Motion Stay Filed With Withdraw Appearance

Description

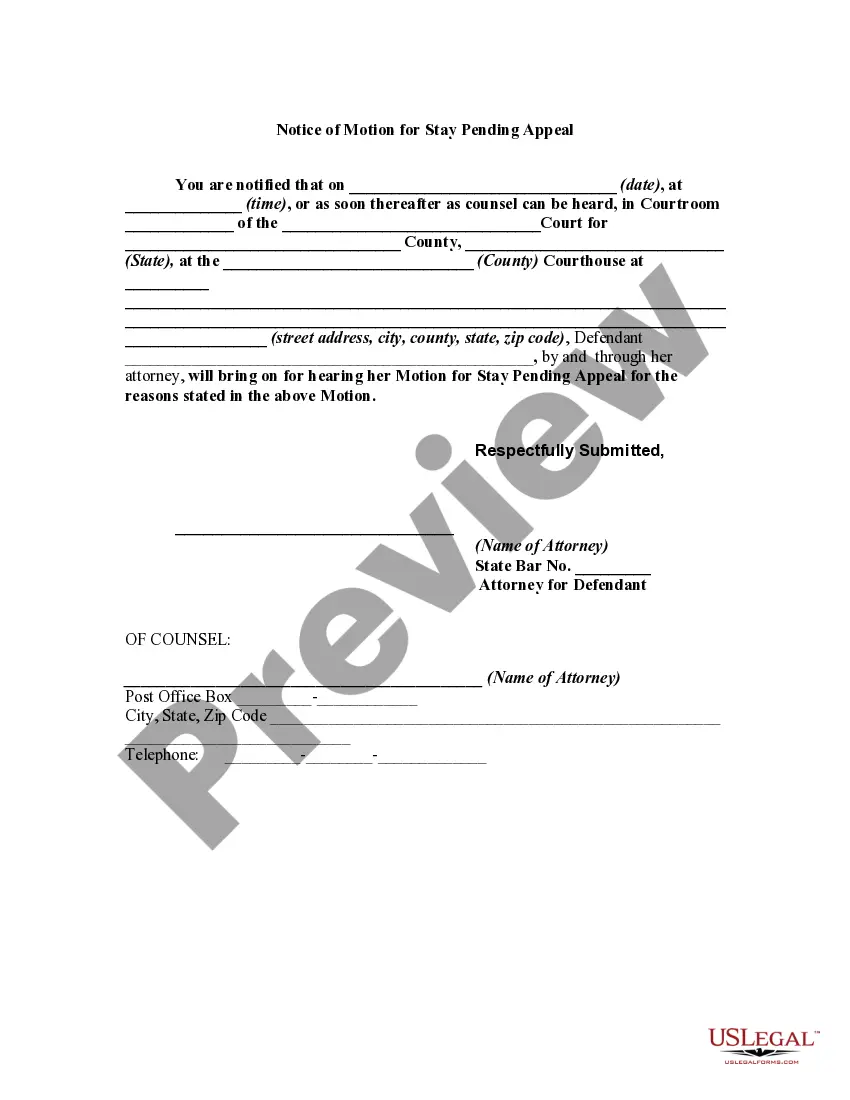

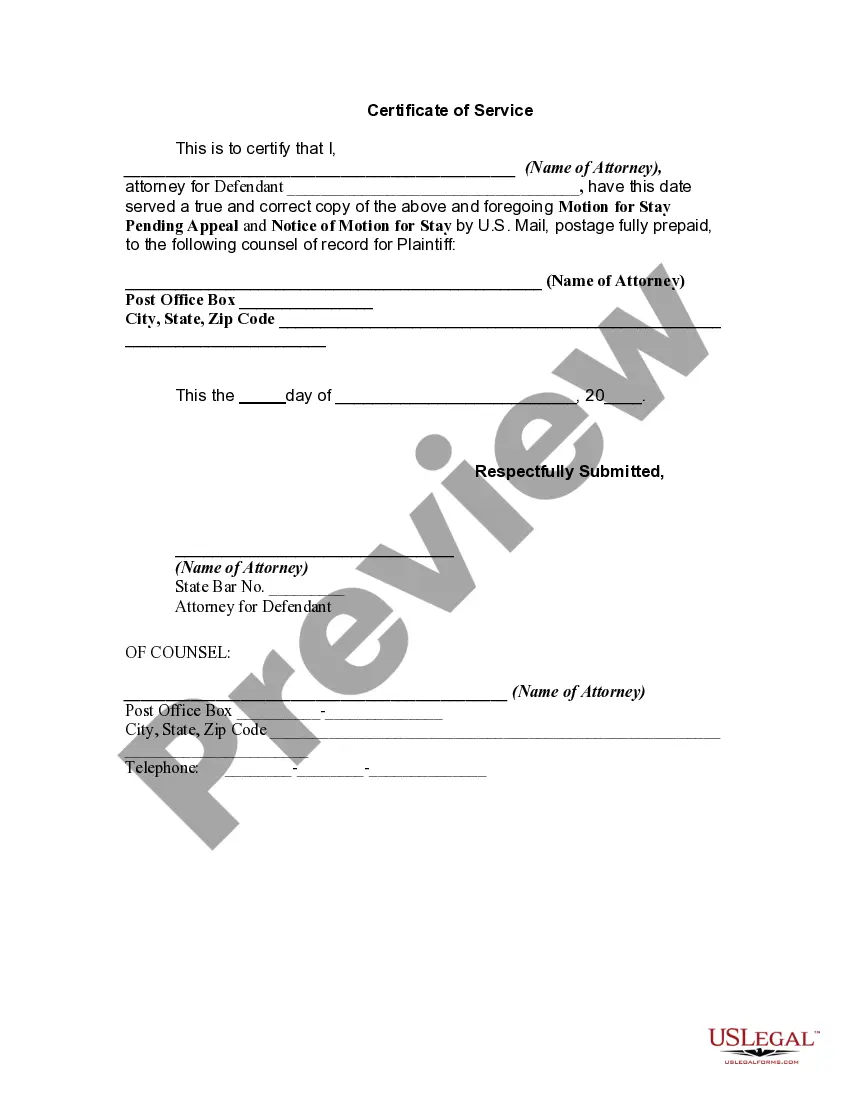

How to fill out Motion For Stay Pending Appeal And Notice Of Motion?

The Motion Stay Submitted With Withdraw Appearance you observe on this page is a reusable legal template created by qualified attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and lawyers with over 85,000 verified, state-specific documents for any business and personal circumstance.

Subscribe to US Legal Forms to have legitimate legal templates for all of life’s situations at your fingertips.

- Examine the document you require and review it.

- Browse the example you explored and view it or assess the form description to ensure it meets your needs. If it doesn't, employ the search tool to find the right one. Click Buy Now once you have identified the template you require.

- Register and Log In.

- Select the payment plan that works best for you and sign up for an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

- Choose the format you desire for your Motion Stay Submitted With Withdraw Appearance (PDF, Word, RTF) and download the file to your device.

- Fill out and sign the document.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to efficiently and precisely fill out and sign your form with a legally-binding electronic signature.

- Re-download your documents as needed.

- Utilize the same document again whenever required. Access the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

Upon lapse, a Financing Statement ceases to be effective and any security interest or agricultural lien that was perfected by the Financing Statement becomes unperfected, unless the security interest is perfected otherwise.

A UCC filing is the official notice lenders use to indicate that they have a security interest in a borrower's assets or property. The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default.

Lapsed UCC filing: The filing has passed its effective period and no continuation has been filed. Purged UCC filing: The filing has been removed from the index and is no longer searchable in most state systems.

If a continuation is not filed, the financing statement will lapse 5 years from the original filing date. A continuation extends the filing period 5 additional years from the initial filing date.

Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

UCC Filing Records This is done on a county level and can be hand searched at the local county courthouse. The information is also forwarded to state records. Most states now permit access of UCC records online. In Maryland, this information is available online at the Maryland Department of Assessments and Taxation.

Maryland Department of Assessments and Taxation.