Withdraw Attorney Form For Llc

Description

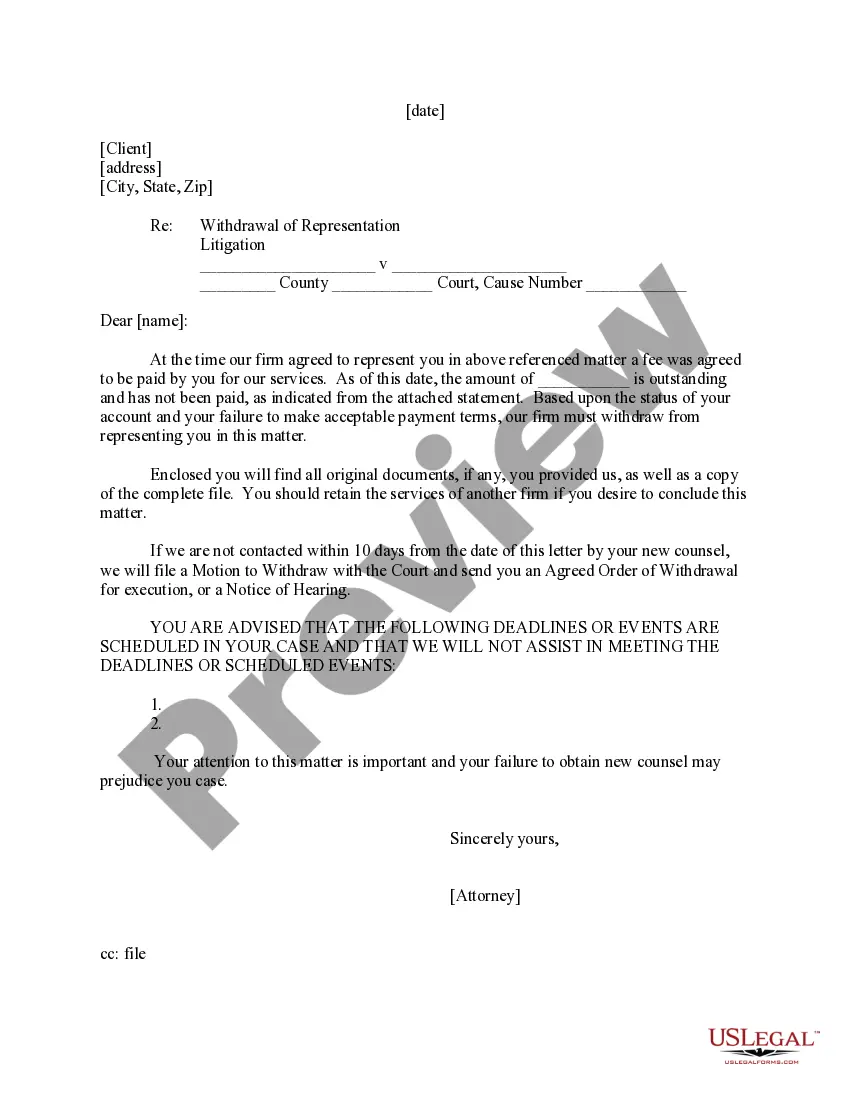

How to fill out Motion To Withdraw As Attorney?

