Trust Without Beneficiary

Description

How to fill out Agreement Between Trustor And Trustee Terminating Trust After Disclaimer By Beneficiary?

Whether for corporate objectives or personal issues, everyone must confront legal circumstances at some time in their life.

Completing legal documents necessitates meticulous care, starting with selecting the correct form template.

With an extensive US Legal Forms catalog available, you no longer have to waste time searching for the correct template across the web. Utilize the library’s user-friendly navigation to find the suitable template for any circumstance.

- For instance, if you select an incorrect version of a Trust Without Beneficiary, it will be rejected when submitted.

- Therefore, it is crucial to obtain a trustworthy source of legal documents such as US Legal Forms.

- If you need to acquire a Trust Without Beneficiary template, adhere to these simple steps.

- Identify the template you require by utilizing the search bar or browsing the catalog.

- Review the form’s details to confirm it is appropriate for your situation, state, and county.

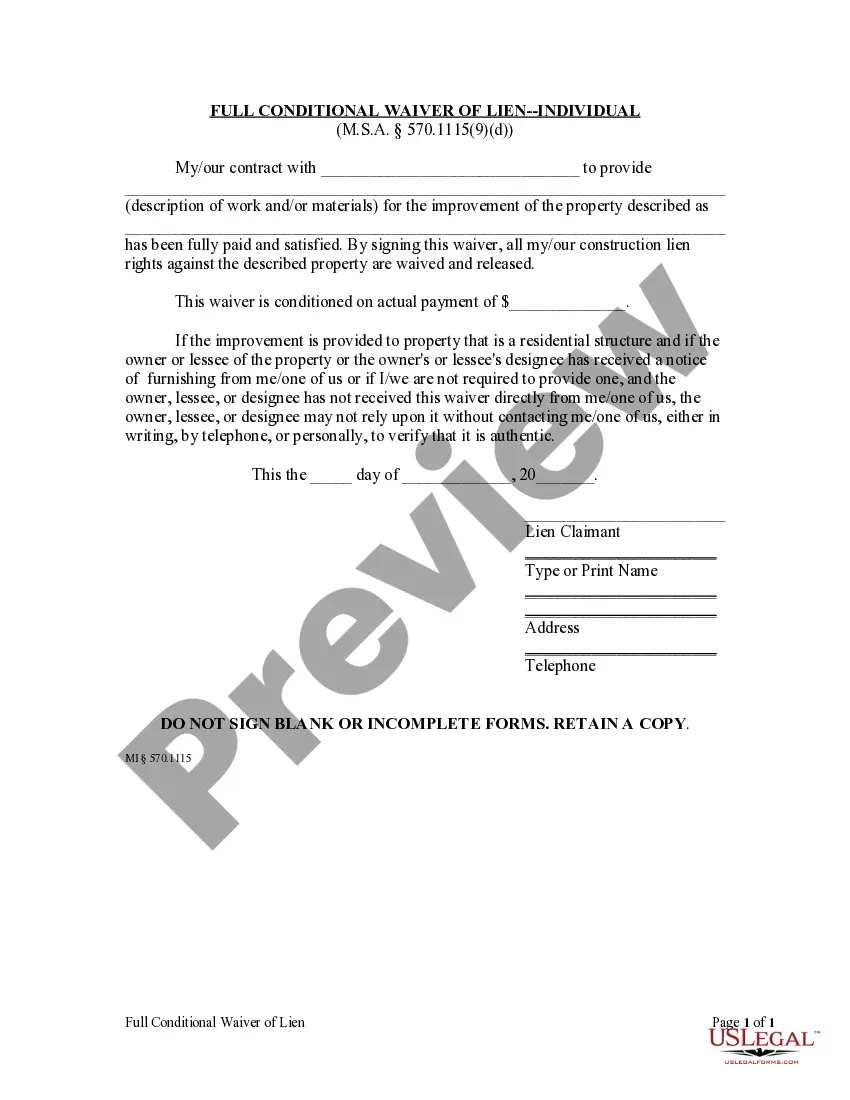

- Click on the form’s preview to inspect it.

