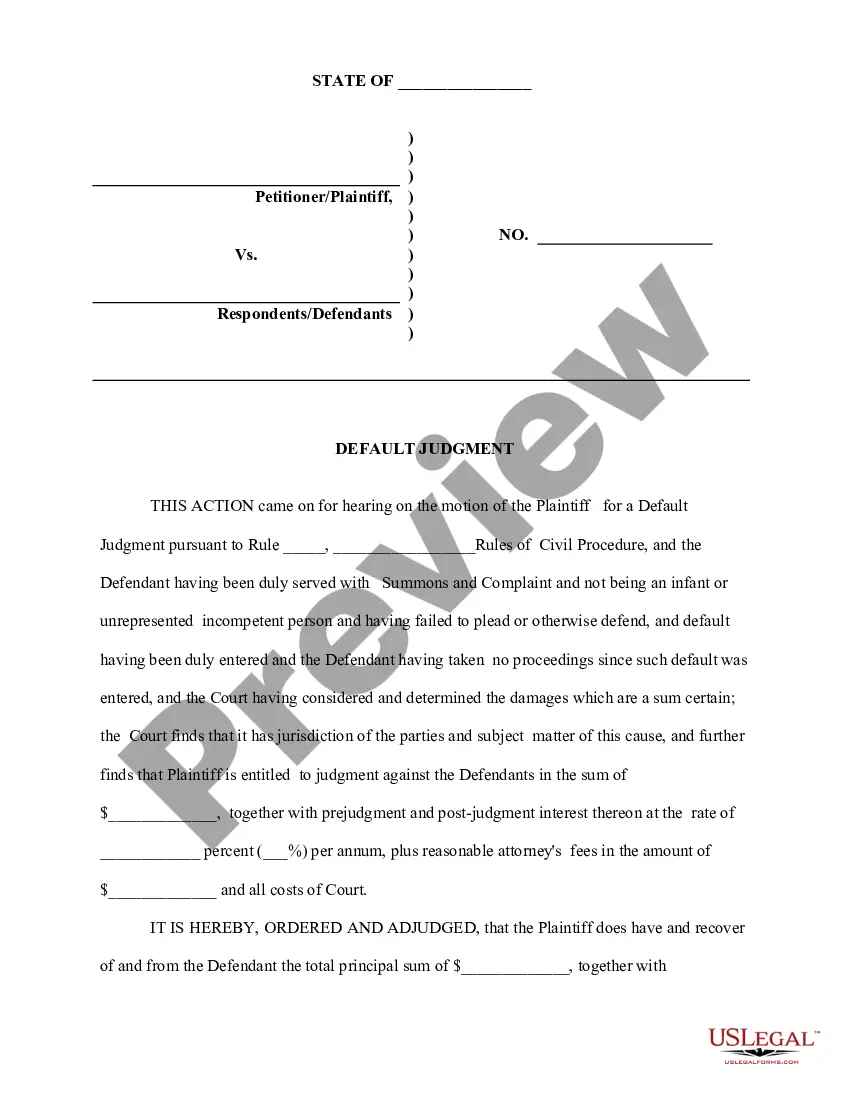

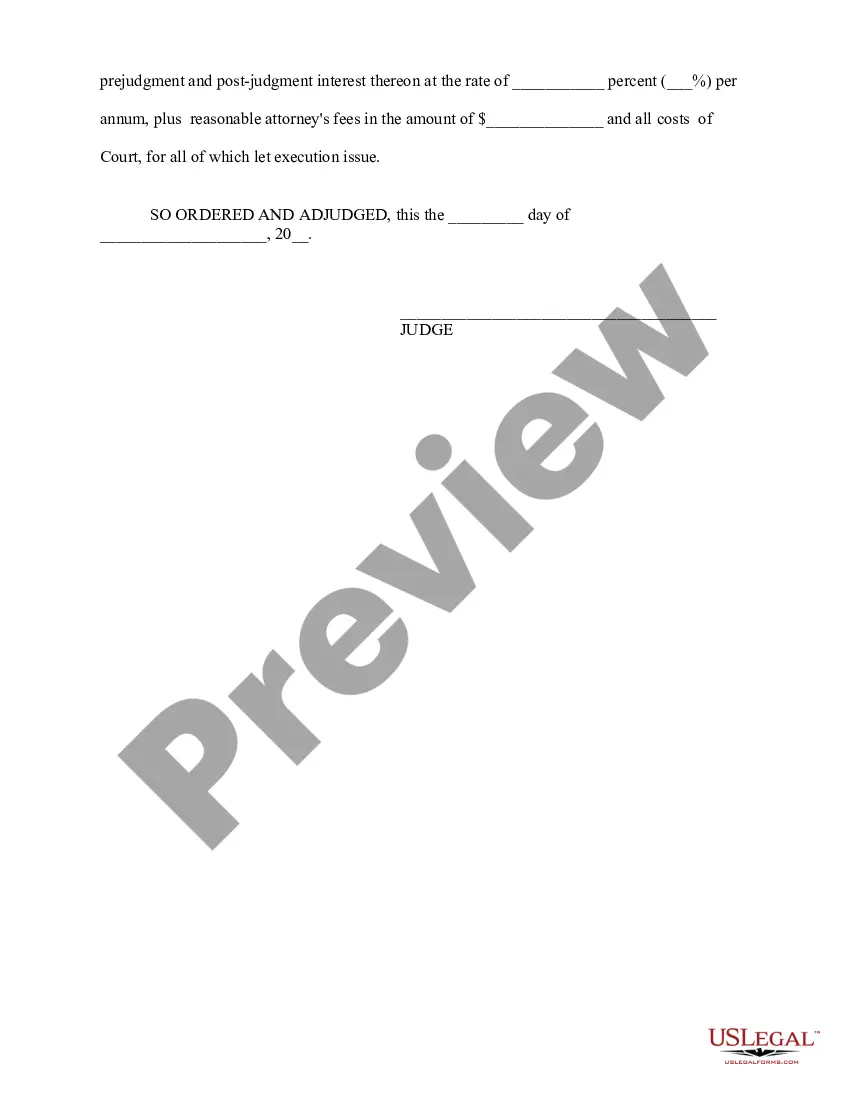

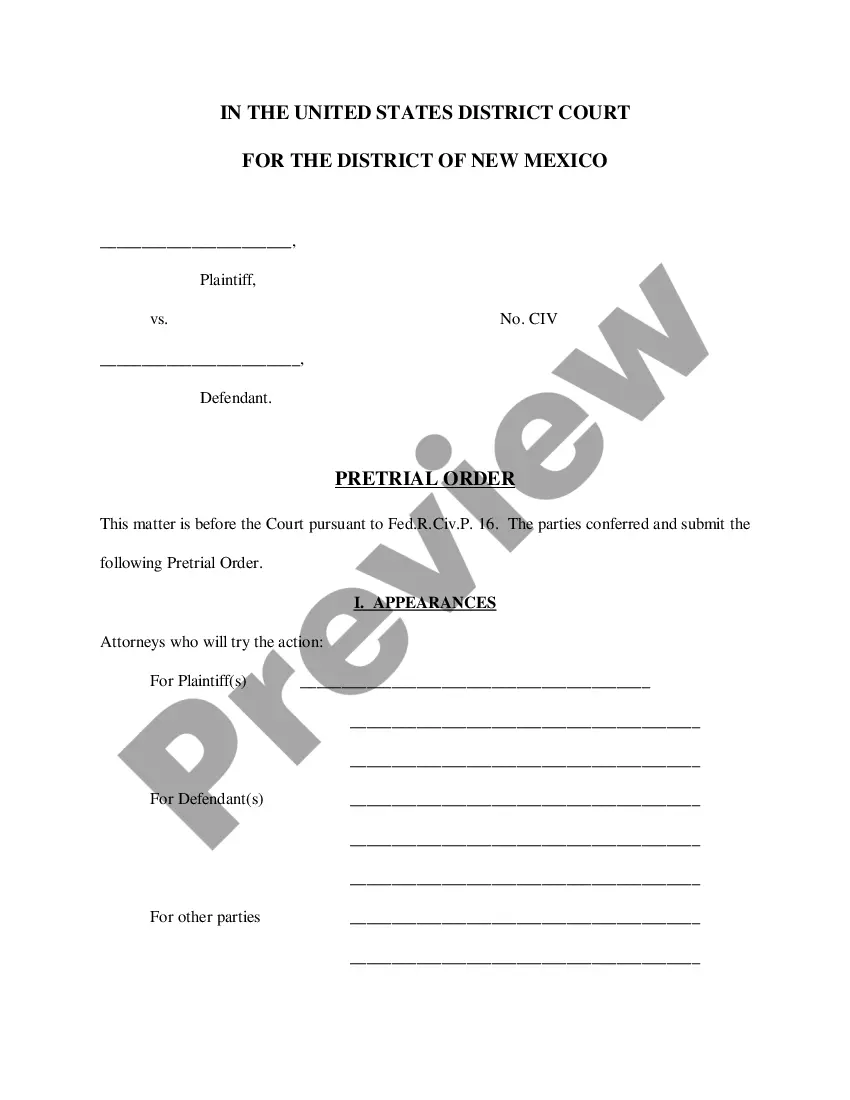

Default Judgment Form With 2 Points

Description

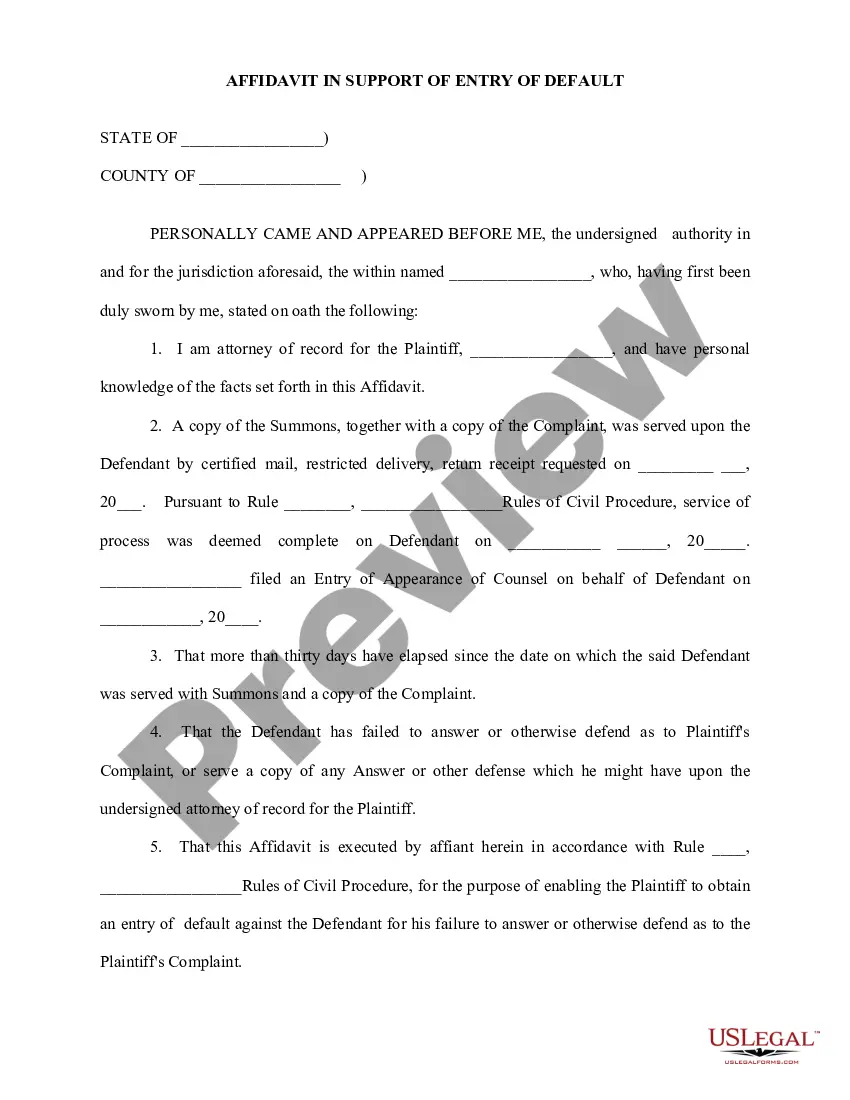

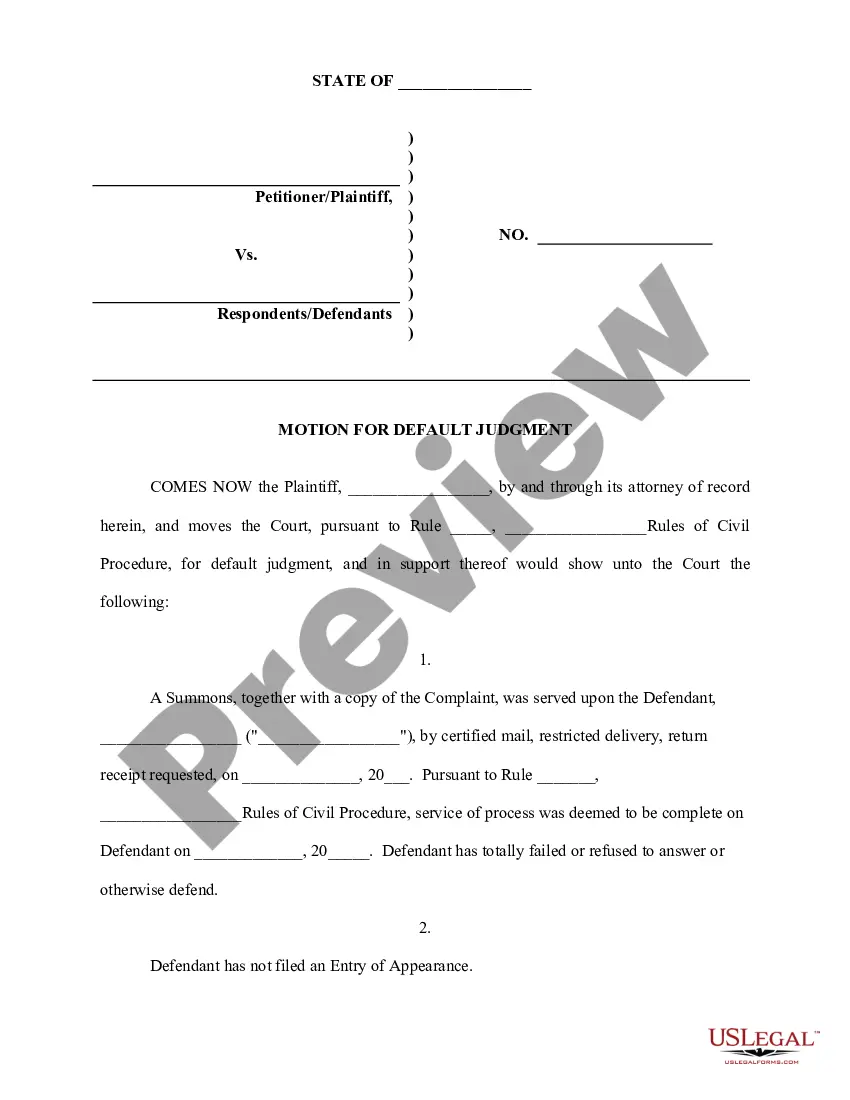

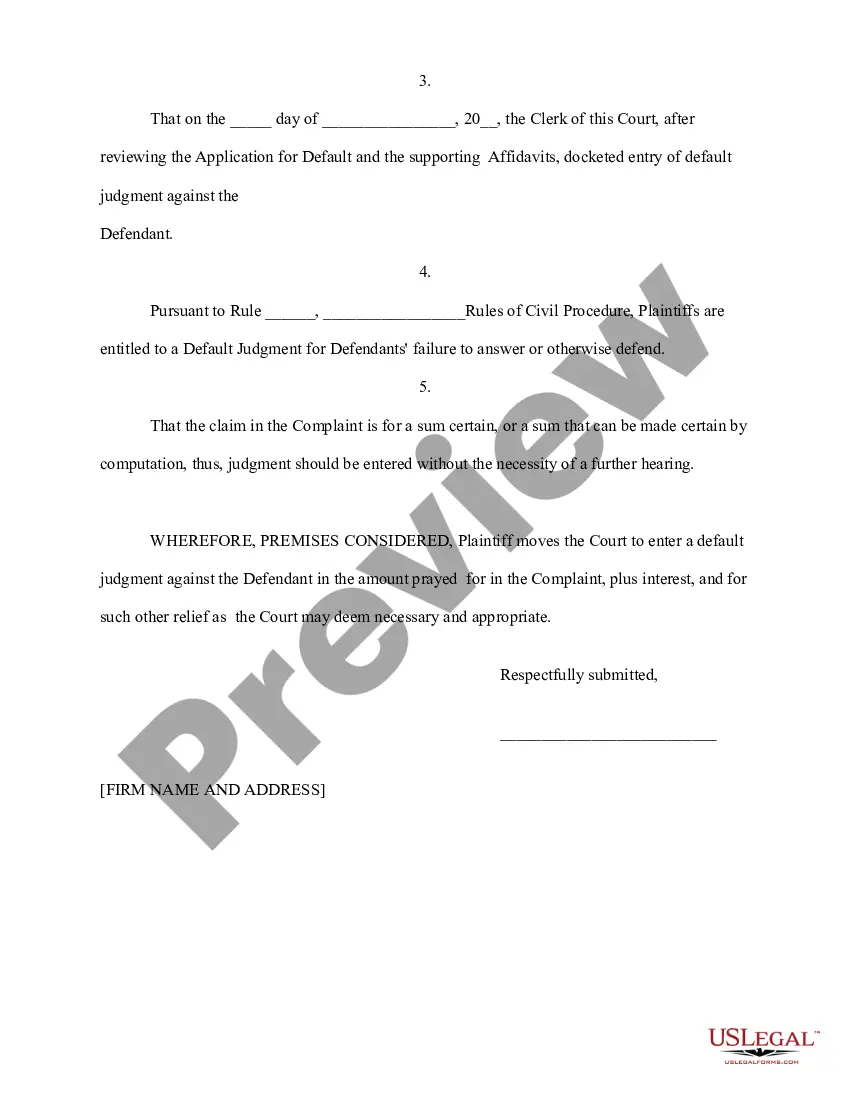

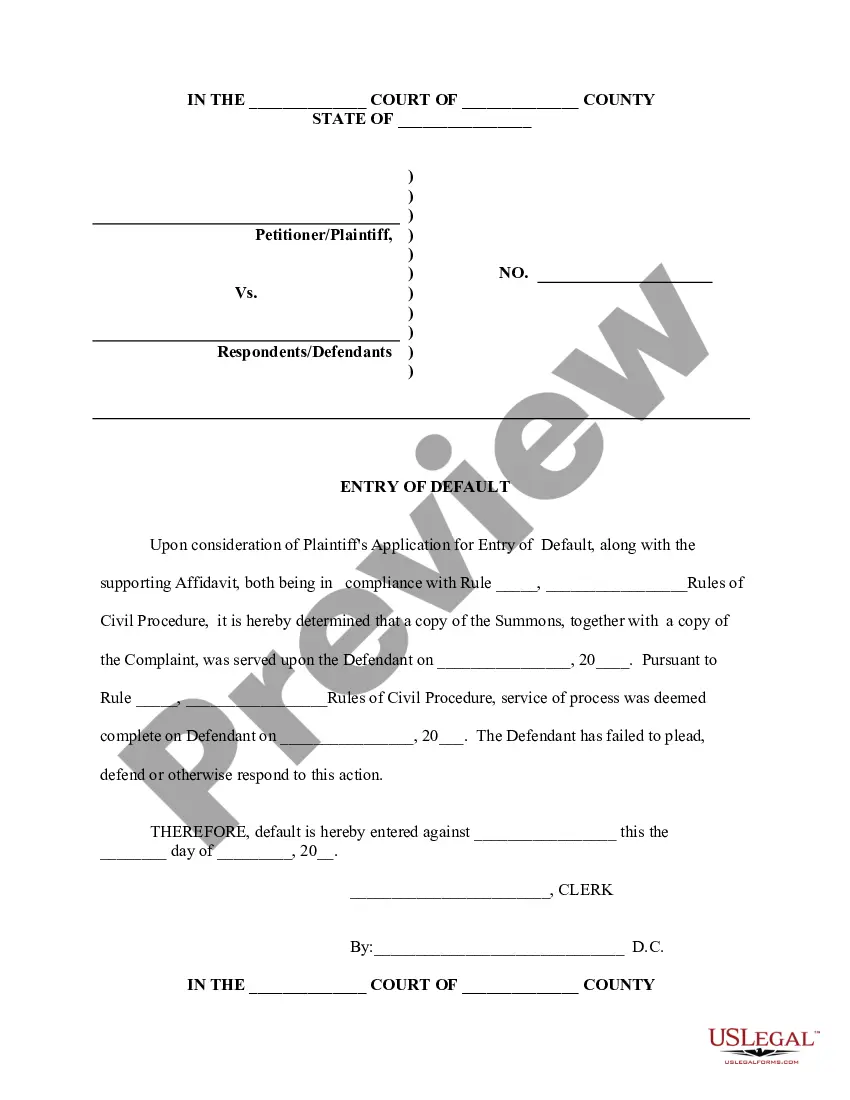

How to fill out Application For Entry Of Default - Affidavit - Motion - Entry Of Default - Default Judgment?

Locating a reliable resource to obtain the latest and most suitable legal templates is almost half the challenge of navigating bureaucracy.

