Motion Stay File Format Not Supported

Description

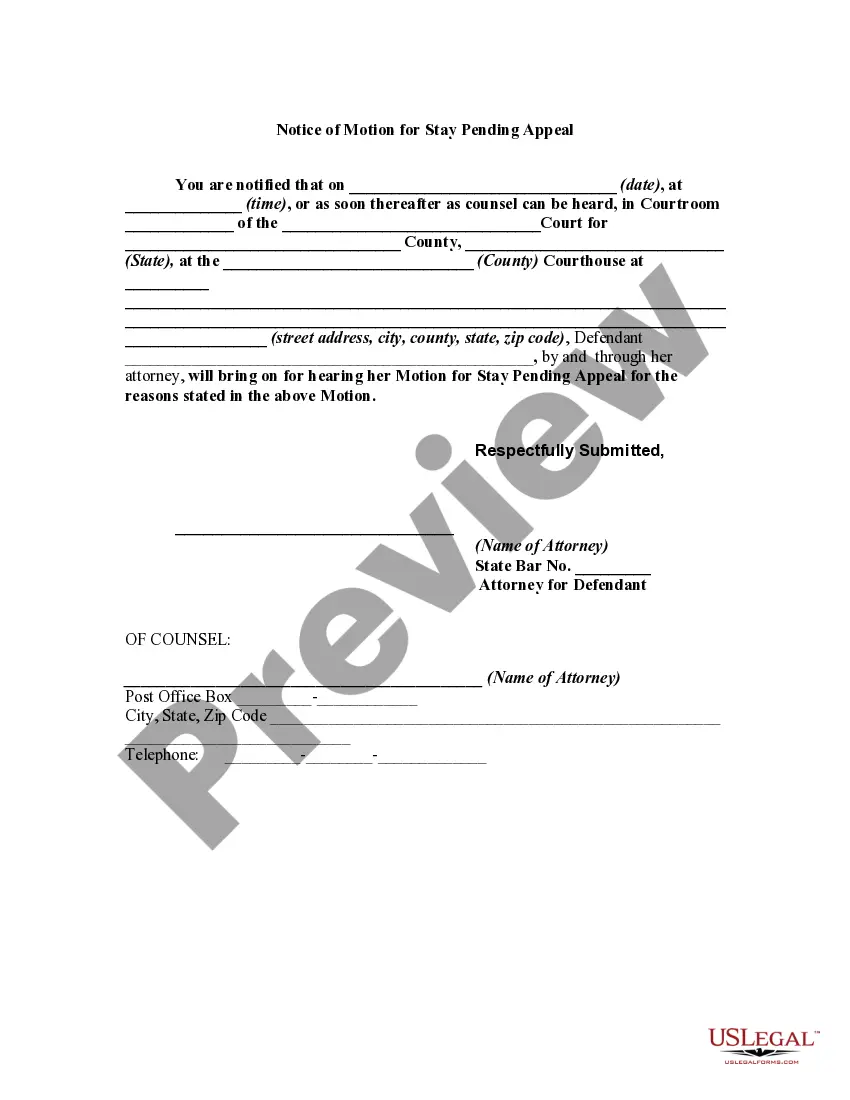

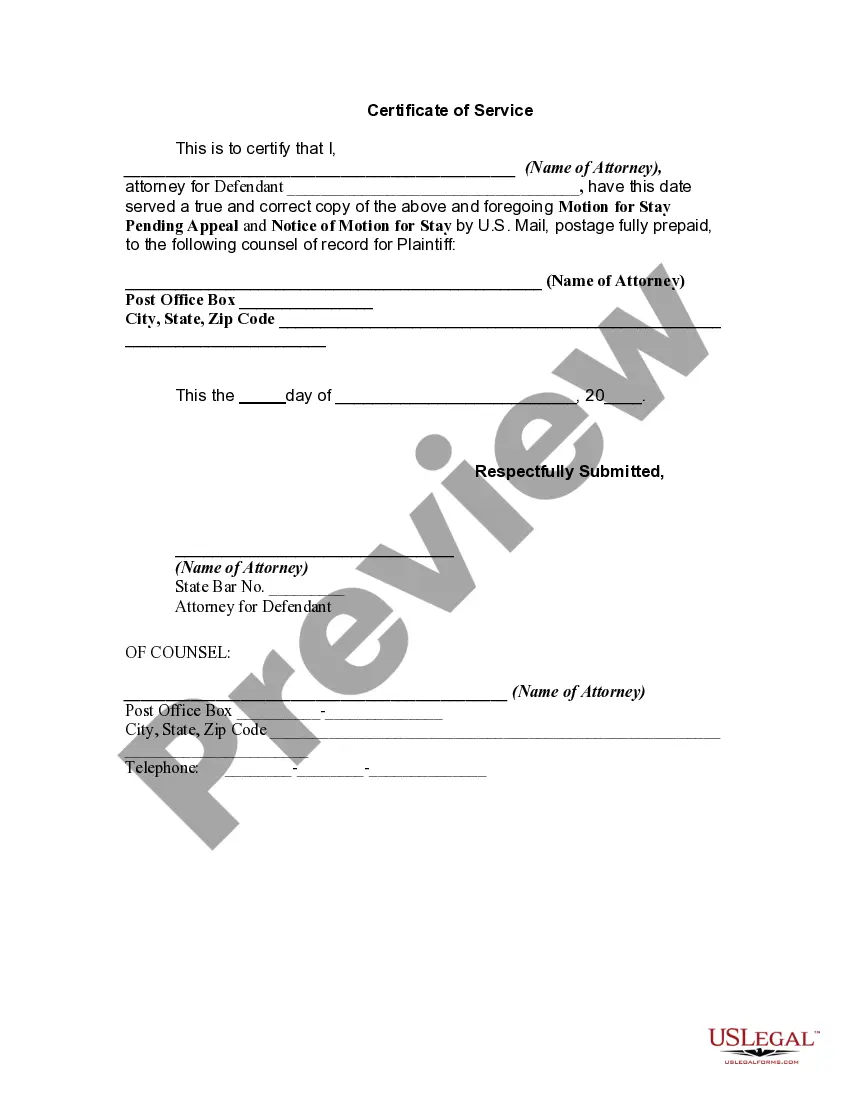

How to fill out Motion For Stay Pending Appeal And Notice Of Motion?

Handling legal paperwork and processes can be an arduous addition to your entire day.

Motion Stay File Format Not Supported and similar forms often require you to search for them and find the best method to complete them accurately.

Consequently, whether you are managing financial, legal, or personal affairs, having a comprehensive and accessible online library of forms readily available will significantly help.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific forms and numerous resources that will help you finalize your documents swiftly.

Is this your first time using US Legal Forms? Sign up and create a free account in a few minutes, and you’ll obtain access to the form library and Motion Stay File Format Not Supported. After that, follow the steps listed below to complete your form.

- Browse the collection of pertinent documents accessible to you with just a single click.

- US Legal Forms provides you with state- and county-specific forms available anytime for download.

- Protect your document management processes using a premium service that allows you to compile any form in minutes without extra or hidden fees.

- Simply Log In to your account, find Motion Stay File Format Not Supported and download it instantly in the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

Form 511 is used by an Electing PTE to file an income tax return for a specific tax year or period and to remit Electing PTE tax paid with respect to all members' distributive or pro rata shares of income.

