Default Judgement In Texas For Credit Card Debt

Description

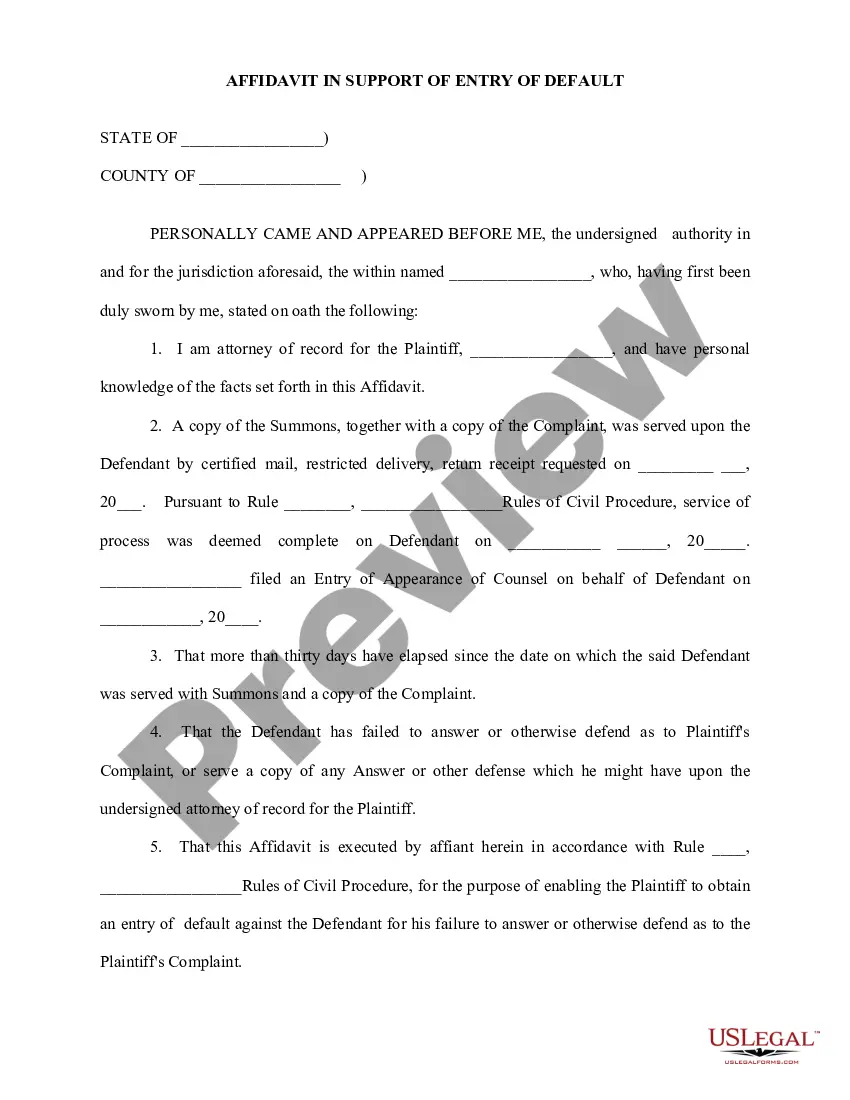

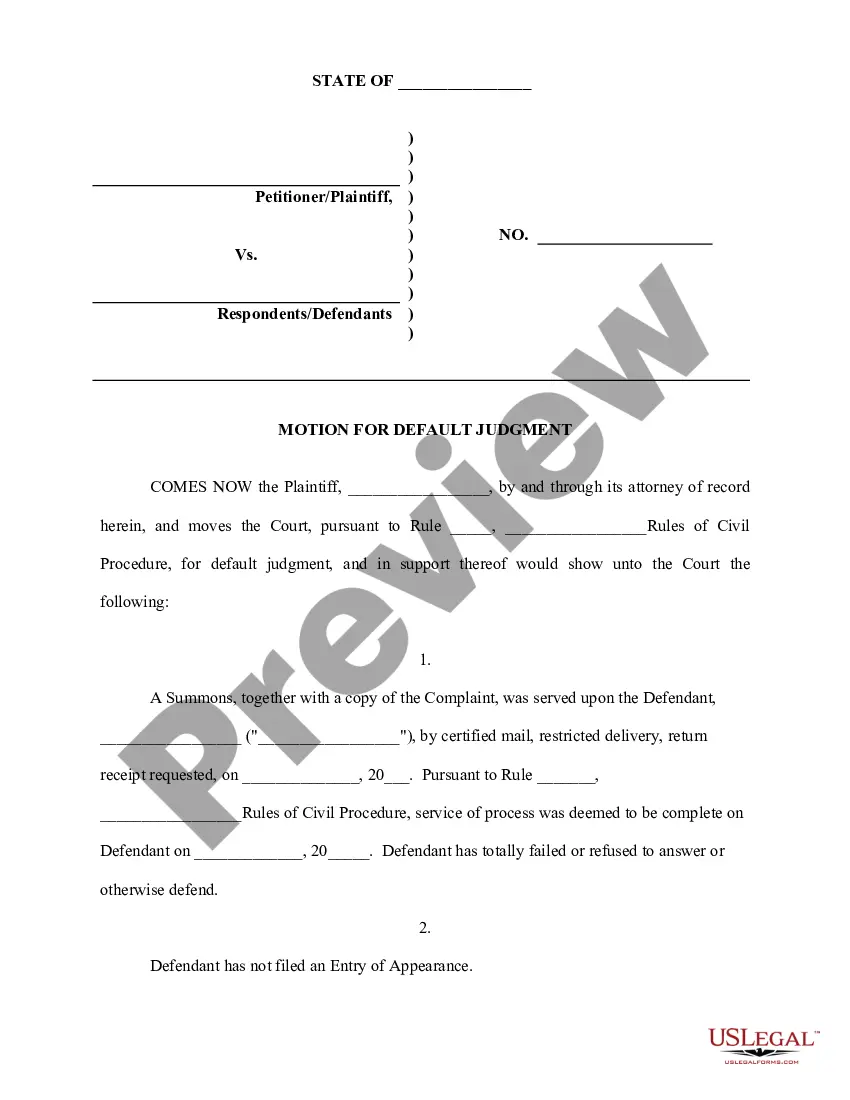

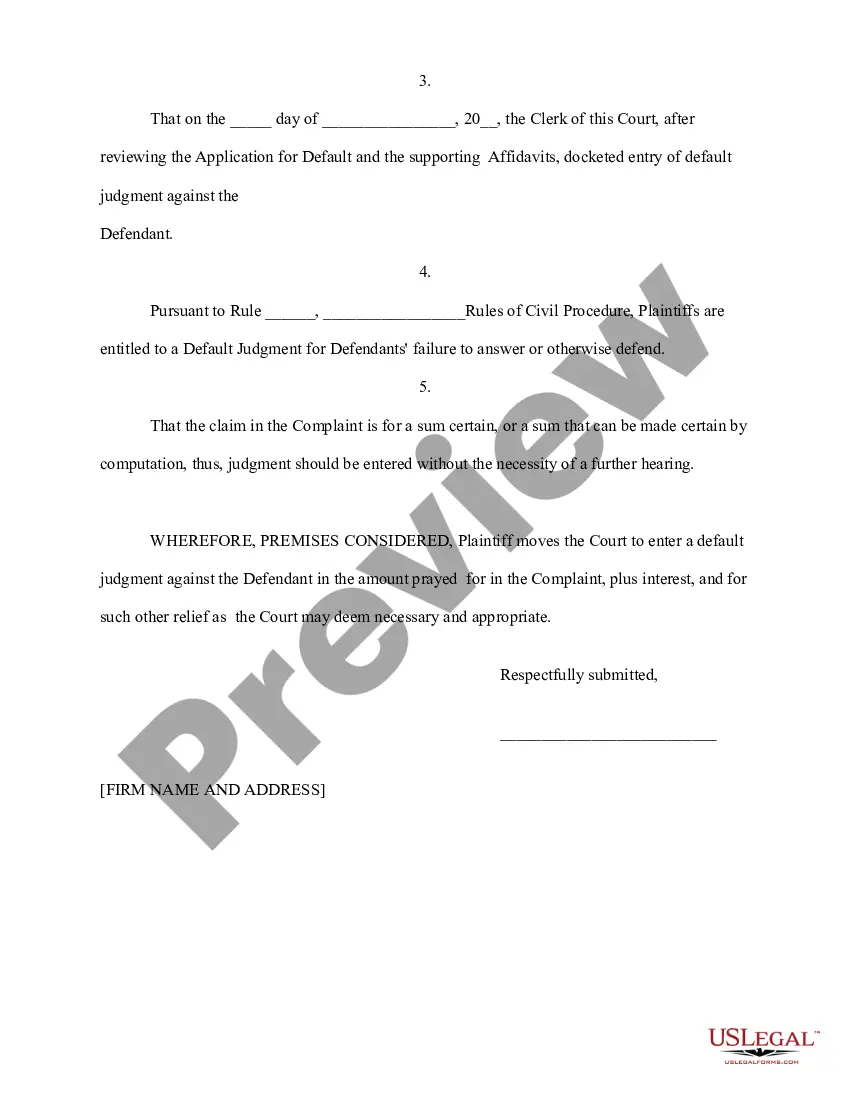

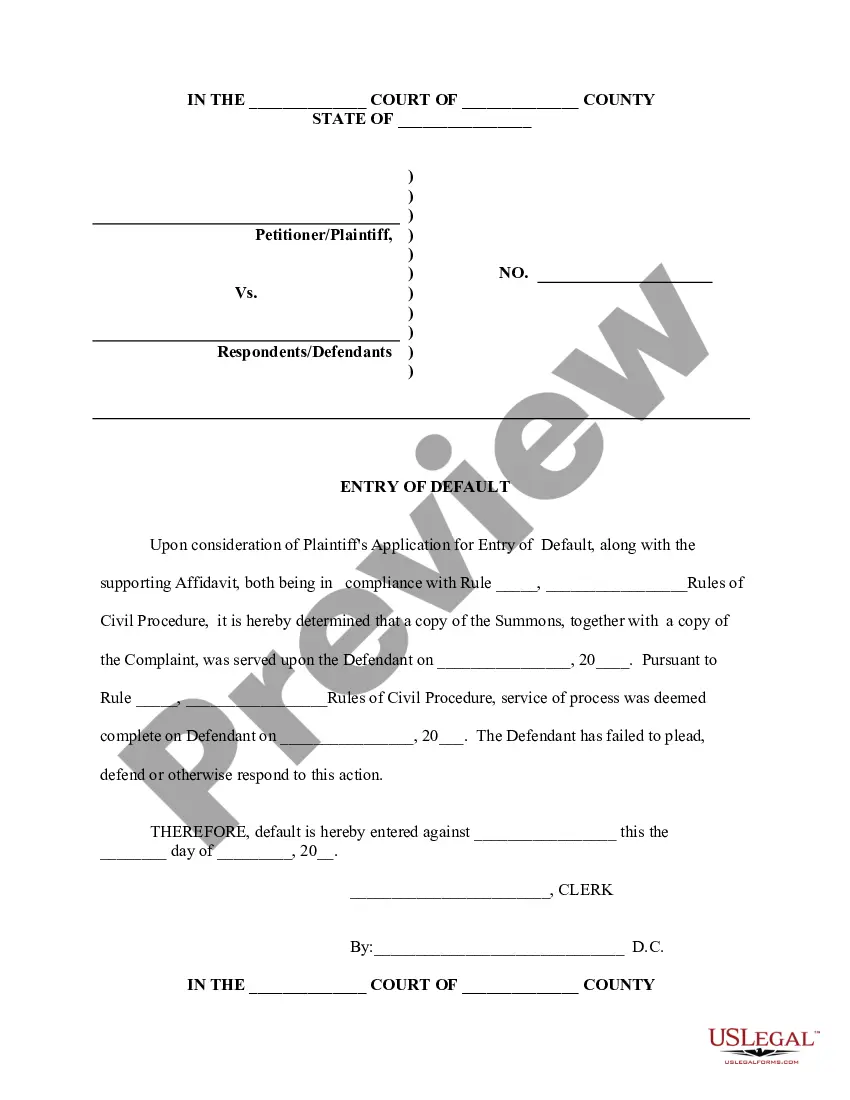

How to fill out Application For Entry Of Default - Affidavit - Motion - Entry Of Default - Default Judgment?

Whether for business purposes or for personal affairs, everybody has to manage legal situations sooner or later in their life. Completing legal paperwork demands careful attention, starting with selecting the appropriate form sample. For example, if you choose a wrong edition of a Default Judgement In Texas For Credit Card Debt, it will be turned down when you send it. It is therefore crucial to have a reliable source of legal documents like US Legal Forms.

If you have to obtain a Default Judgement In Texas For Credit Card Debt sample, follow these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Check out the form’s description to ensure it fits your case, state, and region.

