Sample Nunc Pro Tunc Order Form Template

Description

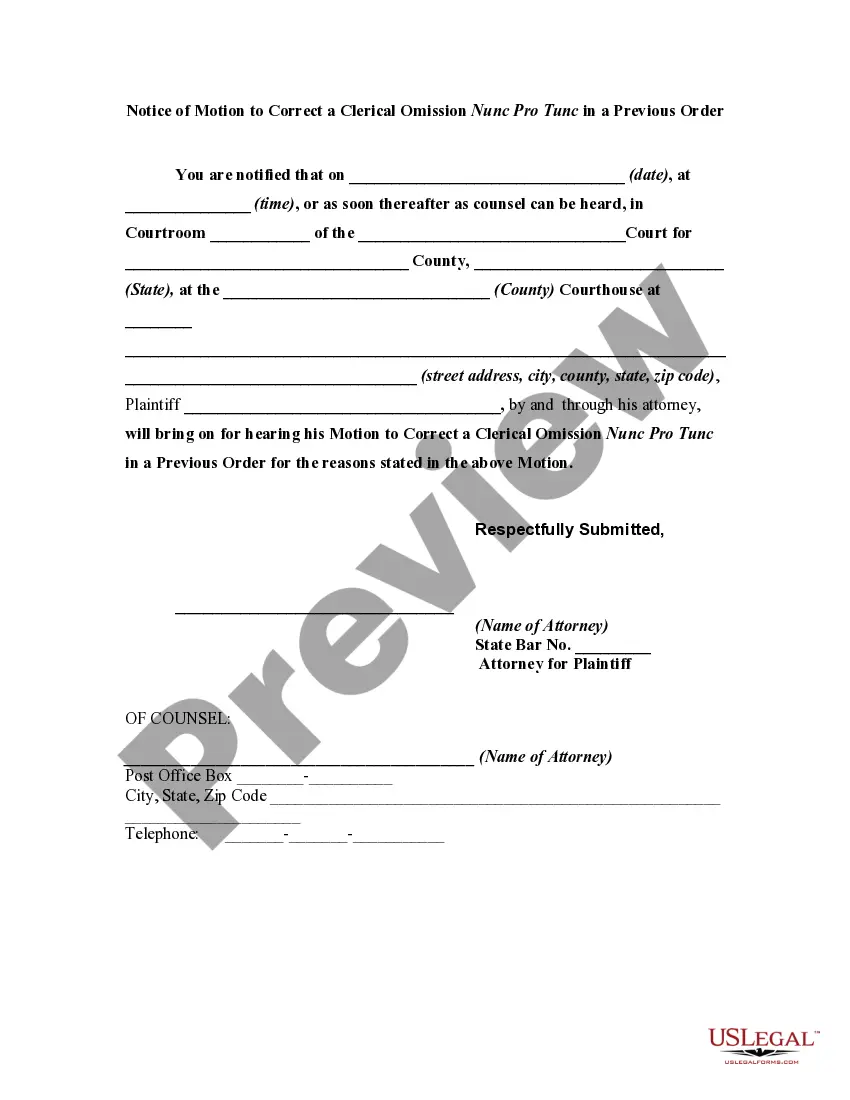

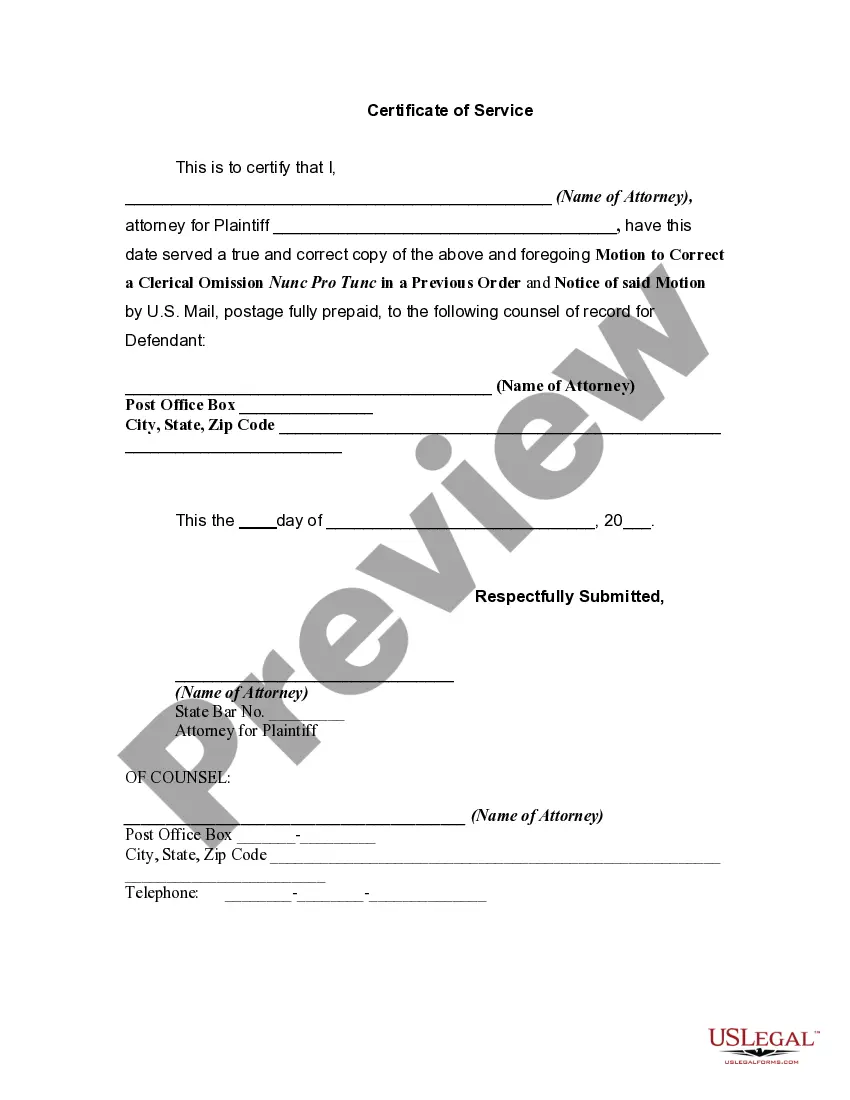

How to fill out Motion To Correct A Clerical Omission Nunc Pro Tunc In A Previous Order?

The Sample Nunc Pro Tunc Order Form Template available on this page is a reusable legal document crafted by experienced lawyers in adherence to federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal experts more than 85,000 validated, state-specific documents for any professional and personal situation. It’s the fastest, simplest, and most reliable method to acquire the forms you require, as the service ensures bank-level data protection and anti-malware safeguards.

Register with US Legal Forms to have validated legal templates for all of life’s circumstances readily available.

- Search for the document you require and examine it.

- Browse through the sample you looked for and either preview it or review the form summary to confirm it meets your needs. If it doesn't, use the search bar to locate the appropriate one. Click Buy Now when you have found the template you desire.

- Sign up and Log In.

- Select a pricing plan that works for you and create an account. Use PayPal or a credit card for a quick transaction. If you already possess an account, Log In and check your subscription to move forward.

- Acquire the editable template.

- Select the format you wish for your Sample Nunc Pro Tunc Order Form Template (PDF, DOCX, RTF) and save the template on your device.

- Complete and sign the document.

- Print the template to finish it by hand. Alternatively, utilize an online multifunctional PDF editor to swiftly and accurately fill out and authenticate your form.

