Child Support Formula Michigan

Description

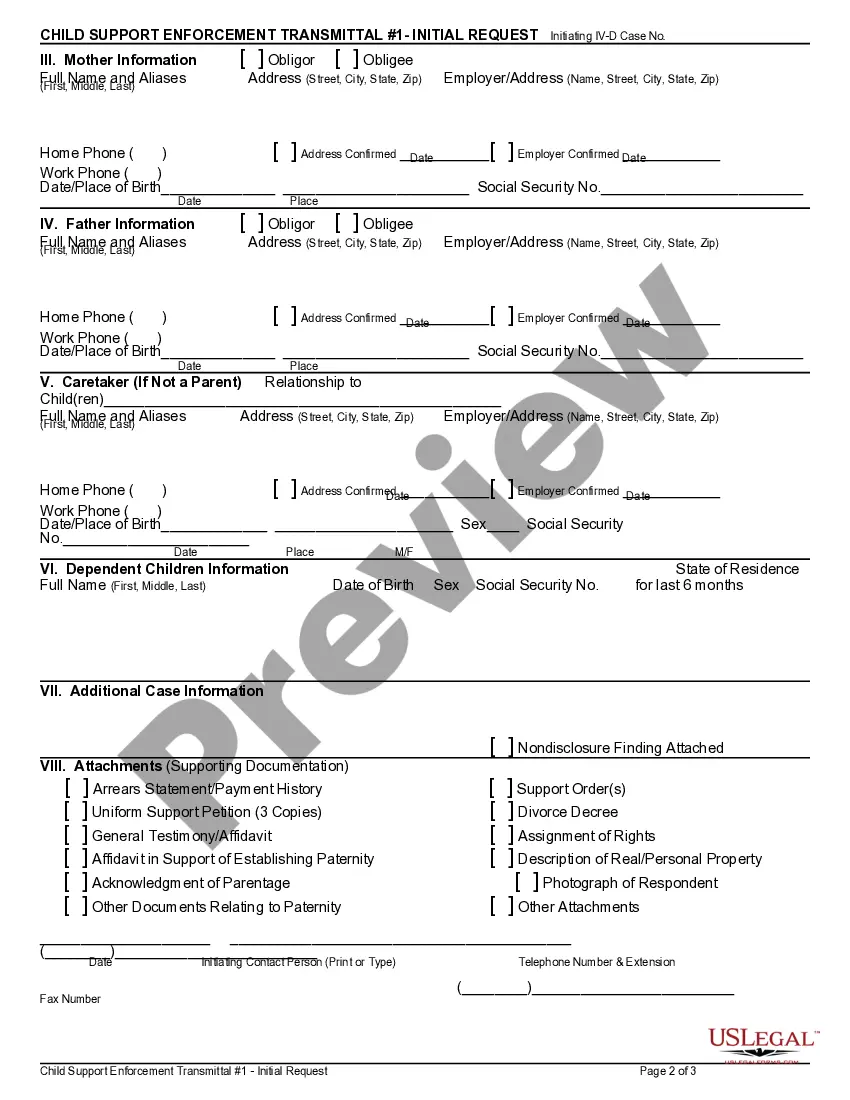

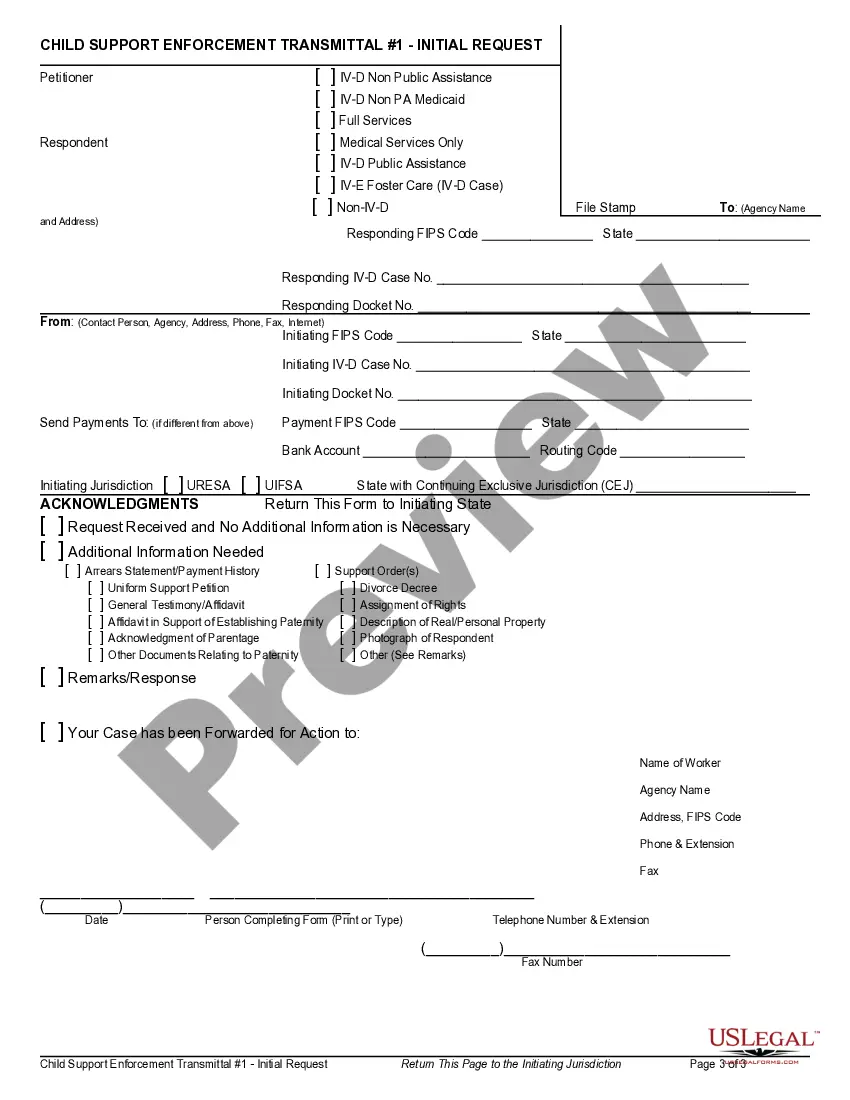

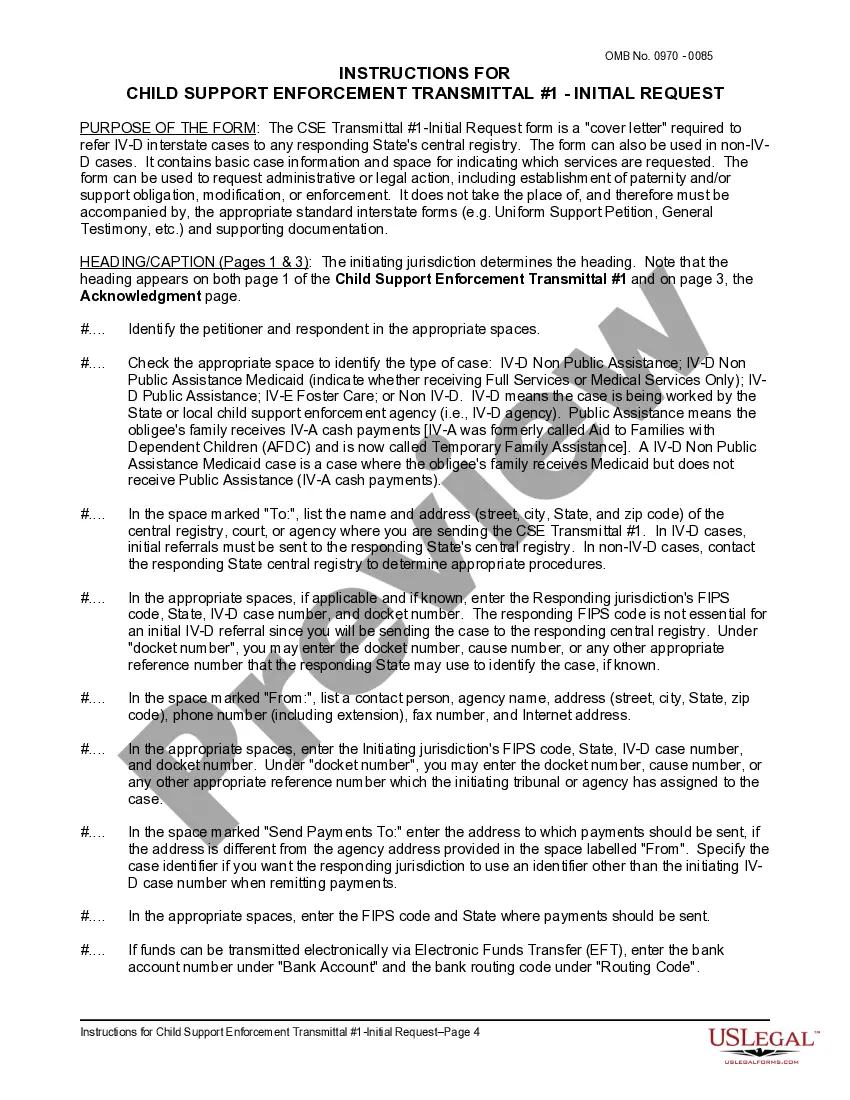

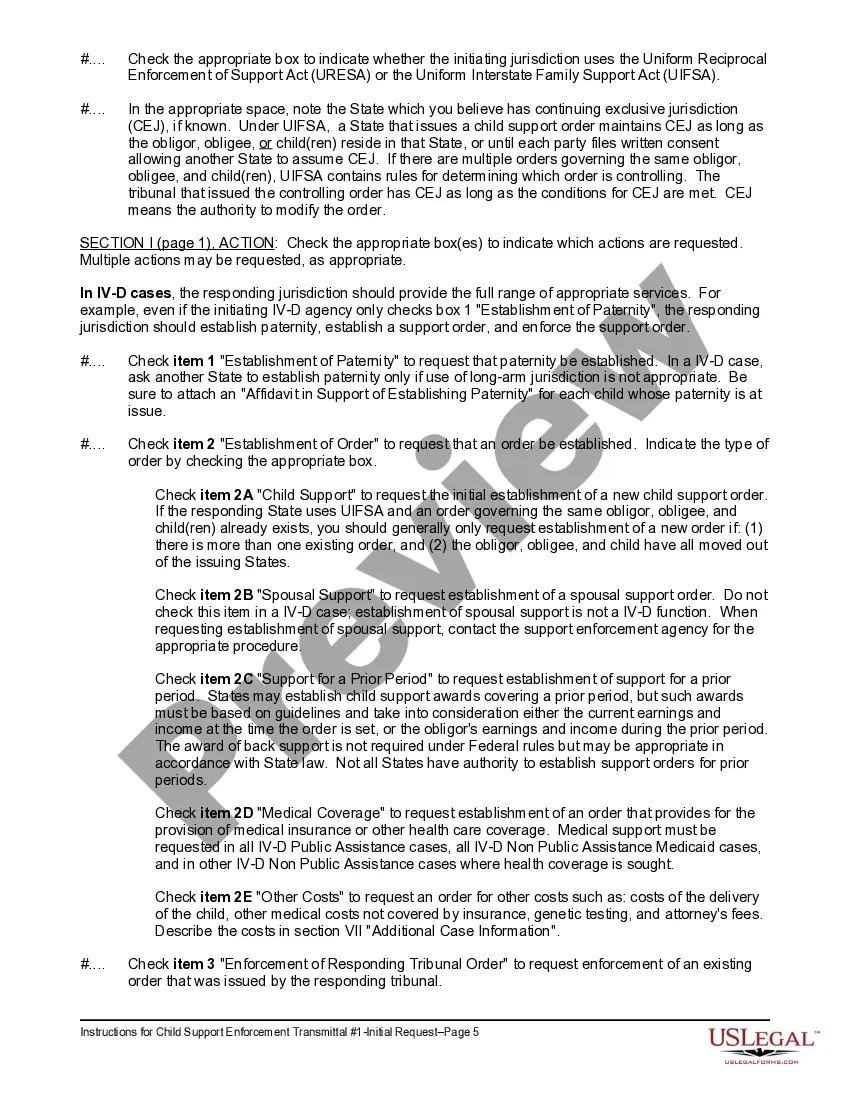

How to fill out Child Support Enforcement Transmittal #1 - Initial Request And Instructions?

Using legal templates that comply with federal and local regulations is essential, and the internet offers many options to choose from. But what’s the point in wasting time searching for the correctly drafted Child Support Formula Michigan sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by attorneys for any professional and personal case. They are easy to browse with all documents arranged by state and purpose of use. Our specialists keep up with legislative changes, so you can always be sure your form is up to date and compliant when acquiring a Child Support Formula Michigan from our website.

Obtaining a Child Support Formula Michigan is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, follow the instructions below:

- Analyze the template using the Preview option or through the text outline to ensure it fits your needs.

- Locate a different sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Child Support Formula Michigan and download it.

All templates you find through US Legal Forms are reusable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Each parent's income is considered, which includes wages, overtime, commissions, bonuses, self-employment income, contract income, investment earnings, social security, unemployment, disability, worker's compensation, retirement income, military pay, tips, gambling earnings, alimony (spousal support), and employment ...

Child support is determined by a formula encompassed in the Michigan Child Support Guidelines. The formula takes into account several factors including the income of each parent, the parenting time schedule, tax deductions, health insurance costs, and the number of children.

The Michigan Child Support Formula determines which parent will pay child support and the support amount, based on factors including each parent's income and the number of nights per year that the child spends with each parent (called "overnights").

The formula uses a parent's net income, which is defined as all income minus deductions and adjustments permitted by the child support manual.

Adding together each parent's monthly net income determines their combined net income. The state uses this figure to set a base support obligation, or how much parents are expected to spend on their children each month. Each parent is responsible for part of the base support obligation, proportional to their income.