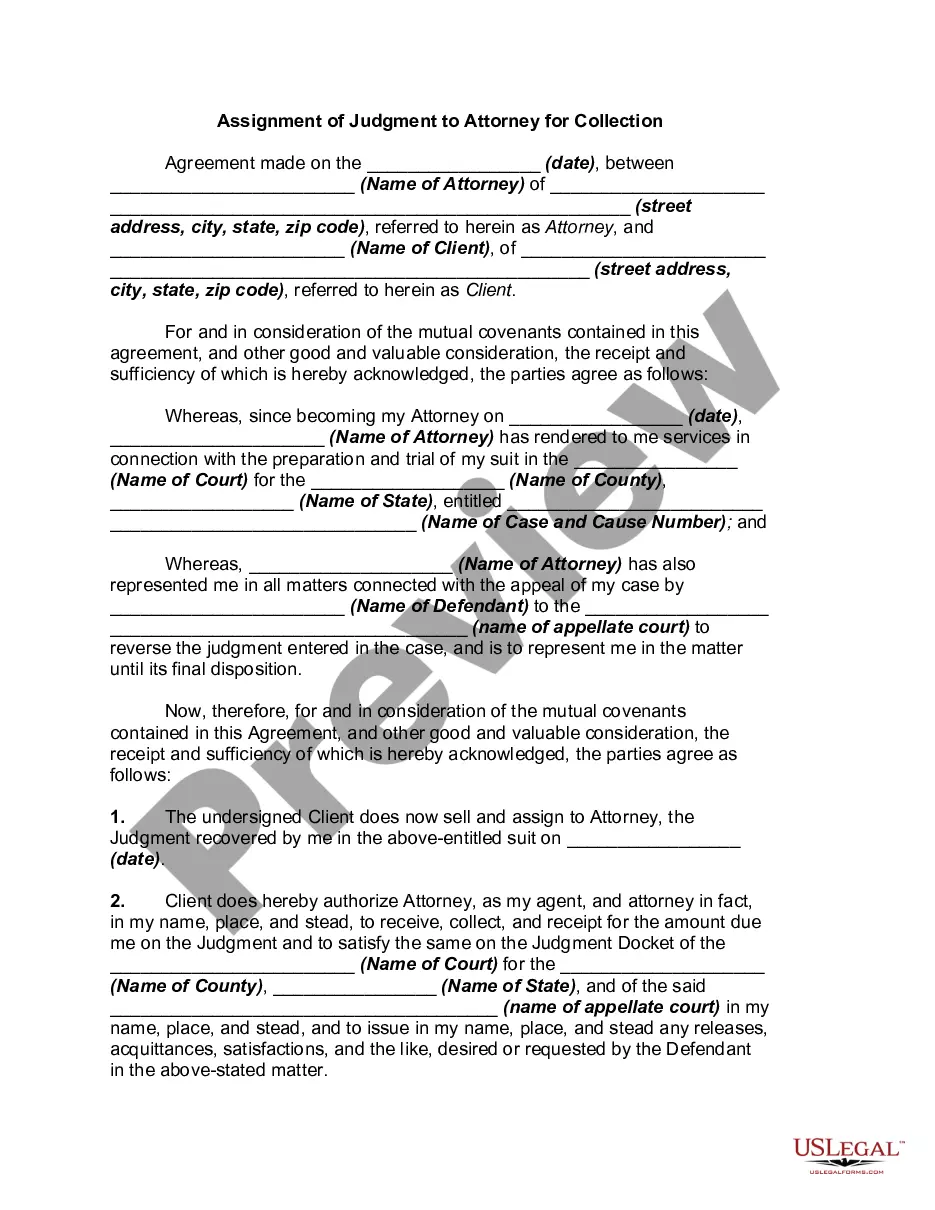

Assignment Of Judgment Form For Florida

Description

How to fill out Assignment Of Judgment?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive research and significant financial resources.

If you seek a simpler and more budget-friendly method of preparing the Assignment Of Judgment Form For Florida or any other documentation without unnecessary obstacles, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal templates covers nearly every area of your financial, legal, and personal matters.

- With just a few clicks, you can quickly obtain state- and county-specific templates meticulously crafted by our legal experts.

- Utilize our service whenever you require trustworthy and dependable support to swiftly find and download the Assignment Of Judgment Form For Florida.

- If you are already familiar with our services and have previously registered an account with us, simply Log In to access your account, locate the template, and download it or re-download it anytime from the My documents section.

- Don't have an account? No worries. Setting it up takes just a few minutes, allowing you to navigate the library.

Form popularity

FAQ

Collecting on a default judgment in Florida involves first ensuring the judgment is properly filed and recorded. You can then initiate collection actions like garnishing wages or placing liens on properties. Using the Assignment of Judgment form for Florida can be particularly helpful if you want to make the process more straightforward and official, facilitating your right to collect.

In Florida, a judgment is generally enforceable for 20 years from the date it was rendered. This means you have a substantial timeframe to collect on the judgment. By utilizing the Assignment of Judgment form for Florida, you can transfer the judgment rights if needed, allowing you to manage the collection process effectively.

The best way to collect a judgment typically involves assessing the assets of the debtor and deciding on the most effective enforcement method. Options include wage garnishment, bank account levies, or property liens, which can help secure the owed amount. Using an Assignment of Judgment Form for Florida can facilitate the collection by allowing you to assign your rights to a third party. Always choose the most appropriate method based on your specific situation.

The final judgment process in Florida involves several key steps, beginning with filing a lawsuit and proceeding through hearings and potentially a trial. After obtaining a judgment, a creditor may need to file additional documents to enforce the judgment. Utilizing an Assignment of Judgment Form for Florida can streamline the enforcement process by transferring your rights to collect. Being familiar with this process can aid you in ensuring timely collection.

Gifts of Real Property in Tennessee. A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee).

A gift letter is a formal document proving that money you have received is a gift, not a loan, and that the donor has no expectations for you to pay the money back. A gift can be broadly defined to include a sale, exchange, or other transfer of property from one person (the donor) to another (the recipient).

I/We [name of gift-giver(s)] intend to make a GIFT of $ [dollar amount of gift] to [name(s) of recipient(s)] , my/our [relationship, such as son or daughter], to be applied toward the purchase of property located at: [address of the house you're buying, if known] .

There is Currently No Tennessee Gift Tax The Tennessee gift tax was repealed in 2012. While every U.S. citizen is subject to the same Federal gift tax rules, the tax laws of the various states do differ. If you gift a property or asset in another state ensure that you are aware of that state's tax policies.

A gift letter is a legal instrument that clearly and explicitly states, without question, that a friend or family member ?gifted? - rather than loaned - you money. You can use a gift letter for mortgage lenders who may be questioning a large influx of cash that suddenly showed up in your checking or savings account.

Confirm the gift with a gifted deposit letter The letter should lay out that the giver has no right to the property. This is known as a gifted deposit letter. This letter proves that you won't have to pay back the money given at a later date.