Trust With Beneficiary

Description

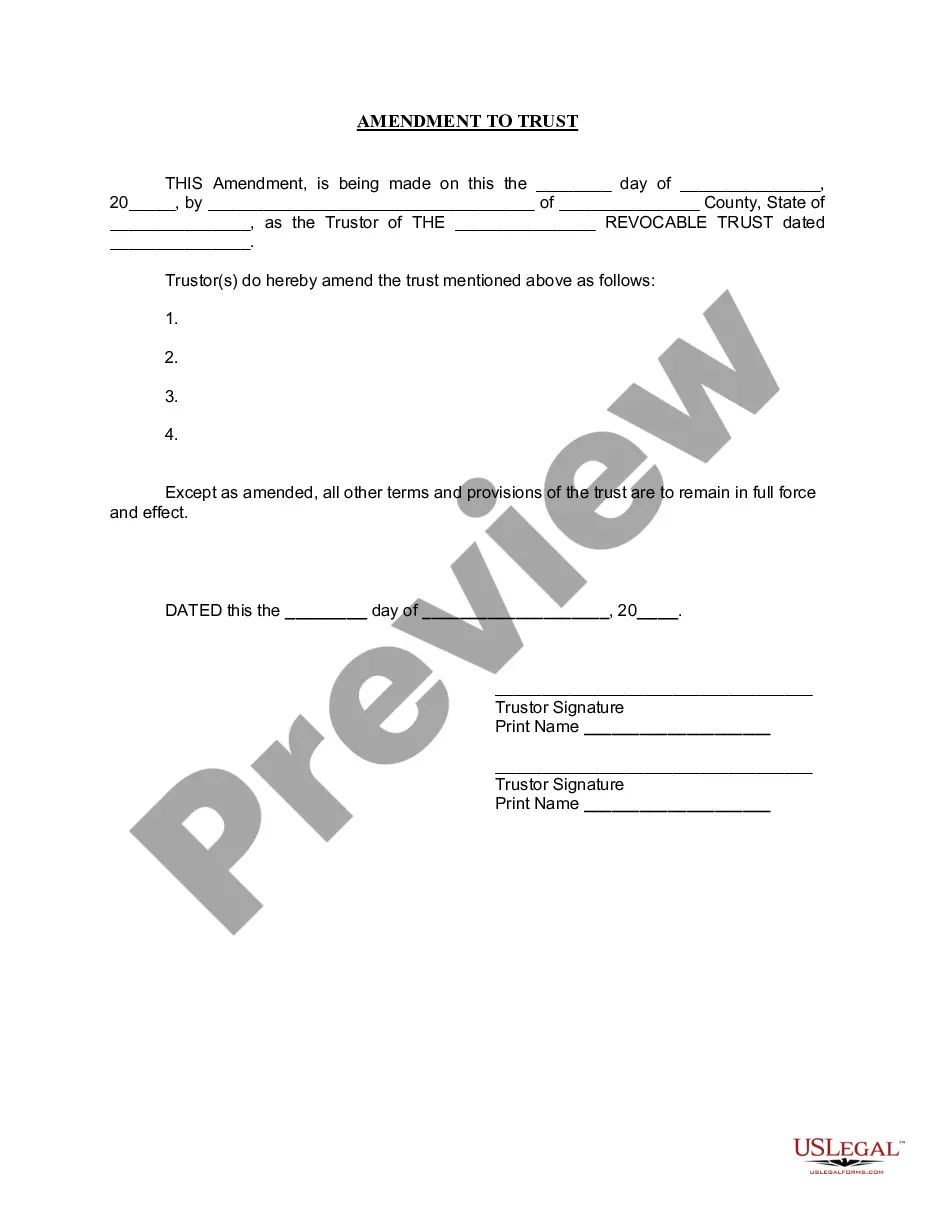

How to fill out Agreement Between Trustor And Trustee Terminating Trust After Disclaimer By Beneficiary?

