Credit Shelter Trust Example

Description

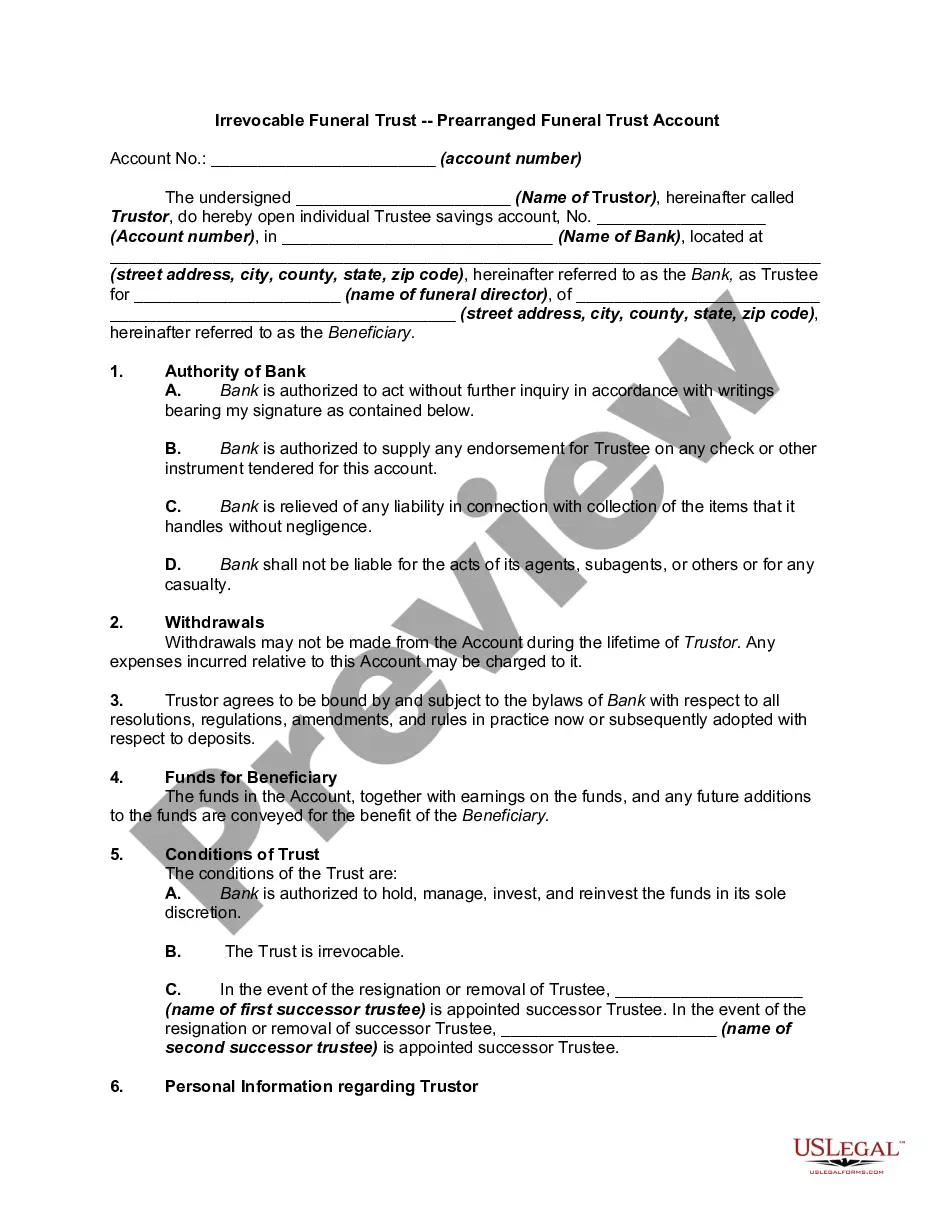

How to fill out Irrevocable Funeral Trust - Prearranged Funeral Trust Account?

