Trust Transfer Deed Sample With Mortgage

Description

How to fill out Bill Of Transfer To A Trust?

Regardless of whether it's for corporate reasons or personal matters, everyone eventually has to handle legal issues at some point in their lives.

Filling out legal documents necessitates meticulous care, beginning with selecting the appropriate form template.

Once downloaded, you can fill out the form using editing software or print it out and complete it by hand. With an extensive US Legal Forms library available, you do not need to waste time searching for the suitable template online. Utilize the library’s easy navigation to locate the right template for any situation.

- For example, if you pick an incorrect version of a Trust Transfer Deed Sample With Mortgage, it will be rejected upon submission.

- Thus, it is crucial to have a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a Trust Transfer Deed Sample With Mortgage template, follow these straightforward steps.

- Obtain the template you require using the search bar or catalog browsing.

- Review the form’s description to ensure it aligns with your circumstances, state, and county.

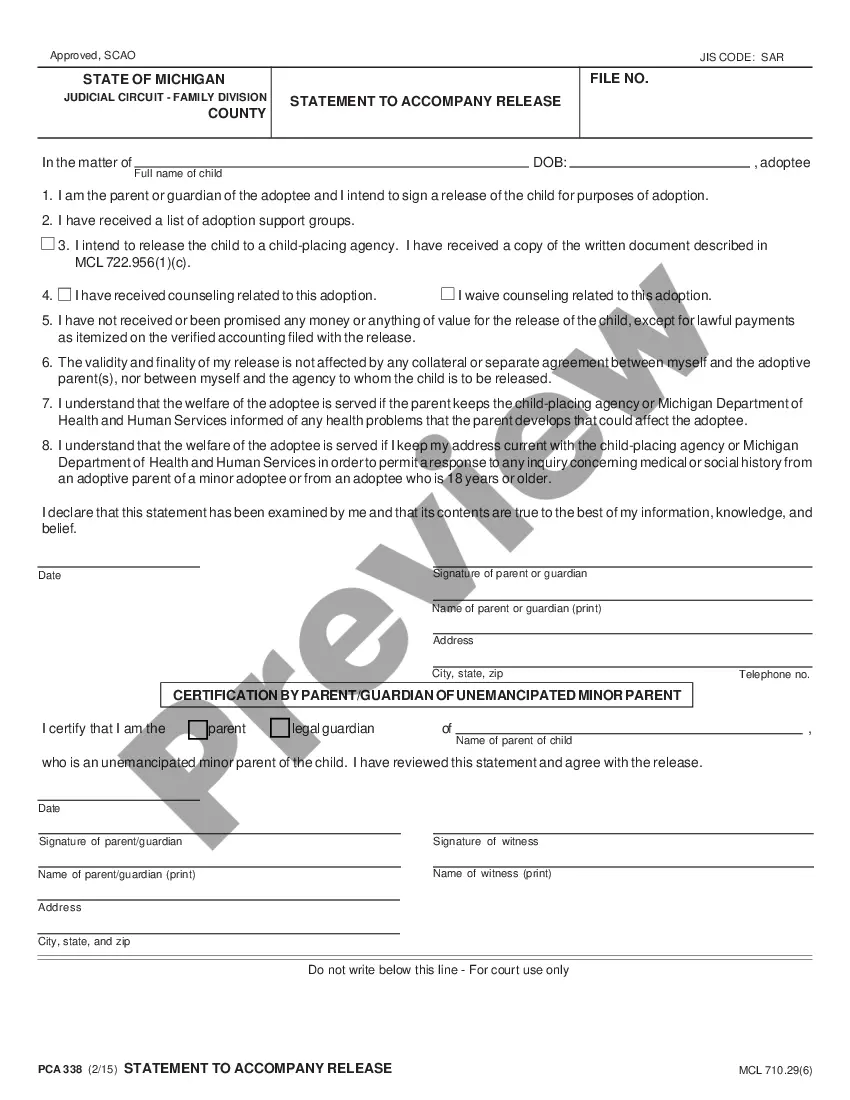

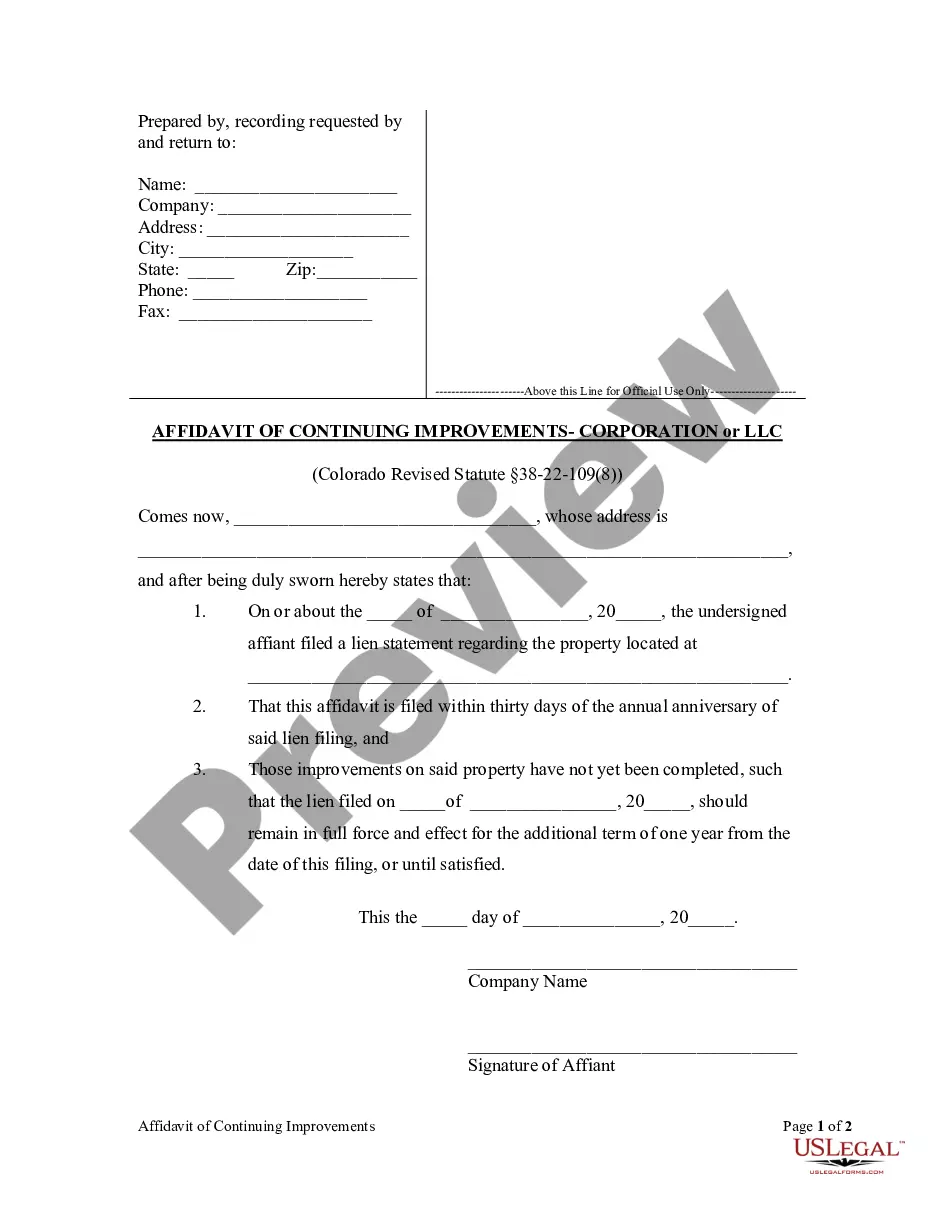

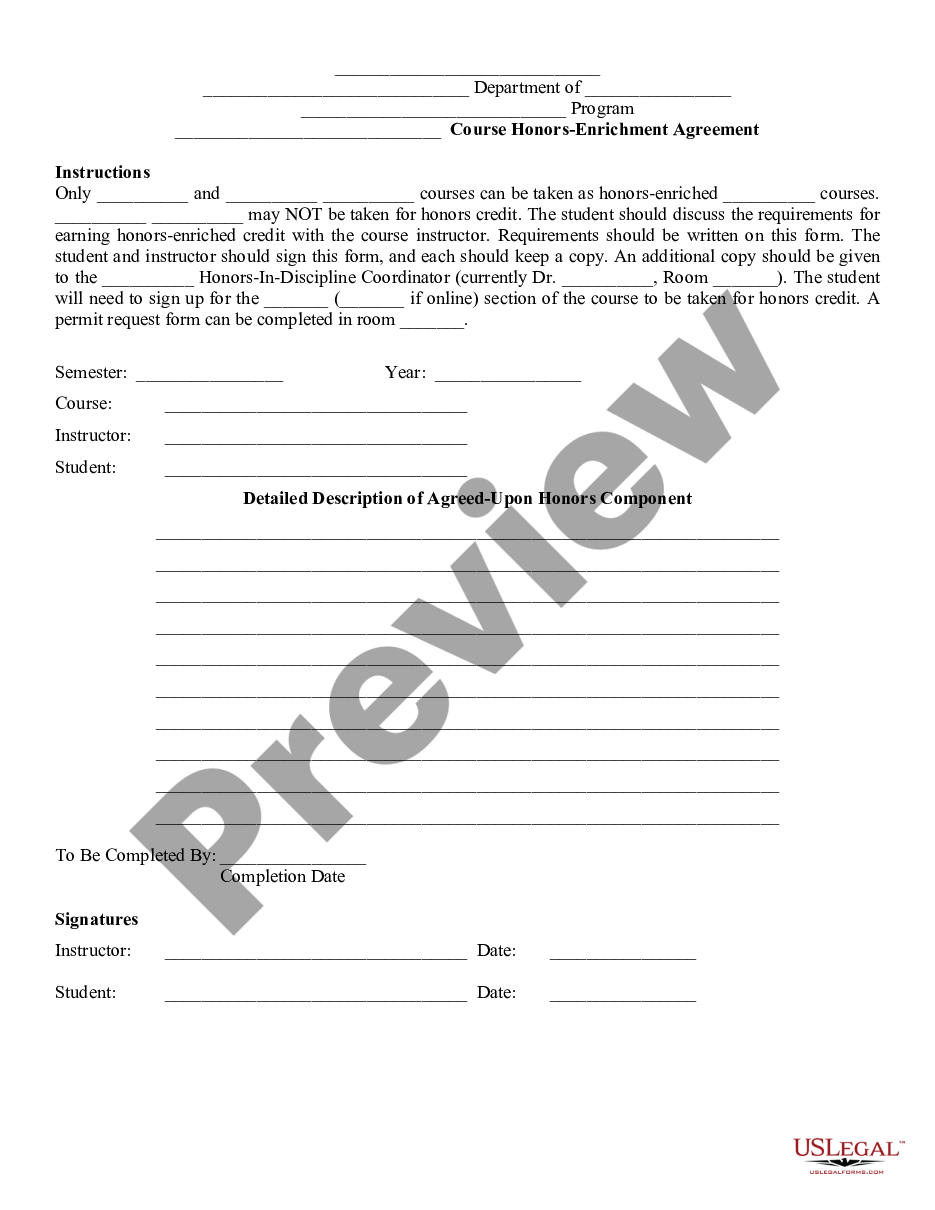

- Click on the form’s preview to view it.

