Partnership Interest Purchase Format

Description

How to fill out Sale And Assignment Of A Percentage Ownership Interest In A Limited Liability Company?

It’s well known that you cannot become a legal expert instantly, nor can you understand how to swiftly create a Partnership Interest Purchase Format without possessing a unique set of abilities.

Drafting legal documents is an extensive procedure that demands particular training and expertise. So why not entrust the creation of the Partnership Interest Purchase Format to the professionals.

With US Legal Forms, one of the most extensive libraries of legal templates, you can find everything from court documents to office communication formats.

You can regain access to your forms from the My documents tab at any time. If you’re a current client, you can simply Log In, and find and download the template from the same section.

Regardless of the reason for your documentation—whether it’s financial, legal, or personal—our website has everything you need. Give US Legal Forms a try now!

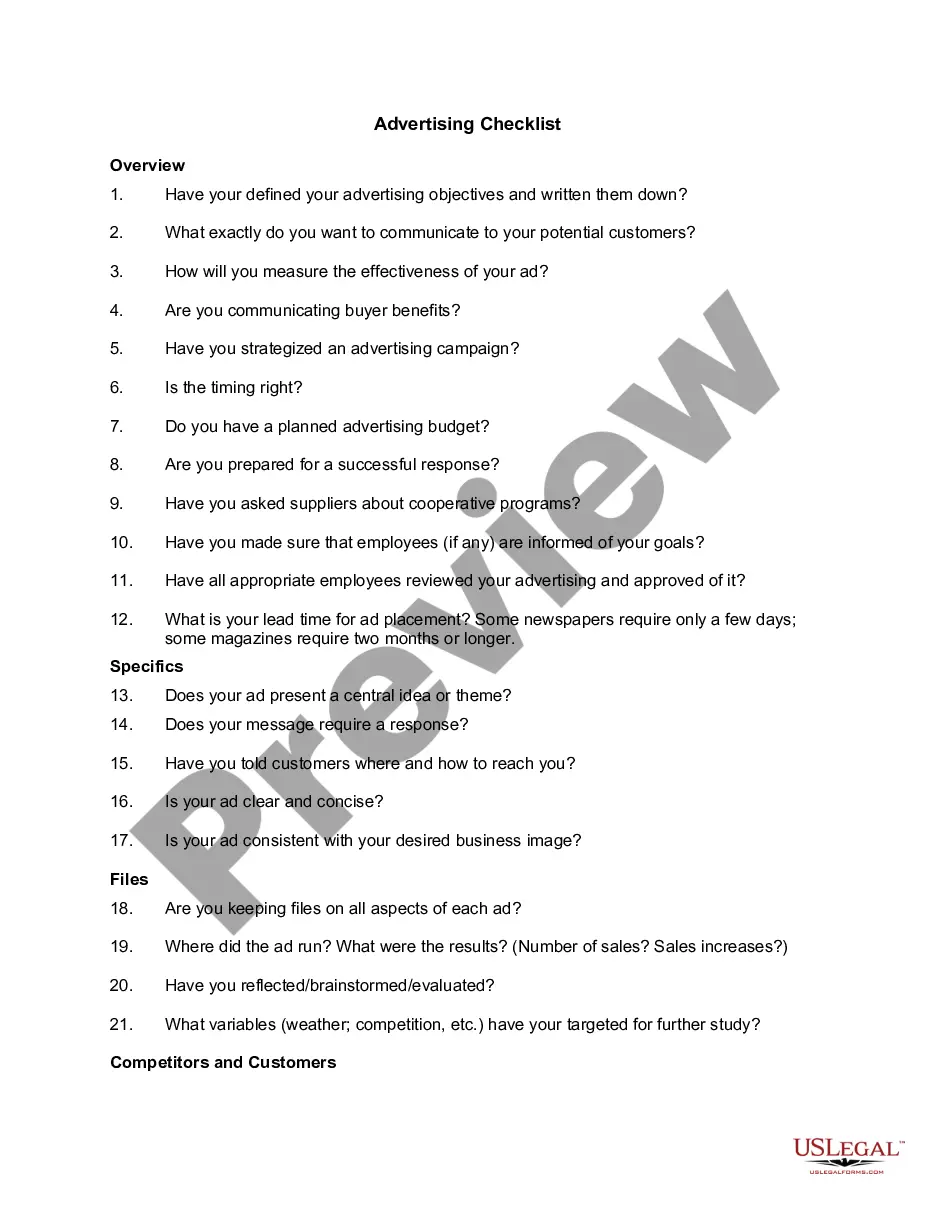

- Understand the document you require by utilizing the search bar at the top of the page.

