How Do You Respond To A Lawsuit For Credit Card Debt

Description

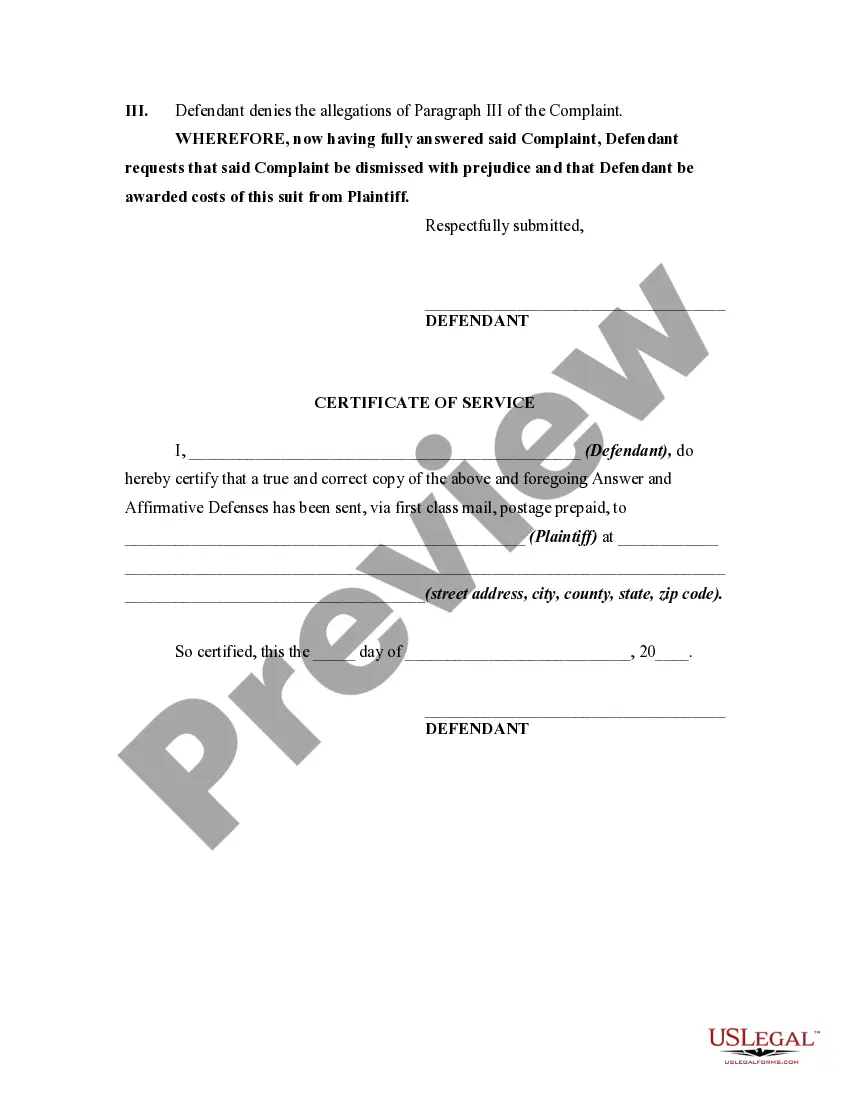

How to fill out General Form Of An Answer By Defendant In A Civil Lawsuit?

- Log in to your US Legal Forms account if you are a returning user. Ensure your subscription is active; if not, renew it as per your plan.

- For new users, begin by checking the Preview mode and form description to confirm you have the right document that complies with your local jurisdiction.

- If necessary, use the Search tab to find additional templates that may better suit your needs.

- Once you find the correct form, click the Buy Now button to select your preferred subscription plan and create an account for access.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download the form to your device and access it anytime from the My Forms menu in your profile.

By following these steps, you not only ensure you have the right documentation but also access resources and expert guidance to help you create a solid response to the lawsuit.

Take control of your financial future with US Legal Forms. Start today to find your necessary legal documents!

Form popularity

FAQ

When you are sued for credit card debt, your first step should be to review the lawsuit documents thoroughly. You should then prepare a written answer that addresses the allegations and defenses. It’s also wise to consider reaching out to a legal professional for guidance or using platforms like US Legal Forms, which provide helpful resources and templates for constructing your response effectively. Knowing how to respond to a lawsuit for credit card debt can greatly impact your case.

The average settlement for credit card debt usually ranges from 30% to 70% of the total amount owed, but this varies based on several factors. These factors include the creditor’s willingness to negotiate, your payment history, and any legal consideration. A knowledgeable professional can help you navigate this process and maximize your potential savings. To explore your options, you might want to check resources available through US Legal Forms to better understand your rights.

To write an answer to a credit card lawsuit, begin by carefully reviewing the complaint you received. Your answer should address each claim made in the lawsuit, clearly stating whether you admit or deny each accusation. Keep in mind that this document is crucial, as it outlines your position and defenses. If you're unsure how to proceed, consider using US Legal Forms; they provide templates and guidance to help you formulate an effective response.

Defending against a credit card lawsuit requires gathering evidence and identifying any inaccuracies in the plaintiff's claims. You may argue that the debt is not yours, or that the amount claimed is incorrect. By utilizing US Legal resources, you can access information on common defenses and strategies to strengthen your case.

Writing an answer to a debt collection lawsuit involves clearly stating your position regarding each claim made against you. Address the points one by one, and make sure to include any defenses you may have. You can utilize templates from US Legal to streamline this task, as they provide straightforward formats that simplify the process.

To effectively respond to a lawsuit for credit card debt, you need to file a written answer with the court within the specified time frame. This answer should address each allegation made in the complaint, stating whether you admit or deny the claims. It’s crucial to prepare a solid defense, and you may find helpful resources on the US Legal platform to guide you through this process.

When writing a response to a credit card lawsuit, start by addressing the court and the plaintiff. Clearly state your position, and provide any facts or evidence supporting your case. Following structured guidelines on how do you respond to a lawsuit for credit card debt can help you format your response correctly, ensuring you meet legal requirements and present your case effectively.

To defend yourself against a credit card lawsuit, gather all relevant documentation, such as account statements and payment records. You might consider filing your answer, presenting your arguments, or disputing the validity of the debt. Knowing how do you respond to a lawsuit for credit card debt will empower you, and using platforms like US Legal Forms can help you prepare strong defenses and legal paperwork.

The 777 rule refers to a strategy some debtors use to manage communication with debt collectors. It involves responding to a debt collection notice only seven times, or not communicating after seven attempts. Consider this approach when thinking about how do you respond to a lawsuit for credit card debt, as controlling the dialogue can help you stay focused and avoid unnecessary stress.

To get out of a credit card lawsuit, evaluate your options carefully. You may be able to settle the debt, negotiate a payment plan, or dispute the claim if you believe it is inaccurate. Understanding how do you respond to a lawsuit for credit card debt is crucial, as an informed approach can lead to favorable outcomes, including reducing your debt or avoiding court altogether.