Trust Transfer Deed Sample Form California

Description

How to fill out Bill Of Transfer To A Trust?

Regardless of whether it is for professional reasons or personal issues, everyone must deal with legal matters at some stage in their lives.

Filling out legal documents requires meticulous care, starting with selecting the correct form template.

With a vast US Legal Forms catalog available, you won’t need to waste time searching for the correct template online. Take advantage of the library’s straightforward navigation to locate the right template for any situation.

- For example, if you select an incorrect version of the Trust Transfer Deed Sample Form California, it will be rejected upon submission.

- Thus, it is crucial to have a dependable source of legal documents such as US Legal Forms.

- If you need to acquire a Trust Transfer Deed Sample Form California template, follow these simple steps.

- Obtain the template you require using the search bar or catalog navigation.

- Review the form’s details to ensure it suits your case, state, and locality.

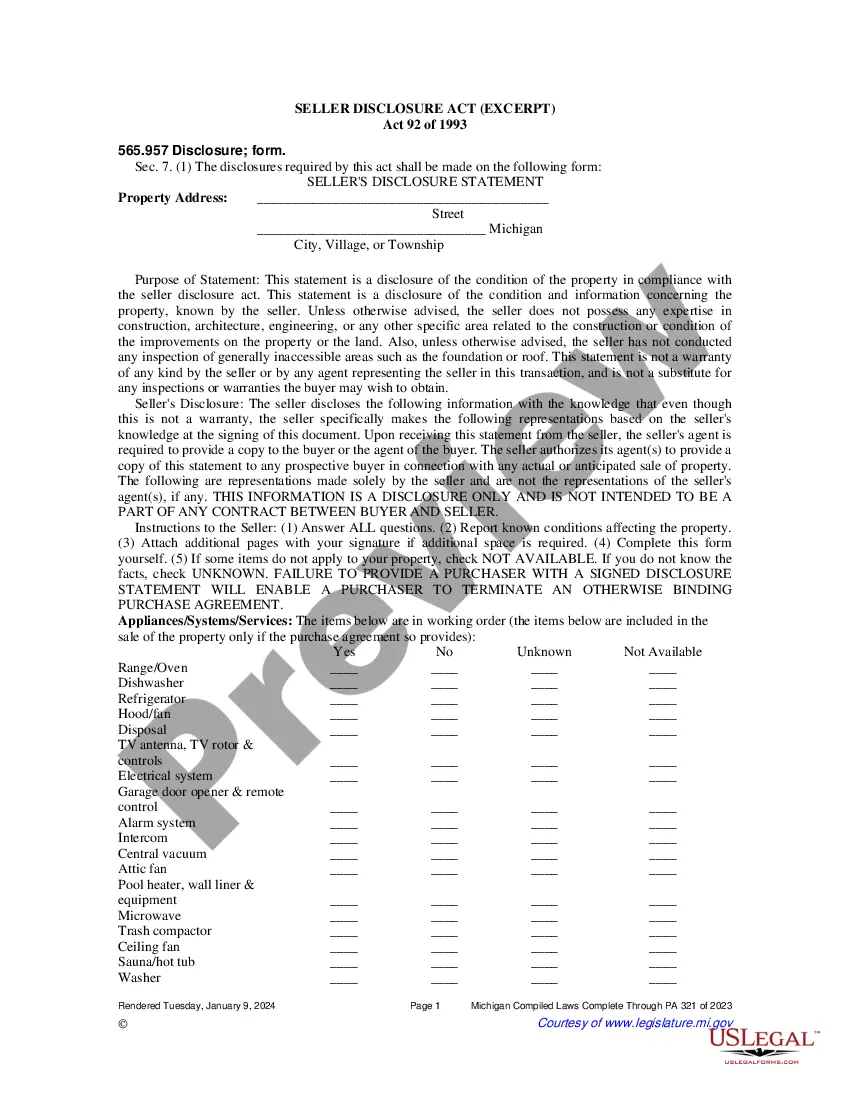

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search option to find the Trust Transfer Deed Sample Form California template you need.

- Download the template if it meets your criteria.

- If you possess a US Legal Forms profile, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Pick the file format you prefer and download the Trust Transfer Deed Sample Form California.

- Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

To transfer property from a trust to an individual in California, you need to create a new deed that specifies the transfer from the trust to the individual. Make sure to sign, notarize, and record this deed with the county recorder’s office. Utilizing a Trust transfer deed sample form California can help you draft the necessary documents correctly. This approach minimizes complications and ensures a smooth transition.

Transferring title to a trust in California requires completing a deed that indicates the property is now held by the trust. Ensure that you provide all necessary details about both the property and the trust. After signing and notarizing the deed, file it with your local county recorder's office. A Trust transfer deed sample form California can be a valuable resource to ensure you meet all requirements and streamline the process.

To change property ownership to a trust, you will need to draft a deed that transfers your property to the trust's name. This requires clear identification of the property and the trust. After signing and notarizing the deed, record it with the appropriate county office. Using a Trust transfer deed sample form California can guide you through the specifics of this process.

Transferring a title to a trust in California involves creating a new deed that names the trust as the property owner. You must complete this deed accurately and have it signed and notarized. Then, file the deed with the county recorder’s office to make the transfer official. A Trust transfer deed sample form California can assist you in drafting the deed correctly, making your task easier.

To transfer a deed of trust in California, you need to prepare a new deed that reflects the change in ownership. This document must be signed, notarized, and recorded with the county recorder's office. Utilizing a Trust transfer deed sample form California can simplify this process, ensuring you include all necessary information. Additionally, consider consulting a legal professional for guidance to avoid potential issues.

When a trustee dies leaving real property to beneficiaries, the successor trustee can use an Affidavit Death of Trustee and a Quitclaim Deed to transfer the real property to the new owners. The instructions explain exactly what to do, including how to complete, notarize, and record both forms.

Real estate can be transferred into a trust by a deed that transfers title from the grantor to the name of the trust. Under California law, a Preliminary Change of Ownership Report must be filed simultaneously with the deed at the county recorder's office in the county where the real property is situated.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

The cost to prepare and file a Short Form Deed of Trust in California is $375.00* total. The flat rate pricing includes filing fees. *Our flat rate pricing covers filing fees for up to 5 pages and do not include notary fees. Additional pages or non-conforming documents will accrue an additional filing fee.