- Examine it (if this option is available) and read the accompanying description to ascertain whether the Partnership Interest Purchase Format is what you’re looking for.

- Restart your search if you need any additional form.

- Create a complimentary account and choose a subscription plan to acquire the form.

- Select Buy now. Once the payment is completed, you can download the Partnership Interest Purchase Format, complete it, print it, and send or mail it to the intended individuals or organizations.

Form popularity

FAQ

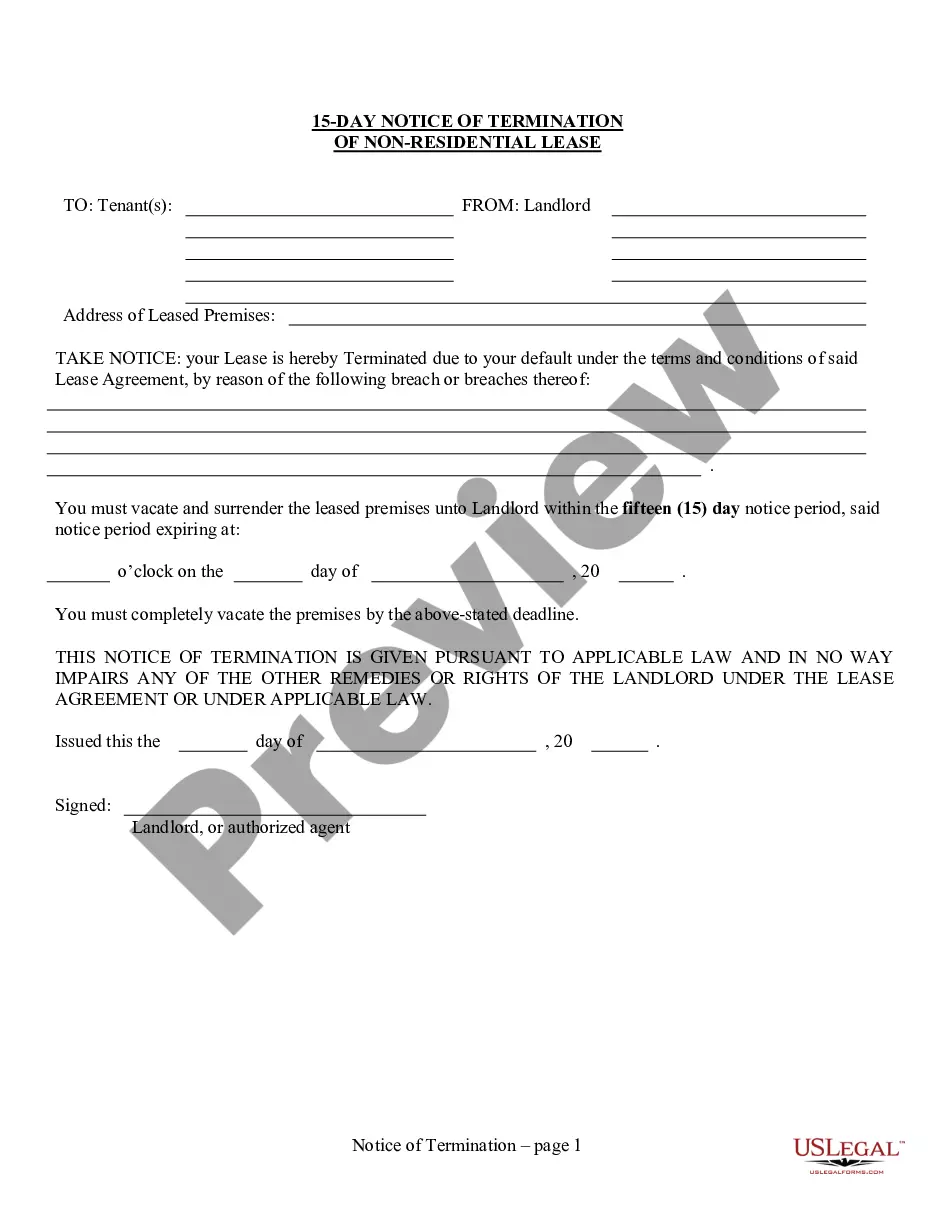

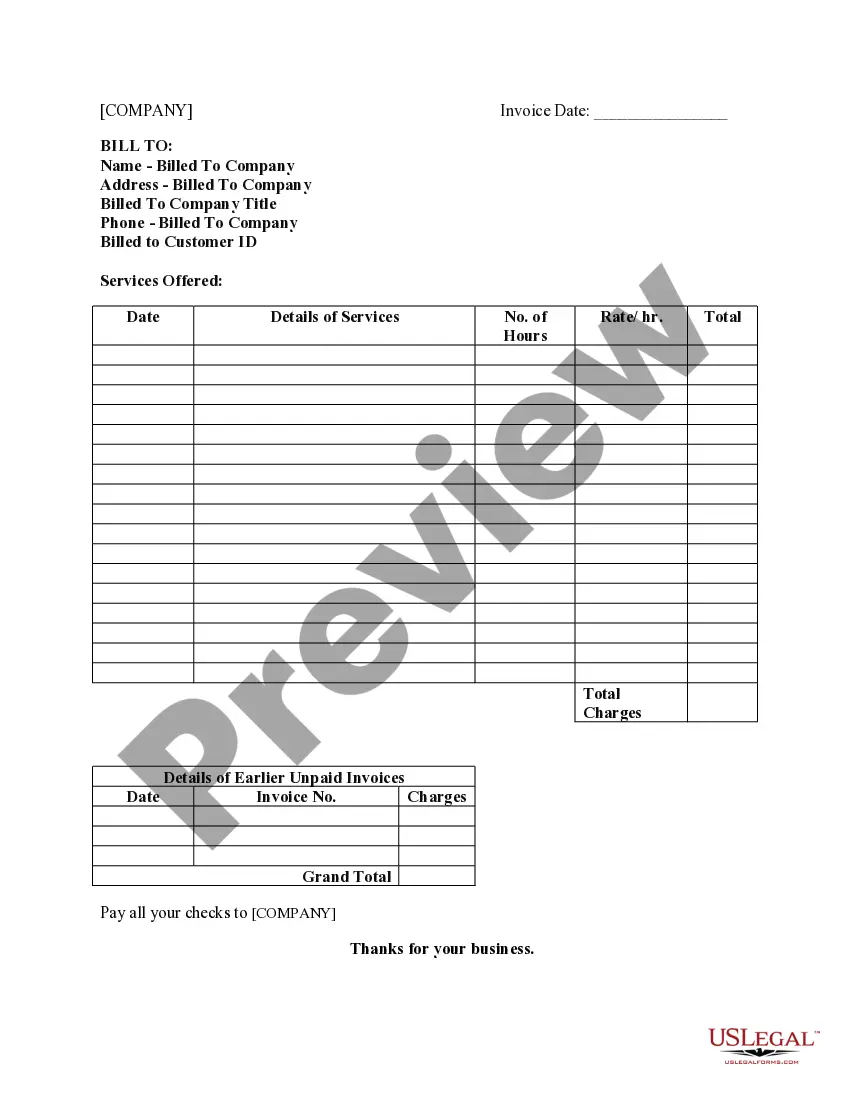

When a partnership interest is purchased, the buyer gains a stake in the partnership and assumes rights and responsibilities as outlined in the partnership agreement. This transaction often requires careful documentation in the partnership interest purchase format to avoid misunderstandings. The partnership's operating structure may change, impacting decision-making and profit distribution.

