Liability Employer Buy With Credit Card

Description

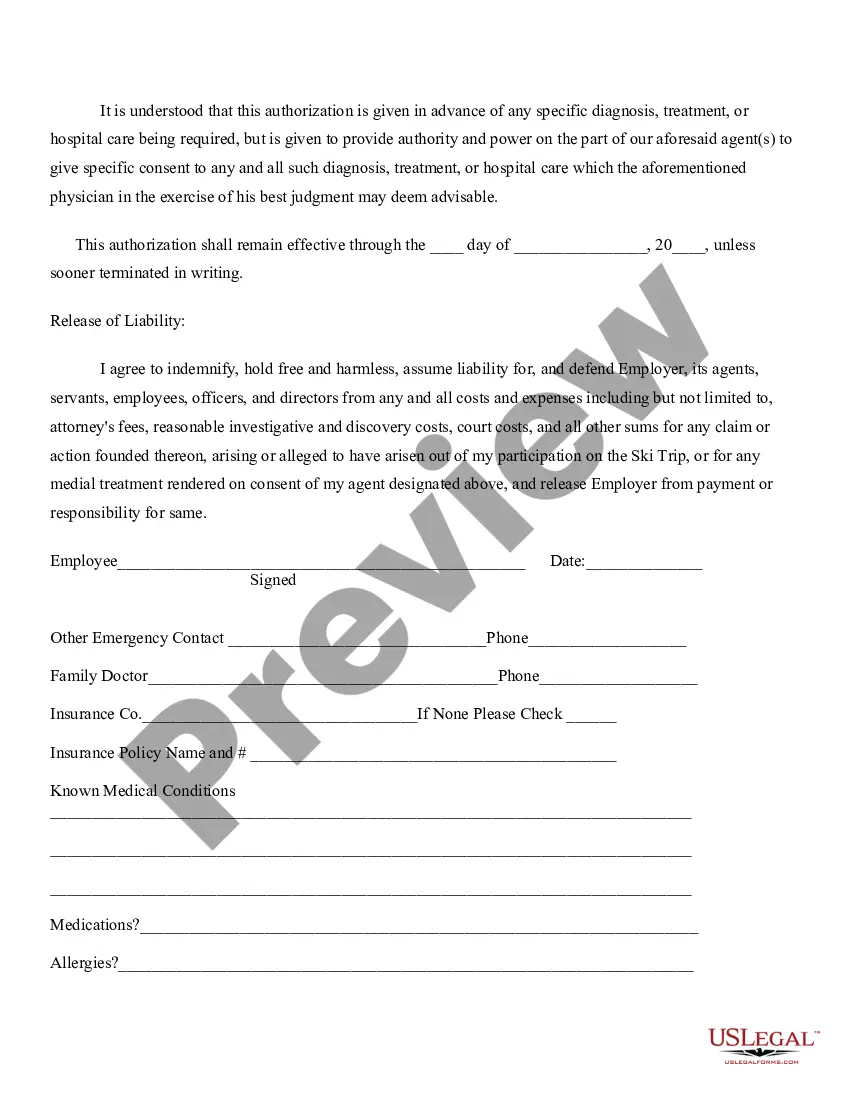

How to fill out Release Of Liability Of Employer - Ski Trip?

It’s obvious that you can’t become a law expert immediately, nor can you figure out how to quickly draft Liability Employer Buy With Credit Card without the need of a specialized set of skills. Putting together legal documents is a time-consuming process requiring a particular training and skills. So why not leave the creation of the Liability Employer Buy With Credit Card to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court documents to templates for internal corporate communication. We know how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and get the document you require in mere minutes:

- Discover the form you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Liability Employer Buy With Credit Card is what you’re looking for.

- Begin your search over if you need any other form.

- Set up a free account and select a subscription plan to buy the template.

- Choose Buy now. Once the payment is complete, you can download the Liability Employer Buy With Credit Card, fill it out, print it, and send or send it by post to the necessary people or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Keep track of your spending. Make sure you keep copies of your statements. Not only is keeping track of your spending a good budgeting strategy, but you may need those statements if you apply for a mortgage. And don't worry -- your employer won't know what you purchase with your card.

Sometimes, in the hustle of trying to take care of things, the lines between your business life and your personal life can become blurred. So, what happens if you take care of some personal shopping on your business credit card? Putting your personal purchases on your business credit card technically isn't illegal.

Business credit cards typically require a personal guarantee, which means both the business and the cardholder are liable for unpaid debt. Some card issuers routinely report business credit card activity on your personal credit report; others do not, or only when your account becomes delinquent.

As a shareholder of a corporation or a member of an LLC, you aren't personally liable if your business can't pay its debts. In other words, you have LLC limited liability or corporate limited liability protection.

As long as you're the only owner of your business, there's nothing legally wrong with using a business bank account or credit card for your own purposes. If you do, though, it can make your life difficult down the road when trying to run your accounting or file your tax return.