Liability Employer Buy With Bitcoin

Description

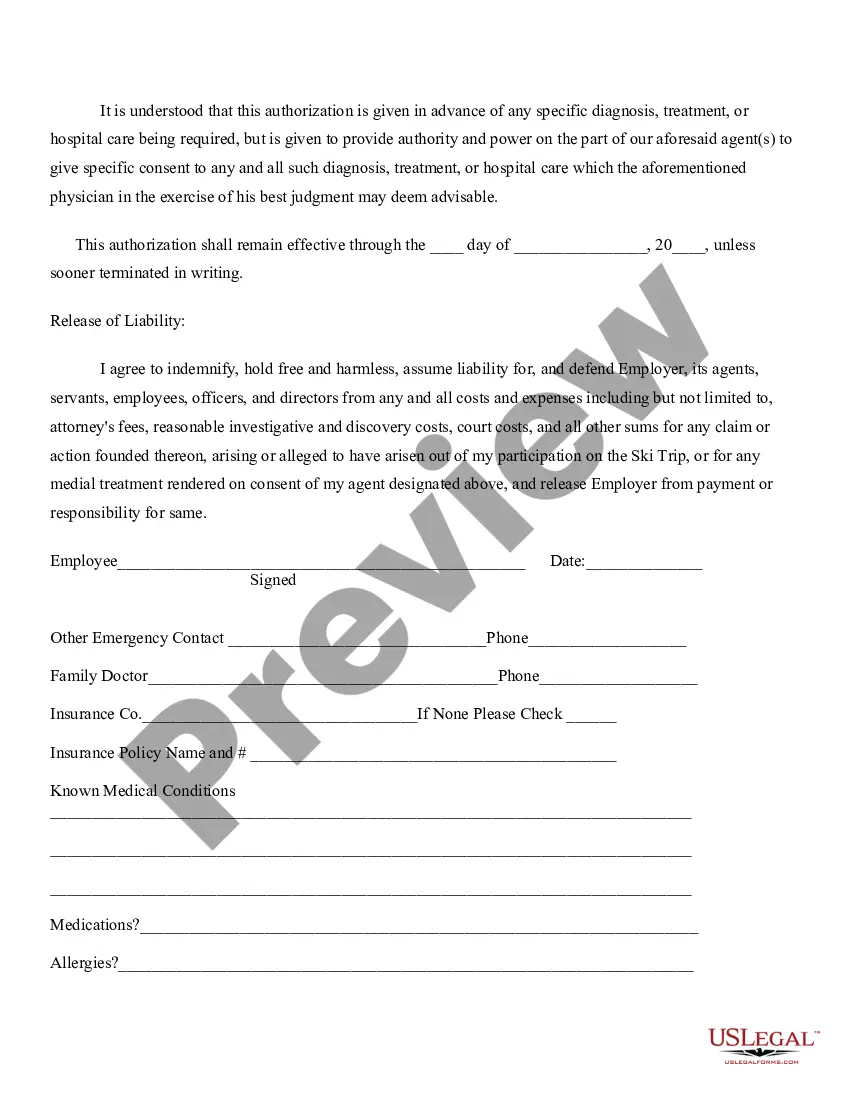

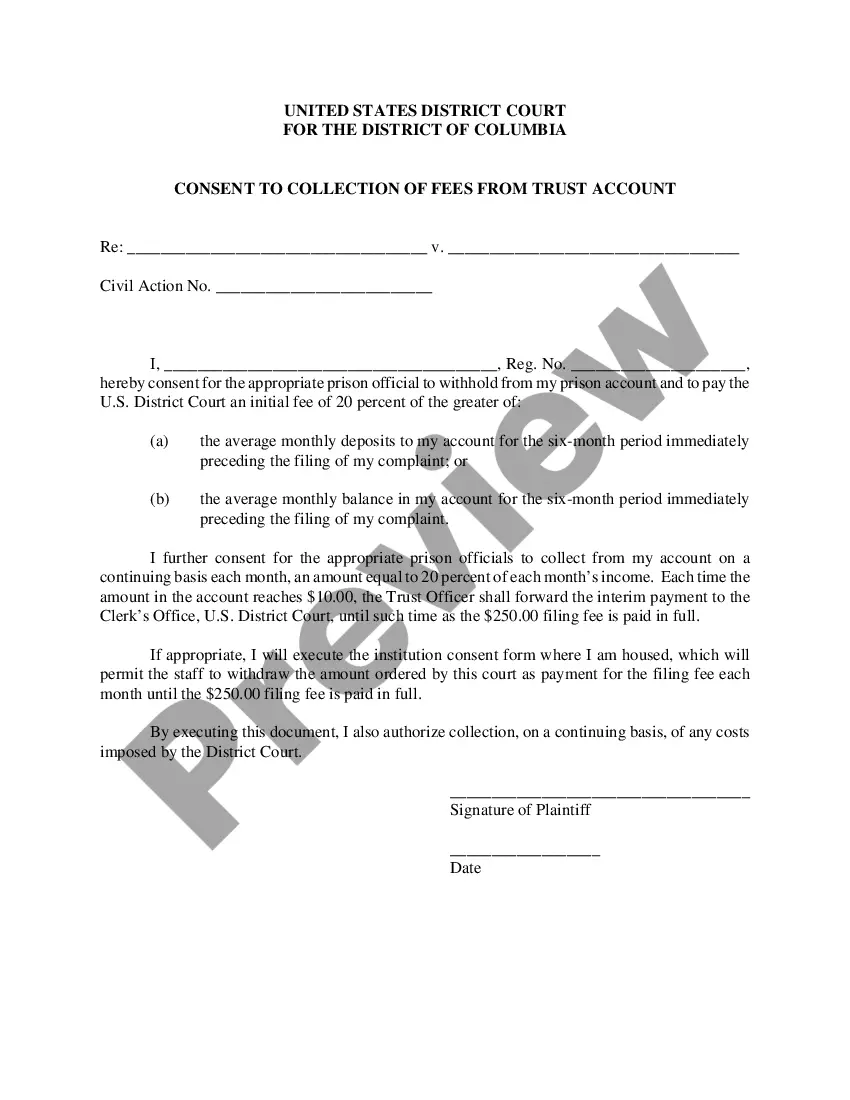

How to fill out Release Of Liability Of Employer - Ski Trip?

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Filling out legal paperwork demands careful attention, beginning from selecting the right form template. For instance, when you pick a wrong edition of a Liability Employer Buy With Bitcoin, it will be turned down once you send it. It is therefore important to have a reliable source of legal papers like US Legal Forms.

If you need to obtain a Liability Employer Buy With Bitcoin template, stick to these easy steps:

- Get the template you need using the search field or catalog navigation.

- Look through the form’s description to make sure it suits your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong document, get back to the search function to locate the Liability Employer Buy With Bitcoin sample you require.

- Get the template when it meets your requirements.

- If you already have a US Legal Forms account, just click Log in to access previously saved files in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Finish the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the file format you want and download the Liability Employer Buy With Bitcoin.

- Once it is downloaded, you can fill out the form by using editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never need to spend time seeking for the right template across the web. Take advantage of the library’s straightforward navigation to find the correct template for any occasion.

