Rental Lease Agreement Contract With Cosigner

Description

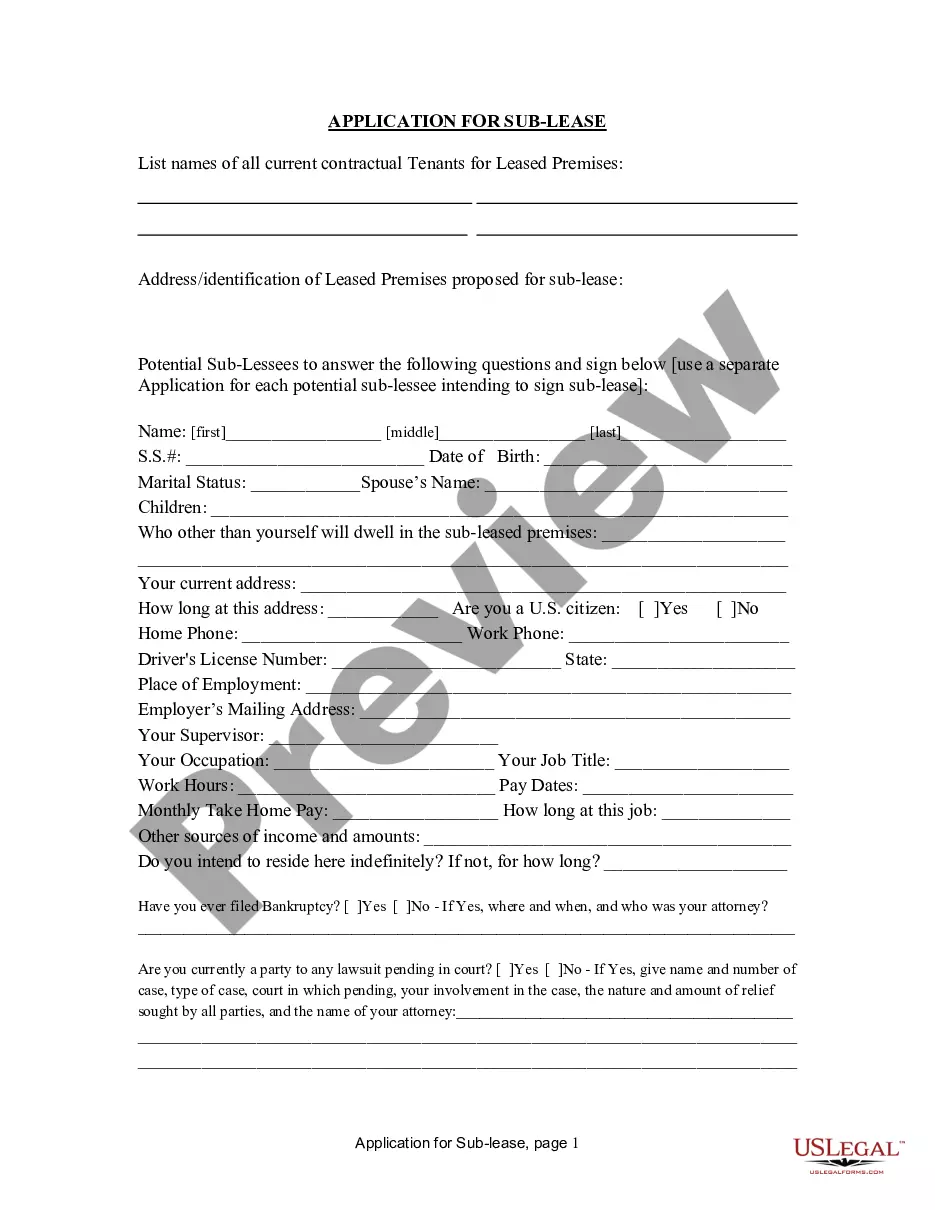

How to fill out Rental Lease Agreement For House?

There's no longer any requirement to waste time searching for legal documents to meet your local state laws. US Legal Forms has gathered all of them in a single location and simplified their availability.

Our platform provides over 85k templates for any business and personal legal needs categorized by state and application area. All forms are correctly drafted and validated, ensuring you receive an updated Rental Lease Agreement Contract With Cosigner.

If you are acquainted with our service and already possess an account, ensure that your subscription is active before downloading any templates. Log In to your account, select the document, and click Download. You can also retrieve all obtained documents anytime by accessing the My documents tab in your profile.

Print your form to complete it manually or upload the sample if you prefer to use an online editor. Creating legal documents under federal and state laws and regulations is quick and easy with our library. Discover US Legal Forms today to maintain your records in order!

- If you have never used our service before, the process will involve additional steps to complete.

- Review the page content thoroughly to ensure it has the sample you require.

- To do this, utilize the form description and preview options if available.

- Use the search field above to browse for another template if the current one does not meet your needs.

- Click Buy Now next to the template title once you identify the right one.

- Choose the most appropriate subscription plan and create an account or Log In.

- Pay for your subscription using a credit card or via PayPal to continue.

- Select the file format for your Rental Lease Agreement Contract With Cosigner and download it to your device.

Form popularity

FAQ

According to the Experian.com website, cosigning for an apartment lease doesn't normally affect a cosigner's credit. Rental payments aren't normally reported to credit bureaus. Because rental payments aren't usually listed in a person's credit report, there's no affect, good or bad, on a cosigner's credit history.

8 steps to remove a co-signer from a leaseMake sure both parties are in agreement.Read the lease thoroughly.Schedule a meeting with the property manager.Prepare for the meeting.Attend the meeting and discuss the desire to remove co-signer.Ask to adjust the lease.Sign the new lease.Understand the length of the lease.

According to Nolo, a cosigner is a person designated to make the rental payments if the tenant does not pay. They sign their name to the lease agreement and are held fully responsible for rent if the tenant stops paying rent.

"The most common reason landlords require a guarantor is because of insufficient income," says Dennis Hughes, a broker with Corcoran. "If this is the case, prospective tenants should, if possible, offer additional security, or offer prepaid rent of several months or moreeven up to a year."

When you cosign on a lease, you're making a legal promise to uphold the terms of the lease and to pay rent if the lessee does not. As a cosigner, your credit could be affected whether or not the person you're cosigning with pays their rent.