Child Support Calculator For Texas

Description

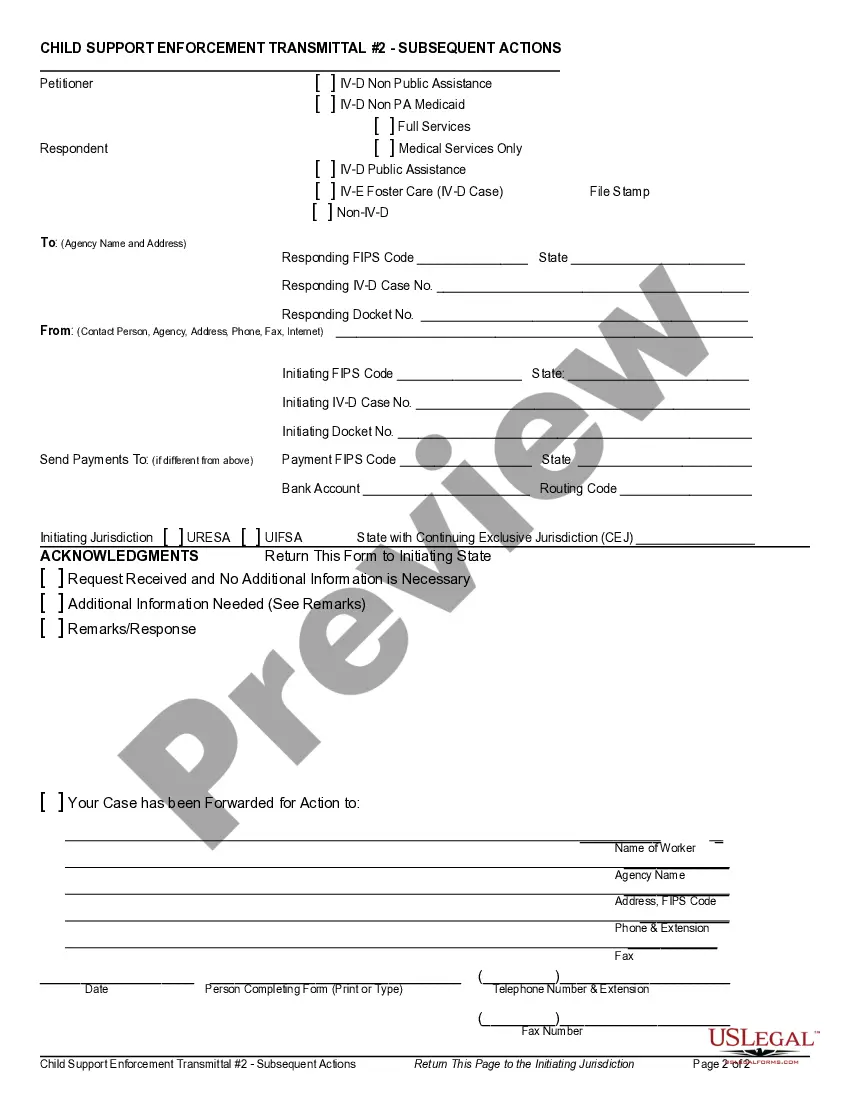

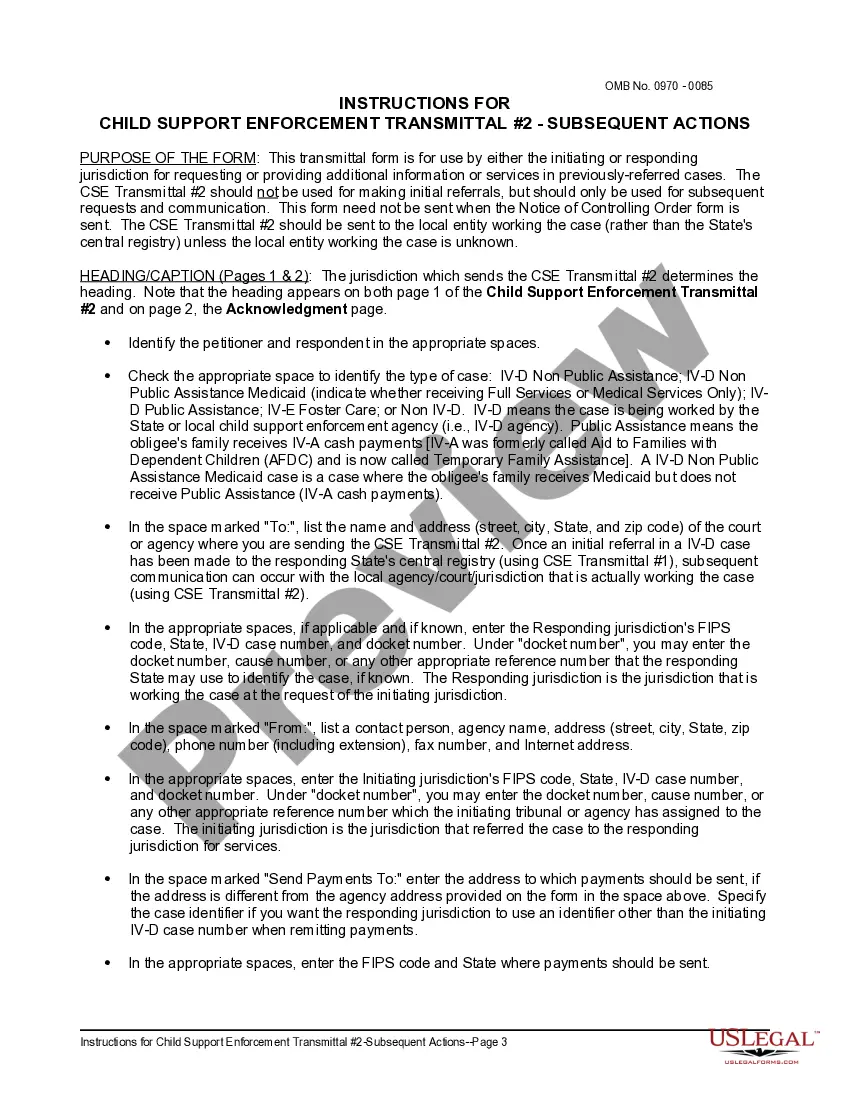

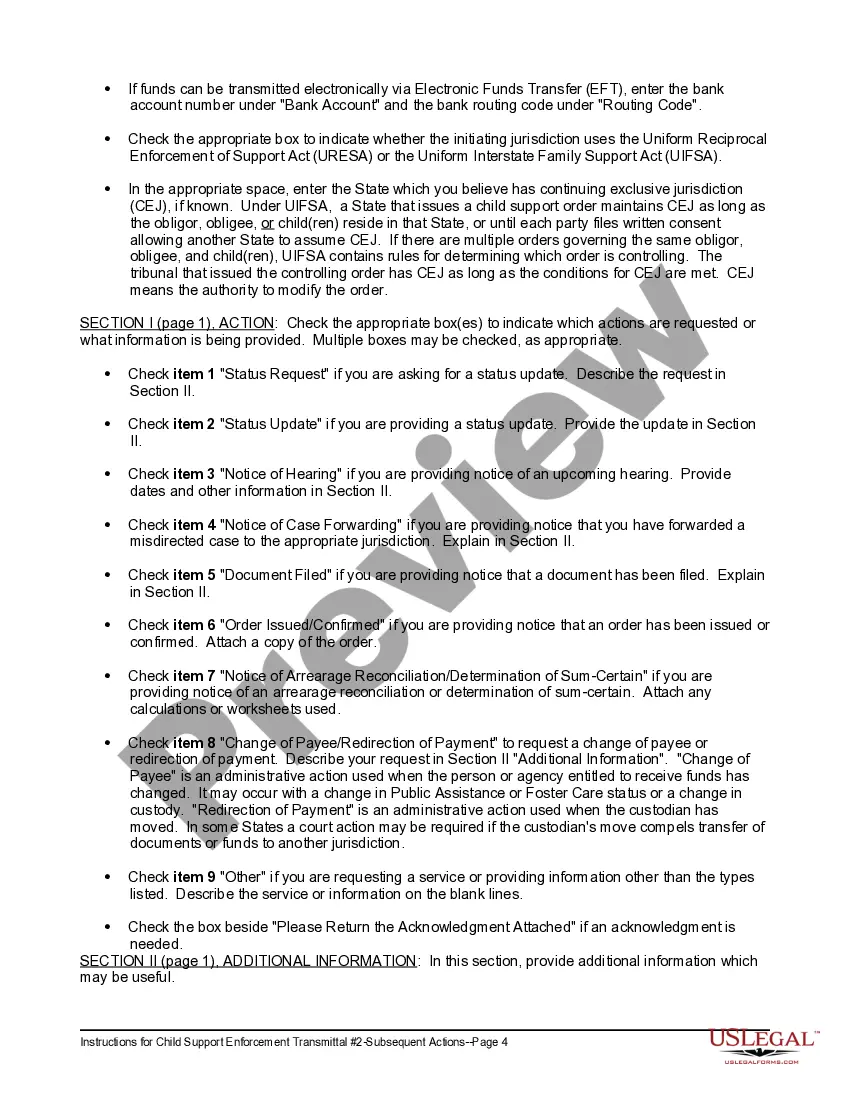

How to fill out Child Support Transmittal #2 - Subsequent Actions And Instructions?

Drafting legal paperwork from scratch can sometimes be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more affordable way of preparing Child Support Calculator For Texas or any other documents without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual library of over 85,000 up-to-date legal forms addresses virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-compliant forms carefully put together for you by our legal experts.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Child Support Calculator For Texas. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and navigate the catalog. But before jumping directly to downloading Child Support Calculator For Texas, follow these tips:

- Check the document preview and descriptions to make sure you have found the form you are searching for.

- Check if template you select complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to get the Child Support Calculator For Texas.

- Download the file. Then fill out, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us now and transform form execution into something easy and streamlined!

Form popularity

FAQ

Texas child support laws provide the following Guideline calculations: one child= 20% of Net Monthly Income (discussed further below); two children = 25% of Net Monthly Income; three children = 30% of Net Monthly Income; four children = 35% of Net Monthly Income; five children = 40% of Net Monthly Income; and six ...

Calculation of child support in Texas requires a parent's net income to determine payment amounts. Net income simply refers to the amount of money left after necessary expenses, such as taxes, are paid. It is calculated first using the parent's gross income.

What are the low-income child support guidelines? 1 child = 15% of the noncustodial parent's average monthly net resources. 2 children = 20% of the noncustodial parent's average monthly net resources. 3 children = 25% of the noncustodial parent's average monthly net resources.

Disposable income = gross pay - mandatory deductions. Mandatory deductions include federal, state, and local taxes; unemployment insurance; workers' compensation insurance; state employee retirement deductions; and other deductions determined by state law.

Is There a Maximum Amount of Child Support? Yes. Texas divorce laws state the maximum child support amount for one child is $1,840. This is because state law dictates a maximum amount of net monthly income that can be used to calculate child support, which is $9,200.