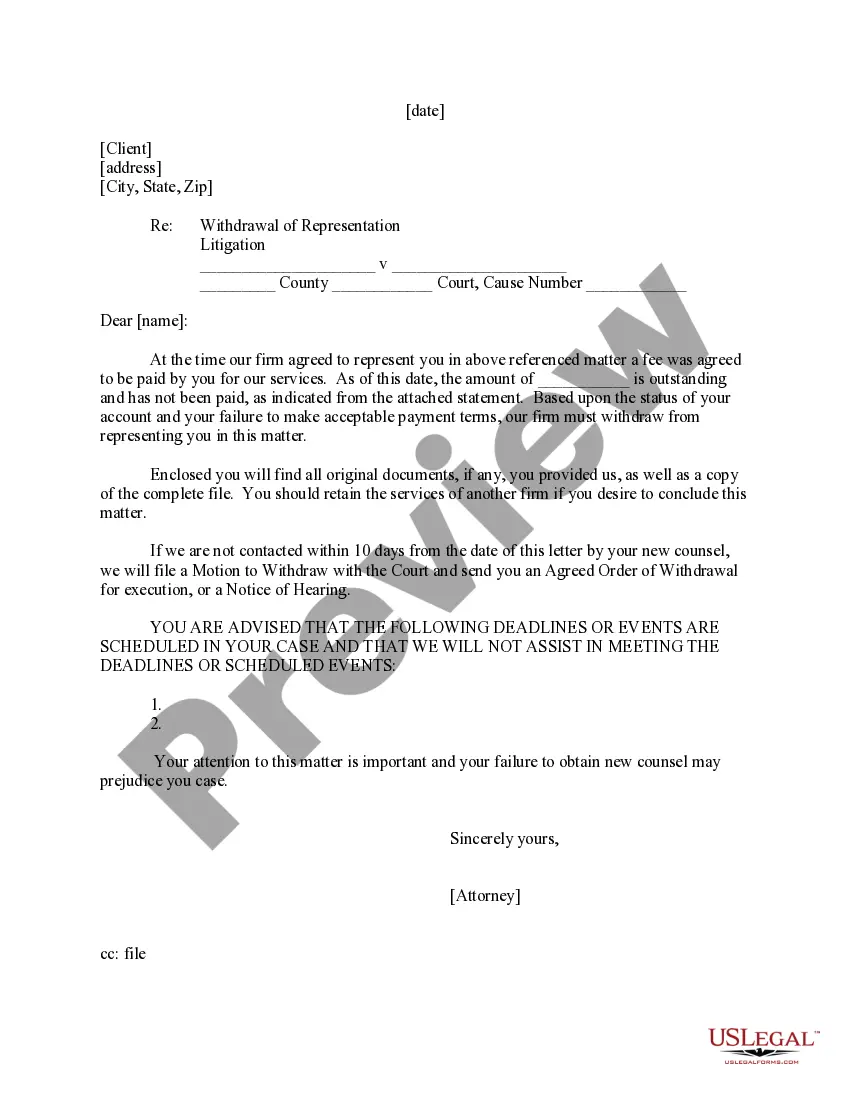

Motion Withdraw Sample Without Prejudice

Description

How to fill out Motion To Withdraw As Attorney?

Managing legal paperwork and processes can be a lengthy addition to your daily tasks.

Motion Withdraw Sample Without Prejudice and similar forms frequently necessitate that you search for them and figure out how to fill them out accurately.

For this reason, if you are addressing financial, legal, or personal issues, having a detailed and practical online directory of forms readily available will greatly assist you.

US Legal Forms is the leading web platform of legal templates, boasting over 85,000 state-specific forms and various tools to help you complete your documents effortlessly.

Simply Log In to your account, find Motion Withdraw Sample Without Prejudice and obtain it instantly in the My documents section. You can also access previously downloaded forms.

- Explore the collection of relevant documents available with just one click.

- US Legal Forms offers you state- and county-specific forms available for download at any time.

- Safeguard your document management processes by using a reliable service that allows you to prepare any form in minutes without extra or concealed charges.

Form popularity

FAQ

South Carolina employees only need to submit an SC W-4 if: They start a new job. They want to make changes to their current South Carolina Withholding. They meet the requirements and want to claim exempt from South Carolina Withholding.

State Only Return Requirements ? The South Carolina e-file program supports federal/state (piggyback) filing and state-only filing through the Federal/State Electronic Filing Program (Modernized e-File System). Both part-year and nonresident returns can be e-filed.

If you elect to file as a full-year resident, file SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. You must complete SC1040TC and attach a copy of the other state's income tax return.

Employers Report of Change (UCE-101-S) Application for Exemption of Business Entity Owners from Unemployment Insurance Coverage (UCE-1060) Application for Exemption of Corporate Officers from Unemployment Insurance Coverage (UCE 1050) UI Tax File Specifications: Technical Services, Policies & Reporting (PDF)

Give us a call at 1-844-898-8542 or email forms@dor.sc.gov so we can direct you to the proper form, or discuss the online filing option that best fits your needs. Filing online using MyDORWAY makes finding the right form easy!

All personal service income earned in South Carolina must be reported to this state. You may choose the way that is most beneficial to you. This option is only available for the year you are a part- year resident. You must also attach a copy of your federal return.

If you are a South Carolina resident, you are generally required to file a South Carolina Income Tax return if you are required to file a federal return.