Adverse Possession In Florida Statute

Description

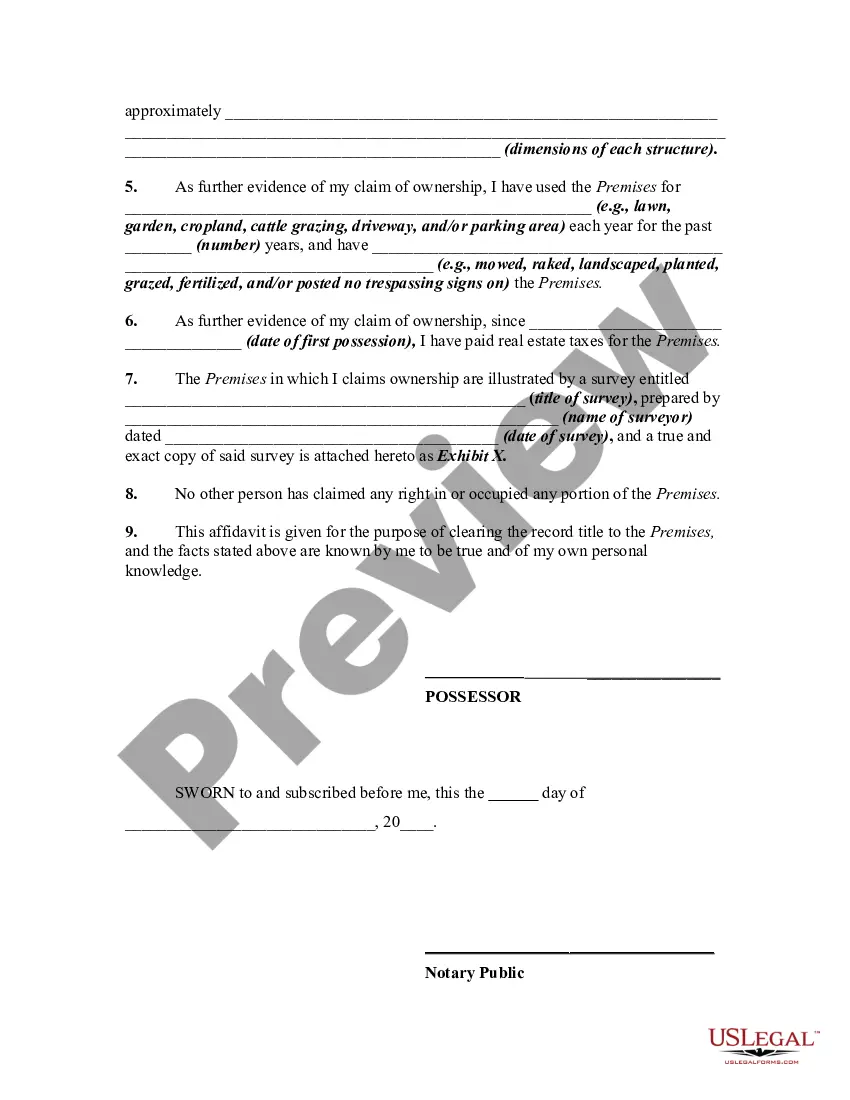

How to fill out Affidavit By Adverse Possessor That Property Held Adversely And Claim Of Title Is Based On Grant Of Ownership From Previous Owner - Squatters Rights?

Utilizing legal templates that adhere to federal and state regulations is essential, and the internet provides numerous options to choose from.

However, what is the benefit of spending time hunting for the perfect Adverse Possession In Florida Statute example online when the US Legal Forms library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 customizable templates created by lawyers for various business and personal situations.

Review the template using the Preview feature or through the text outline to confirm it satisfies your needs.

- They are simple to navigate with all documents sorted by state and intended use.

- Our experts stay updated with legal modifications, ensuring your paperwork is current and compliant when obtaining an Adverse Possession In Florida Statute from our site.

- Acquiring an Adverse Possession In Florida Statute is quick and straightforward for both existing and new users.

- If you possess an account with an active subscription, Log In and store the document sample you need in the appropriate format.

- If you are a newcomer to our platform, follow the steps outlined below.

Form popularity

FAQ

Satisfaction of Mortgage Timeline There are multiple steps to obtain a satisfaction of mortgage. The length of the overall process varies from state to state due to local laws. However, it generally takes around 30 days and most states give lenders fewer than 90 days to complete the document.

