Wraparound Mortgage Form With 2 Points

Description

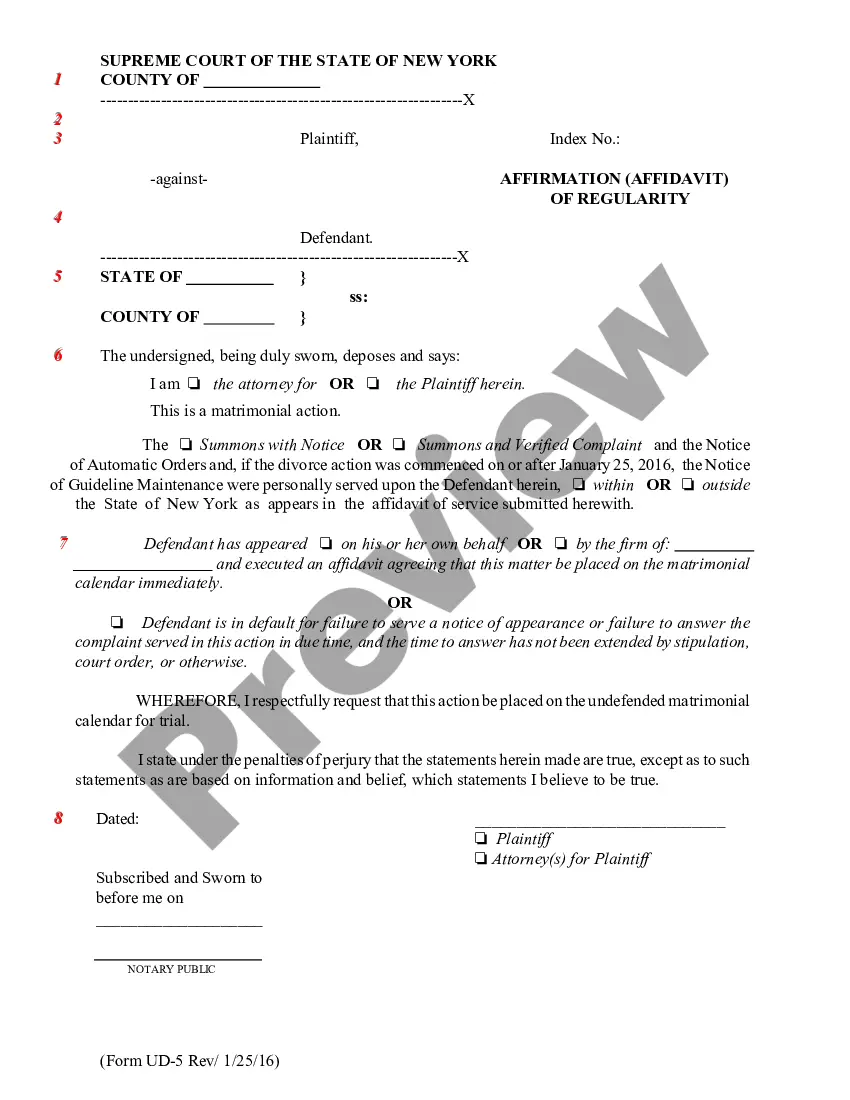

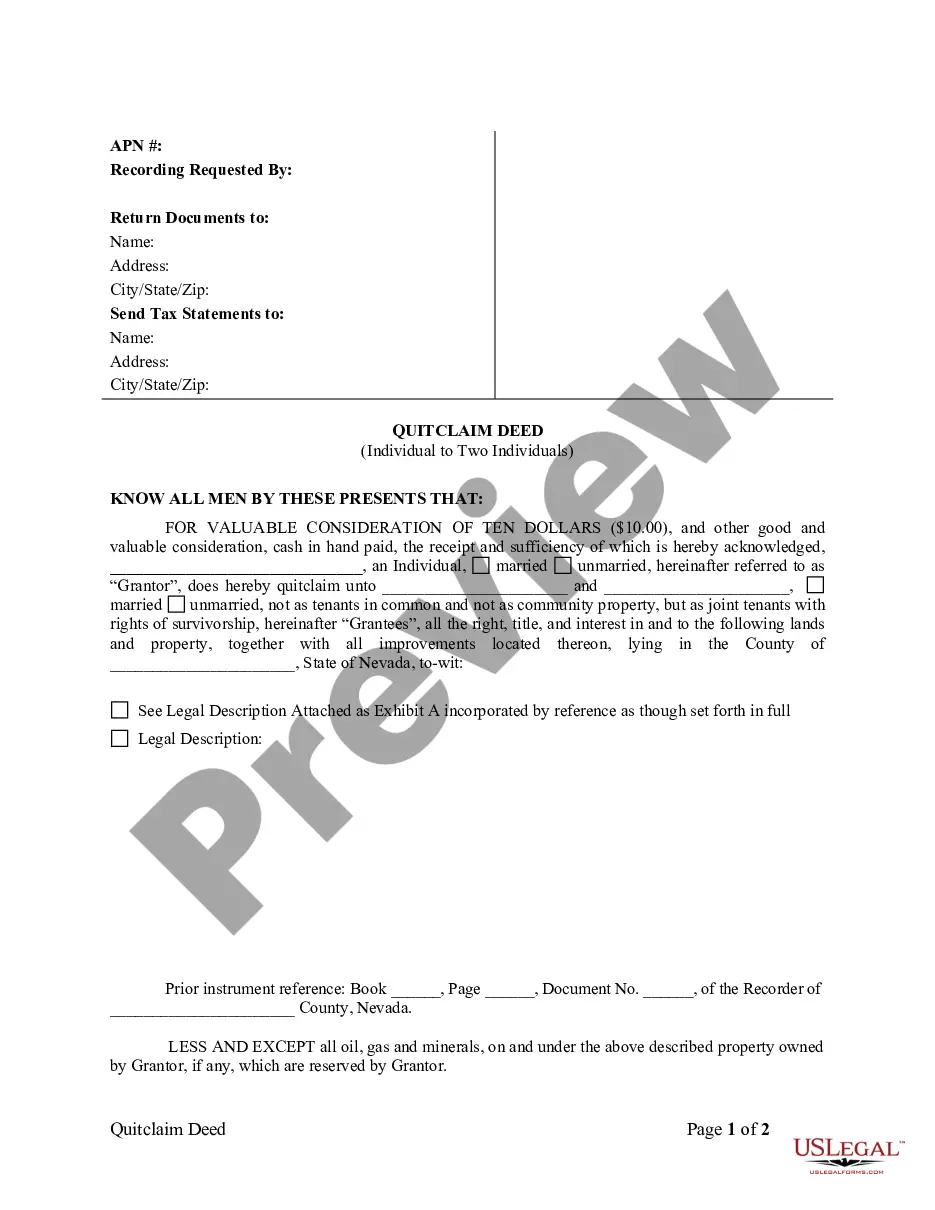

How to fill out Wraparound Mortgage?

Whether for commercial objectives or for individual issues, everyone must handle legal circumstances at some moment in their life.

Completing legal paperwork demands meticulous focus, starting from selecting the appropriate form model.

With an ample US Legal Forms catalog available, you don't have to waste time searching for the right template across the web. Take advantage of the library’s straightforward navigation to find the correct document for any occasion.

- Acquire the template you need by utilizing the search bar or catalog navigation.

- Review the form’s details to ensure it aligns with your situation, state, and locality.

- Access the form’s preview to examine it.

- If it is the incorrect document, return to the search option to locate the Wraparound Mortgage Form With 2 Points template you need.

- Obtain the template when it satisfies your needs.

- If you possess a US Legal Forms account, click Log in to retrieve previously saved templates in My documents.

- If you haven’t registered yet, you may acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you desire and download the Wraparound Mortgage Form With 2 Points.

- Once saved, you can fill out the form using editing software or print it and finish it manually.

Form popularity

FAQ

?If the seller doesn't pay the existing mortgage, the original lender can still foreclose on the house,? says Massieh. This means that even in cases where the buyer upholds their end of the arrangement, making payments on time, the deal could backfire.

Are Wraparound Mortgages Legal? Wraparound mortgages are generally considered to be legal. However, they are less commonly used in the real estate market due to several factors. One of these considerable factors is the increased inclusion of ?due on sale? clauses in many mortgage agreements.

Both parties will sign a promissory note that includes the terms of the mortgage. The seller keeps the existing mortgage on the home and either transfers the title to the buyer right away or once the loan is repaid. The buyer sends the seller their monthly payment, and the seller then pays the original lender.

Wraparound mortgages don't require either to have a DTI of 43% or lower or whatever percentage their prospective lending institution requires. Buyers and investors can purchase property despite having bad credit. To secure a conventional mortgage, a buyer needs to have a credit score of 620 or greater.

Benefits for sellers Along with any appreciation in the home price, sellers get to pocket the difference between their remaining mortgage balance and the wraparound mortgage. They also profit from the difference in their loan's interest rate and the higher one the buyer is paying. Enhanced cash flow.