Legal documentation management can be daunting, even for proficient professionals.

When seeking a Trust With Beneficiary and lacking the time to locate the correct and updated version, the process can be stressful.

US Legal Forms meets all your needs, from personal to corporate paperwork, all in one location.

Utilize cutting-edge tools to create and handle your Trust With Beneficiary.

Here are the steps to follow after obtaining the form you need: Verify that this is the correct form by previewing it and reading its description.

- Access a repository of articles, tutorials, and manuals related to your circumstances and requirements.

- Save time and energy searching for the necessary paperwork and use US Legal Forms' sophisticated search and Preview feature to locate Trust With Beneficiary and obtain it.

- If you hold a subscription, Log In to your US Legal Forms account, search for the form, and secure it.

- Review your My documents tab to see the documentation you have previously acquired and manage your files as desired.

- If this is your first encounter with US Legal Forms, create an account to gain unrestricted access to all the benefits of the library.

- A comprehensive web form directory could revolutionize the way individuals handle these scenarios effectively.

- US Legal Forms is a leading provider in online legal documentation, offering over 85,000 state-specific legal forms available to you at any time.

- With US Legal Forms, you can access localized legal and organizational documentation.

Form popularity

FAQ

A trust with a beneficiary generally does not need to be filed with the IRS unless it earns income. If the trust generates income, it must file a tax return using Form 1041. When creating a trust with a beneficiary, be sure to consult with a tax professional to understand your obligations and ensure compliance, while platforms like US Legal Forms can help with trust documentation.

To set up a trust for your beneficiaries, begin by determining your goals for the trust, such as asset protection and tax benefits. Then, choose a trustee who will manage the trust and carry out your wishes. You can utilize US Legal Forms to create the trust documents, ensuring that everything is in compliance with the law and tailored to your family’s needs.

Setting up a trust with a beneficiary involves several key steps. First, identify the type of trust you want to create, such as a revocable or irrevocable trust. Next, draft a trust document that outlines the terms, including who the beneficiaries are and how the assets will be distributed. Consider using a platform like US Legal Forms to simplify this process and ensure that your trust is legally sound.

When filling out a beneficiary designation form for a trust, start by accurately identifying the trust creator and the beneficiaries. Include pertinent details such as their relationship to you and the specific portions of the trust they will receive. This process often feels complex, but with the assistance of US Legal Forms, you can find comprehensive resources that clarify how to properly designate beneficiaries in a trust, ensuring your wishes are clearly understood.

Filling a beneficiary form requires careful attention to detail. First, identify the type of trust you are working with, then list the beneficiaries along with their full names and addresses. Ensure that you include any special instructions related to the distribution of trust assets. Utilizing US Legal Forms can simplify this task by offering user-friendly templates that align with your needs regarding a trust with beneficiary designations.

To fill out a beneficiary form for a trust, begin by gathering essential information about the trust and its beneficiaries. Clearly state the names and contact details of individuals or entities you wish to designate as beneficiaries. Make sure to follow any specific instructions provided in the form, and consider using US Legal Forms to access templates that help guide you through the process of setting up a trust with beneficiary designations.

The 2-year rule for trusts refers to the timeframe in which certain transfers of assets to a trust may be scrutinized for tax purposes. Generally, if you create a trust and transfer assets within two years of your death, those assets may be included in your estate for tax calculations. Understanding this rule is crucial when setting up a trust with beneficiaries, as it can affect the overall value passed on. Using platforms like USLegalForms can help clarify these regulations and guide you through creating a beneficial trust.

Having beneficiaries does not automatically mean you need a trust with beneficiary. A trust can help ensure your assets are distributed according to your wishes and can offer benefits like avoiding probate and maintaining privacy. If you want more control over how and when your beneficiaries receive their inheritance, a trust may be a wise choice. Consider using resources like USLegalForms to create a trust that suits your specific needs.