Form popularity

FAQ

The IRS treats cryptocurrency as ?property.? If you buy, sell or exchange cryptocurrency, you're likely on the hook for paying crypto taxes. Reporting your crypto activity requires using Form 1040 Schedule D as your crypto tax form to reconcile your capital gains and losses and Form 8949 if necessary.

For US taxpayers, the key factor that affects tax on crypto gains is whether a given profit was realized in the short- or long-term. Long-term tax rates on profits from s held for a year or longer peak at 20%, whereas short-term capital gains are taxed at the same rate as income: 10-37%.

To report your cryptocurrency and NFT disposals on Form 8949, you'll need the following information: A description of the property you sold (ex. ... The date you originally acquired the property. The date you sold or disposed of the property. Proceeds from your crypto disposal. Your cost basis for purchasing the property.

State Labor Laws and Cryptocurrency Payments California law prohibits employers from paying wages that aren't ?payable in cash, on-demand, without discount.? Big fluctuations in the price of Bitcoin and other cryptocurrencies are common, so crypto-compensation could lead to violating state law.

Key Takeaways. Bitcoin has been classified as an asset similar to property by the IRS and is taxed as such. U.S. taxpayers must report Bitcoin transactions for tax purposes. Retail transactions using Bitcoin, such as purchase or sale of goods, incur capital gains tax.