Partnership Interest Purchase For Services

Description

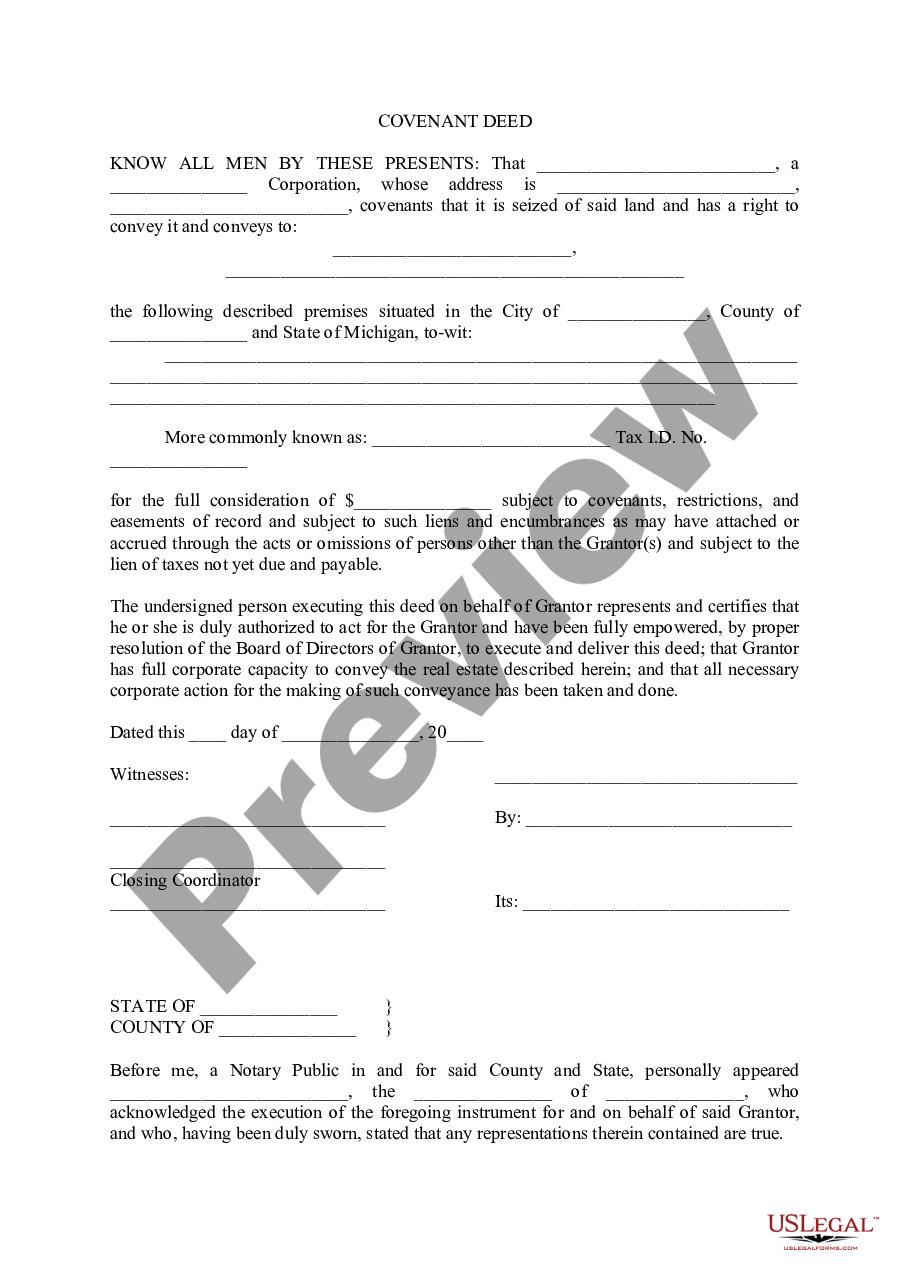

How to fill out Sale And Assignment Of A Percentage Ownership Interest In A Limited Liability Company?

