Beneficiary Receipt Form For Inheritance

Description

How to fill out Release By Trustee To Beneficiary And Receipt From Beneficiary?

Handling legal documents and procedures could be a time-consuming addition to your day. Beneficiary Receipt Form For Inheritance and forms like it often need you to look for them and understand how to complete them appropriately. For that reason, whether you are taking care of economic, legal, or personal matters, having a thorough and hassle-free online library of forms on hand will help a lot.

US Legal Forms is the number one online platform of legal templates, offering more than 85,000 state-specific forms and a variety of resources to assist you complete your documents easily. Discover the library of appropriate documents available with just a single click.

US Legal Forms provides you with state- and county-specific forms available at any time for downloading. Shield your document management operations with a high quality support that lets you make any form within minutes without additional or hidden charges. Just log in to the account, identify Beneficiary Receipt Form For Inheritance and acquire it immediately from the My Forms tab. You may also access previously saved forms.

Would it be your first time utilizing US Legal Forms? Register and set up your account in a few minutes and you will have access to the form library and Beneficiary Receipt Form For Inheritance. Then, stick to the steps below to complete your form:

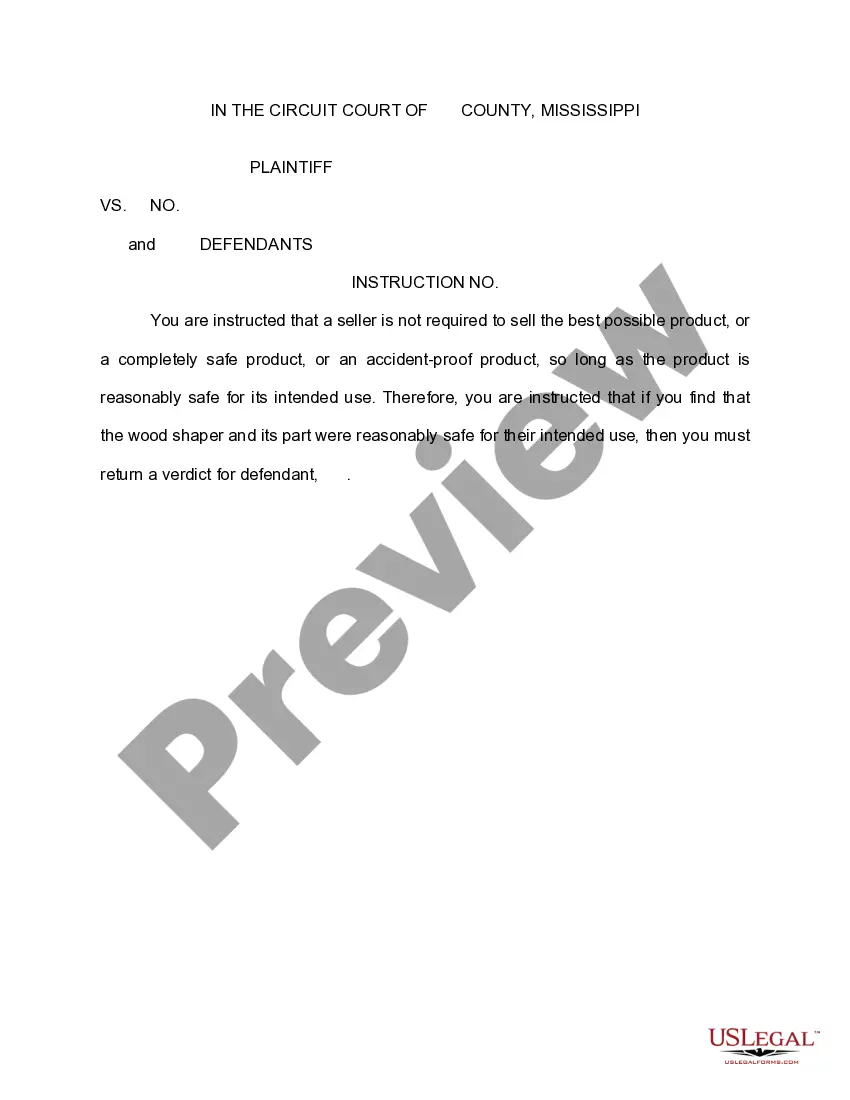

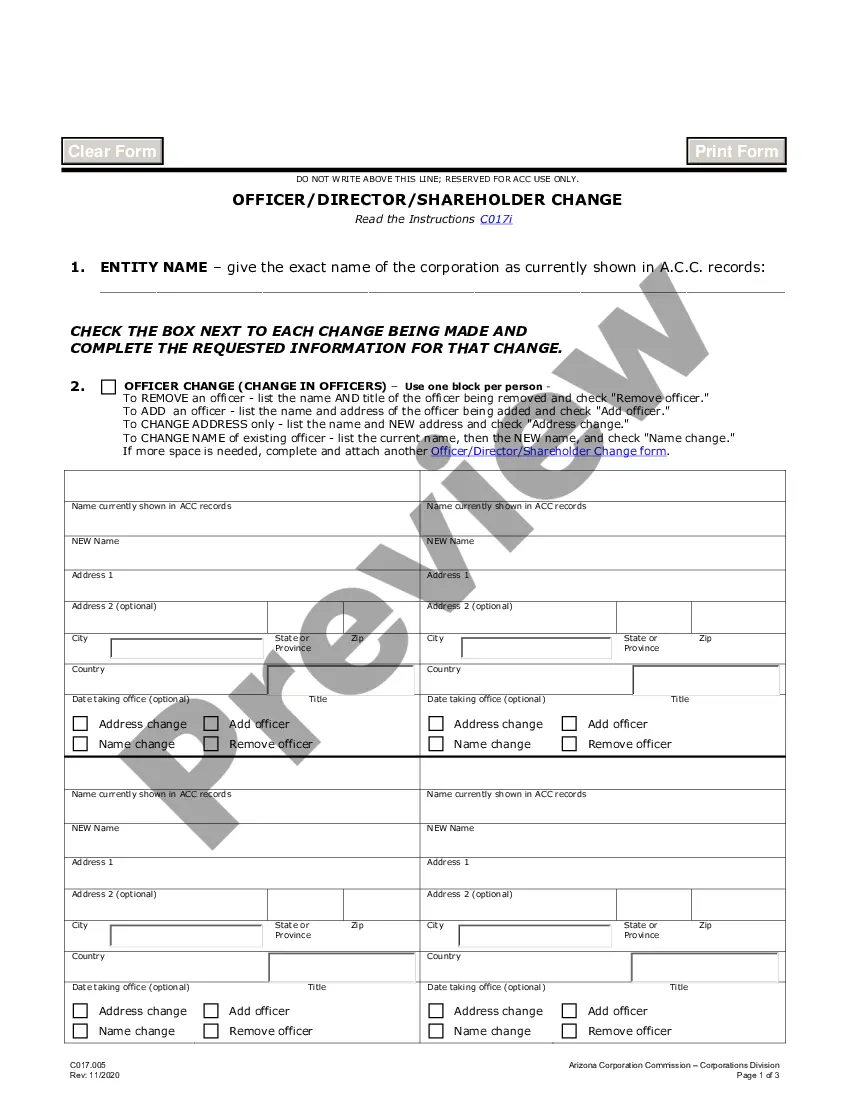

- Ensure you have discovered the proper form using the Review option and looking at the form information.

- Select Buy Now once all set, and choose the monthly subscription plan that suits you.

- Press Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of experience assisting users control their legal documents. Get the form you require today and enhance any operation without having to break a sweat.

Form popularity

FAQ

The executor or personal representative should obtain a written receipt from the beneficiary to confirm that the legacy has been paid. It is also a good idea to provide the beneficiaries with a copy of the financial records and ask them to provide a receipt to acknowledge payment.

Spouse, partner, children, parents, brothers and sisters, business partner, key employee, trust and charitable organization.

It is a document that can verify the exact amount and date of a distribution. The receipt and release can shelter you from future obligations of the estate or trust that would require a return of a distribution.

The Receipt And Release should provide that the beneficiary agrees to immediately refund to the Trustee part or all of the distributed Trust property and assets (or the cash proceeds resulting from the sale thereof) that may be requested in writing by the Trustee if it is subsequently determined that: (1) part or all ...

It is often written by the executor or trustee to provide beneficiaries with specific details about their inheritance, such as the assets they will receive, distribution timelines, any applicable taxes or fees, and any requirements or conditions that need to be fulfilled.