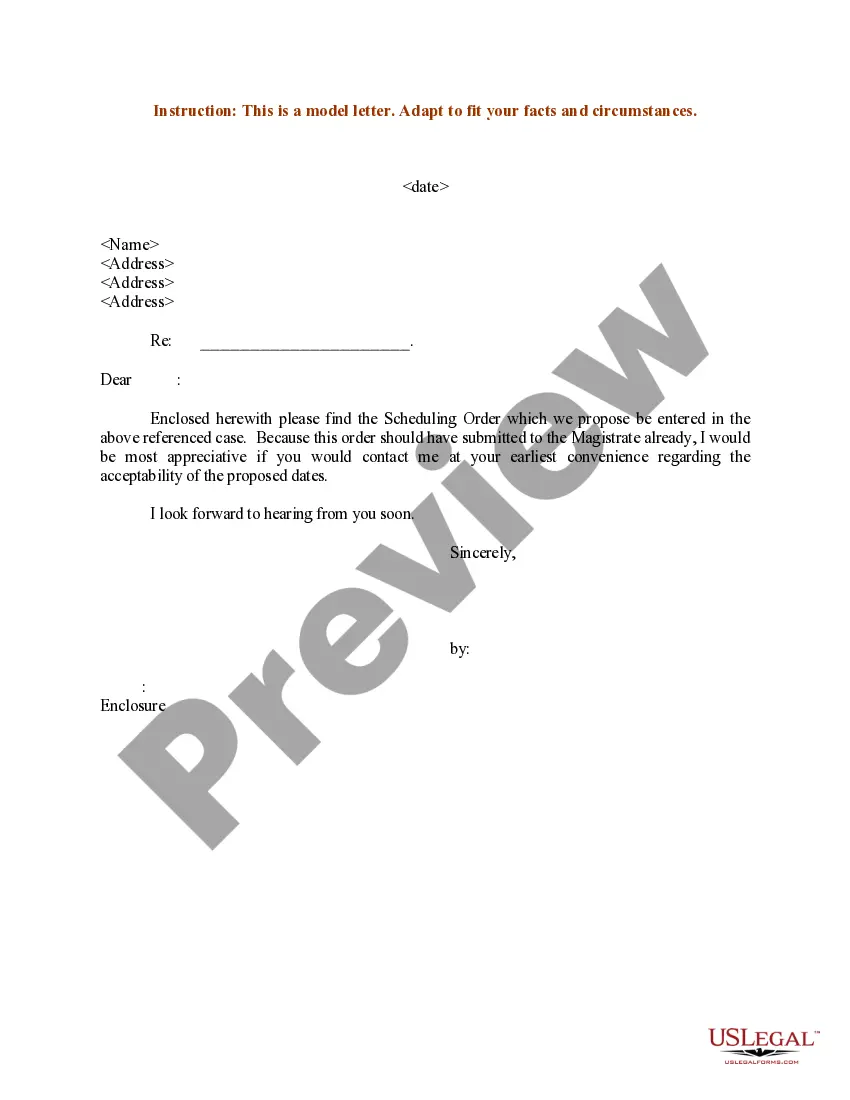

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Completing legal paperwork demands careful attention, beginning from choosing the correct form template. For example, if you choose a wrong edition of a Withdraw Attorney Form For Llc, it will be rejected once you send it. It is therefore essential to have a reliable source of legal files like US Legal Forms.

If you have to obtain a Withdraw Attorney Form For Llc template, follow these simple steps:

- Find the template you need by using the search field or catalog navigation.

- Check out the form’s description to ensure it matches your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect form, get back to the search function to locate the Withdraw Attorney Form For Llc sample you require.

- Download the file when it meets your requirements.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the account registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Pick the document format you want and download the Withdraw Attorney Form For Llc.

- After it is saved, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you don’t have to spend time seeking for the appropriate template across the internet. Make use of the library’s simple navigation to find the right form for any situation.

Form popularity

FAQ

File Form 8821 to: Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form. Delete or revoke prior tax information authorizations.

Form 2848, Power of Attorney and Declaration of RepresentativePDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information AuthorizationPDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

If your representative does not have a copy of the power of attorney he or she wants to withdraw, he or she must send the IRS a statement of withdrawal that indicates the authority of the power of attorney is withdrawn, lists the matters and years/ periods, and lists the name, taxpayer identification number, and ...

There are 2 ways to revoke a Power of Attorney authorization: Authorize Power of Attorney for a new representative for the same tax matters and periods/years. A new authorization will automatically revoke the prior authorization. Send a revocation to the IRS.

You may withdraw an authorization at any time. To do so, you must write ?WITHDRAW? across the first page of Form 8821 with a current signature and date below the annotation.