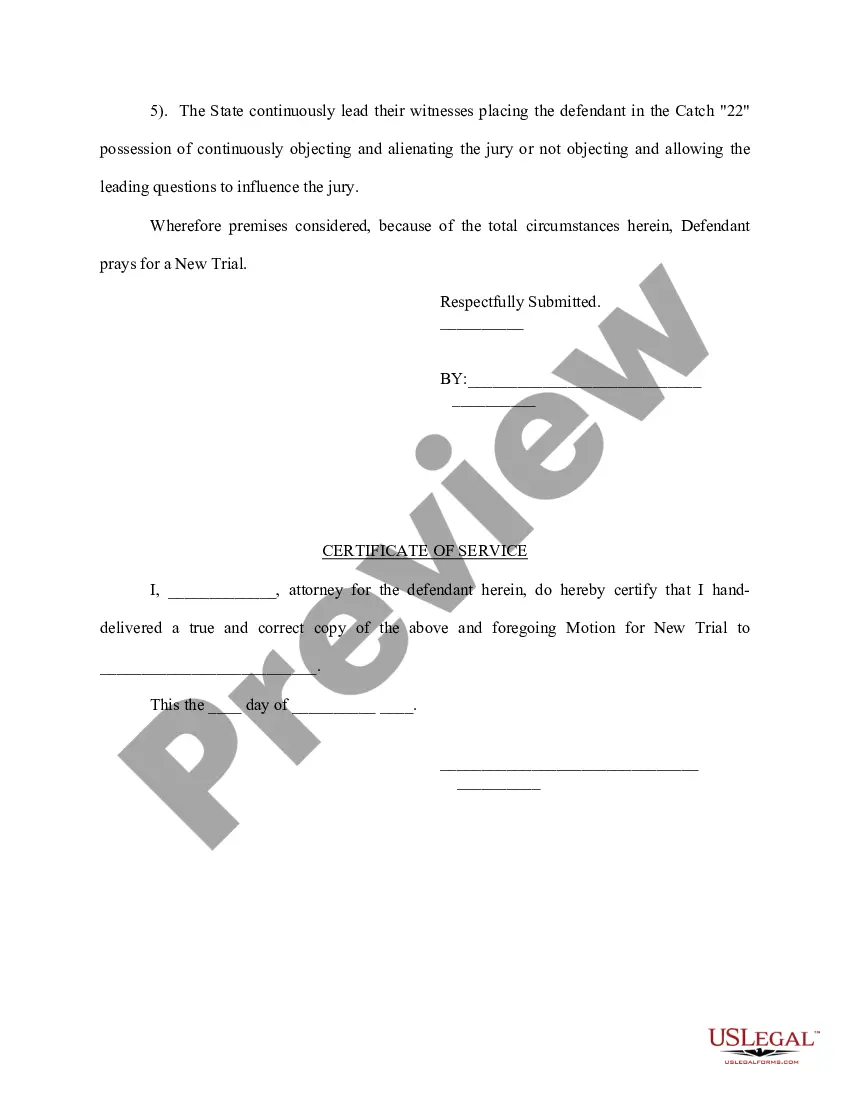

Texas Motion For A New Trial With No Evidence

Description

How to fill out Motion For New Trial?

