Parent Child Support With Taxes

Description

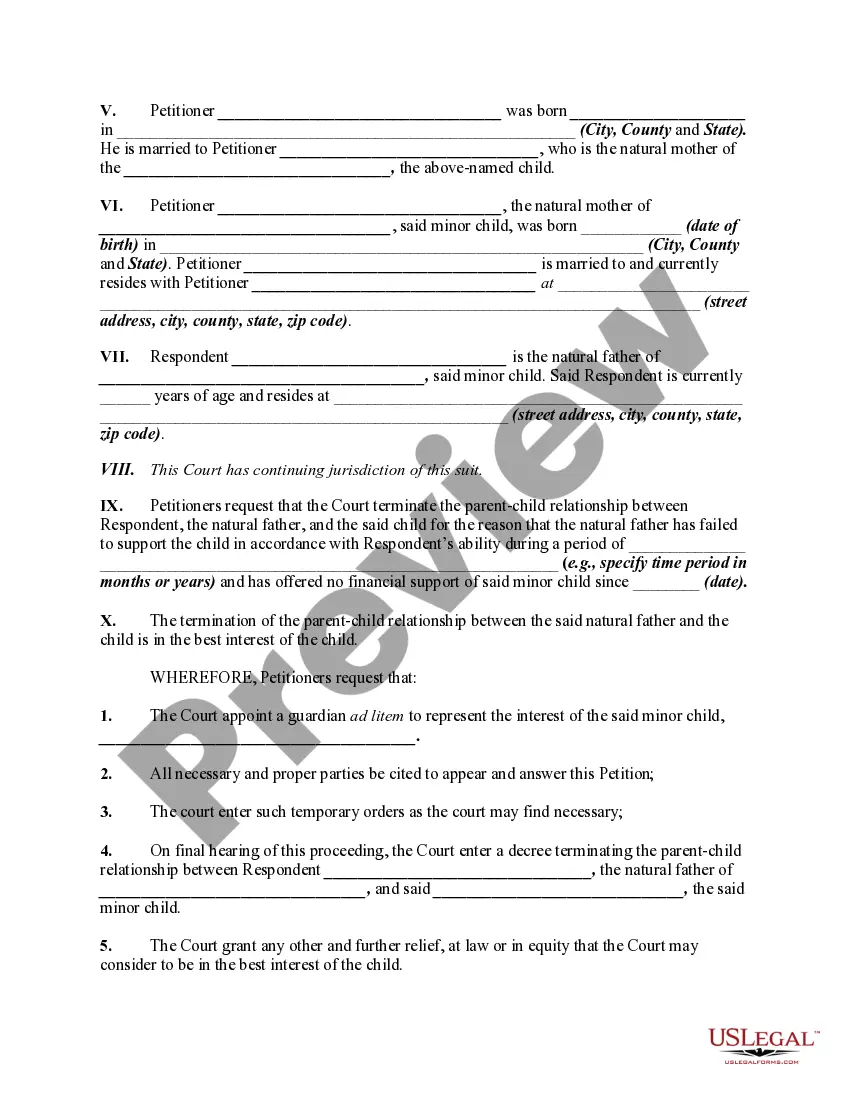

How to fill out Petition By Stepfather And Natural Mother To Terminate Natural Fathers Parent / Child Relationship For Failure To Support Child - Release Of Parental Rights?

Regardless of whether it is for corporate reasons or personal issues, everyone encounters legal circumstances at some point during their lifetime.

Filling out legal documents requires meticulous focus, starting with choosing the correct form template. For example, selecting an incorrect version of the Parent Child Support With Taxes will lead to its rejection upon submission.

With an extensive library of US Legal Forms available, you will not waste time searching for the correct sample online. Take advantage of the library’s straightforward navigation to find the right form for any circumstance.

- Locate the required sample by using the search box or browsing the catalog.

- Review the form’s description to verify it suits your needs, state, and county.

- Click on the form’s preview to take a look at it.

- If it is not the right form, go back to the search feature to find the Parent Child Support With Taxes template you need.

- Download the file if it fulfills your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Choose the suitable pricing plan.

- Complete the registration form for your profile.

- Select your payment method: utilize a credit card or PayPal account.

- Choose the desired file format and download the Parent Child Support With Taxes.

- Once saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

If you pay support, you can deduct the payments on your federal or state income tax forms. If you receive support, you must report the payments as income on your federal and state tax forms.

You can claim a child as a dependent if he or she is your qualifying child. Generally, the child is the qualifying child of the custodial parent. The custodial parent is the parent with whom the child lived for the longer period of time during the year.

The custodial parent is the parent with whom the child lived for the greater number of nights during the year. The other parent is the noncustodial parent. In most cases, because of the residency test, the custodial parent claims the child on their tax return.

If you cared for an elderly parent, your parent may qualify as your dependent, resulting in additional tax benefits for you. A parent may qualify as a dependent if their gross income doesn't exceed $4,700 (tax year 2023) and the support you provide exceeds their income by at least one dollar during the tax year.

More In Forms and Instructions If you are the custodial parent, you can use Form 8332 to do the following. Release a claim to exemption for your child so that the noncustodial parent can claim an exemption for the child.