Trust Fund And How They Work For A Child

Description

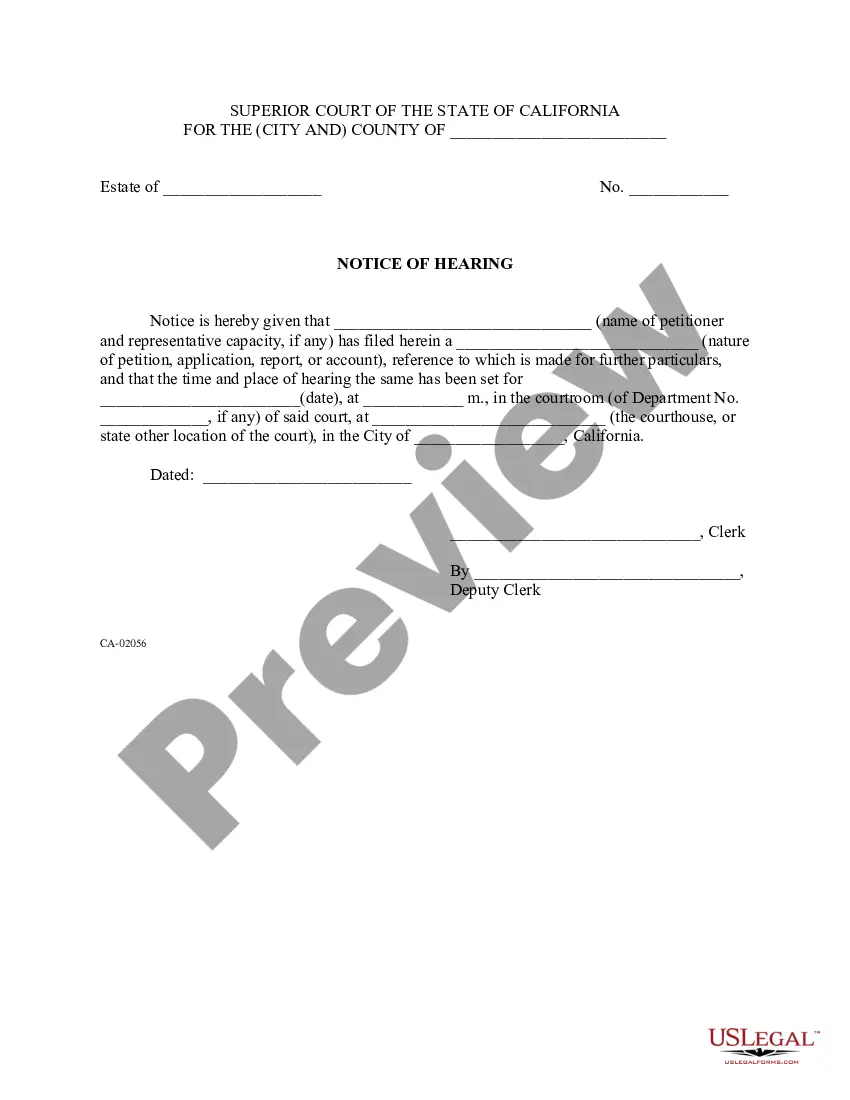

How to fill out Irrevocable Trust Funded By Life Insurance?

Whether for business purposes or for individual matters, everyone has to manage legal situations sooner or later in their life. Completing legal papers requires careful attention, starting with choosing the appropriate form template. For instance, when you pick a wrong version of a Trust Fund And How They Work For A Child, it will be declined once you submit it. It is therefore important to get a trustworthy source of legal papers like US Legal Forms.

If you have to get a Trust Fund And How They Work For A Child template, stick to these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Look through the form’s description to make sure it fits your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong form, return to the search function to locate the Trust Fund And How They Work For A Child sample you need.

- Download the template when it matches your requirements.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Select the proper pricing option.

- Complete the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the document format you want and download the Trust Fund And How They Work For A Child.

- After it is saved, you are able to complete the form by using editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never have to spend time seeking for the right template across the web. Use the library’s straightforward navigation to get the right form for any situation.

Form popularity

FAQ

Once you're 18, the choice is yours. You'll need to log into your online account where you can withdraw money either by bank transfer or by asking us to post a cheque. You also now have the option to move money into an ISA or a Lifetime ISA. If you've not yet decided, it's ok to do nothing!

A trust fund baby is someone whose parents or grandparents have placed assets in a trust fund for them. They can start accessing the money once they hit a certain age, typically at age 18, or once a certain event occurs, such as the death of the individual who set it up.

Consider a lifetime trust. The trustee would have discretion to distribute money, but the child would never have a right to demand chunks of cash. This is the best approach if you are concerned that a child has creditors or may divorce in the future.

The median inheritance in the survey was $69,000 (the average was $707,291). For trust funds, that median wealth transfer was way, way higher ? $285,000 (and the average was $4,062,918).

Once you're 18, the choice is yours. You'll need to log into your online account where you can withdraw money either by bank transfer or by asking us to post a cheque. You also now have the option to move money into an ISA or a Lifetime ISA. If you've not yet decided, it's ok to do nothing!