- Download your documents one more time.

- Access the same document again whenever necessary. Open the My documents section in your account to redownload any previously acquired forms.

Form popularity

FAQ

Nunc pro tunc is typically pronounced as 'nuhnk proh tungk.' It is a phrase often used in legal contexts to indicate retroactive actions. Understanding this term is crucial when working on documents like a Sample nunc pro tunc order form template, which may require precise language to ensure clarity and correctness.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.

Doing so allows your mortgage provider to ensure future financial liquidity so that it can keep extending home loans to other borrowers. Under such a scenario, your original loan holder basically ?flips? the mortgage and assigns its security rights in a home to the new owner of the note instead.

Assignments are generally freely permitted in most modern mortgage agreements. Once the borrower has received proper notice of the assignment, payments will be made to the new creditor. A mortgage assumption occurs when a buyer agrees to take on the seller's current loan and mortgage obligations.

Before a bank can institute a foreclosure proceeding, the bank must record the assignment of the note. The bank must also be in actual possession of the note. If the bank fails to ?produce the note,? that is, cannot demonstrate that the note was assigned to it, the bank cannot demonstrate it owns the note.

This transfer, or assignment, is usually only allowed when the mortgage is assumable, says Rajeh Saadeh, a Somerville, New Jersey-based real estate attorney. When transferring an assumable mortgage, the new borrower agrees to make all future payments at the original interest rate.