Served With Summons For Debt

Description

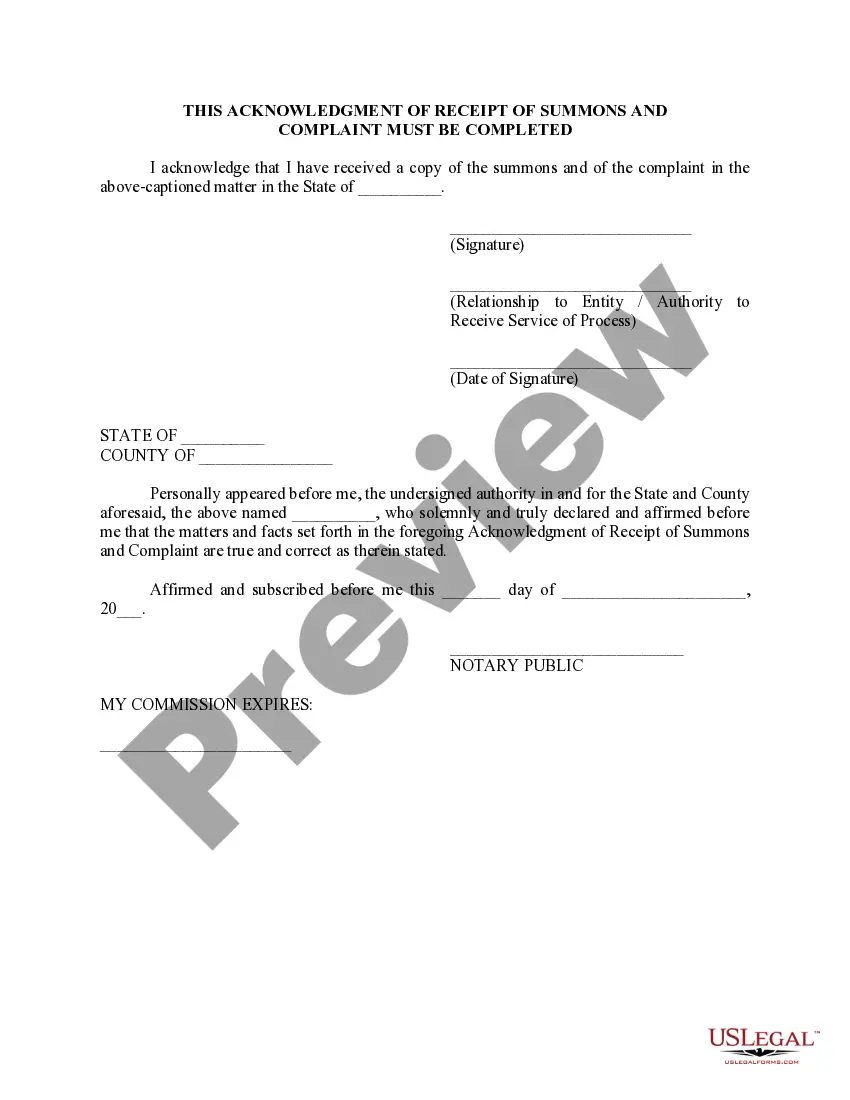

How to fill out Notice - Served With Complaint And Summons?

Legal documentation administration can be daunting, even for experienced professionals.

If you are looking for a Served With Summons For Debt and do not have time to search for the appropriate and current version, the tasks can be challenging.

Access a library of articles, guides, and resources pertinent to your situation and requirements.

Save time and effort searching for the documents you need and use US Legal Forms' sophisticated search and Review feature to find Served With Summons For Debt and download it.

Take advantage of the US Legal Forms online library, backed by 25 years of experience and reliability. Streamline your daily document management into a simple and user-friendly process today.

- If you have a monthly subscription, Log In to your US Legal Forms account, locate the form, and download it.

- Check your My documents tab to review the documents you previously saved and manage your folders as necessary.

- If you're new to US Legal Forms, create an account to gain unlimited access to all features of the library.

- After downloading the desired form, ensure it is the correct version by previewing it and reviewing its details.

- Confirm that the template is valid in your state or region.

- Click Buy Now when you are prepared.

- Access state- or region-specific legal and business documentation.

- US Legal Forms caters to all your requirements, from personal to business forms, all from one platform.

- Utilize advanced tools to fill out and manage your Served With Summons For Debt.

Form popularity

FAQ

In New York debt collection lawsuits, you can answer the summons in writing or in person, if the court allows. Either way is fine, so long as you provide the answer within the legal time frame (10-30 days, depending on how you were served). Remember,the court clerk can provide general information but not legal advice.

Credit Card Debt: Guide to Responding to Court Summons Review the Complaint and The Summon. You should review the summon and look out for important details including: ... Calculate the Deadline for Filing A Response. ... Draft A Response to The Complaint. ... File the Answer Form. ... Serve Copies to The Plaintiff.

You may settle your case at any time prior to having the court make a decision (a judgment) by either: Paying the full amount of the debt (plus any fees, costs, and interest required) Negotiating to pay a lesser amount and having the other side agree to accept that amount as full payment.

I am responding to your contact about collecting a debt. You contacted me by [phone/mail], on [date] and identified the debt as [any information they gave you about the debt]. I do not have any responsibility for the debt you're trying to collect.

Yes, you can settle a debt after being served with a lawsuit by a creditor. In fact, settling a debt after being served is often a more favorable outcome compared to letting the debt go to court.