Trust Ben

Description

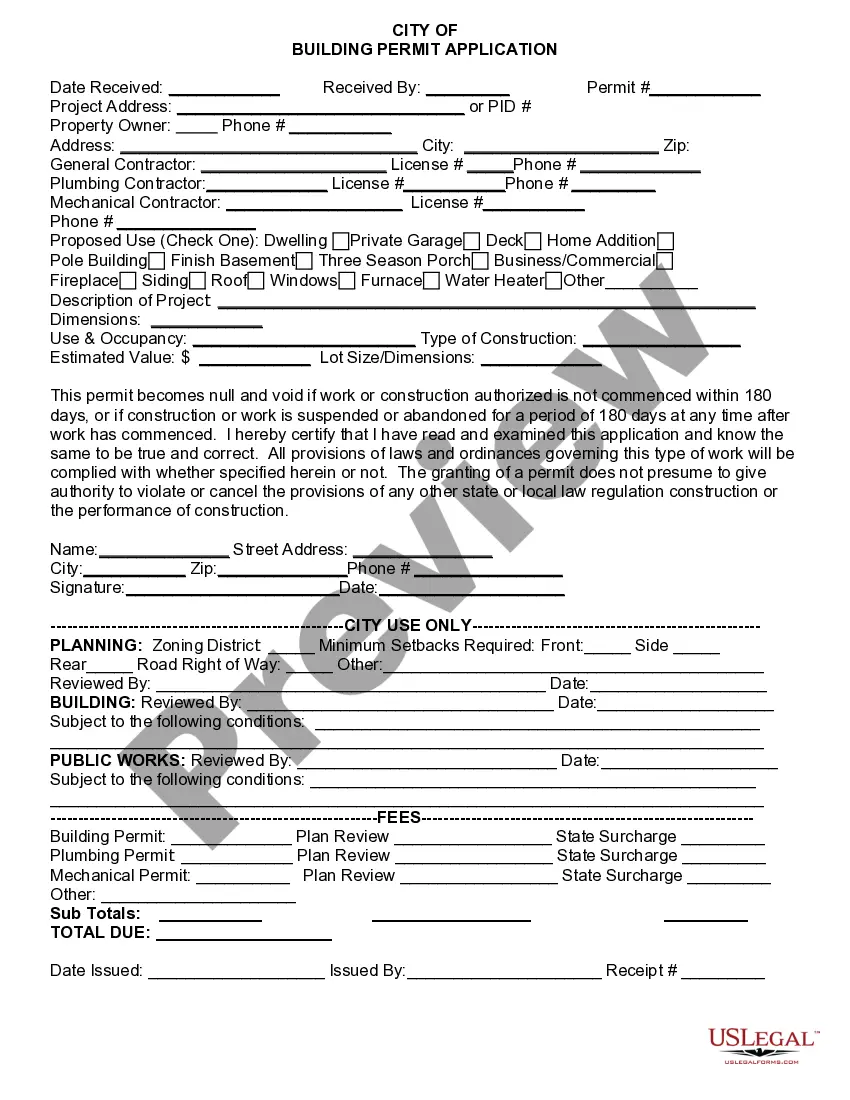

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is valid to access the library of forms.

- For first-time users, start by browsing the Preview mode and reviewing the descriptions to ensure you select the appropriate form for your needs.

- If you don’t find the right form, utilize the Search tab to identify other templates that match your requirements.

- Once you find your desired document, click on the Buy Now button and choose a suitable subscription plan.

- Complete your purchase by entering your credit card information or using your PayPal account.

- Download the form onto your device, then access it in the My Forms menu whenever you need it.

Using US Legal Forms not only saves time but also grants you access to expert assistance for completing forms accurately. Trust Ben to guide you through legal complexities with ease and confidence.

Explore the benefits of US Legal Forms today and start simplifying your legal document processes! Visit our website to get started.

Form popularity

FAQ

Beneficient Company specializes in providing liquidity solutions for alternative assets. They help clients access capital while ensuring Trust ben through a transparent and effective process. By offering services that simplify the complexities of alternative investments, Beneficient fosters a supportive environment for their clients' financial growth. This commitment makes them a trustworthy partner in the finance industry.

Beneficient was founded in 2018, with the mission to revolutionize financial services for alternative investments. Since its inception, the company has grown rapidly, embodying the concept of Trust ben by ensuring that clients receive top-notch guidance. The firm continually evolves to meet the needs of today's investors, reinforcing its dependable reputation in the finance world.

Chris L. McHugh serves as the CEO of VOYA Health. He is committed to ensuring that the company's services align with the best interests of their clients. Through a strong commitment to transparency and communication, VOYA Health embodies the principles of Trust ben. Their mission is to provide comprehensive health solutions that clients can rely on.

Jason A. H. N. L. B. is the CEO of beneficient. He leads a team dedicated to creating financial solutions that empower clients. Beneficient focuses on building Trust ben through personalized service and innovative approaches to financial management. Their dedication to client satisfaction is evident in every interaction.

The CEO of Anthem Trust is Dr. Douglas W. McNish. He brings a wealth of knowledge in finance and investment management. Under his direction, Anthem Trust has built a strong reputation for fostering Trust ben among clients through transparent dealings and reliable services. This approach encourages investors to have confidence in their financial decisions.

The CEO of Quorum Business Solutions is Vishwa G. Kuppa. With years of experience in the business and technology sectors, he focuses on delivering innovative solutions. His leadership style emphasizes trust and collaboration, key elements that relate to the concept of Trust ben. For businesses seeking guidance, Quorum provides excellent services in the realm of business solutions.

Yes, you can file form 1041 electronically. E-filing streamlines the process and reduces the risk of errors. By using platforms like uslegalforms, you can handle your trust ben filings with ease, ensuring compliance and saving time.

You need to file a 1041 if your trust earns income over a specific threshold or if it has gross income over $600. Additionally, if your trust has beneficiaries, this form is generally necessary to report income distribution. Consulting with a tax professional or using uslegalforms can help clarify your obligations.

Certain forms cannot be filed electronically, including some older tax forms or those requiring specific attachments. Generally, forms related to trusts, like certain state returns, might not support e-filing. It's essential to check the IRS guidelines or consult with uslegalforms for the most accurate information.

To file for a trust, you typically need IRS form 1041. This form is specifically designed for estates and trusts, allowing you to report income, deductions, and gains on behalf of the trust. Ensure that you have all relevant documents and income statements ready to facilitate a smooth process.