- If it is not the correct document, go back to the search tool to locate the Trust Transfer Deed Sample With Mortgage form you need.

- Download the file if it satisfies your criteria.

- If you possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you do not yet have an account, you can obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the profile registration form.

- Select your payment method: you can choose a credit card or PayPal account.

- Choose the document format you prefer and download the Trust Transfer Deed Sample With Mortgage.

Form popularity

FAQ

Obtaining a mortgage while a property is held in a trust is possible, but it can be complex. Lenders often require additional documentation and may want to review the trust documents. It's beneficial to consult a professional, and using a trust transfer deed sample with mortgage can help clarify the process. This resource can assist you in meeting lender requirements and securing financing.

Yes, you can transfer property with a mortgage into a trust. However, it's essential to understand the implications this may have on your mortgage terms. Some lenders may require notification of the transfer, and certain mortgages contain clauses that could trigger a due-on-sale clause. For a comprehensive understanding, a trust transfer deed sample with mortgage can guide you through the necessary steps.

Yes, you can transfer your property into a trust even if you have a mortgage. However, this process typically requires the lender's approval. A trust transfer deed sample with mortgage can guide you through the necessary steps and ensure that you handle the mortgage properly. It's advisable to consult with a legal professional to avoid any potential complications during the transfer.

Getting a mortgage after a Protected Trust Deed is possible. It may not occur immediately, but it certainly is possible. However, it will not be possible to obtain a re-mortgage on a home that is still in the Trust Deed, without the Trustee's permission, until they have discharged their interest.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

A grantor may place a mortgaged home in a living trust by signing a warranty or quitclaim deed from the current owners to the trust. In this case, the deed would name the living trust as grantee and would be and recorded just like any other property transfer.

A mortgage in trust may be something that you have never previously considered, but it may be appropriate. Anyone who owns property can put their mortgage in a revocable living trust so as to not deal with the probate process after death and utilize other estate planning benefits.