Every Maryland pass-through entity must file a return on Form 510, even if it has no income or the entity is inactive. Every other pass-through entity that is subject to Maryland income tax law must also file on Form 510.

Purpose of Form Form 510D is used by a pass-through entity (PTE) to declare and remit estimated tax for nonresi- dents.

To revive a Maryland LLC, you'll need to file the Articles or Certificate of Reinstatement with the Maryland State Department of Assessments and Taxation (SDAT). You'll also have to fix the issues that led to your Maryland LLC's dissolution and, in some cases, obtain a Maryland tax clearance certificate.

Purpose of Form Form 510/511D is used by a pass-through entity (PTE) to declare and remit estimated tax for nonresi- dents. The PTE may elect to declare and remit estimated tax on behalf of resident members. Effective July 1, 2021, PTEs may elect to pay tax for all mem- bers at the entity level.

We offer several ways for you to obtain Maryland tax forms, booklets and instructions: Download them. You can download tax forms using the links listed below. Request forms by e-mail. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. Visit our offices.

If you are required to file Form 515, then you are subject to local income tax on that portion of your federal adjusted gross income from salary, wages or other compensation for personal services performed in any county of Maryland or Baltimore City. If you have income other than wages subject to Maryland.

An electing PTE will file Form 511. An electing PTE is taxed on the ?pass-through entity's taxable income.? This is the income/loss amount entered on line 2 of the new Form 511. The term ?pass-through entity's taxable income? is a specifically defined term in Maryland's income tax law.