Creating legal documents from the ground up can frequently feel somewhat daunting.

Certain situations could require extensive research and a significant financial investment.

If you seek a more straightforward and economical method of preparing Partnership Interest Purchase For Services or any other documents without unnecessary complications, US Legal Forms is readily available to assist you.

Our online repository of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal affairs.

Review the document preview and descriptions to confirm you are accessing the correct form. Ensure the form you choose complies with the rules and laws of your state and county. Select the appropriate subscription plan to purchase the Partnership Interest Purchase For Services. Download the file, then complete, certify, and print it out. US Legal Forms holds a strong reputation and over 25 years of experience. Join us today and make document completion a simple and efficient process!

- With just a few clicks, you can swiftly access state- and county-specific forms expertly crafted for you by our legal experts.

- Utilize our platform whenever you require dependable and trustworthy services through which you can effortlessly find and download the Partnership Interest Purchase For Services.

- If you’re a returning user and have previously set up an account with us, simply Log In to your account, find the template and download it or retrieve it anytime in the My documents section.

- No account yet? No worries. It takes just a few minutes to register and explore the catalog.

- However, before jumping straight to downloading Partnership Interest Purchase For Services, consider these suggestions.

Form popularity

FAQ

When a partner sells their partnership interest, they transfer their rights and obligations to the buyer, which can alter the partnership's structure. The remaining partners may need to approve the sale, depending on the partnership agreement. For those navigating a partnership interest purchase for services, it’s important to follow the correct procedures to avoid complications. Legal platforms such as US Legal Forms can provide templates and guidance to facilitate a smooth transaction.

When a partnership interest is purchased, the new partner acquires a share of the profits, losses, and decision-making authority of the partnership. This change can impact the dynamics of the existing partnership, so clear communication is essential. For individuals involved in a partnership interest purchase for services, understanding the rights and responsibilities of the new partner is crucial. Utilizing resources like US Legal Forms can help ensure that all legal aspects are addressed properly.

An interest in exchange for services in an LLC refers to the ownership stake a member receives as compensation for their work or expertise. This arrangement allows individuals to contribute their skills to the business without an upfront investment. If you're exploring a partnership interest purchase for services, understanding this concept is vital, as it can affect how ownership and profits are shared among members. Platforms like US Legal Forms can assist in drafting agreements that clarify these arrangements.

Yes, a partnership can buy back a partner's interest, which is often referred to as a buyout. This process typically involves a mutual agreement on the value of the interest and the terms of the buyout. For those considering a partnership interest purchase for services, it’s crucial to have clear documentation of the agreement to avoid future disputes. Consulting with legal professionals can help ensure that the buyout process is handled smoothly.

To report a partnership buyout, partners must document the transaction accurately on their tax returns. Typically, the selling partner needs to report the sale on Form 8949, and the partnership must inform the IRS of any changes in ownership. For those involved in a partnership interest purchase for services, maintaining precise records is essential to ensure compliance with tax regulations. Using platforms like US Legal Forms can simplify this process by providing the necessary forms and guidance.

The 7 year rule for partnerships refers to the IRS guideline that affects the tax treatment of partnership interests. If a partner sells their interest in a partnership after holding it for more than seven years, the capital gains from that sale may be taxed at a lower rate. This rule is important for partners considering a partnership interest purchase for services, as it can influence their long-term investment strategy. Understanding these tax implications can help partners make informed decisions.

Guaranteed payments to partners are compensation to members of a partnership in return for time invested, serviced provided, or capital made available. The payments are essentially a salary for partners that is independent of whether the partnership is successful.

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

To be legally enforceable, an Assignment of Partnership Interest must be signed by the assignor, the assignee, and all the remaining members of the partnership. If applicable, witnesses to the signing need to sign the document as well. The signatures do not need to be notarized to be valid.

Overview. A partner who receives an interest in partnership capital in exchange for services he has performed or will perform for the partnership recognizes income equal to the value of the interest he receives.