Investment Trust Agreement With Builder

Description

How to fill out Real Estate Investment Trust Advisory Agreement?

How to locate specialized legal documents that comply with your state regulations and create the Investment Trust Agreement With Builder without consulting an attorney.

Numerous online services provide templates for various legal situations and requirements. However, it may require considerable time to determine which of the existing examples meet both the intended purpose and legal standards for you.

US Legal Forms is a reliable service that assists you in finding authentic documents crafted in alignment with the latest updates to state laws, helping you save on legal costs.

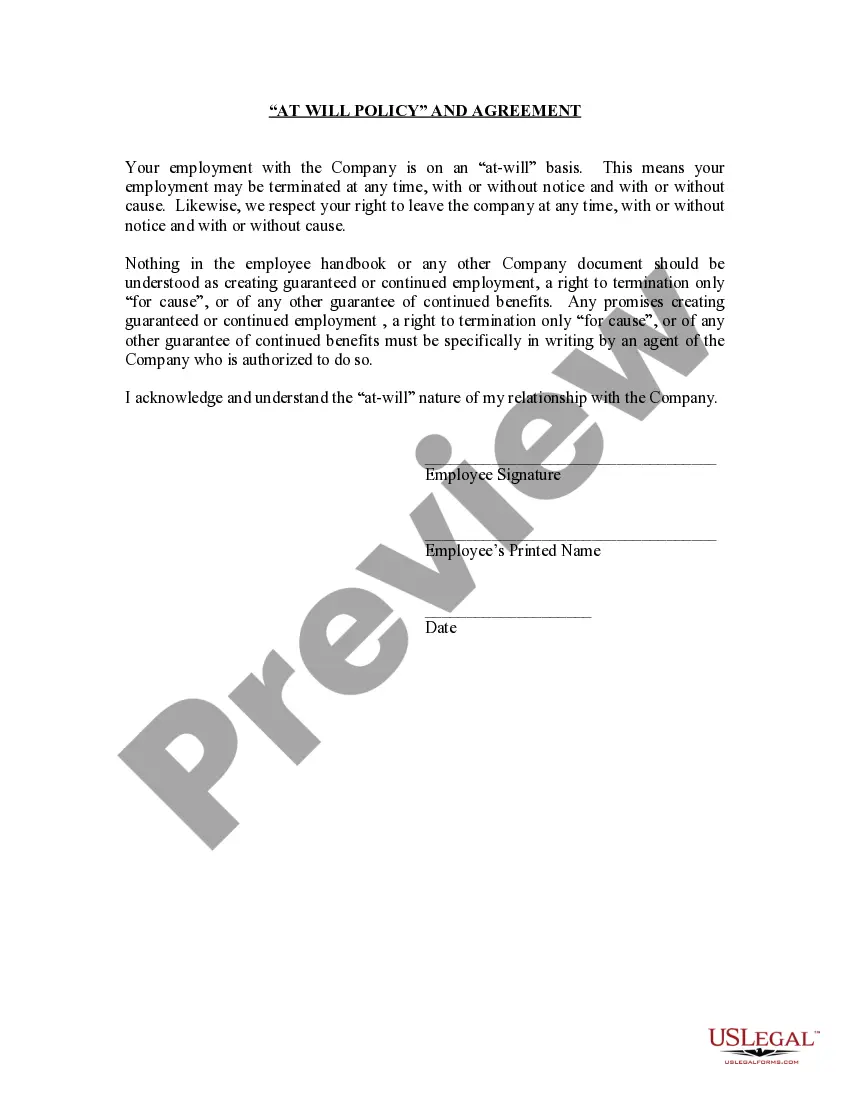

If you do not have a US Legal Forms account, follow the directions below: Go through the webpage you have opened to verify if the form meets your requirements. To accomplish this, utilize the form description and preview options if accessible. Search for an alternative template in the header that presents your state if necessary. Click the Buy Now button when you identify the correct document. Choose the most appropriate pricing plan, then Log In or create an account. Select your payment option (by credit card or through PayPal). Alter the file format for your Investment Trust Agreement With Builder and click Download. The acquired templates remain in your possession: you can always refer back to them in the My documents section of your profile. Subscribe to our library and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not a typical online directory.

- It's a compilation of over 85,000 validated templates for assorted business and personal circumstances.

- All documents are categorized by field and jurisdiction to streamline your search process and minimize complications.

- Moreover, it is compatible with advanced solutions for PDF editing and eSignatures, allowing users with a Premium subscription to swiftly finalize their documents online.

- It requires minimal time and effort to acquire the required documents.

- If you already possess an account, Log In and confirm that your subscription is active.

- Download the Investment Trust Agreement With Builder using the corresponding button beside the file name.

Form popularity

FAQ

To put your home in the trust, only two simple forms are required in California.Obtain a California grant deed from a local office supply store or your county recorder's office.Complete the top line of the deed.Indicate the grantee on the second line.Enter the trustees' names and addresses.More items...

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

Assets that should not be used to fund your living trust include:Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities.Health saving accounts (HSAs)Medical saving accounts (MSAs)Uniform Transfers to Minors (UTMAs)Uniform Gifts to Minors (UGMAs)Life insurance.Motor vehicles.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

Open a trust account in just 4 stepsA legally established trust with your attorney.A completed trust account application, including personal information of the trustees, the type of trust, the date of the trust, and the trust's tax identification number.Supporting legal trust documents (as detailed below).