A deed of reconveyance, also known as a satisfaction of mortgage, is a document that proves you've paid off your mortgage. The deed of reconveyance releases the lien the mortgage lender placed on your property. You'll need this document to prove a clear title when you sell your home.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.

If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.

In addition the following information should be included: The Payee Name. The Owner(s) of the mortgage holder. Total amount of mortgage. Mortgage date of execution. Full and legal description of the property to include tax parcel number. Acknowledgement that all payments have been made in full.

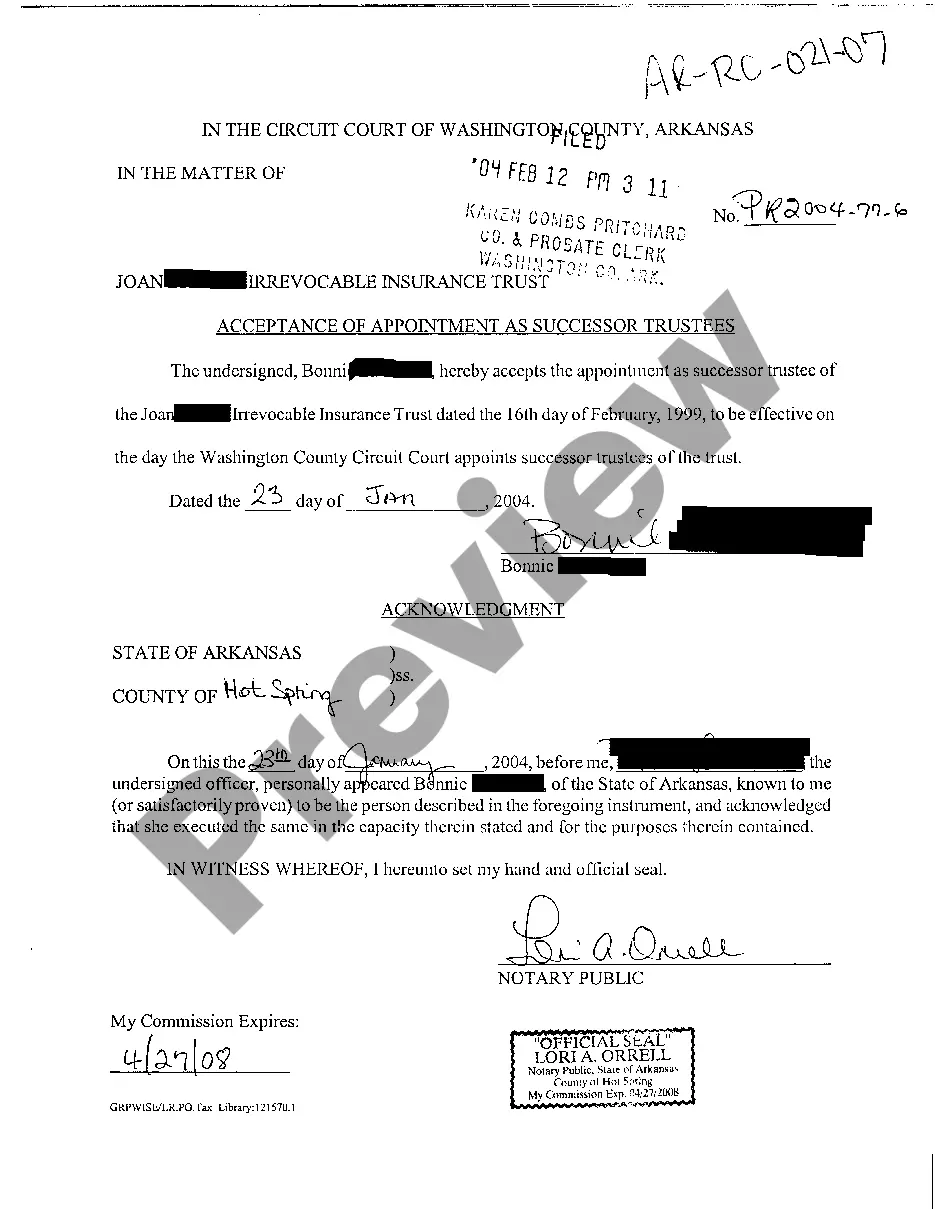

While most states have either mortgages or deeds of trust, there are a few states that allow you to choose which is better for you. These states include Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, and Montana.