Acquiring legal templates that adhere to federal and state laws is essential, and the web provides numerous choices to choose from. However, what’s the use in spending time searching for the accurately drafted Credit Shelter Trust Example template online when the US Legal Forms online library has already gathered such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates prepared by lawyers for any business and personal situation. They are simple to navigate with all documents categorized by state and intended use. Our experts keep up with legal updates, ensuring that your form is always current and compliant when obtaining a Credit Shelter Trust Example from our site.

Acquiring a Credit Shelter Trust Example is swift and straightforward for both existing and new users. If you already possess an account with an active subscription, Log In and download the document sample you need in the appropriate format. If you are new to our site, follow the instructions below.

All templates you find through US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal documentation service!

- Review the template using the Preview tool or via the text outline to ensure it suits your requirements.

- Search for another sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the appropriate form and select a subscription option.

- Create an account or Log In and make a payment using PayPal or a credit card.

- Choose the best format for your Credit Shelter Trust Example and download it.

Form popularity

FAQ

To set up a credit shelter trust, begin by consulting with a qualified estate planning attorney who understands your financial situation. They can guide you through the process of drafting the trust document and ensuring it aligns with your wishes. Next, transfer assets into the trust, specifying how they will be managed and distributed. By following these steps and seeking assistance from platforms like US Legal Forms, you can create a credit shelter trust that provides peace of mind for you and your family.

A credit shelter trust example illustrates how individuals can use this estate planning tool to minimize taxes on their heirs. This trust allows a portion of your estate to bypass estate taxes, thereby preserving wealth for your beneficiaries. For instance, when one spouse passes away, the trust can hold their assets, which are not subject to estate tax, while the surviving spouse benefits from the income generated. By utilizing a credit shelter trust example, you can effectively secure your family's financial future.

The maximum amount for a credit shelter trust depends on the federal estate tax exemption limits. As of 2023, this limit is set at over $12 million per individual. However, laws can change, so it's essential to stay informed about current regulations. Consulting with a legal expert can help you determine how to maximize the benefits of a credit shelter trust example in your specific situation.

Using a credit shelter trust offers several benefits. It allows you to protect your assets from estate taxes, ensuring that more of your wealth is passed on to your heirs. Additionally, it provides control over how and when your assets are distributed, which can be particularly useful for complex family situations. If you're looking for a way to secure your legacy, a credit shelter trust example may be an effective solution.

Yes, a credit shelter trust can be sued, just like any other entity. If the trust holds assets that are involved in legal disputes, claimants may pursue legal action against the trust. However, the structure of the trust can provide some level of protection for personal assets, which is a key advantage of using a credit shelter trust example.

A revocable living trust is often considered one of the best options to avoid taxes while maintaining control over your assets. However, for specific tax benefits, a credit shelter trust example can help shield your estate from taxes upon your death. Each trust type has unique benefits, so it is wise to evaluate your financial situation and goals before deciding.

Typically, the credit shelter trust itself is a separate entity for tax purposes. This means the trust will need to file its own tax return. The income generated by the assets in the trust is taxable to the beneficiaries when distributed. Understanding these tax implications can be complex, so consulting with a tax professional is advisable.

A credit shelter trust can have some disadvantages that you should consider. First, it may require ongoing legal and administrative costs, which can add up over time. Additionally, the trust may limit your control over assets once they are placed in the trust. Lastly, navigating the regulations surrounding credit shelter trusts can be complex, so having professional guidance is essential.

A credit shelter trust, also known as a bypass trust, allows a married couple to minimize estate taxes. For instance, if one spouse passes away, the trust can hold an amount up to the estate tax exemption limit, while the surviving spouse can access the income generated. This arrangement protects the assets from estate taxes upon the death of the surviving spouse. Using a credit shelter trust example can help you visualize how this strategy works in real-life scenarios.

One of the biggest mistakes parents make is failing to clearly define the terms of the trust. Without specific instructions, beneficiaries may not understand how to use the funds effectively. Additionally, parents often overlook the importance of regularly reviewing and updating the trust as family dynamics change. Using a credit shelter trust example can help illustrate effective strategies for setting up a trust fund.