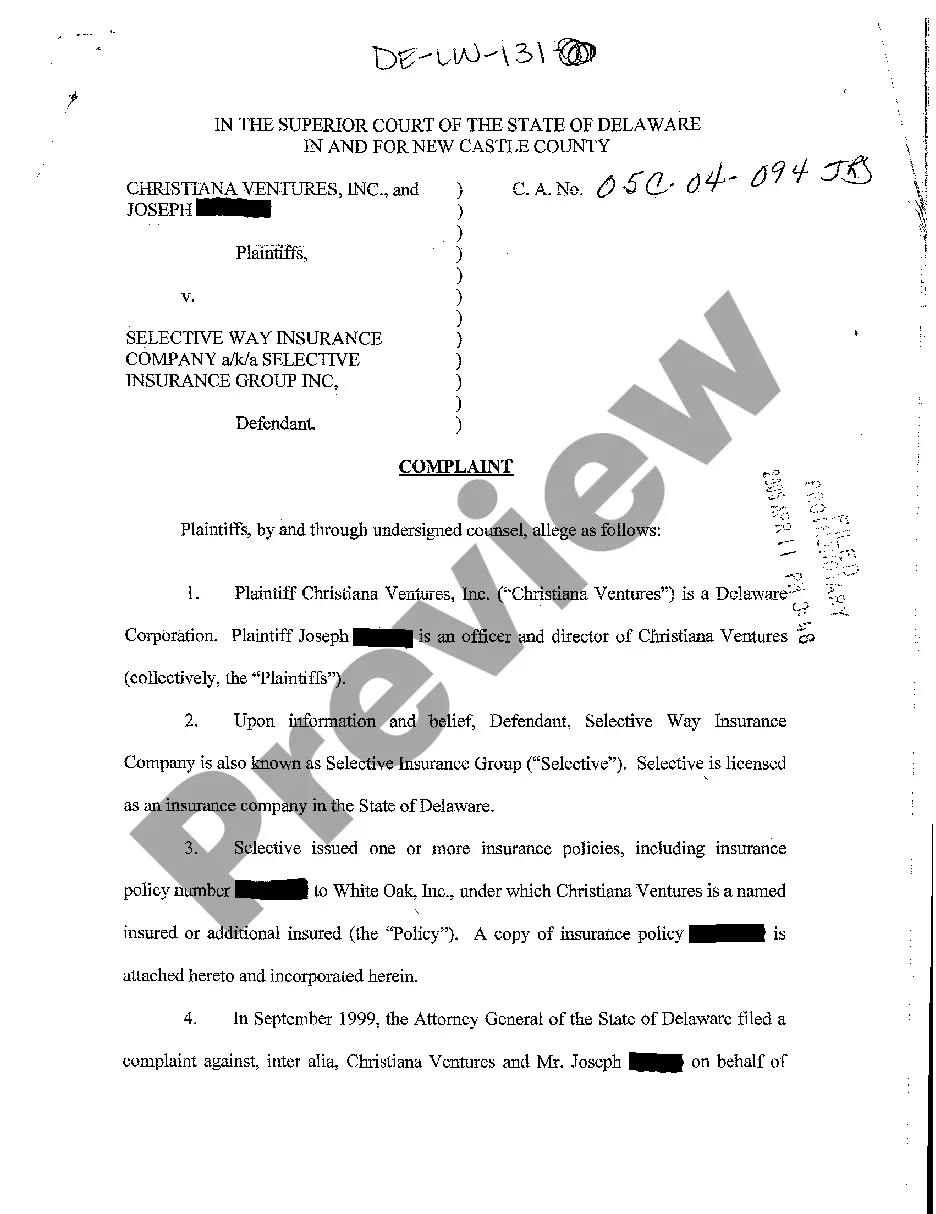

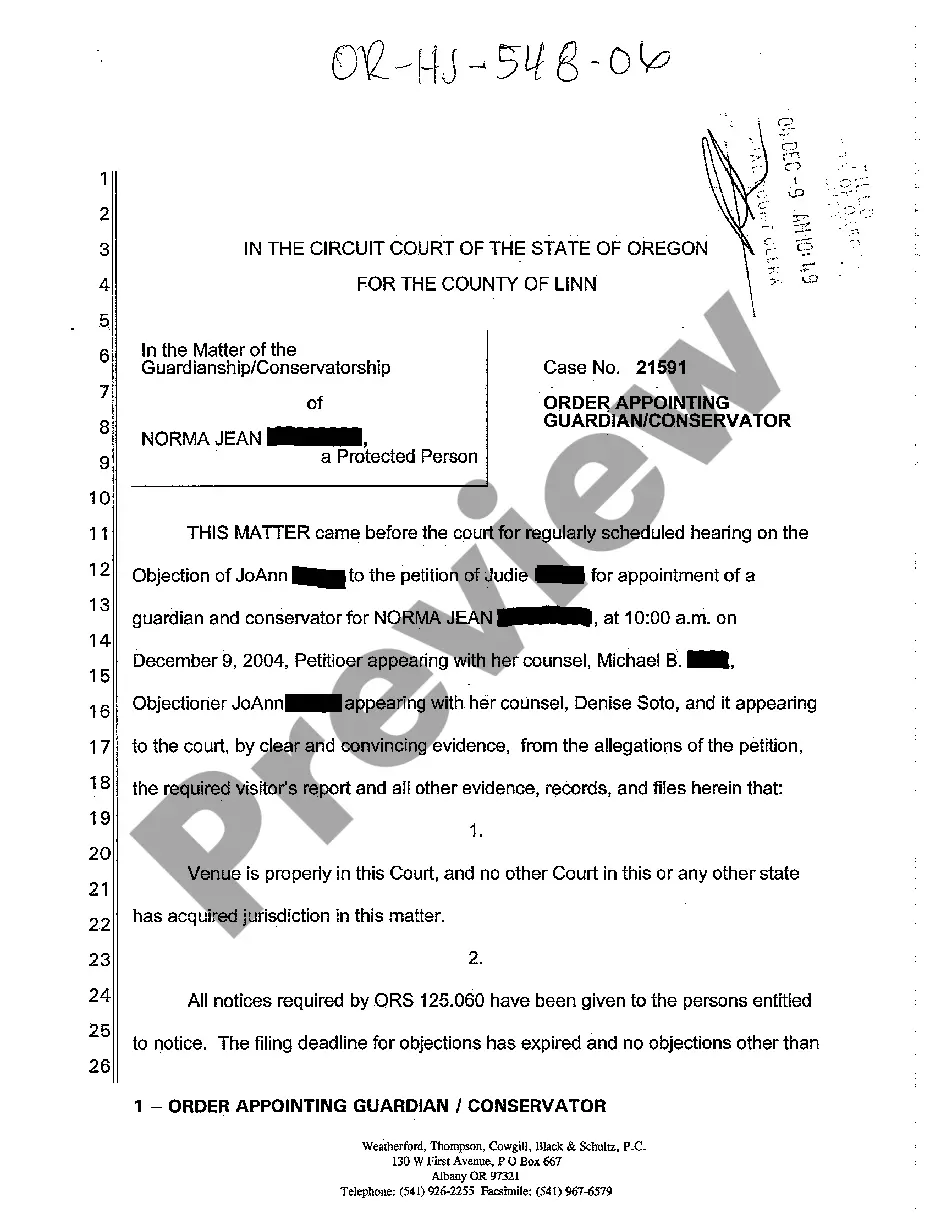

Regardless of whether it is for corporate needs or personal issues, every individual must deal with legal matters at some time in their lives.

Completing legal documents requires meticulous focus, starting from selecting the correct template example.

Once saved, you can fill out the form using editing software or print it to complete it manually. With an extensive collection from US Legal Forms available, you won’t need to spend time searching the internet for the right sample. Take advantage of the library's simple navigation to obtain the appropriate template for any situation.

- For example, choosing an incorrect variant of the Texas Motion For A New Trial With No Evidence will result in its rejection upon submission.

- Thus, it is essential to find a reliable source for legal paperwork such as US Legal Forms.

- If you need a Texas Motion For A New Trial With No Evidence template, adhere to these straightforward guidelines.

- Retrieve the required sample by utilizing the search bar or catalog navigation.

- Review the form’s overview to confirm it matches your legal case, state, and locality.

- Click on the form’s preview to inspect it.

- If it is not the correct document, return to the search option to find the Texas Motion For A New Trial With No Evidence template you are looking for.

- Obtain the template once it satisfies your criteria.

- If you possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you are not yet a member, acquire the form by clicking Buy now.

- Choose the suitable payment option.

- Fill out the account registration form.

- Select your payment method: either a credit card or PayPal account.

- Choose the format of the document you want and download the Texas Motion For A New Trial With No Evidence.

Form popularity

FAQ

In Illinois, a warranty deed transfers title to the grantee with broad warranties and covenants of title and is the form of deed customarily used in residential real estate transactions.

