Settlement Offer Letter For Second Mortgage

Description

How to fill out Settlement Offer Letter From A Business Regarding A Disputed Account?

How to locate professional legal documents that adhere to your state regulations and draft the Settlement Offer Letter For Second Mortgage without hiring an attorney.

Numerous online services offer templates to address a variety of legal matters and formalities.

However, it may require time to identify which of the accessible samples fulfill both application and legal standards for your situation.

Download the Settlement Offer Letter For Second Mortgage using the button next to the document name. If you don't possess a US Legal Forms account, follow the instructions below: Review the webpage you've accessed and confirm whether the form meets your requirements. To do this, utilize the form description and preview options if available. Look for an additional sample in the header by providing your state if necessary. Click the Buy Now button when you find the appropriate document. Choose the best pricing plan, then sign in or register for an account. Select the payment method (by credit card or via PayPal). Convert the file format for your Settlement Offer Letter For Second Mortgage and click Download. The obtained templates will remain in your control: you can always return to them in the My documents section of your profile. Subscribe to our library and create legal documents independently like a seasoned legal expert!

- US Legal Forms is a trustworthy service that assists you in finding formal paperwork crafted in accordance with the latest updates in state law and helps you save on legal costs.

- US Legal Forms is not just a standard online library.

- It consists of more than 85,000 authenticated templates for different business and life situations.

- All documents are categorized by region and state to expedite your search process.

- Furthermore, it integrates with powerful solutions for PDF modification and electronic signatures, allowing users with a Premium subscription to swiftly complete their documents online.

- It requires minimal time and effort to acquire the required documents.

- If you already have an account, Log In and verify your subscription's validity.

Form popularity

FAQ

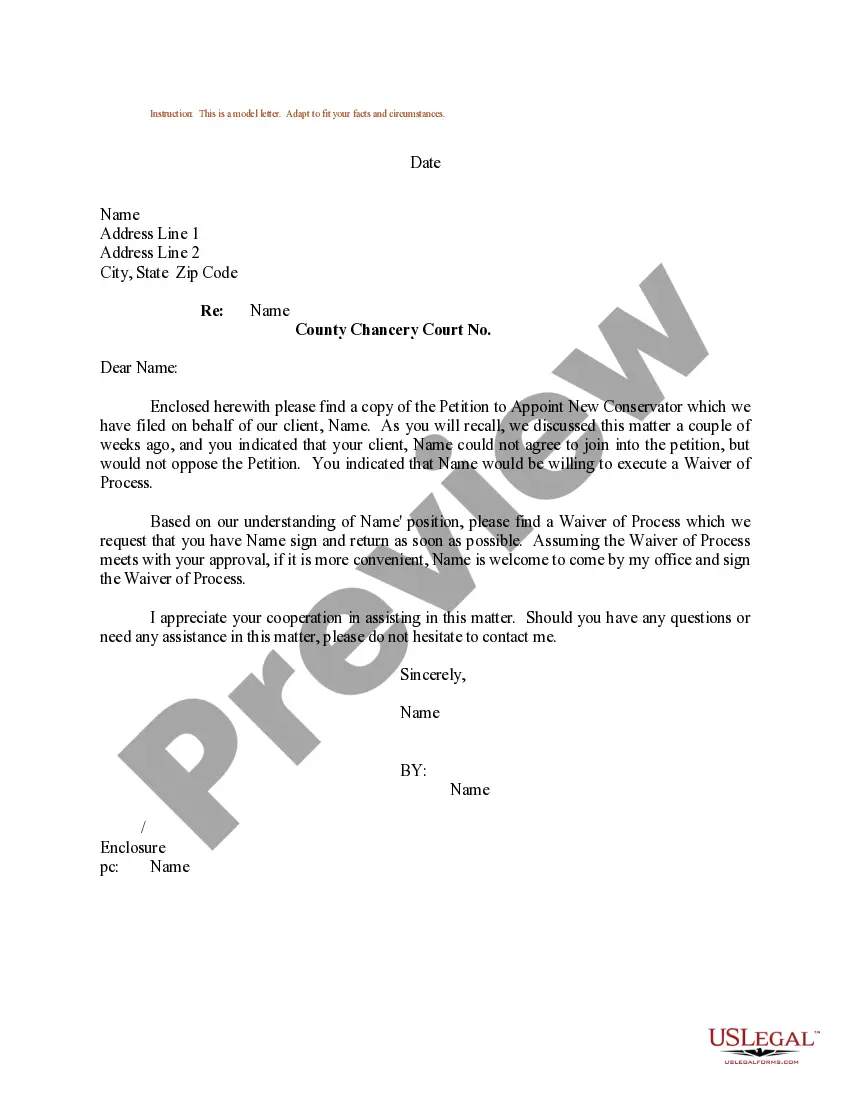

To request a final settlement letter, contact your creditor directly and clearly express your request. Provide any necessary details, such as account numbers and previous communications. Make sure to emphasize the importance of this letter, as it formalizes the conclusion of the agreement specified in your settlement offer letter for a second mortgage.