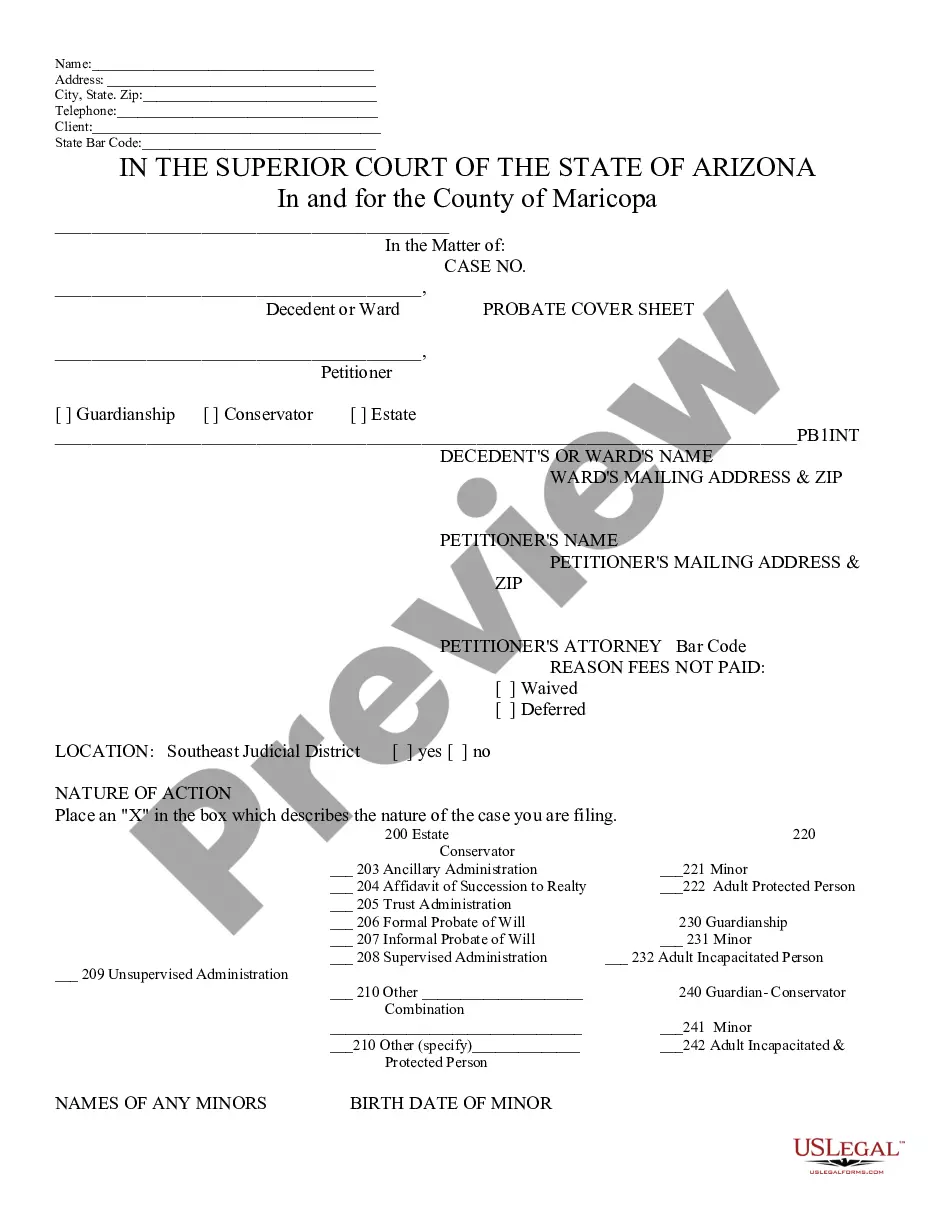

Form 8308 must be filed when a partnership interest is transferred, and it documents the details of the transfer to the IRS. This form is crucial for reporting ownership changes and ensuring proper tax treatment of the transaction. Adhering to the correct partnership interest purchase format is vital for timely and accurate filing.

The format of a partnership deed includes specific clauses that define the partnership's terms, including the name of the partnership, the purpose, and the roles of each partner. It should also outline the profit-sharing arrangement and procedures for resolving disputes. A well-structured partnership interest purchase format can serve as a foundation for creating a robust partnership deed.

To report the transfer of partnership interest on Form 1065, you will need to indicate the changes in ownership on the appropriate lines of the form. Specifically, you should reflect the new partner's information and the percentage of interest they hold. Using the right partnership interest purchase format will help streamline this process, ensuring compliance with IRS regulations.

The 8453 form is used by taxpayers to submit their electronic tax returns to the IRS. This form serves as a declaration that the information provided is accurate and complete. When dealing with a partnership interest purchase format, it's important to ensure that all required forms, including 8453, are properly filed to avoid any penalties.

The form for partnership transfer of interest is typically a partnership interest purchase format that outlines the terms of the transaction. This document should include details such as the names of the parties involved, the percentage of interest being transferred, and any payment terms. It's essential to draft this form carefully to ensure clarity and legality in the transfer process.

A partnership agreement should include details such as the purpose of the partnership, ownership interest, decision-making process, responsibilities and liabilities of each partner, dispute resolution procedures, and continuity and succession planning.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

Partnership interests can be divided into capital interests and profits interests. Capital Interest. A partnership interest that gives the owner an immediate right to a share of proceeds if the partnership assets are sold at fair market value and the proceeds distributed in a complete liquidation of the partnership.

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).