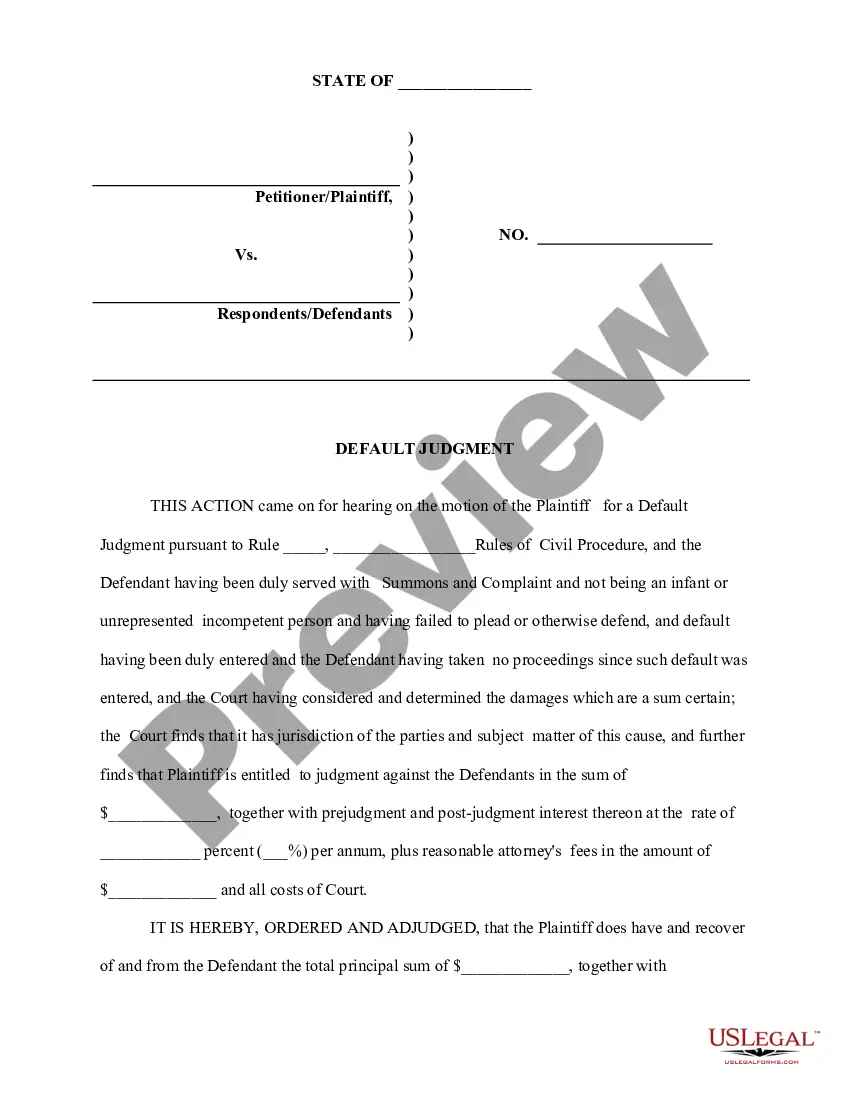

- Click on the form’s preview to examine it.

- If it is the wrong form, get back to the search function to find the Default Judgement In Texas For Credit Card Debt sample you need.

- Get the template if it meets your requirements.

- If you already have a US Legal Forms profile, click Log in to access previously saved files in My Forms.

- In the event you do not have an account yet, you may download the form by clicking Buy now.

- Select the proper pricing option.

- Finish the profile registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Select the document format you want and download the Default Judgement In Texas For Credit Card Debt.

- After it is downloaded, you are able to complete the form with the help of editing software or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you never need to spend time looking for the right template across the web. Take advantage of the library’s easy navigation to find the appropriate form for any occasion.

Form popularity

FAQ

The plaintiff should make a written request for the clerk to enter a default judgment, and provide the clerk with an affidavit of the amount owed by the defendant and a proposed clerk's default judgment. Internal Procedures: All documents are forwarded to the docket clerk for processing within 24 hours.

Your answer can be a handwritten letter to the court that says you do not agree with the lawsuit. Include your case (cause) number and mailing address and any defenses you may have to the lawsuit; for example, the amount they claim you owe is incorrect, the account isn't yours, or the debt is older than 4 years.

However, Texas does allow for a bank account to be frozen. Once your wages are deposited into your bank account, the funds can be frozen and possibly seized. In order to do this, a debt collector must have won the lawsuit and had an order issued by the court.

Generally, a Motion to Set Aside a Default Judgment and Notice of Hearing must be filed within 30 days of the date the default judgment was signed by the judge. Lastly, if you were served notice of the default judgment by publication, you have two years from the date of the default judgment to ask for a new trial.

What Is a Motion for Default Judgment in Texas? Issues arise when a defendant fails to file a timely response to the civil complaint. As a rule, when the defendant fails to respond, the plaintiff may file a motion for a default judgment. Default judgments are decisions made by the court against the defendant.