Discharge Bankruptcy 7 Without Cd

Description

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceedings For Concealment By Debtor And Omitting From Schedules Fraudulently Transferred Property?

Accessing legal templates that comply with federal and state laws is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the appropriate Discharge Bankruptcy 7 Without Cd sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and life case. They are easy to browse with all documents collected by state and purpose of use. Our specialists keep up with legislative updates, so you can always be sure your form is up to date and compliant when getting a Discharge Bankruptcy 7 Without Cd from our website.

Obtaining a Discharge Bankruptcy 7 Without Cd is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, follow the guidelines below:

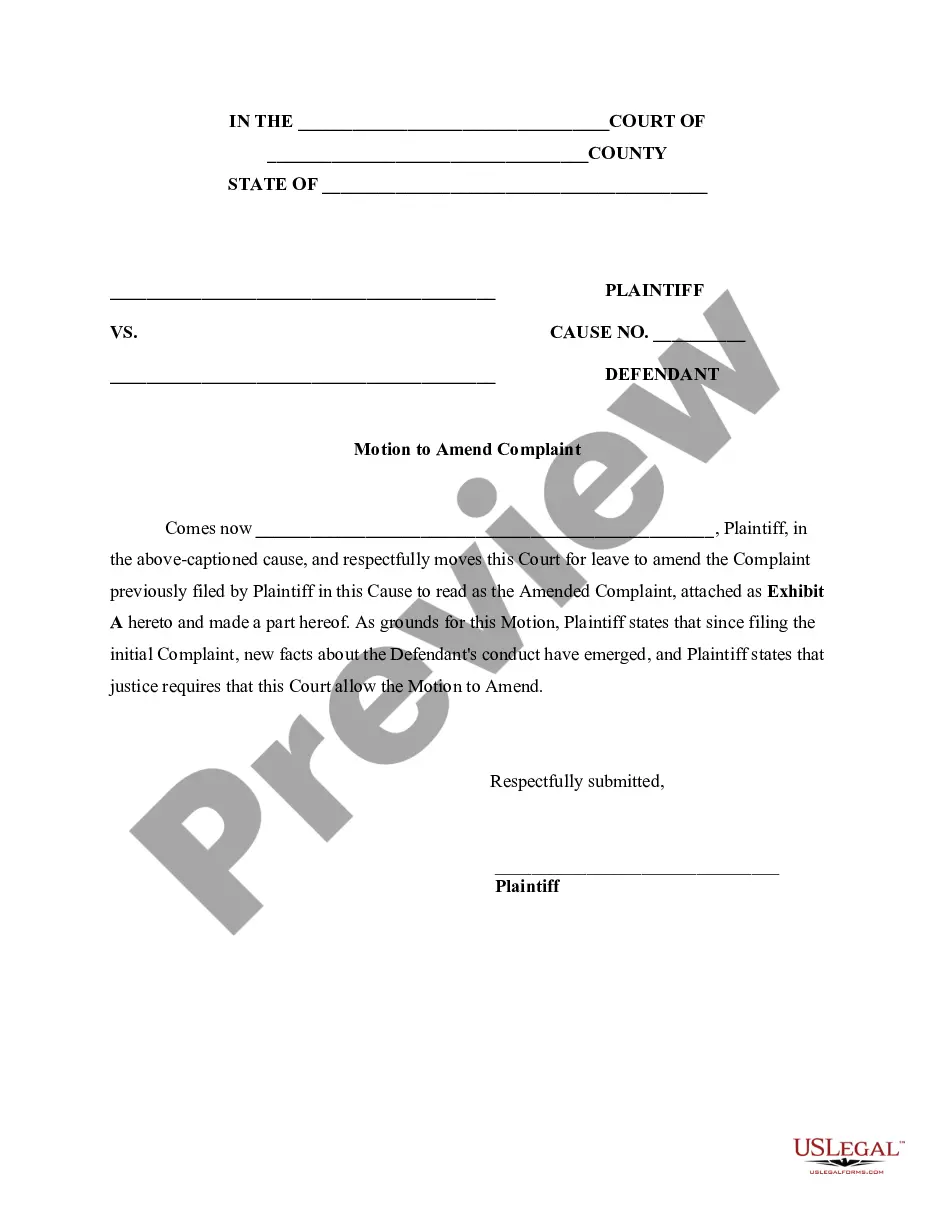

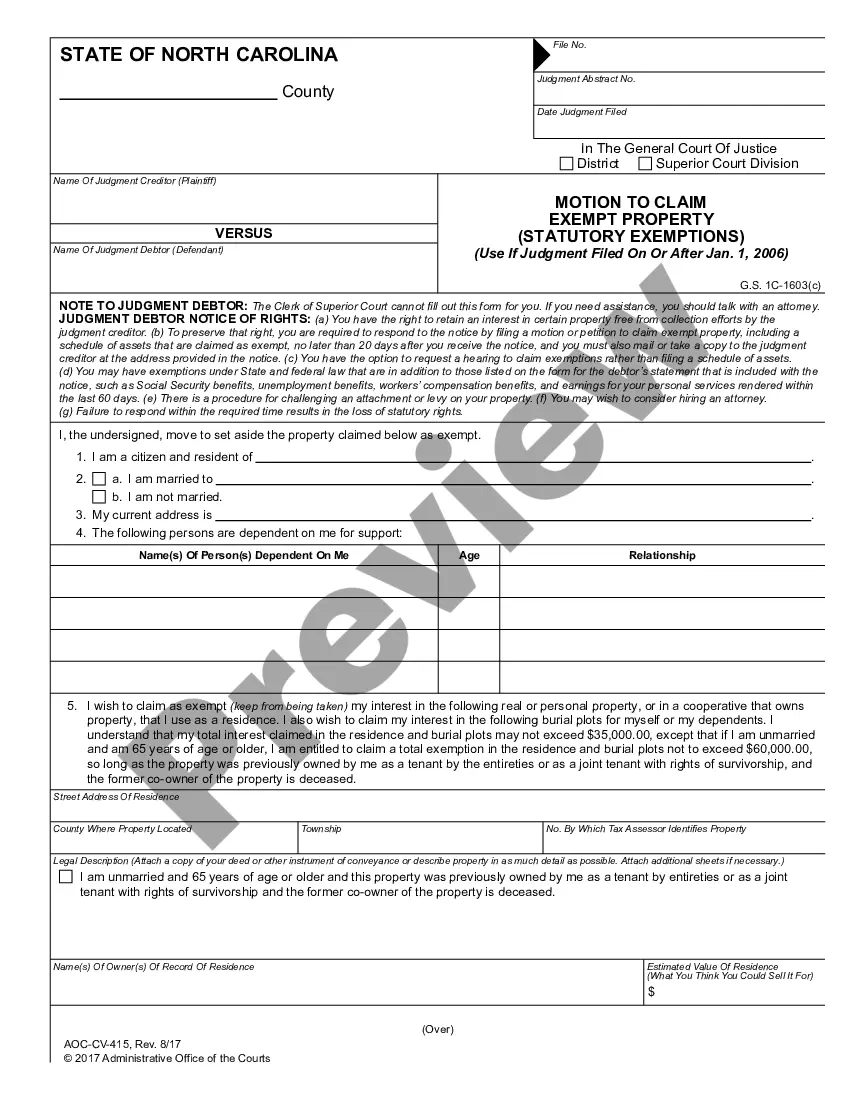

- Take a look at the template utilizing the Preview feature or through the text outline to ensure it fits your needs.

- Look for another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Discharge Bankruptcy 7 Without Cd and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

While credit card debt is a major reason people wind up filing for bankruptcy, you cannot file for bankruptcy on credit card debt alone, as the law requires that all your debts be listed in the bankruptcy documents.

You can wipe out or discharge tax debt by filing Chapter 7 bankruptcy only if all of the following conditions are met: The debt is federal or state income tax debt. ... You did not willfully evade paying your taxes or file a fraudulent return. ... Your tax debt is at least three years old.

In Chapter 7 bankruptcy, you sell off some of your assets to pay a portion of your debts, and the rest of the amount owed is discharged, which means it is erased. Chapter 7 bankruptcy is typically a highly effective way to get rid of credit card debt, but there are some exceptions.

You can only receive a chapter 7 discharge once every eight years. Other rules may apply if you previously received a discharge in a chapter 13 case. No one can make you pay a debt that has been discharged, but you can voluntarily pay any debt you wish to pay.

In a chapter 7 case, however, a discharge is only available to individual debtors, not to partnerships or corporations. 11 U.S.C. § 727(a)(1). Although an individual chapter 7 case usually results in a discharge of debts, the right to a discharge is not absolute, and some types of debts are not discharged.