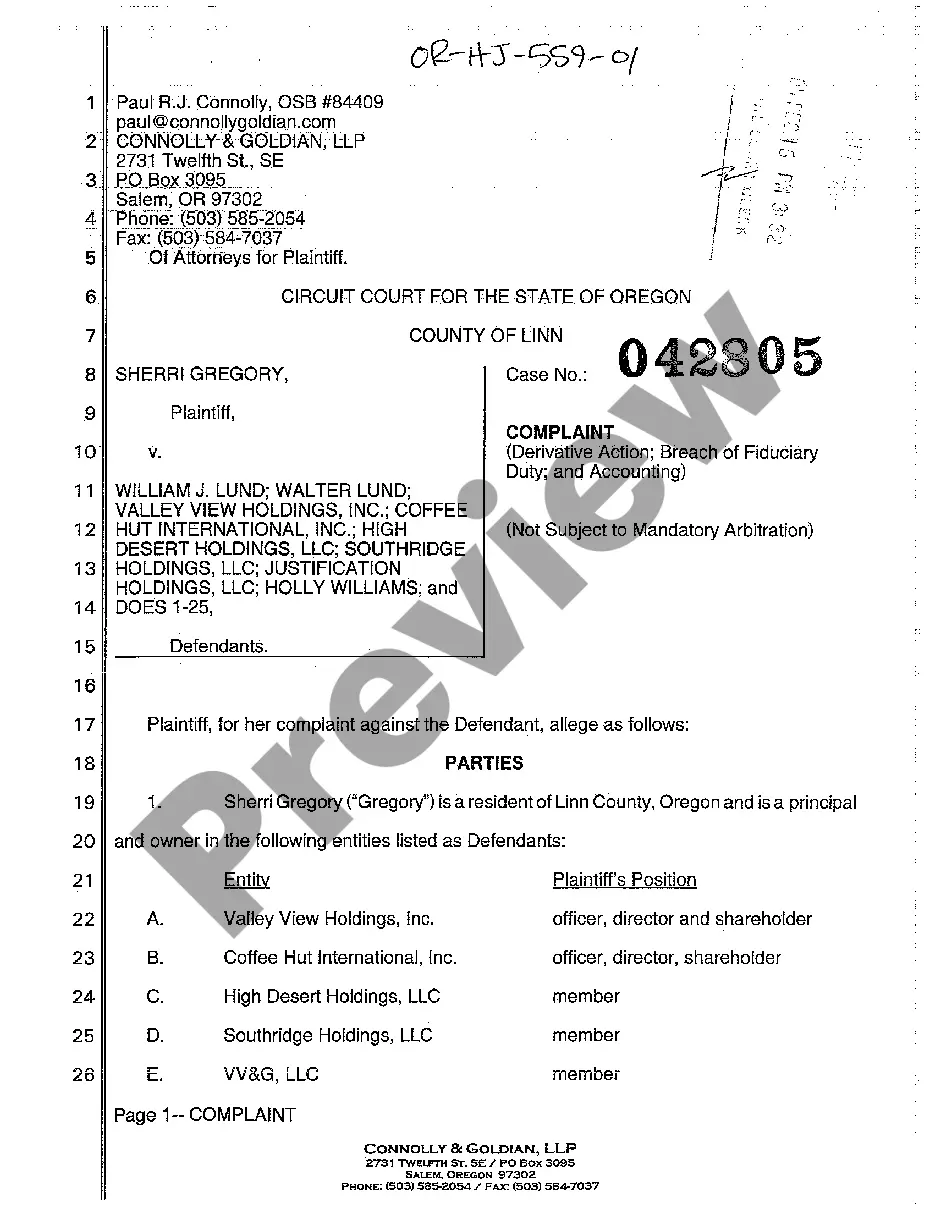

How to fill out Oregon Complaint For Accounting And Constructive Trust?

Among countless paid and free templates that you’re able to find on the web, you can't be certain about their reliability. For example, who created them or if they are qualified enough to deal with what you need those to. Always keep relaxed and utilize US Legal Forms! Get Oregon Complaint for Accounting and Constructive Trust templates made by skilled legal representatives and prevent the costly and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to write a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the form you are trying to find. You'll also be able to access all of your previously downloaded documents in the My Forms menu.

If you are using our platform the first time, follow the instructions listed below to get your Oregon Complaint for Accounting and Constructive Trust quick:

- Make sure that the document you see applies in the state where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing process or look for another sample using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

When you have signed up and purchased your subscription, you can use your Oregon Complaint for Accounting and Constructive Trust as many times as you need or for as long as it stays valid where you live. Edit it with your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

A holds funds that he knows have been paid to him by mistake. A holds an asset that he has obtained by means of fraud. A and another person (B) share a common intention that B should have a beneficial interest in an asset, and B has acted to his detriment on the basis of that intention.

A constructive trust is an extraordinary remedy, not a cause of action. Instead, a constructive trust is imposed based upon an established cause of action. One such cause of action is breach of fiduciary duty, often seen in probate and trust litigation.

Enforcement of a Constructive Trust The establishment of a constructive trust is typically imposed by a court of law. The court may choose to enforce this equitable remedy if the defendant would receive an unfair advantage if the trust is not imposed, or if the defendant has interfered with an existing trust.

A constructive trust is an equitable remedy imposed by a court to benefit a party that has been wrongfully deprived of its rights due to either a person obtaining or holding a legal property right which they should not possess due to unjust enrichment, oppressive conduct or due to a breach of fiduciary duty.

The imposition of a constructive trust requires: (1) the existence of res (property or some interest in property); (2) the right of the complaining party to that res; and (3) some wrongful acquisition or detention of the res by another party who is not entitled to it. See Burlesci v.