- If it is not the correct document, return to the search function to locate the Trust Without Beneficiary example you need.

- Obtain the file when it meets your requirements.

- If you possess a US Legal Forms account, click Log in to retrieve previously saved documents in My documents.

- In case you do not have an account yet, you can download the form by clicking Buy now.

- Select the suitable payment option.

- Complete the account registration form.

- Choose your payment method: you may use a credit card or PayPal account.

- Select the file format you desire and download the Trust Without Beneficiary.

- Once it is downloaded, you can complete the form using editing software or print it and finish it by hand.

Form popularity

FAQ

Yes, you can create a trust without beneficiaries, although it might not serve its typical purpose. A trust without beneficiaries does not distribute assets to specific individuals but can still fulfill other goals, such as protecting assets or managing them for a certain period. For example, you might set up a trust without beneficiaries to preserve wealth for future generations or to provide for a charity after your passing. At US Legal Forms, we offer resources and templates to help you establish a trust without a beneficiary that meets your needs.

When a trust does not have a designated beneficiary, the assets typically become part of the deceased's estate. This means that the assets may go through probate, which can lead to delays and additional expenses. Moreover, the distribution of these assets will adhere to state laws regarding inheritance, which may not align with the intent of the trust creator. Using a trust without a beneficiary can create complexities, so consider utilizing USLegalForms to establish a clear plan for asset distribution.

Generally, a trust does not have to be filed with the IRS unless it has taxable income. However, certain types of trusts, like irrevocable trusts, may require a tax identification number and filing. It's essential to understand your trust's tax obligations thoroughly. For more specific guidance, US Legal Forms can be a great resource.

Yes, you can create a trust without a designated beneficiary, but it is highly discouraged. A trust without a beneficiary may lead to confusion regarding asset distribution and can complicate the trust's administration. It is best practice to identify a beneficiary to ensure that your wishes are honored. US Legal Forms offers helpful resources to guide you through this process.

If a trust has no beneficiary, the assets held within the trust may not be distributed according to your wishes. Typically, the assets could revert to the estate of the creator or be distributed according to state law. This scenario often underscores the importance of designating beneficiaries when establishing a trust. Consulting with US Legal Forms can help you navigate these complexities.

In some instances, you can create a trust for someone without their knowledge, but it is not always advisable. It may lead to complications, particularly when that person becomes aware of their trust status. Open communication about a trust is important for its management and effectiveness. A trust without a beneficiary could complicate matters further.

The minimum amount to start a trust varies based on the type of trust and the state laws. Generally, there is no set minimum, but having a starting amount of at least a few thousand dollars is advisable. This initial funding can ensure your trust operates effectively and meets its intended purposes. Creating a trust without a beneficiary may require significant assets to manage.

Most trusts indeed require beneficiaries to function effectively; otherwise, they may lose their purpose. Beneficiaries ensure that the trust assets are allocated properly according to the grantor's wishes. While some trusts can operate without beneficiaries, such situations can complicate asset distribution. Using US Legal Forms can help you ensure that your trust is structured correctly and includes beneficiaries for clearer asset management.

Yes, you can establish a trust without naming any beneficiaries, but it may not serve its intended purpose. A trust without beneficiaries often leads to complications, such as the assets reverting to the grantor's estate. If you are considering this option, it is advisable to consult legal advice. US Legal Forms can guide you in drafting a clear trust document that avoids these issues and protects your interests.

A trust can become invalid for various reasons, including lack of proper documentation, failure to comply with state laws, or absence of a clear grantor intention. Additionally, not naming a beneficiary or having an unlawful purpose can lead to an invalid trust. It is crucial to understand the legal requirements for creating a valid trust. With US Legal Forms, you can access templates that help you avoid common pitfalls, ensuring your trust remains valid.