Identifying the correct legal documents requires precision and meticulousness, which is why it's essential to source Default Judgment Form With 2 Points from reputable providers, such as US Legal Forms.

After obtaining the template on your device, you can edit it with the editor or print it out and fill it in manually. Eliminate the complications associated with your legal paperwork. Explore the extensive collection at US Legal Forms where you can discover legal templates, verify their applicability to your situation, and download them instantly.

- Utilize the library navigation or search functionality to find your template.

- Examine the details of the form to determine if it meets the specifications for your state and area.

- View the form preview, if available, to confirm that it is indeed the form you need.

- Return to the search if the Default Judgment Form With 2 Points does not fulfill your specifications.

- If you are certain of the form's applicability, proceed to download it.

- If you are a registered customer, click Log in to verify your identity and access your chosen templates in My documents.

- If you haven't created an account, click Buy now to acquire the form.

- Select the pricing option that matches your needs.

- Complete the registration to finalize your acquisition.

- Conclude your transaction by choosing a payment method (credit card or PayPal).

- Select the format for downloading Default Judgment Form With 2 Points.

Form popularity

FAQ

Limitations: Requires adherence to trust document's instructions on asset assignments. Joint assets, including certain IRAs and retirement plans, cannot be placed into a one-person trust. No complete tax avoidance: Total avoidance of taxes is rarely possible with living trusts, though there may be ways to reduce them.

How Much Does It Cost to Create a Living Trust in Nebraska? The price of creating a trust largely depends on how you go about making one. If you use a lawyer, fees can easily run $1,000 or more, depending on the hourly or project rate. If you want to keep costs down, there are online programs that cost less than $100.

When you use a trust, your assets can be distributed to your beneficiaries immediately upon your death, whereas with a will nothing can happen until probate concludes. If you own property in more than one state, your living trust allows you to avoid property in all of the states.

In order for the trust to be effective, all property and assets listed within the instrument must be transferred into the trust's name. Once the document has been drafted, it should be signed in the presence of a Notary Public.

To make a living trust in Nebraska, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

In Nebraska, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts may cost even more. Online platforms like Snug provide more affordable options for creating wills and trusts, offering transparent pricing and quality estate planning services.

A living trust is a legal document that, just like a will, contains your instructions for what you want to happen to your assets when you die. But, unlike a will, a living trust avoids probate at death, can control all of your assets, and avoids the need for a court appointed conservator if you should become disabled.