A special warranty deed that transfers title to real estate from a grantor to a grantee. In Illinois, a special warranty deed transfers title to the grantee with limited warranties and covenants of title and is the form of deed customarily used in commercial real estate transactions.

How Do I Get a Warranty Deed in Illinois? In most cases, property owners turn to a real estate attorney to complete a warranty deed in the state of Illinois. While warranty deeds can be created on your own, they must comply with legal requirements and include the necessary language to make them official.

Each Illinois county has a county recorder who receives deeds for recording and keeps the county's land records. A deed must be filed with the recorder for the county where the property is located. The county clerk serves as recorder in counties with populations under 60,000.

While the seller in a Warranty Deed must defend the title against all other claims and compensate the buyer for any unsettled debts or damages, the seller in a Special Warranty Deed is only responsible for debts and problems accrued or caused during his ownership of the property.

When a buyer purchases property under a special warranty deed, there is the possibility that a prior creditor or owner could make a claim against the property. The best way to protect yourself as a buyer is to buy title insurance when you purchase the property.

A grant deed, also known in many states as a limited warranty deed or a special warranty deed, gives the grantee some, but not all, of the assurances of a general warranty deed.

General Warranty Deed It offers the highest level of protection to the buyer because it guarantees that there are absolutely no problems with the home ? even dating back to prior property owners. This quality of coverage is why most lenders will require you to get a general warranty deed when buying your house.