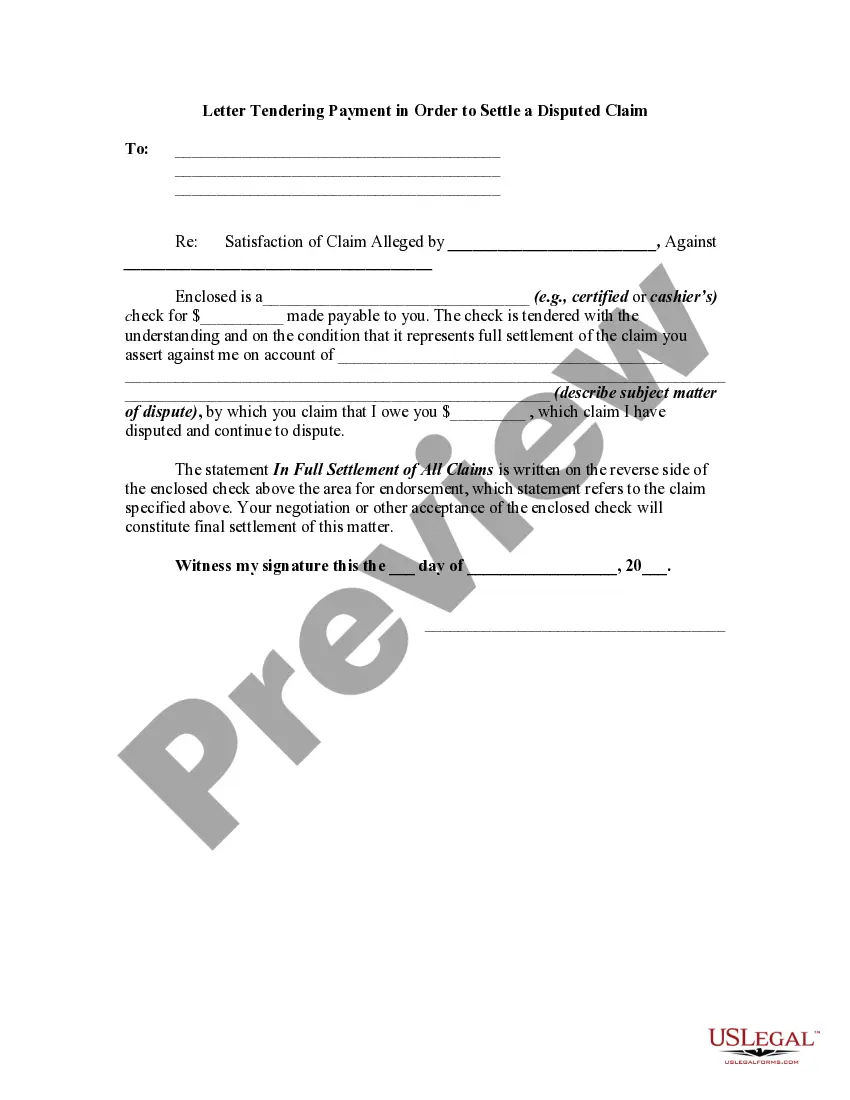

A settlement offer letter typically includes your personal information, a brief explanation of your situation, and the proposed settlement amount. Ensure that the letter is polite and formally structured. By using a clear template, you can enhance your chances of reaching an agreement with the creditor regarding your settlement offer letter for a second mortgage.

Begin with your address and the date, followed by the creditor's information. Clearly outline your request for settlement and include details like the account number and the amount owed. Express your desire to reach a resolution quickly and smoothly, as effective communication is key to your settlement offer letter for a second mortgage.

Start with a formal greeting and address the creditor directly. Clearly explain your financial situation and the reasons for seeking a settlement, then specify how much you can offer and request approval for this offer. Make your case compelling, as this increases the likelihood of a favorable response regarding your settlement offer letter for a second mortgage.

A claim settlement letter typically outlines the specifics of the claim, including dates, amounts, and the reason for the claim. It includes a clear request for a settlement and specifies any documentation that supports your claim. By formally presenting your case, you build a stronger argument for your settlement offer letter for a second mortgage.

Begin by clearly stating your intent to settle a debt or obligation. Include essential details, such as your account number and the amount you owe, followed by your proposal for a settlement offer. Make sure to politely request a response and include your contact information to facilitate further communication.

Accepting a settlement offer from a creditor can be a beneficial step towards financial stability, especially if debt is overwhelming you. A settlement offer letter for a second mortgage can provide you with the means to resolve your debt without paying the full amount owed. While it has potential drawbacks, such as temporarily lowering your credit score, eliminating debt can open the door to better financial opportunities down the line. Evaluate all your options and consult with professionals to make an informed decision.

Removing a second mortgage can be achieved through various means, such as refinancing or negotiating a settlement. Engaging in a settlement offer letter for a second mortgage can allow you to negotiate a lower payout to clear the debt entirely. Alternatively, refinancing the mortgage may provide lower interest payments or even eliminate the second mortgage altogether. Each option depends on your financial strategy and current circumstances.

Accepting a settlement typically affects your credit report negatively, but it is often better than leaving the debt unpaid. When you agree to a settlement offer letter for a second mortgage, it indicates to creditors that you made an effort to resolve the debt. While your credit score may drop initially, settling can ultimately improve your financial health by eliminating a burdensome debt, allowing you to focus on rebuilding your credit.

Taking a settlement offer from a creditor can be a smart financial decision, especially if you are overwhelmed by debt. A well-crafted settlement offer letter for a second mortgage can help you negotiate lower payments or even resolve the debt entirely. However, it’s important to consider your financial situation and future implications before agreeing. Consulting with a financial advisor or legal expert can provide clarity.